-

5 Ways to Compute Gross Pay with Ease

This article provides answers to a worksheet on calculating gross pay, including step-by-step instructions for determining regular and overtime wages.

Read More » -

FHA Rental Income Calculation Worksheet Guide

This worksheet outlines how to calculate potential rental income for properties insured by FHA, providing guidelines for loan approval and property valuation processes.

Read More » -

Gross Pay Calculator: Simplify Your Earnings Calculation

This worksheet provides a step-by-step guide to calculate an employee's gross pay, considering various components like hours worked, overtime, and additional earnings.

Read More » -

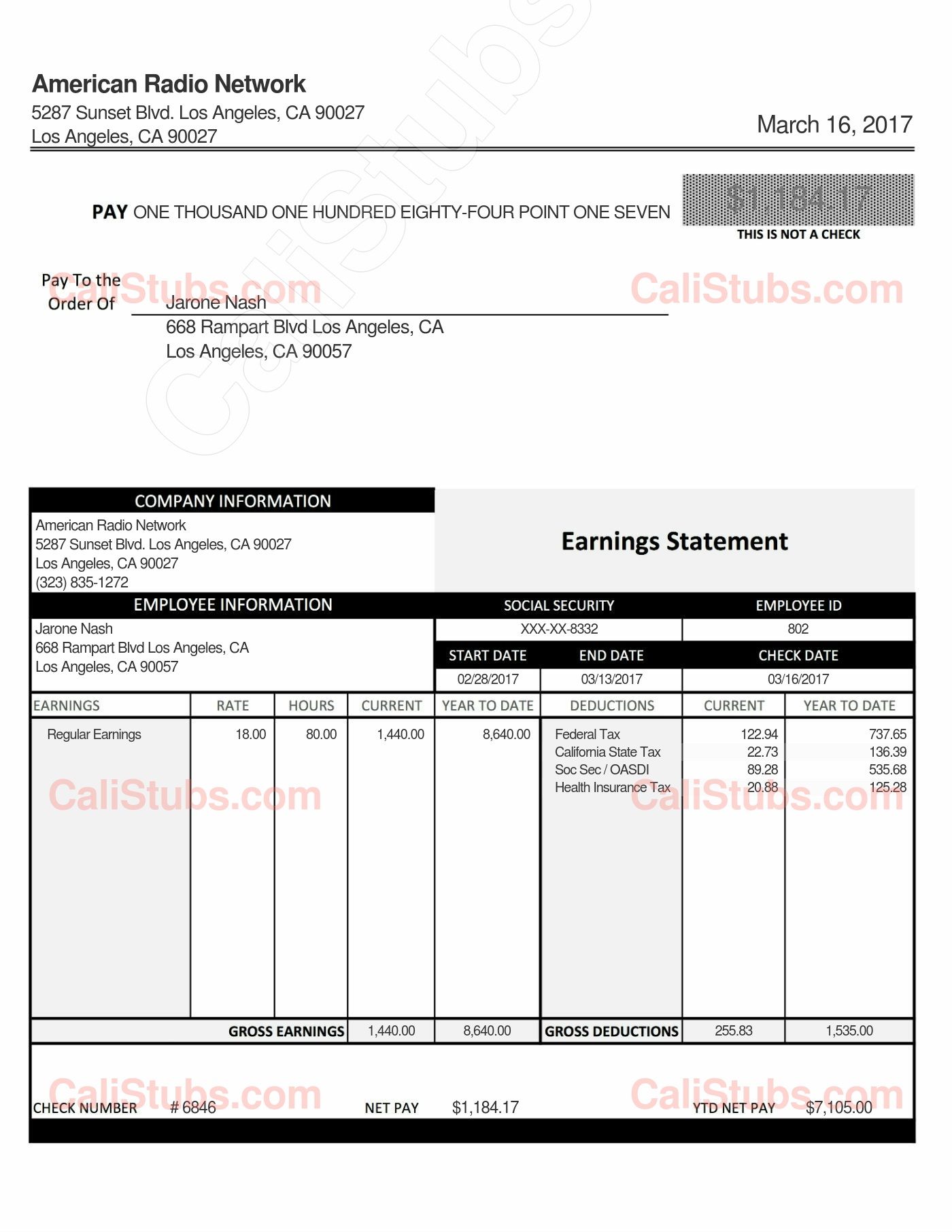

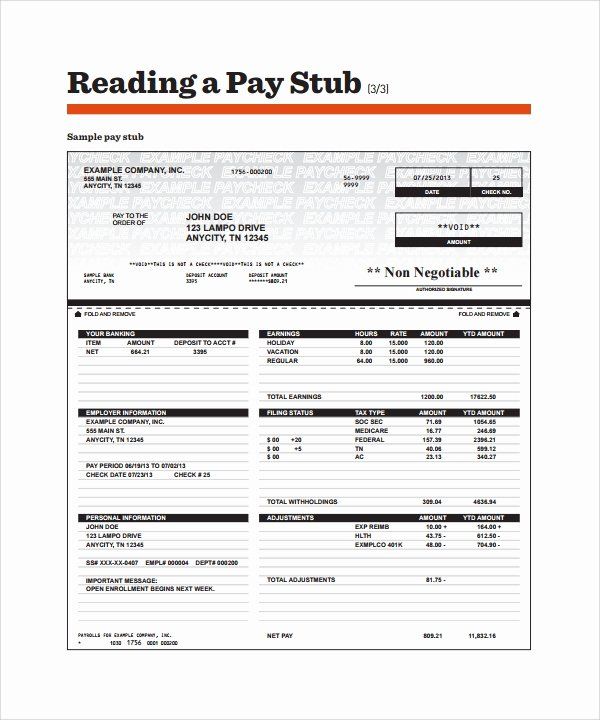

7 Tips for Understanding Your Pay Stub Easily

A worksheet designed to educate users on interpreting pay stubs, including understanding gross earnings, taxes, deductions, and net pay.

Read More » -

State and Local Income Tax Refund Guide

Worksheet to calculate state and local income tax refunds, aiding in tax preparation.

Read More » -

5 Tips to Understand Your Pay Stub Easily

A worksheet guide to understanding and interpreting the components of a pay stub.

Read More » -

TurboTax Carryover Worksheet: Simplify Your Tax Prep

Explanation of using the Turbotax Carryover Worksheet to manage tax loss carryovers effectively.

Read More » -

Pay Stub Practice Sheets for Finance Students

Practical worksheets designed to teach students how to read and understand pay stubs, enhancing financial literacy.

Read More » -

Unlock Your Home Loan Potential with Fannie Mae's Income Worksheet

This article outlines how to use the Fannie Mae Income Worksheet to properly calculate and document income for mortgage loan purposes, ensuring compliance with Fannie Mae guidelines.

Read More » -

5 Simple Steps to Complete Your 1099-R Worksheet

A guide on using the IRS Simplified Method Worksheet for 1099-R forms, offering step-by-step instructions for calculating taxable pension or annuity distributions.

Read More »