State and Local Income Tax Refund Guide

Getting the Most Out of Your State and Local Income Tax Refunds

Filing taxes can be one of the most daunting financial responsibilities each year, but understanding how to navigate state and local income taxes can lead to significant refunds. This guide will provide you with detailed insights into managing your state and local tax obligations, optimizing your deductions, and ensuring you receive every penny you're entitled to.

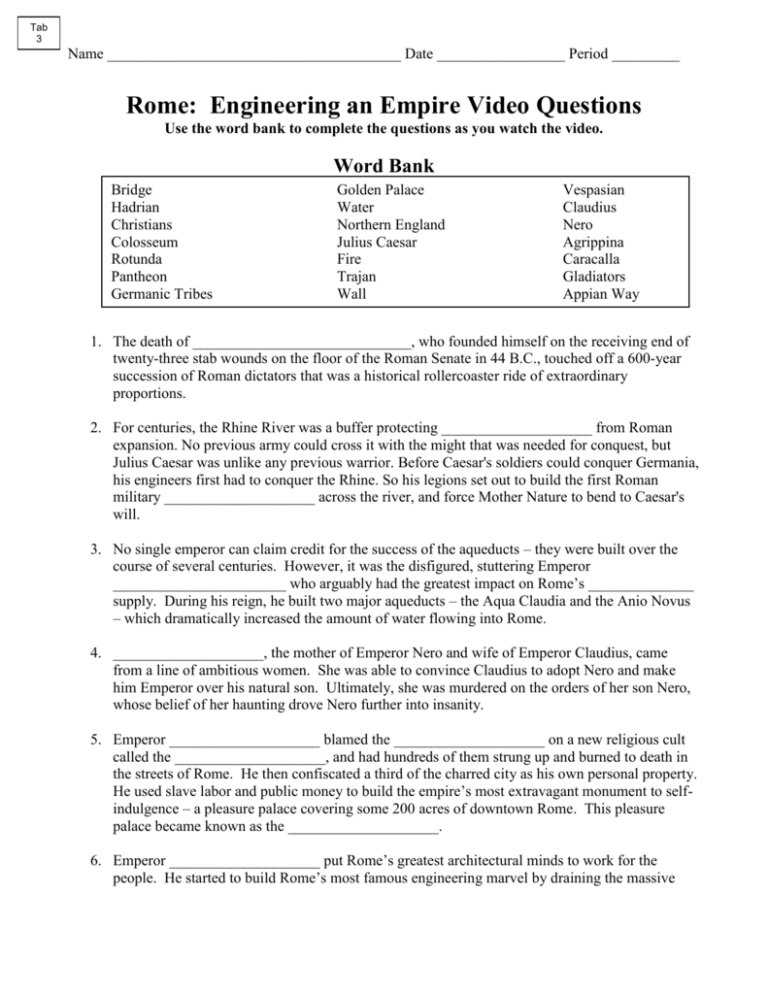

Understanding State and Local Income Taxes

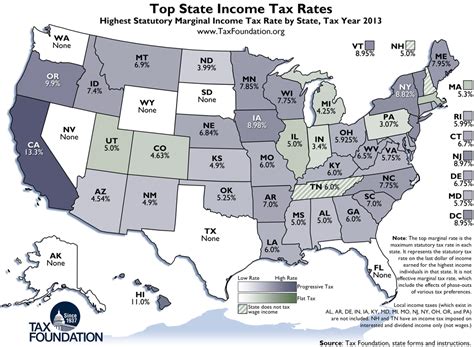

State and local income taxes are additional to the federal tax obligations that many U.S. residents must handle. While federal income tax remains uniform, state and local taxes can vary widely:

- Progressive Tax Systems: States like California and New York use a progressive system where the tax rate increases with income.

- Flat Tax Systems: States like Illinois and Pennsylvania have a single tax rate, regardless of income.

- No Income Tax: Some states, including Florida, Nevada, and Texas, do not levy a personal income tax at all.

Local taxes can include municipal taxes, school district taxes, and other special district taxes, which further complicate the tax landscape:

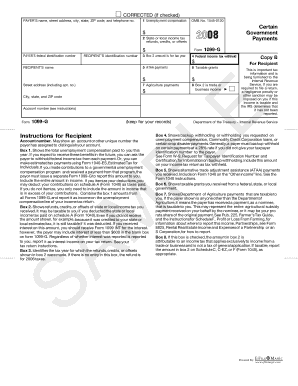

- State Income Tax: Must be filed with your state's revenue department.

- Local Taxes: These might be part of your state return or require separate filings.

Understanding your state's tax system is crucial for optimizing your refunds. Here's a table of some states with their tax system:

| State | Tax System | Local Taxes |

|---|---|---|

| California | Progressive | Yes, varies |

| Florida | No Income Tax | Varies by county |

| Illinois | Flat Tax | Chicago has additional tax |

| New York | Progressive | Yes, varies |

💡 Note: Be sure to check local regulations and any changes in tax laws which might affect your refunds.

How to Optimize Your Refund

Here are several strategies to ensure you get the most out of your state and local income tax refunds:

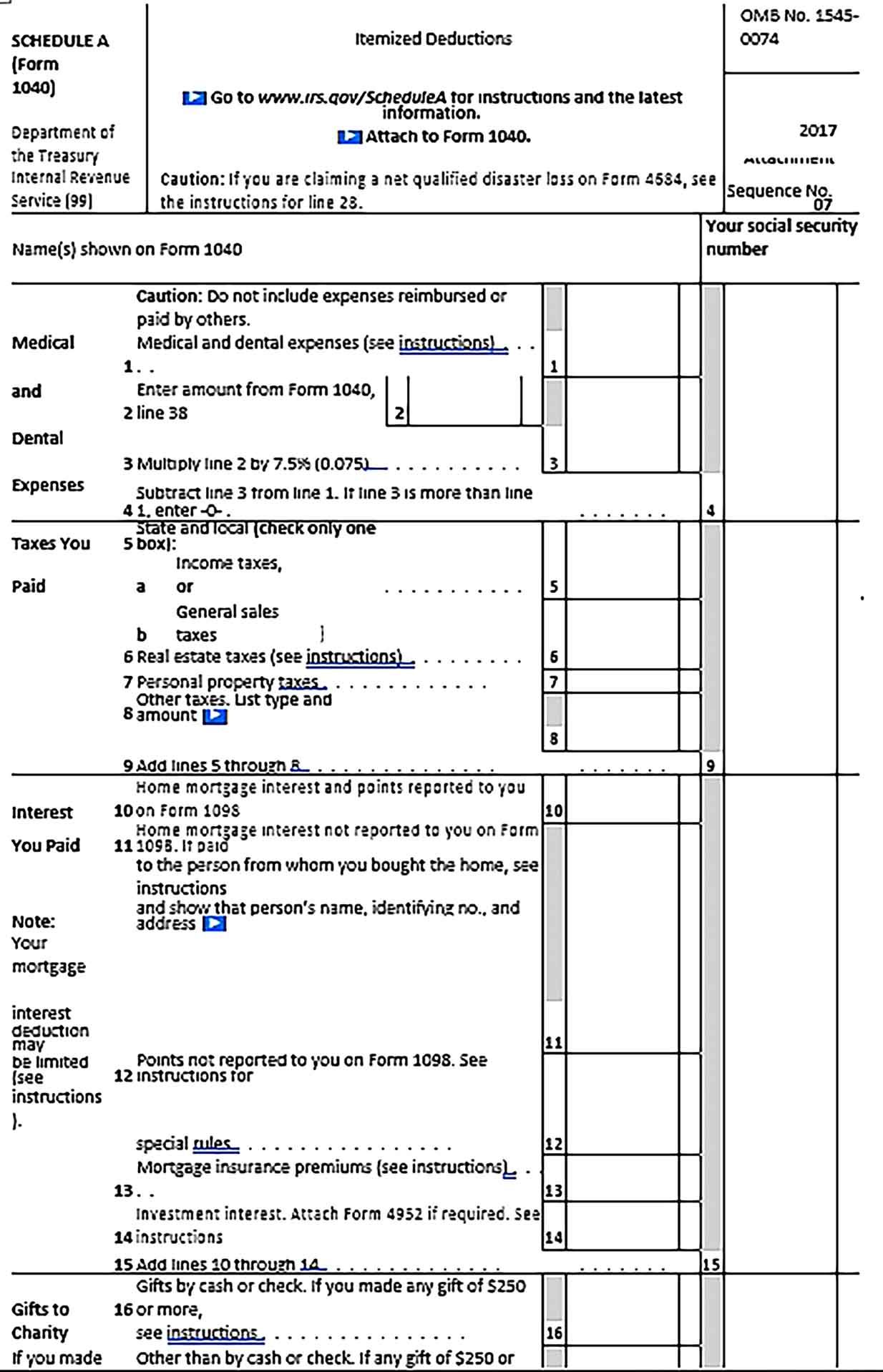

Claim Allowable Deductions

- Itemized Deductions: If you itemize on your federal return, you can often do the same for state and local taxes. Common deductions include mortgage interest, medical expenses, and charitable contributions.

- Standard Deduction: Some states offer a standard deduction which you might be able to claim if your itemized deductions don't exceed this amount.

Refundable Credits

Many states offer refundable tax credits, which can increase your refund:

- EITC (Earned Income Tax Credit): Many states have their own version of the federal EITC.

- Child Tax Credit: Similar to the federal credit, this can provide additional funds.

- Other Credits: Look for state-specific credits related to education, environmental efforts, or healthcare.

File on Time

Filing your taxes on time not only avoids penalties but can also expedite your refund process. States might offer incentives or faster processing for electronic filings.

Withhold Correctly

Adjust your withholdings throughout the year to match your tax liability. Too little withheld can lead to owing taxes, while too much means you've given the state an interest-free loan.

💡 Note: Use state-specific withholding calculators to estimate your annual tax liability accurately.

Special Cases and Situations

Here are some situations where state and local tax refunds might have different considerations:

Retirement Income

Some states offer tax breaks for retirement income, either through exemptions or credits:

- Exemptions: Certain forms of retirement income might be exempt from state taxes.

- Credits: Specific credits for retirees or seniors might exist.

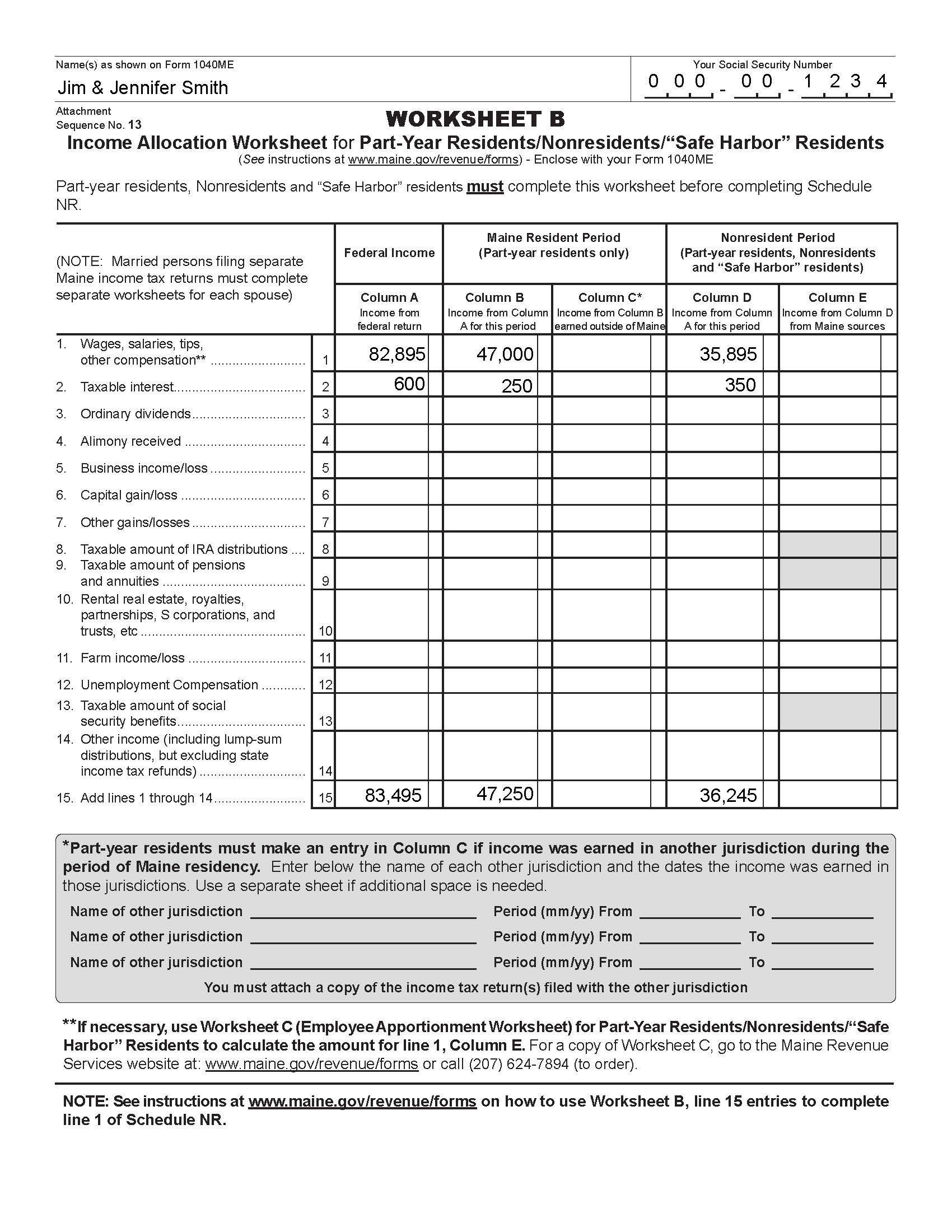

Moving Between States

If you've moved during the tax year, filing taxes can become complicated. You'll need to file returns in both states, prorating your income according to the time spent in each state.

Non-Resident Workers

If you earn income in a state where you don't reside, you'll typically need to file a non-resident return. Some states have reciprocal agreements to simplify this process.

The Refund Process

Once you've filed your returns, the refund process varies by state:

Expected Timelines

- Filing Method: Electronic filings generally result in faster refunds.

- State-Specific Delays: Some states might take longer to process due to high volumes or budget constraints.

Tracking Your Refund

Most states offer tools to track your refund online or by phone:

- State Revenue Department Websites: Often provide refund status tracking.

- Refund Hotlines: For those preferring phone support.

Key insights into closing your tax year include:

The complexities of state and local income taxes require a thorough understanding to ensure you're not leaving money on the table. By strategically planning your deductions, understanding your state's tax system, and staying informed about changes in tax laws, you can maximize your refunds. Remember, every state has its unique approach to taxation, and local variations further complicate the landscape. Stay diligent, file on time, and use available tools to track your refund, ensuring a smooth and beneficial tax season.

What is the difference between federal and state tax refunds?

+

Federal tax refunds are issued based on your federal income tax filing, addressing taxes paid to the U.S. government. State tax refunds relate to taxes paid to the state where you live or earned income, which can vary in amount and refund processing times due to differing state tax laws and systems.

Can I claim a state tax refund if I paid local taxes?

+Yes, but it depends on your state’s tax laws. Some states allow you to claim local taxes as part of your state tax return, while others require separate filings for local taxes.

How can I estimate my state and local tax refunds?

+You can use state-specific calculators or consult with tax professionals to estimate your refunds. These tools factor in income, withholdings, deductions, and credits to give you a good estimate of what to expect.