Gross Pay Calculator: Simplify Your Earnings Calculation

Understanding your gross pay is more than just a number; it's the key to budgeting, tax preparation, and financial planning. Whether you're a salaried employee, a freelancer, or someone working on an hourly wage, accurately calculating your gross pay can seem overwhelming. This comprehensive guide will walk you through everything you need to know to simplify your earnings calculation.

What is Gross Pay?

Gross pay refers to the total amount you earn before any deductions like taxes, social security, health insurance, or retirement contributions are taken out. It is the raw amount of money you make before any adjustments, and understanding it is crucial for:

- Negotiating salaries or rates

- Understanding your income for loan applications

- Calculating your tax obligations

- Planning your personal finances

Key Components of Gross Pay

Here are the primary elements that typically form part of your gross pay:

- Base Pay or Salary: The fundamental compensation for your work, whether it's hourly, weekly, or monthly.

- Allowances: Additional payments like travel, housing, or meal allowances.

- Bonuses: Any performance-based or lump sum payments.

- Commissions: Income earned from sales or similar activities.

- Overtime: Additional earnings for working beyond regular hours.

How to Calculate Your Gross Pay

Calculating gross pay can differ slightly depending on your payment structure. Here's how you can do it for various scenarios:

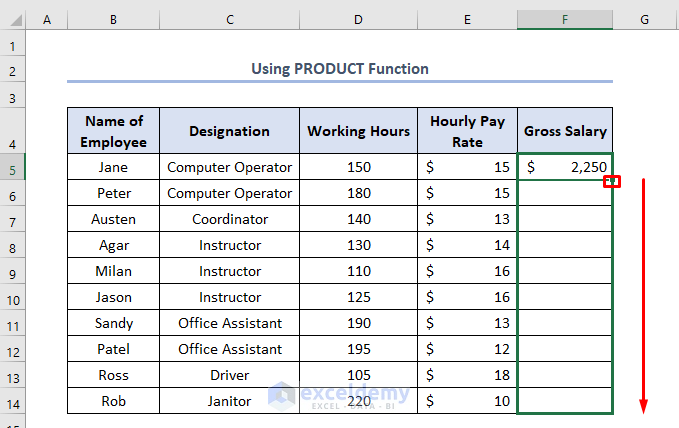

For Salaried Employees

If you have a fixed salary, your gross pay calculation is straightforward:

- Identify your Annual Salary: This is what your employer has agreed to pay you for the year.

- Divide by Pay Periods: If you are paid monthly, divide by 12; if bi-weekly, by 26; or weekly, by 52.

🔎 Note: If your salary includes bonuses or commissions, these should be added to your base salary before division to find your gross pay per pay period.

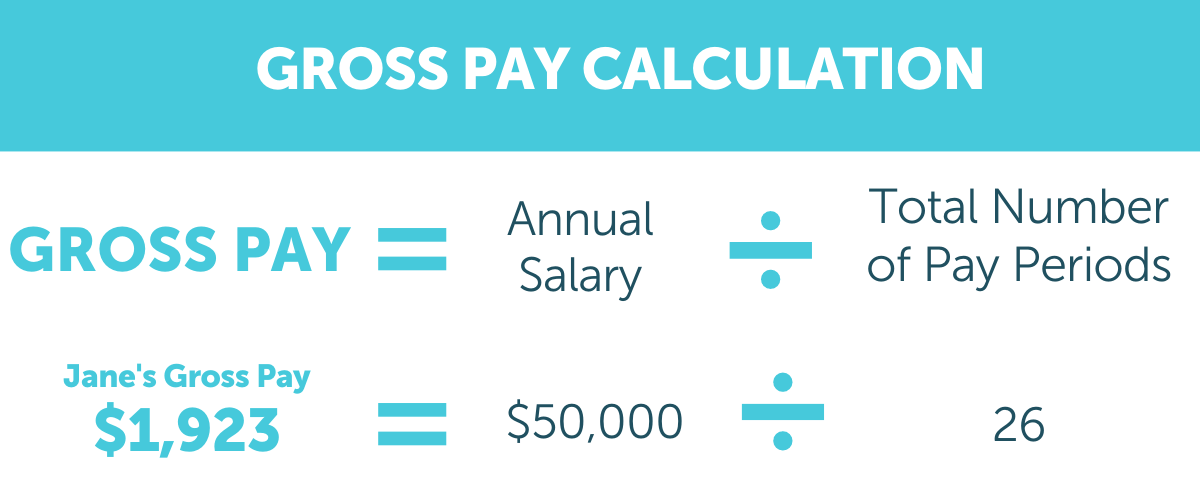

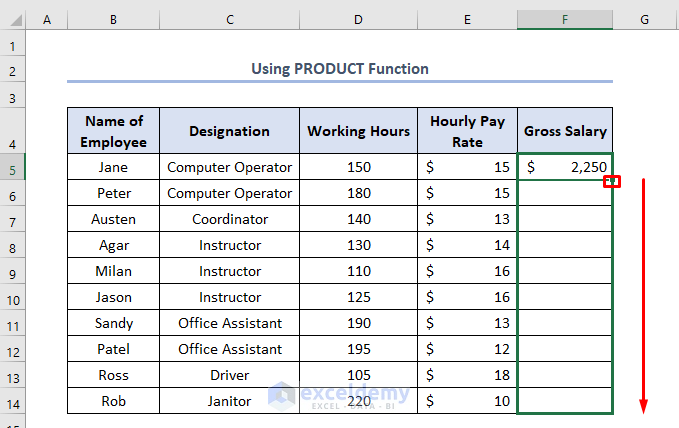

For Hourly Wage Workers

The formula for hourly workers is:

- Hourly Rate × Hours Worked: If you earn 20 per hour and work 40 hours per week, your weekly gross pay would be 20 × 40 = $800.

For Freelancers and Contractors

Freelancers often have more complex gross pay calculations because:

- You might invoice clients monthly or upon project completion.

- Various rates might apply depending on the work, location, or client.

- Travel expenses or other reimbursables can add to gross income.

Your gross pay would generally include all invoiced amounts plus any additional reimbursements.

Understanding Deductions from Gross Pay

While your gross pay gives you an overview of your earnings, understanding the deductions is equally important:

- Federal Income Tax: Withheld from your pay based on your income level and tax bracket.

- State and Local Taxes: Depending on your location, additional taxes might apply.

- Social Security and Medicare: Known as FICA taxes in the U.S., these are mandatory contributions.

- Retirement Contributions: 401(k) or similar plans, where you might have pre-tax contributions.

- Health Insurance Premiums: Often deducted from your pay for employee health plans.

- Other Deductions: Union dues, child support, or other garnishment orders.

Table: Common Deductions and Their Purposes

| Deduction Type | Purpose |

|---|---|

| Federal Income Tax | To cover your federal tax liability. |

| State/Local Tax | State and local contributions towards public services and infrastructure. |

| Social Security Tax | Supports social security benefits. |

| Medicare Tax | Covers national health insurance for those over 65. |

| Retirement Plans | Saves for retirement, often reducing taxable income. |

🌟 Note: Understanding deductions helps in planning your net income and personal budget more accurately.

The Importance of Accurate Gross Pay Calculation

Having an accurate gross pay figure is essential for:

- Loan Applications: Financial institutions assess your loan eligibility based on gross pay.

- Salary Negotiations: Knowing your gross pay helps in negotiating better terms.

- Tax Planning: Gross pay informs you of your tax obligations and potential refunds.

- Budgeting: Enables better financial planning by setting a realistic budget.

Tools and Resources for Gross Pay Calculation

Here are some tools and resources to help:

- Online Gross Pay Calculators: Websites like PaycheckCity or ADP offer calculators tailored to your pay structure.

- Excel Spreadsheets: You can create a custom calculator in Excel for recurring calculations.

- Pay Stub Analyzers: Services like those offered by HR software can provide detailed breakdowns.

- Financial Advisors: Professional advice can help understand complex pay structures and deductions.

📊 Note: Free or low-cost tools are available, but professional advice might be worth considering for intricate situations.

Wrapping Up

In this detailed guide, we’ve explored the nuances of calculating gross pay, highlighting its importance in various financial aspects of life. From understanding what constitutes gross pay to how it’s calculated and what deductions typically reduce it, this knowledge empowers you to better manage your finances, negotiate your worth, and plan for the future. Remember, knowing your gross pay is the first step toward financial literacy and control over your earnings.

What is the difference between gross pay and net pay?

+

Gross pay is the total amount you earn before any deductions. Net pay, on the other hand, is what you take home after taxes and other deductions have been subtracted from your gross pay.

Can freelancers and contractors receive gross pay?

+

Yes, freelancers and contractors invoice their clients for the gross amount, which includes their fees plus any reimbursable expenses. However, they need to account for self-employment taxes and business expenses when calculating their net income.

How can I check if my employer is calculating my gross pay correctly?

+

You can cross-reference your pay stubs with the contract terms or company policies. Use online calculators or an accountant to verify calculations or understand discrepancies.