-

5 Steps to Calculate Income with Fannie Mae Worksheet

This article provides a detailed guide on using the Income Calculation Worksheet for conforming to Fannie Mae's loan underwriting standards.

Read More » -

Earned Income Credit Worksheet CP 27 Guide

Worksheet for calculating and verifying eligibility for the Earned Income Tax Credit on CP 27 forms.

Read More » -

Maximize Your Tax Benefits with Worksheet 1 in Pub. 596

Explanation of how to use Worksheet 1 from IRS Publication 596 to determine eligibility for the Earned Income Credit.

Read More » -

7 Ways to Maximize Your Credit Limit with Form 8812

This article provides an in-depth guide on Form 8812, detailing how to calculate and report the Additional Child Tax Credit using the Credit Limit Worksheet, helping taxpayers understand eligibility and maximize their tax benefits.

Read More » -

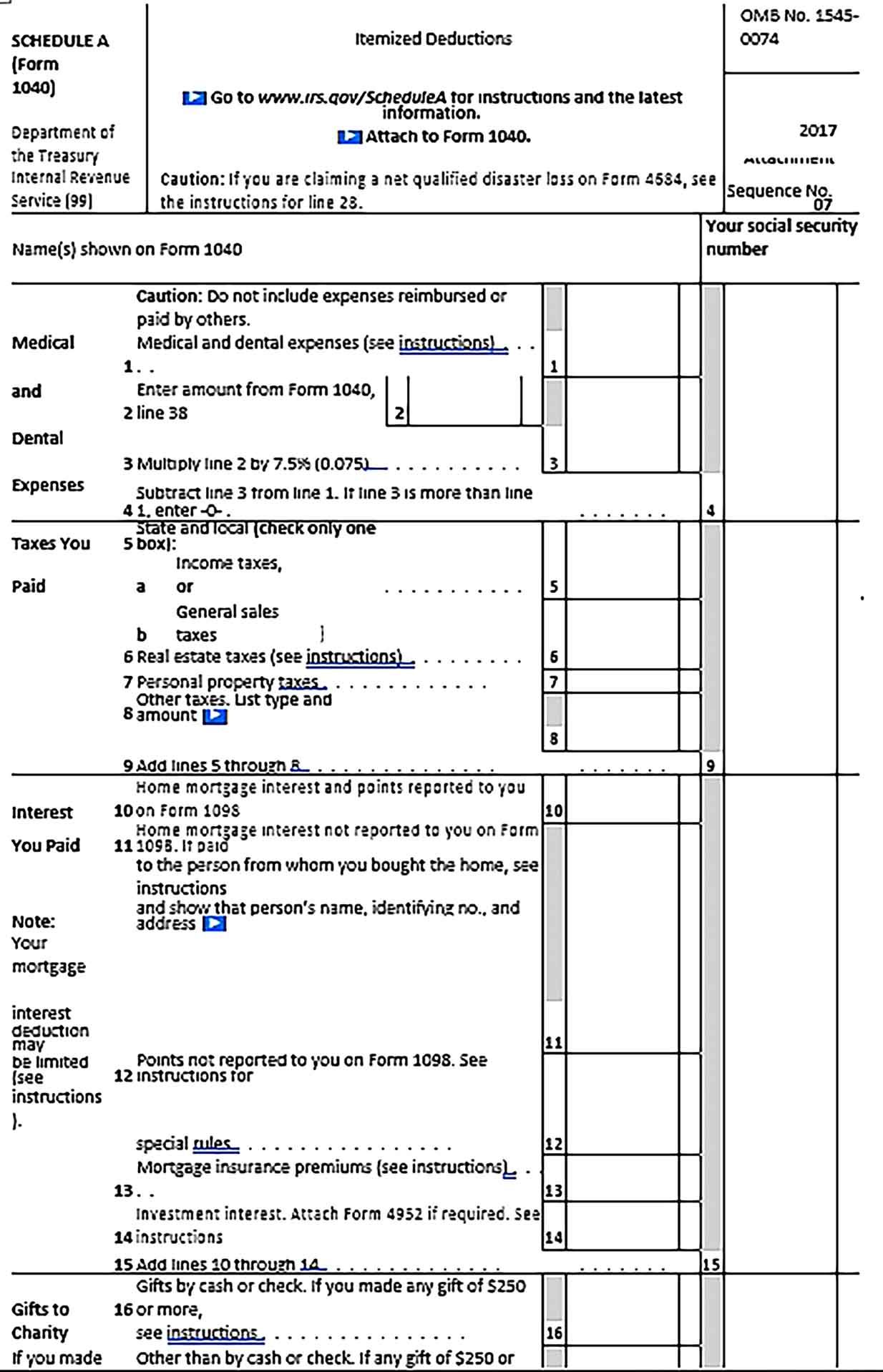

Maximize Savings with Maryland's Top 5 Deductions

Maryland Itemized Deduction Worksheet assists taxpayers in calculating deductions on their state tax returns, detailing various state-specific expenses and federal adjustments.

Read More » -

Maximize Your State Tax Refund with This Worksheet

A guide to calculating your state tax refund efficiently.

Read More » -

5 Ways to Maximize Your Schedule 8812 Worksheet

Use Schedule 8812 Worksheet to determine Additional Child Tax Credit eligibility and calculate the amount.

Read More » -

State and Local Income Tax Refund Guide

Worksheet to calculate state and local income tax refunds, aiding in tax preparation.

Read More » -

Maximize Your Oregon Tax Savings with Personal Allowances Worksheet

Oregon Personal Allowances Worksheet: A step-by-step guide to help Oregon taxpayers determine their tax withholdings by calculating personal allowances based on state-specific criteria.

Read More » -

5 Ways to Maximize Your Tax Refund Today

A guide on how to properly calculate and report state and local tax refunds on your federal income tax return.

Read More »