TurboTax Carryover Worksheet: Simplify Your Tax Prep

Are you dreading tax season because of the complexities involved in filing your returns? Do terms like "carryover worksheet" make your head spin? Worry no more! This guide will walk you through how to simplify your tax preparation with TurboTax's Carryover Worksheet feature. Understanding how to navigate through this tool can not only save you time but also ensure accuracy in your filings, potentially saving you from overpaying or underpaying your taxes.

Understanding Carryover

Carryover refers to the process where tax benefits or losses from previous years are applied to the current tax year. This can include:

- Losses from investments or businesses.

- Excess charitable contributions.

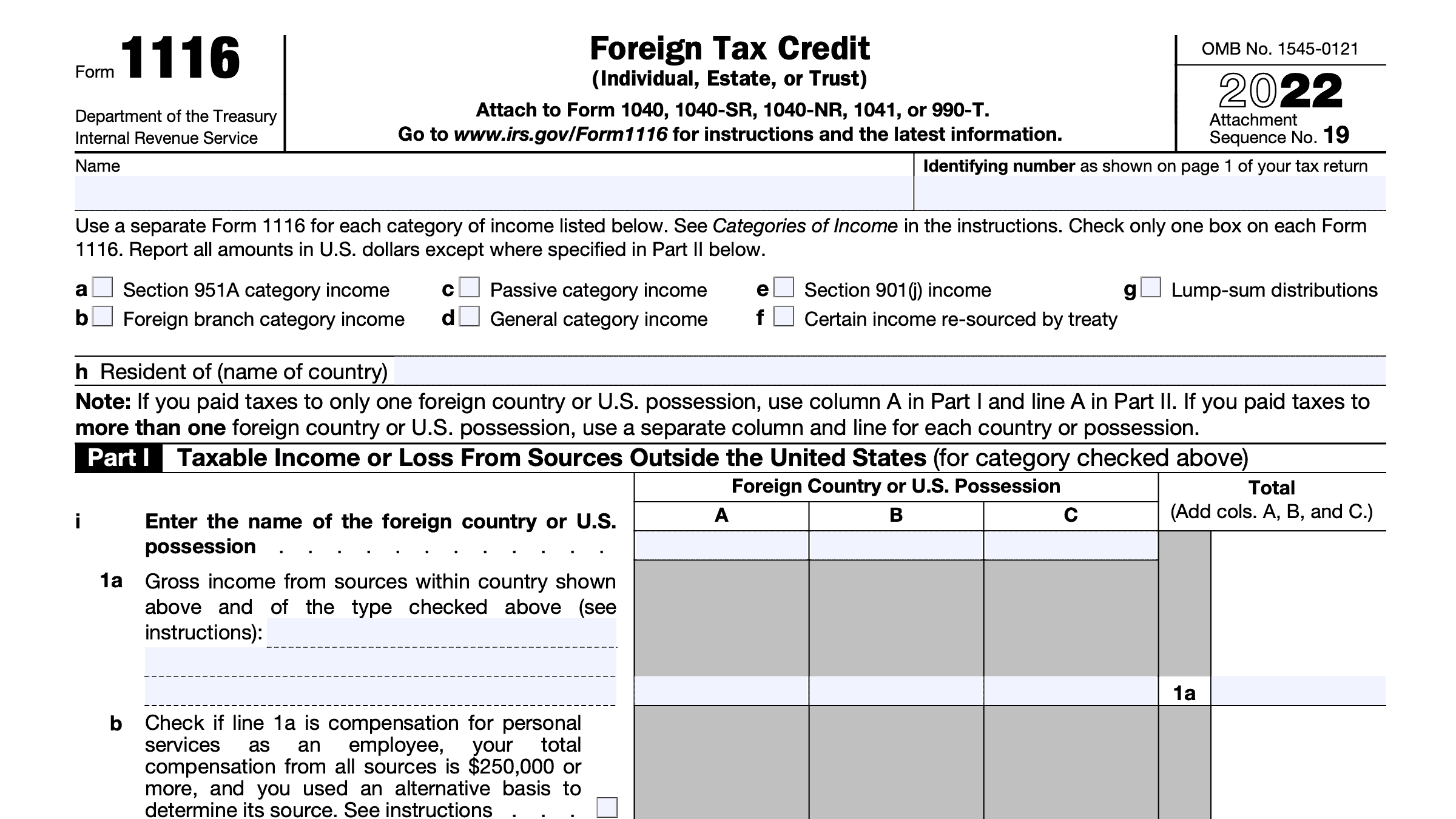

- Foreign tax credits or alternative minimum tax credits.

TurboTax's Carryover Worksheet helps users to correctly transfer these amounts, ensuring they take advantage of any tax savings opportunities.

Why is Carryover Important?

Here are some reasons why mastering carryover can benefit you:

- Maximize Tax Benefits: You can reduce your taxable income or increase your refund by using carryover from losses or credits.

- Prevent Penalties: Not reporting carryover correctly can result in errors, which might lead to penalties from the IRS.

- Future Tax Planning: Knowing your carryover amounts helps in strategic tax planning for the future.

Using TurboTax’s Carryover Worksheet

Here's how you can use TurboTax to simplify your carryover:

Step-by-Step Guide

Follow these steps to effectively use the Carryover Worksheet:

- Access Your Tax File: Log into TurboTax with your existing account or create a new one if you're a first-time user.

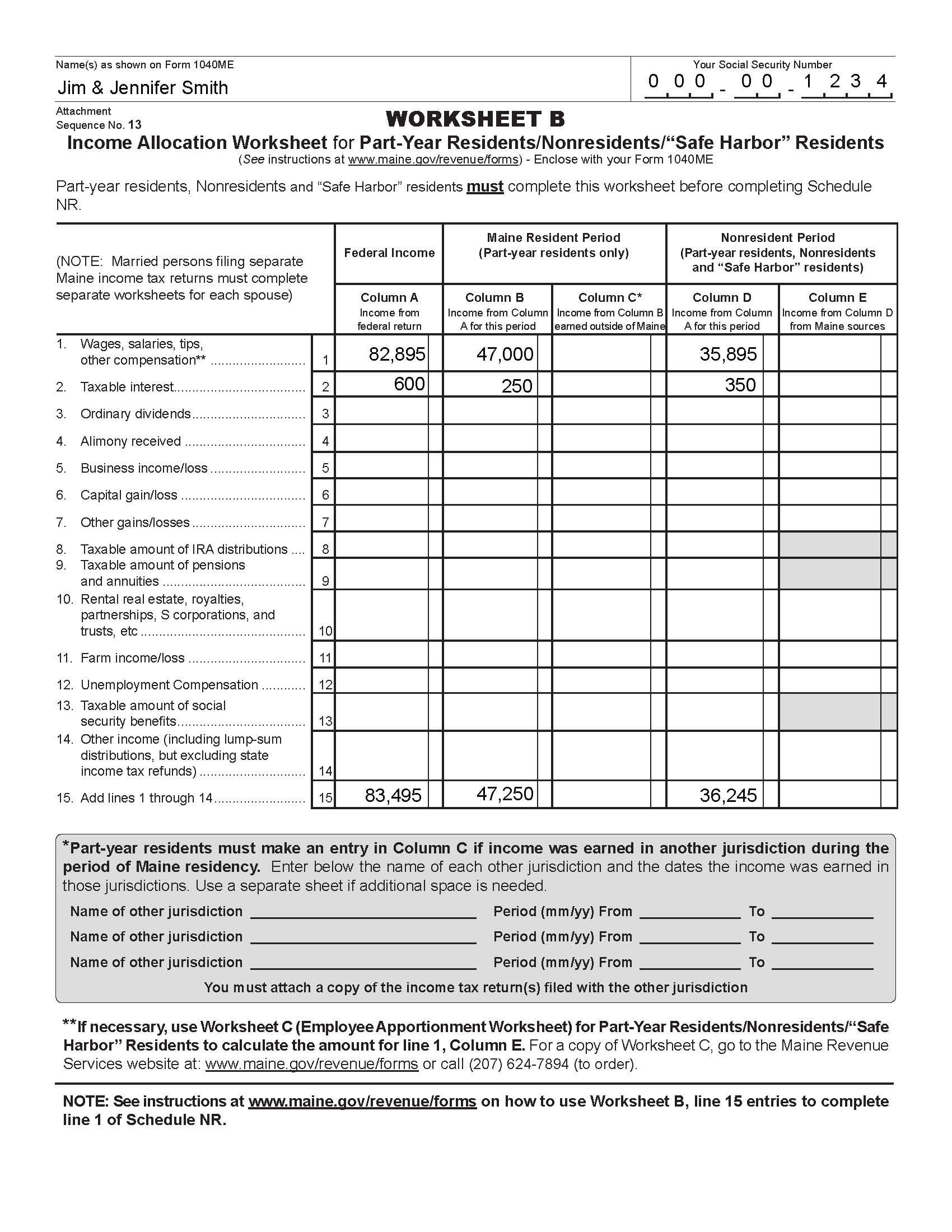

- Enter Your Income Information: Navigate through the income section, entering details like wages, investments, and self-employment income.

- Identify Carryover Losses or Credits: When prompted for previous years' losses or credits, enter the amounts as shown on your last year's tax return or from IRS documentation.

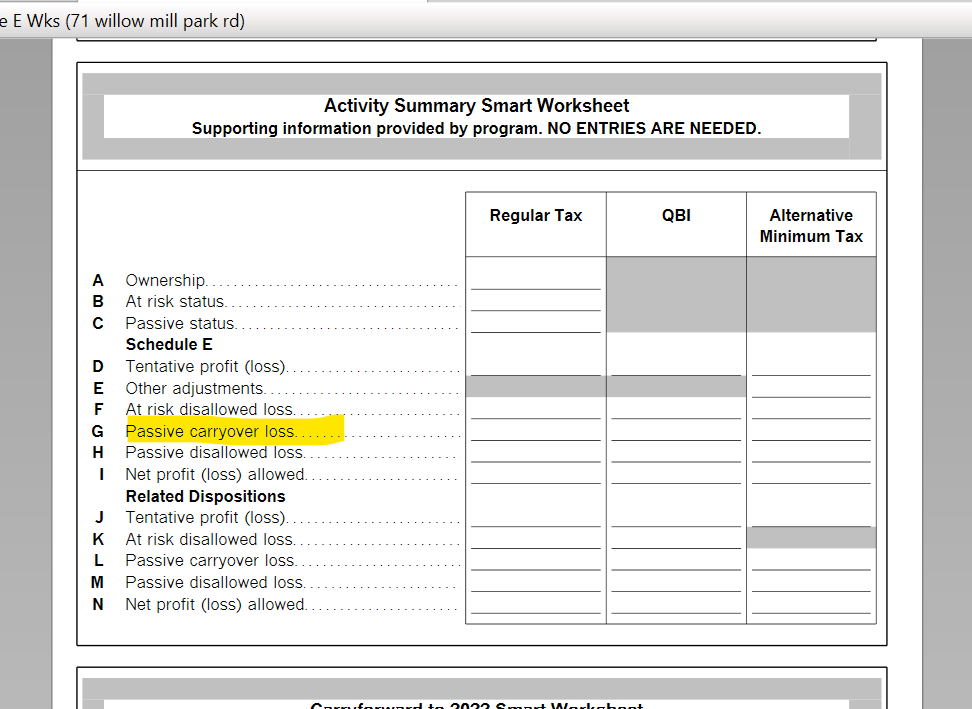

- Use the Carryover Worksheet:

- TurboTax will guide you to enter losses, credits, or donations that you can carry forward.

- Enter the carryover information as guided by the software. TurboTax will automatically calculate the amounts you can use this year.

- Review and Adjust: Review the carryover amounts to ensure they match your records. TurboTax allows for easy editing if you find any discrepancies.

- Complete Your Filing: Continue with the rest of your tax preparation, and TurboTax will integrate the carryover data into your tax return.

Tips for Using Carryover Effectively

- Keep Good Records: Always keep a detailed record of previous years' tax returns, carryover calculations, and IRS notices.

- Understand IRS Limits: Be aware of the limitations and rules set by the IRS for carryovers, which TurboTax can help you navigate.

- Plan Ahead: Knowing your carryover status can help in planning future tax strategies, including timing of income or investments.

💡 Note: Ensure you have all your previous tax returns handy for accurate carryover information.

Maximizing Tax Benefits with Carryover

Here are several ways you can leverage carryover for tax optimization:

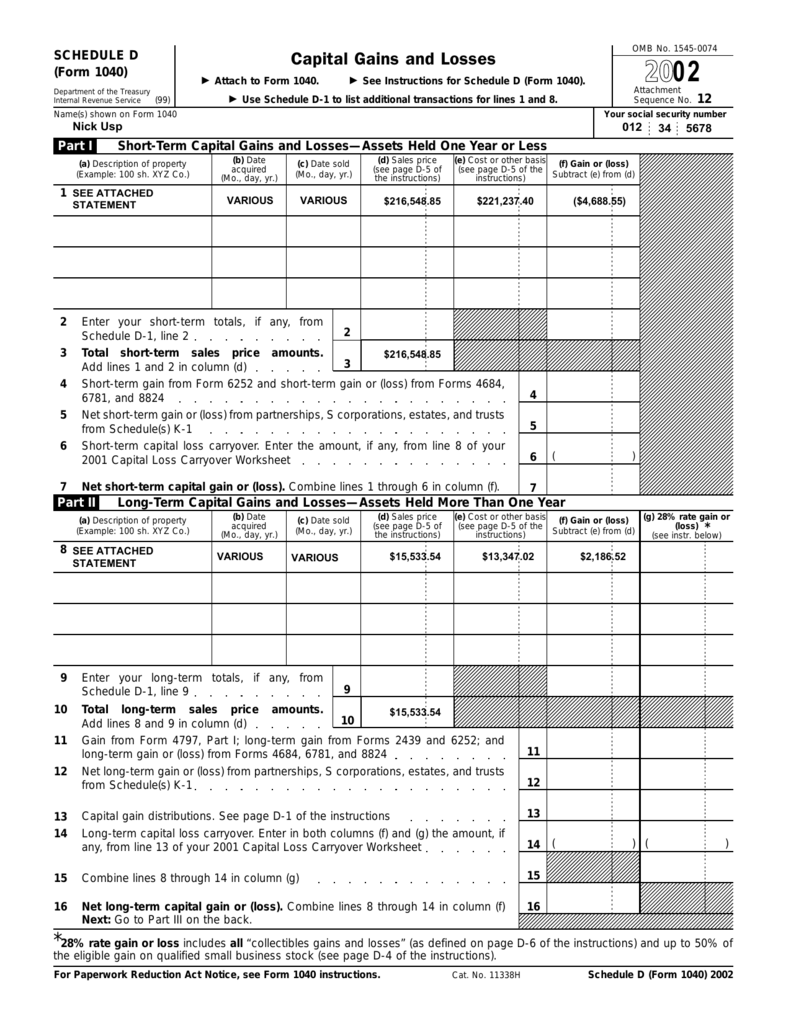

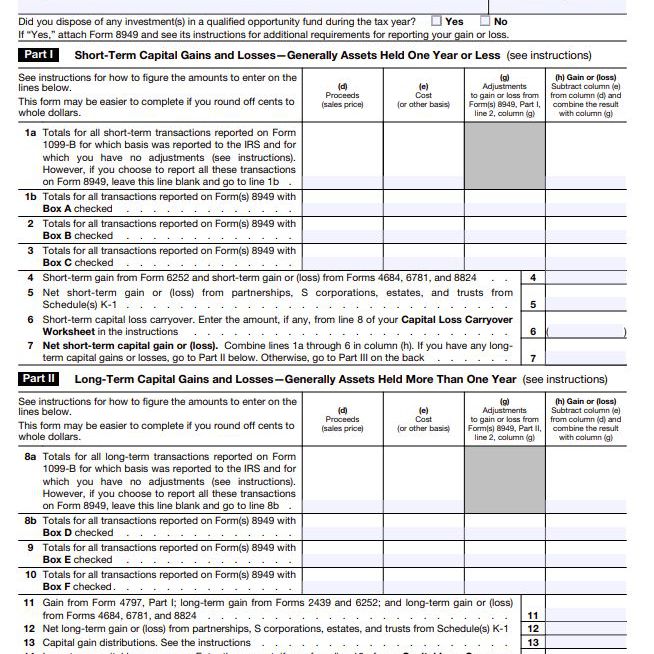

- Offset Future Gains: Use capital loss carryovers to offset future capital gains.

- Reduce Taxable Income: Deduct carryover charitable contributions to lower your taxable income.

- Claim Unused Credits: Apply unused tax credits from previous years against current tax liabilities.

Potential Challenges and Solutions

Here are some common hurdles taxpayers face and how to overcome them:

- Inaccurate Records: Maintain meticulous records to ensure carryover accuracy.

- Complex Tax Situations: For intricate financial portfolios, consider consulting a tax professional.

- Software Limitations: If TurboTax doesn't cover your specific carryover needs, its help center or customer support can assist.

By following this guide and effectively using TurboTax's Carryover Worksheet, you can streamline your tax preparation process, minimize errors, and potentially maximize your tax benefits. Keep in mind that taxes are complex, and sometimes personal or unique tax situations require more than just software to manage. However, with tools like TurboTax at your disposal, you can approach tax season with confidence and efficiency.

What is a carryover?

+

Carryover refers to the tax benefits or losses from previous tax years that can be applied to the current tax year.

Can I use TurboTax to handle my carryover?

+

Yes, TurboTax’s Carryover Worksheet simplifies the process, helping you enter and manage carryovers from previous tax years.

What if I lose my previous year’s tax records?

+

Without previous records, you can request transcripts from the IRS or work with a tax professional to reconstruct your carryover information.