5 Simple Steps to Complete Your 1099-R Worksheet

Whether you are a retiree, someone who has inherited a pension plan, or just an individual who has taken a distribution from an IRA, navigating the IRS Form 1099-R can seem daunting. This crucial tax document details distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. The good news? By following a few simple steps, you can efficiently complete your 1099-R worksheet and ensure your tax filings are accurate. Here, we will walk through five straightforward steps to make this process easier and error-free.

Step 1: Gather Necessary Information

Before you delve into filling out your 1099-R form, make sure you have all relevant documents and information ready:

- Your most recent 1099-R forms, which should be sent to you by the paying institutions.

- Records of any rollovers or transfers if you’ve moved funds between retirement accounts.

- Details of any taxable and non-taxable distributions.

- Documentation related to disability pensions, if applicable.

- Evidence of contributions to retirement accounts, especially for Roth IRAs or after-tax employee contributions.

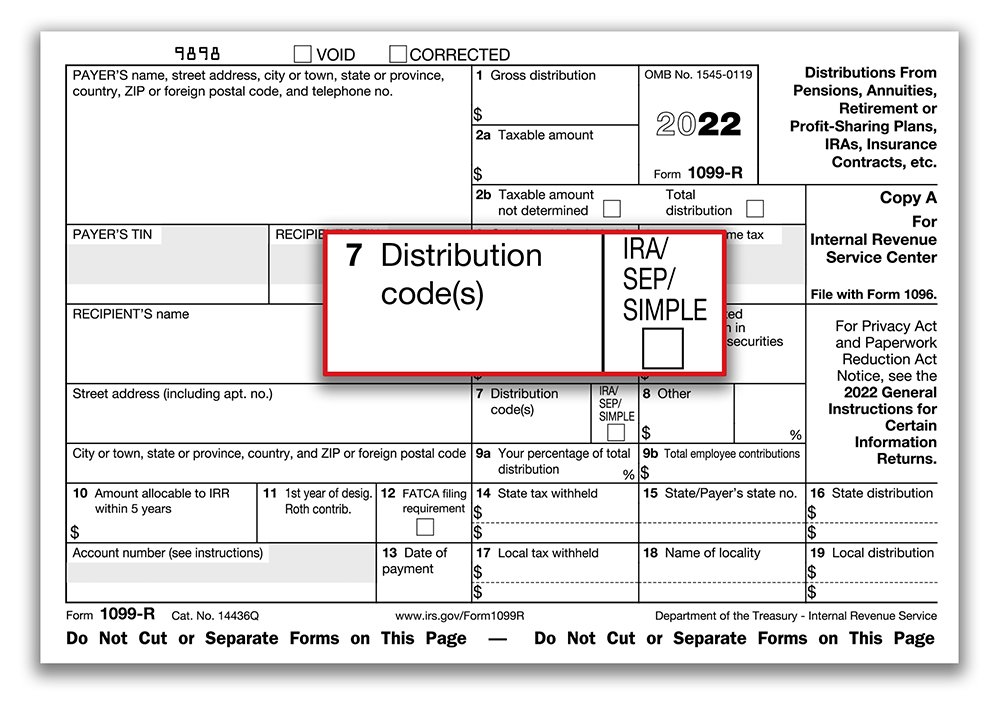

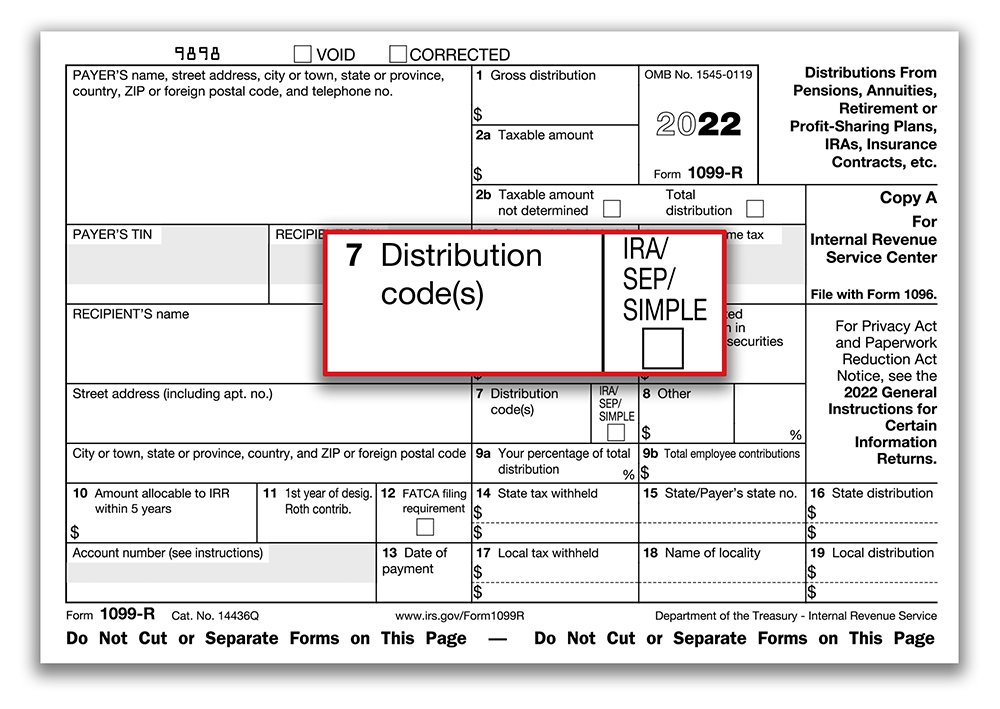

Step 2: Understand the Different Boxes

The 1099-R form consists of several key boxes that convey different pieces of information:

- Box 1: Gross distribution.

- Box 2a: Taxable amount.

- Box 3: Capital gain included in Box 2a (if any).

- Box 4: Federal income tax withheld.

- Box 7: Distribution code, indicating the type of payment (e.g., normal distribution, early distribution, etc.).

Understanding what each box represents will help you accurately report your income.

⚠️ Note: If Box 2a is blank, the entire amount in Box 1 is taxable.

Step 3: Calculate Your Taxable Amount

The most common pitfall is miscalculating the taxable amount. Here’s what you need to know:

- Pre-tax contributions (traditional 401(k), 403(b), etc.): The full amount in Box 1 is typically taxable.

- After-tax contributions (Roth IRAs or non-deductible contributions): You need to determine what part, if any, is taxable.

- Special calculations are necessary for insurance policies, annuities, and lump-sum distributions.

Utilize IRS worksheets or tax software, or consult with a tax advisor for accurate calculations.

Step 4: Address Any Special Circumstances

Some distributions come with unique tax implications:

- Disability Pensions: If under age 65, some part of this might not be taxable.

- Inherited IRAs or Pension Plans: The rules differ depending on whether you’re the spouse of the deceased or not.

- Early Withdrawals: There can be penalties if you’re under age 59½ unless an exception applies.

🔎 Note: Check the distribution code in Box 7 to understand if special tax rules apply.

Step 5: Complete the 1099-R Worksheet

With all your information prepared, you can now complete the worksheet:

- Enter the Gross Distribution: This is the amount in Box 1.

- Identify the Taxable Amount: Use the information from Steps 2 and 3 to correctly report this.

- Record Any Capital Gain: This goes in Box 3 if applicable.

- Withholding: Include the amount withheld for federal income taxes in Box 4.

- Report Correctly: Transfer the data from your worksheet to your tax return.

💡 Note: If you’ve used a tax software, it might do the worksheet for you, but always double-check the entries.

By following these steps, you're not just filling out a form; you're ensuring that your tax return reflects your financial situation accurately. This reduces the risk of errors, which can lead to audits or penalties. Remember, taxes can be intricate, especially when retirement accounts come into play, so if you're ever unsure, it's best to consult with a tax professional or use reputable tax software designed to handle such complexities.

What does Box 7 of the 1099-R mean?

+

Box 7 on Form 1099-R indicates the distribution code, which explains the nature of the distribution. This code is crucial as it dictates how the distribution should be treated for tax purposes (e.g., normal distribution, early distribution subject to penalty, etc.).

What happens if my 1099-R is wrong?

+

If there’s an error on your 1099-R, contact the issuing institution to request a corrected form (1099-R with an “X” in the CORRECTED box). You must file your tax return with the correct information; otherwise, you could face IRS scrutiny or have to amend your return later.

Do I need to report a rollover on my tax return?

+

A direct rollover from one retirement account to another is usually not taxable if done within 60 days. However, you must report it on your tax return, and if Box 7 shows code G, then no taxation is required for that distribution.