Pay Stub Practice Sheets for Finance Students

Why Finance Students Need to Understand Pay Stubs

In the ever-evolving world of finance, pay stubs are more than just records of your earnings; they are windows into various financial calculations, taxes, and benefits management. For finance students, mastering the intricacies of pay stubs is not only beneficial but necessary for career success. Here's why:

- Comprehensive Payroll Understanding: Pay stubs offer a snapshot of earnings, deductions, taxes, and net pay. Knowing how to read and interpret these details is critical.

- Professional Skill Enhancement: Finance roles often require the ability to dissect pay stubs for audits, compensation analysis, and compliance checks.

- Preparation for Job Market: A thorough understanding of pay stubs can make you stand out in interviews for finance-related roles.

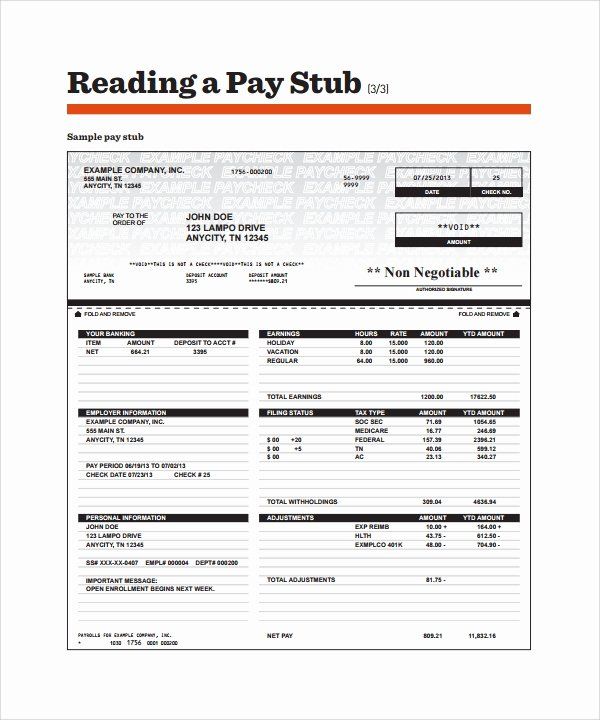

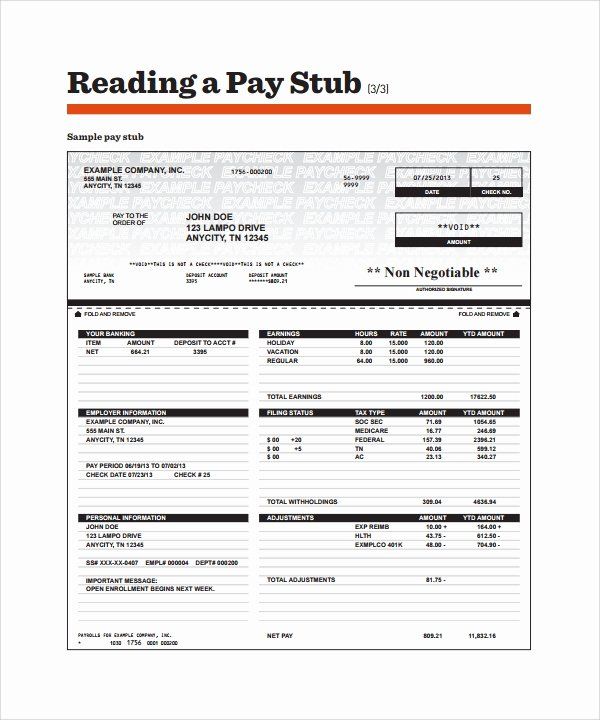

Basic Anatomy of a Pay Stub

A typical pay stub includes several key elements, each with its importance:

| Element | Description |

|---|---|

| Employee Information | Name, ID, and address |

| Gross Earnings | Total pay before deductions |

| Deductions | Taxes, insurance, retirement contributions, etc. |

| Net Pay | Take-home pay after all deductions |

| YTD Totals | Year-to-date totals of various categories |

Understanding these elements forms the foundation for navigating financial paperwork in the real world.

💡 Note: Pay stubs can differ between companies, but these are the core components you'll always see.

Creating Practice Pay Stubs

Let's dive into how finance students can create practice pay stubs to improve their understanding:

Using Spreadsheet Software

- Set Up the Spreadsheet: Start by defining rows and columns for each pay stub component.

- Enter Employee Information: Fill in details like name, ID, and address at the top.

- Calculate Gross Earnings: Incorporate regular earnings, overtime, bonuses, and commissions.

- Apply Deductions: Include taxes, healthcare contributions, and other deductions.

- Compute Net Pay: Subtract all deductions from the gross earnings to get the take-home pay.

- Track Year-to-Date (YTD) Totals: Update cumulative totals for each category.

⚠️ Note: Formulas can simplify complex calculations for ongoing practice.

Practice Scenarios

- Monthly, Bi-weekly, and Weekly Pay Frequencies: Understand different pay cycles and their impact.

- Salary vs. Hourly Pay: Differentiate between fixed salaries and variable hourly pay.

- Overtime Pay: Explore how overtime affects gross earnings and deductions.

- Employee Benefits: Simulate scenarios with different employee benefits and their costs.

- Correcting Errors: Practice amending mistakes in pay stubs for accuracy training.

Advanced Concepts in Pay Stubs

As you delve deeper into finance, understanding more complex aspects of pay stubs becomes vital:

- Pre-Tax vs. Post-Tax Deductions: Learn the difference and how they impact taxable income.

- Tax Calculations: Understand various taxes like Federal, state, Social Security, and Medicare.

- Benefit Deductions: Dive into health, dental, vision insurance, retirement plans, and life insurance costs.

- Garnishments: Practice dealing with legal deductions from wages.

- YTD Reconciliation: Ensure YTD totals match company records for accuracy.

These advanced concepts not only provide a deeper understanding but also prepare you for real-world financial challenges.

Utilizing Online Tools and Resources

Various online tools can enhance your practice with pay stubs:

- Pay Stub Generators: Use tools to create mock pay stubs quickly for practice.

- Learning Platforms: Engage with online courses on HR and payroll management.

- Finance Forums: Participate in discussions for insights from peers and professionals.

Tips for Effective Practice

Here are some strategies to maximize your learning through pay stub practice:

- Realistic Data: Use real numbers to create scenarios that simulate actual payroll.

- Peer Collaboration: Discuss pay stub scenarios with classmates or professionals.

- Scenario Diversity: Explore different types of employment scenarios to broaden your understanding.

- Stay Updated: Keep abreast of changes in laws and tax regulations.

- Record Keeping: Maintain records of your practice pay stubs for reference.

By following these tips, you'll enhance your learning experience and better prepare for your finance career.

Why are pay stubs important in finance?

+

Pay stubs are crucial because they provide detailed records of earnings, deductions, and net pay, which are vital for financial analysis, audits, and compliance. Understanding pay stubs is essential for roles involving payroll, HR, and financial planning.

How can creating practice pay stubs benefit finance students?

+

Creating practice pay stubs allows finance students to familiarize themselves with payroll terminology, understand the calculation of various deductions, and gain hands-on experience in a controlled environment before facing real-world financial tasks.

What are some common mistakes when reading pay stubs?

+

Common mistakes include misunderstanding deductions, overlooking YTD totals, not recognizing the difference between pre-tax and post-tax contributions, and missing out on employer contributions to benefits.

Can finance students use software to generate pay stubs?

+

Absolutely! Various software and online tools allow students to input data and generate realistic pay stubs for practice. These tools help automate calculations and simulate different scenarios.

What advanced payroll concepts should finance students practice?

+

Advanced payroll concepts include understanding pre-tax vs. post-tax deductions, detailed tax calculations, managing employee benefits, addressing garnishments, and YTD reconciliation for accuracy and compliance.

Mastering pay stubs as a finance student isn’t just about understanding numbers; it’s about grasping the broader implications of financial decisions, compliance, and strategic planning. Whether you’re entering the world of accounting, human resources, or financial management, the ability to analyze and interpret pay stubs can greatly enhance your career prospects. This practice not only prepares you for future job responsibilities but also instills confidence in dealing with complex payroll data, tax laws, and employee benefits. Remember, proficiency in pay stubs is more than a skill—it’s a language of finance that speaks volumes about your capabilities in the professional world.