5 Tips to Understand Your Pay Stub Easily

Pay stubs are essential documents that provide a detailed breakdown of your earnings, deductions, and contributions. They are crucial for understanding your financial inflow and can help in managing your finances effectively. In this blog post, we will explore five practical tips to help you understand your pay stub with ease. Whether you're a new employee or someone looking to get a better grasp of your financials, these tips will make the process simpler and more straightforward.

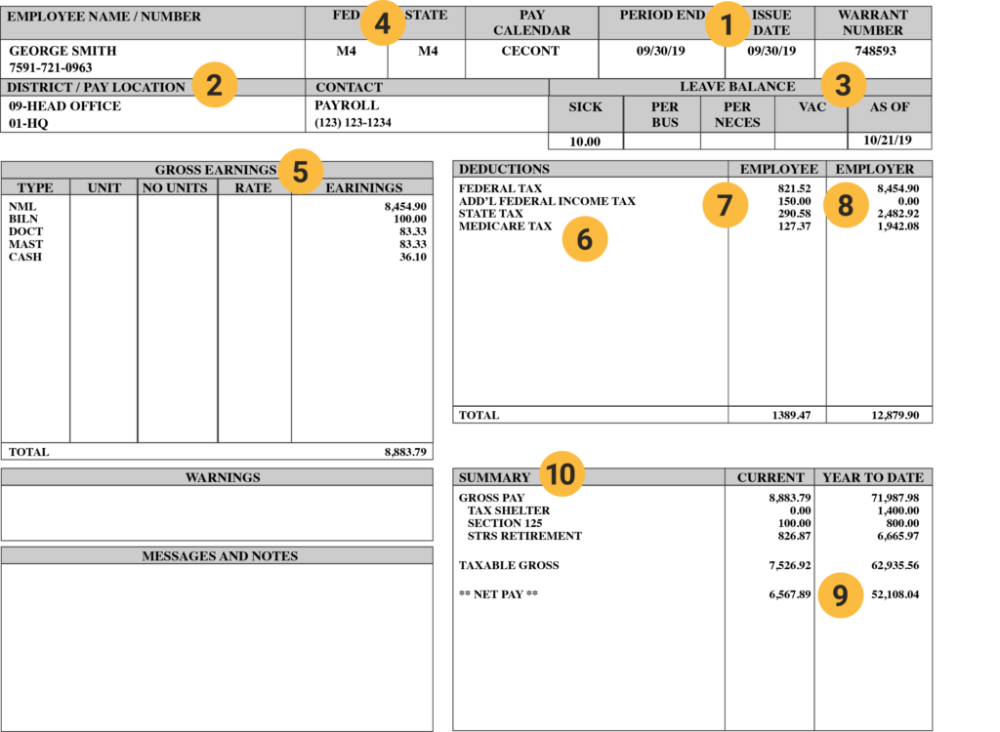

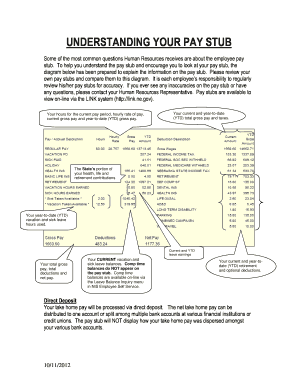

1. Familiarize Yourself with Key Terms

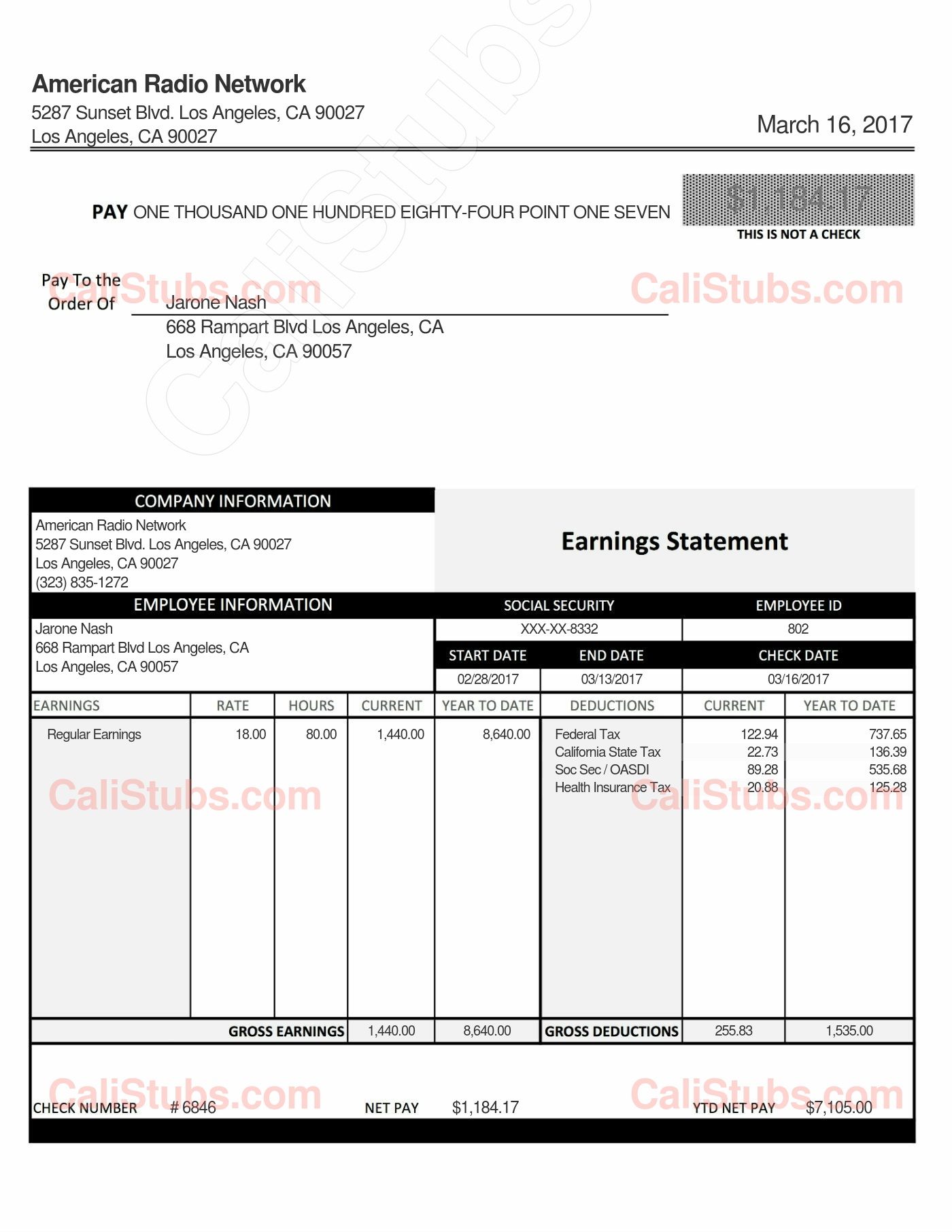

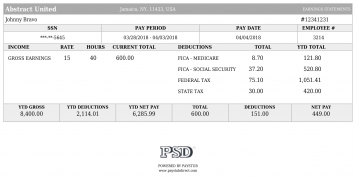

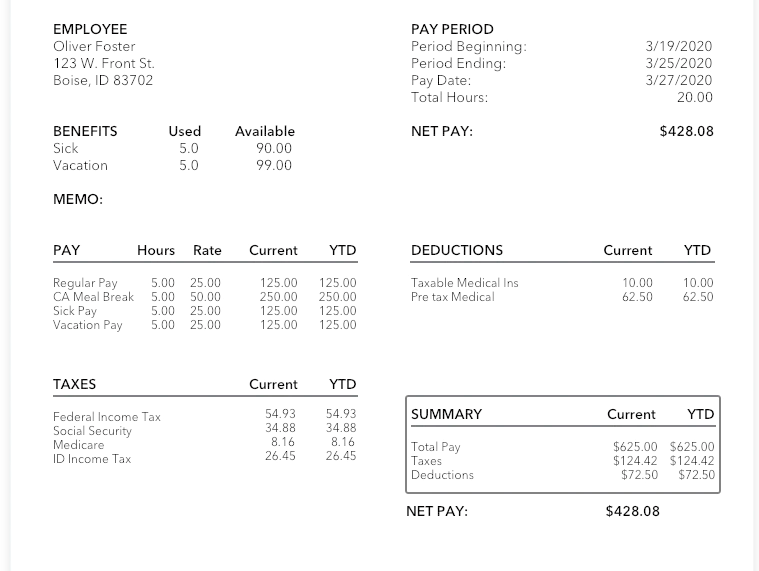

- Gross Pay: The total amount you've earned before any deductions are applied. This can include your regular salary, overtime, bonuses, and other compensations.

- Net Pay: What you actually take home after all deductions have been made. This is the amount you'll deposit into your bank account.

- Deductions: These are amounts withheld from your gross pay. Common deductions include taxes, Social Security, Medicare, health insurance premiums, retirement contributions, and others.

- YTD (Year-To-Date): Shows the total amounts earned and deducted since the beginning of the tax year up to the current pay period.

- EIN (Employer Identification Number): A unique number assigned to an employer for tax purposes.

Understanding these terms helps in quickly navigating your pay stub and ensuring all calculations are correct.

2. Recognize Common Deductions

Pay stubs typically list several deductions, each with its own purpose:

- Federal Income Tax: Withheld based on your earnings and the number of allowances claimed on your W-4 form.

- State and Local Taxes: Depending on where you work, you might see state or even local taxes deducted.

- Social Security (FICA): A portion of your salary goes toward Social Security benefits, which is about 6.2% of your gross income, up to a certain limit.

- Medicare: Another FICA tax that's 1.45% of your gross earnings, with no earnings cap.

- Health Insurance: If your employer provides health insurance, your share of the premium might be deducted.

- Retirement Plans: Deductions for contributions to retirement plans like a 401(k) or other pension schemes.

- Other Voluntary Deductions: This might include contributions to charitable organizations, union dues, etc.

By recognizing these common deductions, you can verify if the right amounts are being withheld or if you need to adjust your withholdings.

3. Check for Accuracy

Errors can happen, so it's essential to:

- Confirm that your hours worked, pay rate, and gross pay calculations are correct.

- Ensure all deductions are in line with your agreements or the policies you've enrolled in.

- Review if any payments or benefits you're expecting (like bonuses or commissions) appear on your stub.

- Look for any unexpected changes or mistakes in taxes or other deductions which could indicate an error in your tax form or employer's settings.

Regularly verifying your pay stub can help catch and correct errors, avoiding potential financial discrepancies or tax issues later on.

🔍 Note: If you find discrepancies, contact your HR or payroll department immediately to resolve any issues. Keep your pay stubs for at least three years to match with tax records.

4. Utilize Online Resources and Tools

Many employers now provide electronic access to pay stubs, offering:

- Immediate access to your pay information, reducing the risk of lost or forgotten paper stubs.

- The ability to download, print, or save digital copies for record-keeping.

- Tax calculators to estimate your withholding or refunds.

- Online portals or apps for managing your benefits, updating personal details, or changing deductions.

These tools not only save time but also provide functionalities like historical data comparison or real-time updates, which can be very helpful in understanding your pay situation.

5. Seek Professional Advice

If your pay stub is still confusing or if you're facing complex financial situations:

- Consider consulting a tax professional or financial advisor who can provide personalized advice.

- They can guide you through deductions, tax planning, and financial optimization based on your specific circumstances.

- They can also help if you encounter discrepancies or if you're planning for retirement or other long-term financial goals.

In understanding your pay stub, remember it's not just about knowing what's on it but also about taking actionable steps with that knowledge. Whether it's adjusting your withholdings, planning for taxes, or simply ensuring you're getting paid correctly, understanding your pay stub is a fundamental step towards financial literacy and empowerment.

Summary

In this blog post, we've provided you with five tips to help you easily understand your pay stub. From recognizing key terms to ensuring accuracy and utilizing digital tools, these strategies can transform your understanding of your financial document from daunting to manageable. Remember, your pay stub is more than just a piece of paper; it's your key to financial clarity and security.

What should I do if I find a mistake on my pay stub?

+

If you notice an error on your pay stub, immediately reach out to your HR or payroll department. Provide them with details of the mistake, including the period in question and what you believe should be correct. They’ll typically investigate and correct any errors found.

How often should I check my pay stub?

+

It’s recommended to review your pay stub with each paycheck to catch any errors early. However, at a minimum, ensure you review it quarterly or before any tax-related deadlines to prepare for filing your taxes.

Can my employer change deductions without informing me?

+

Generally, employers should notify employees of changes in deductions, especially if those changes are voluntary or related to benefits. However, changes in mandatory deductions like taxes can occur without specific notification. Always check your pay stub regularly to stay informed.