Unlock Your Home Loan Potential with Fannie Mae's Income Worksheet

Understanding the Importance of Fannie Mae's Income Worksheet

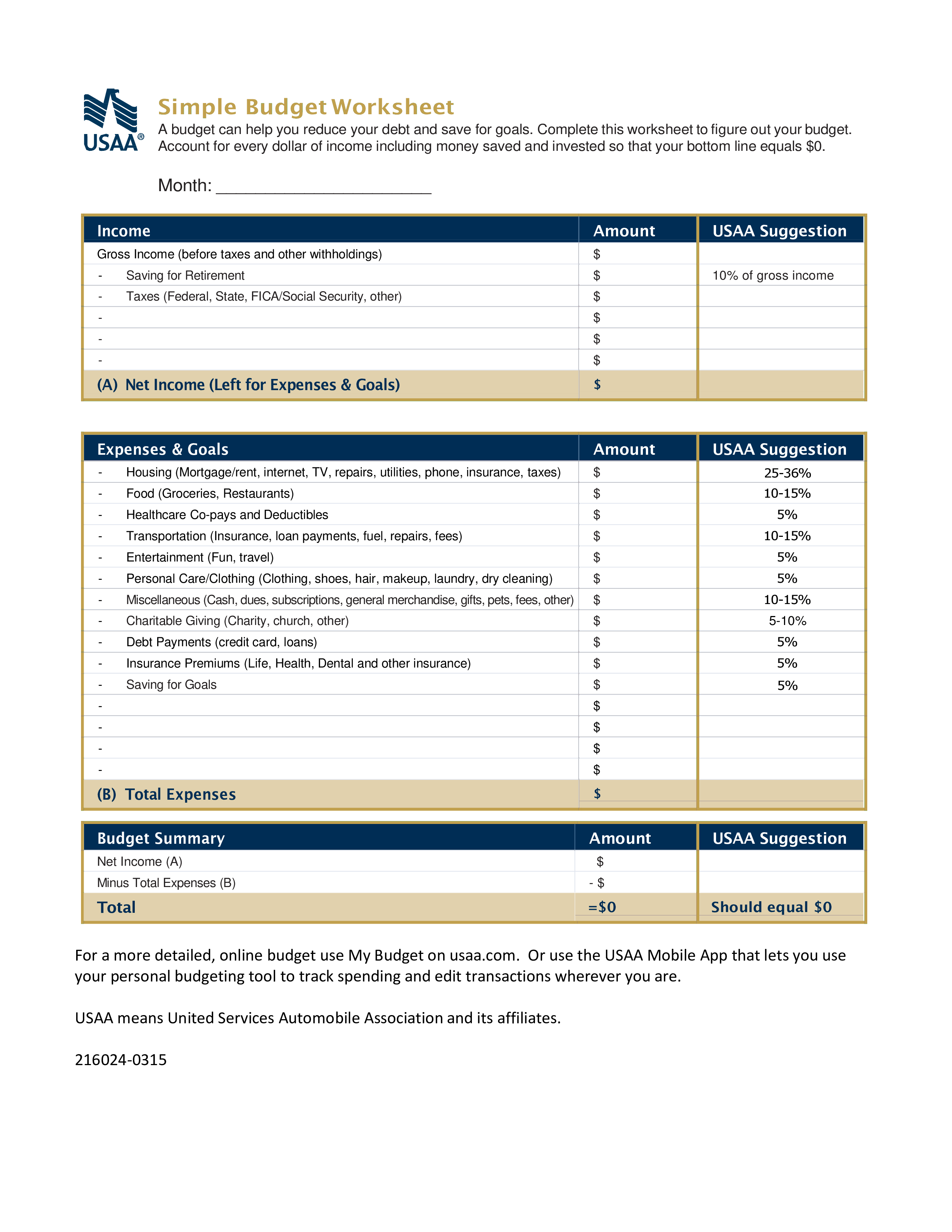

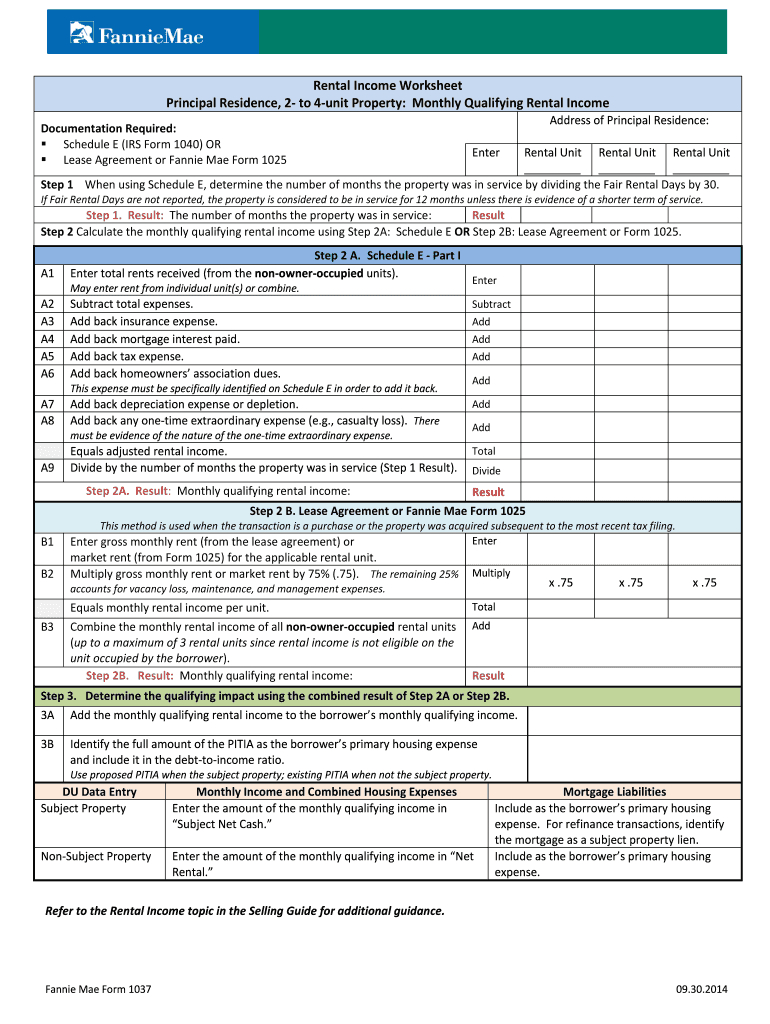

Securing a home loan in today’s real estate market can be quite the challenge. From finding the right property to navigating through the labyrinth of mortgage requirements, every step is crucial. Among the many tools designed to streamline this process, Fannie Mae’s Income Worksheet stands out as a pivotal resource for both lenders and borrowers. This tool helps in accurately assessing a borrower’s income, thereby ensuring a smoother mortgage underwriting process.

What is Fannie Mae?

Fannie Mae, or the Federal National Mortgage Association, is a government-sponsored enterprise that provides financial products and services, such as mortgage-backed securities (MBS), to enhance the flow of capital into the mortgage market. Its goal is to support the availability and affordability of home loans to low- and moderate-income borrowers.

The Role of the Income Worksheet

The income worksheet from Fannie Mae plays a pivotal role in loan underwriting. Here’s how:

- Accuracy: It ensures that the lender has a precise and comprehensive view of a borrower’s financial status.

- Compliance: It helps lenders meet the regulatory and Fannie Mae's specific guidelines for loan approval.

- Efficiency: By standardizing the income calculation process, it reduces the time taken for loan approval, benefiting both the lender and the borrower.

How to Use the Income Worksheet

Using the income worksheet correctly can significantly influence the outcome of your mortgage application. Here’s a step-by-step guide:

1. Gathering Documents

Before you start filling out the worksheet, ensure you have:

- Recent pay stubs (covering at least 30 days)

- W-2 forms for the last two years

- Tax returns for the last two years

- Documentation of any additional income like bonuses, commissions, overtime, etc.

- Details of rental income, child support, or any other income source

2. Fill Out the Worksheet

Here’s what you should do:

- Input your base salary from your pay stubs.

- Include any consistent overtime or bonus if your employment history supports its reliability.

- List all other sources of income, ensuring they meet Fannie Mae's criteria for stable income.

- Verify all income sources and amounts with supporting documentation.

🌟 Note: Ensure that all income sources are accurately represented. Discrepancies could lead to delays or denial of your mortgage application.

3. Calculate Your Income

Fannie Mae has specific guidelines on how to calculate income:

- For salaried employees, it’s usually the annual salary or an average if the income has varied over the past two years.

- For self-employed individuals, consider using a two-year average of net income from tax returns after non-cash deductions and expenses.

- Adjustments might be made for seasonal employment, variable income, or income from business or rental properties.

| Income Source | Calculation Method |

|---|---|

| Salary | Base annual salary from pay stub or employment letter. |

| Hourly Wages | Hourly rate multiplied by average hours worked weekly, then annualized. |

| Bonuses/Commissions | Two-year average if consistent, or history can be proven. |

| Self-Employment | Net income from tax returns, adjusted for non-cash expenses. |

💡 Note: Different types of income might have different qualifying criteria. Review Fannie Mae's guidelines carefully.

4. Review and Submit

After filling out the worksheet:

- Double-check all entries for accuracy and completeness.

- Have a professional review your worksheet, if possible, especially if self-employed or with multiple income sources.

- Submit along with your mortgage application, ensuring all documents support your stated income.

In summary, Fannie Mae’s Income Worksheet is not just a form but a pivotal tool that helps you present your financial picture accurately, ensuring you can unlock your home loan potential effectively. By following the steps outlined, you prepare yourself for a more straightforward loan process, potentially reducing the likelihood of rejections or delays.

FAQs often arise during the mortgage application process. Here are some commonly asked questions about using Fannie Mae’s Income Worksheet:

Can I include future expected income on the Fannie Mae Income Worksheet?

+

Typically, only income that is stable and likely to continue should be included. However, in some cases, lenders might consider verifiable future income, but this needs to be discussed with your lender.

What if my income varies year to year?

+

Fannie Mae guidelines allow for an average of income over the past two years, which can account for variations. Make sure to provide documentation to support this average.

Do I need to fill out the worksheet myself, or can my lender do it for me?

+

While lenders often help fill out these forms, it’s advisable for borrowers to understand and contribute to the process to ensure accuracy and completeness.