Earned Income Credit Worksheet CP 27 Guide

Understanding the intricacies of tax refunds and credits can be overwhelming, especially when complex documentation like the CP 27 is involved. The Earned Income Credit (EIC) is a beneficial tax credit designed to help low to moderate-income workers and families, and the CP 27 form plays a crucial role in ensuring that taxpayers claim the correct amount. In this comprehensive guide, we will delve into what the EIC Worksheet CP 27 is, how to complete it, and what it means for your tax return.

What is the Earned Income Credit?

The Earned Income Credit, commonly referred to as EIC or EITC (Earned Income Tax Credit), is a refundable tax credit for working people who have low to moderate income. Here's how it benefits taxpayers:

- Increased Income: It effectively increases your income by reducing your taxes or even refunding money back if the credit exceeds taxes owed.

- No Child Requirement: While it's more substantial for taxpayers with children, you can still claim a modest EIC without having qualifying children.

- Combat Poverty: It's aimed at reducing poverty levels by incentivizing work and aiding in the welfare of families.

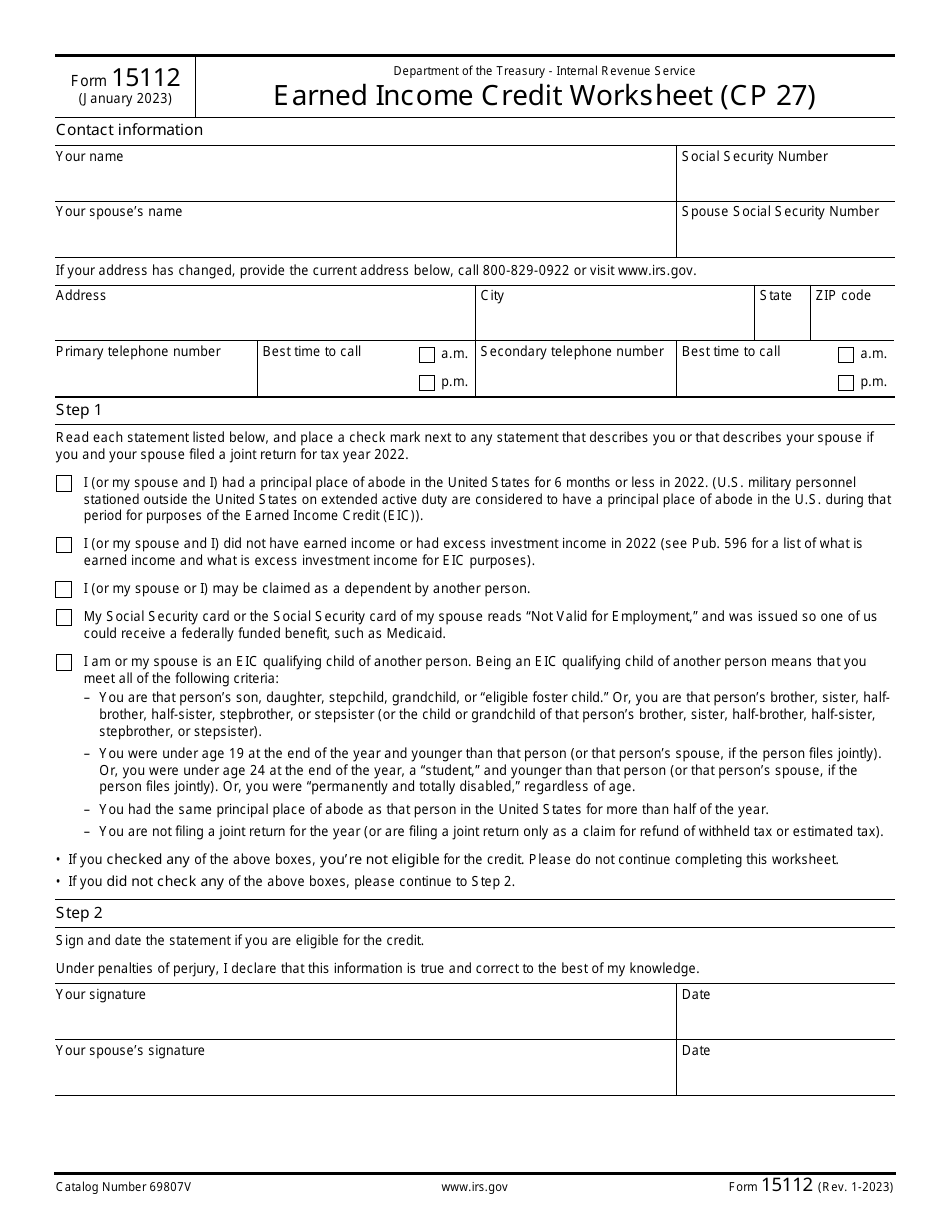

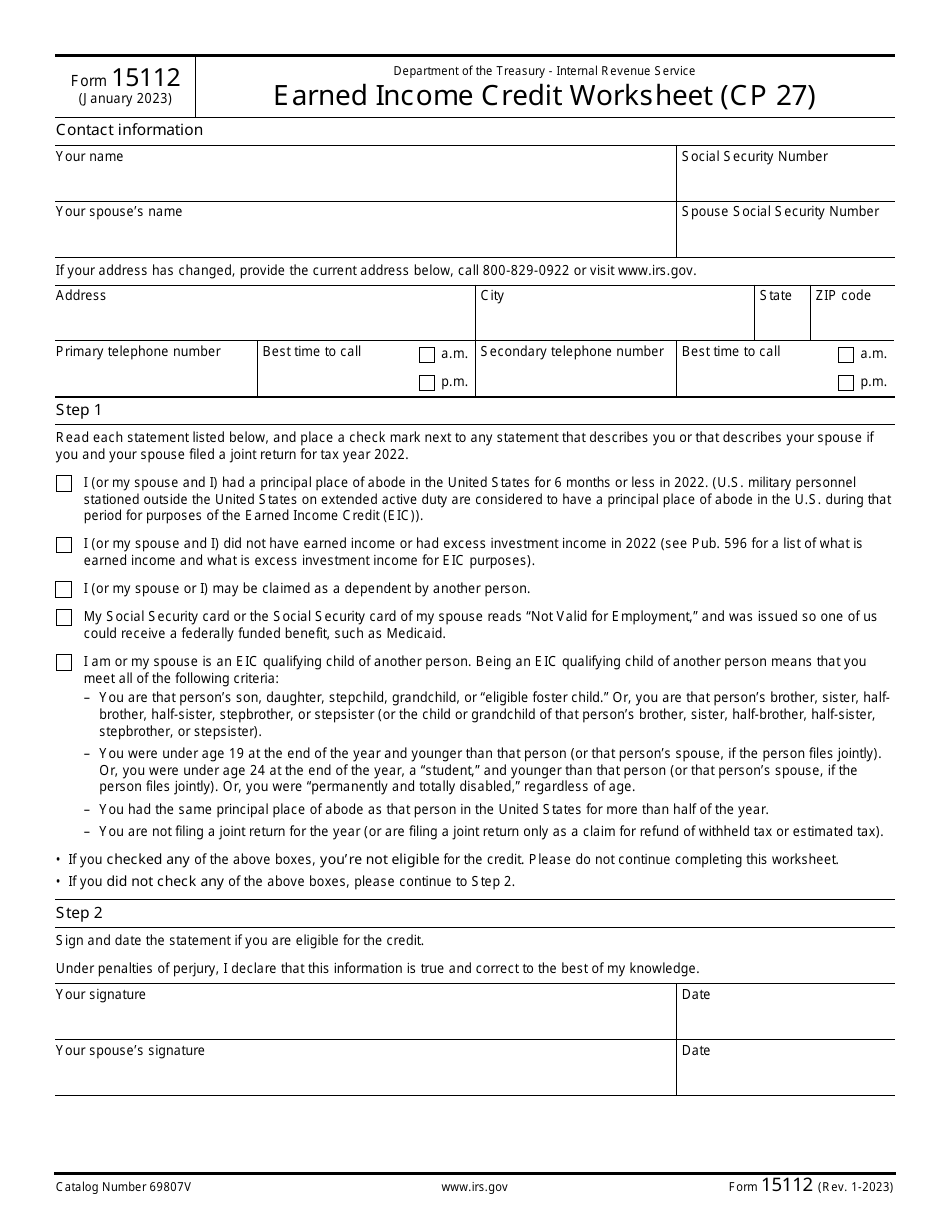

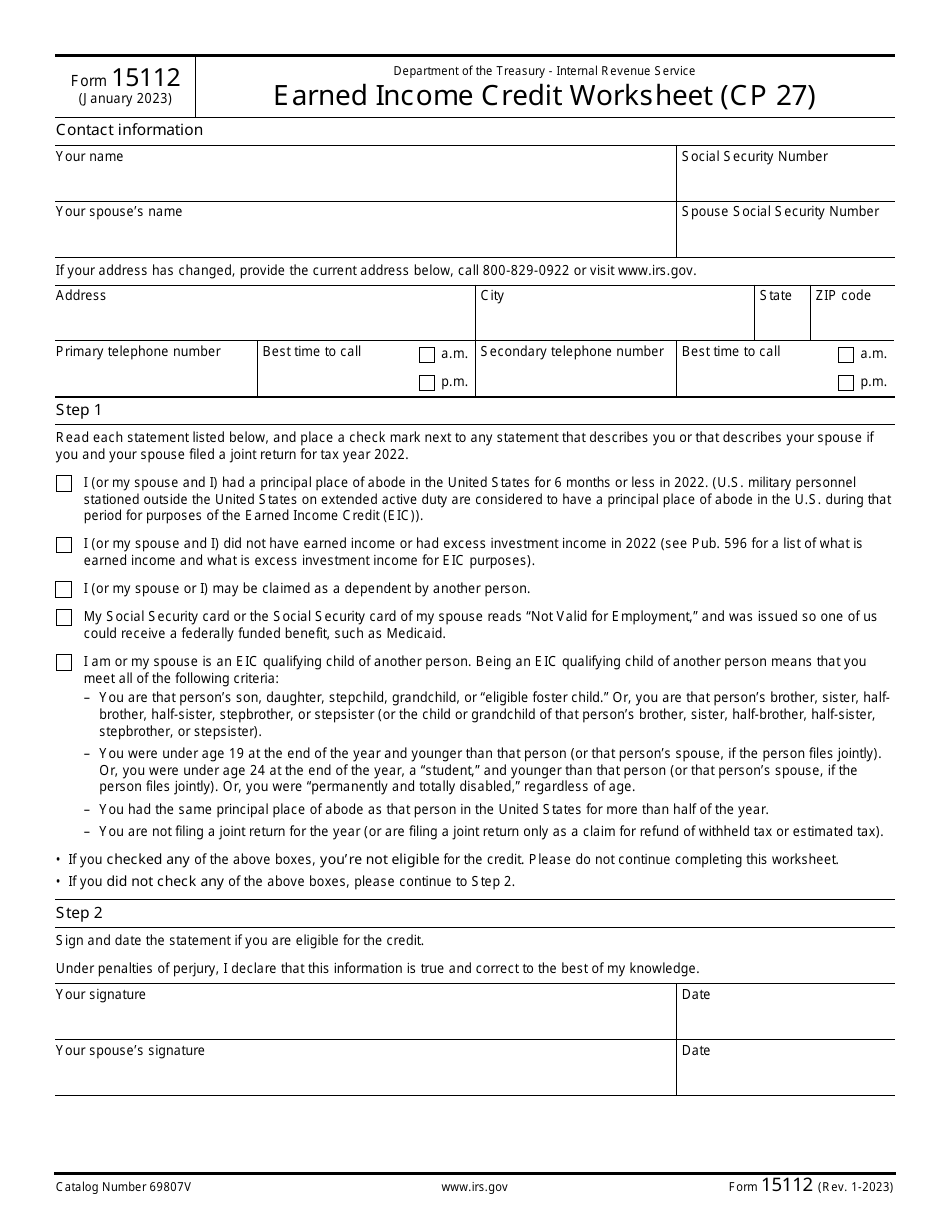

Understanding the CP 27 Form

The CP 27 form, officially known as the Earned Income Credit (EIC) Worksheet, is used by taxpayers to determine their eligibility and the amount of EIC they can claim. Here's what you need to know:

Why is CP 27 Important?

- It helps calculate the correct EIC amount for your tax situation.

- It ensures you don't inadvertently claim an incorrect amount, which could lead to tax penalties.

- It's especially useful if your income or household composition changes year over year.

💡 Note: The IRS uses the information provided on the CP 27 form to verify your eligibility and the credit amount, so accuracy is paramount.

How to Fill Out the EIC Worksheet CP 27

Let's walk through the steps to complete the EIC Worksheet:

Step 1: Determine Your Eligibility

- Confirm that your earned income is within the income limits for your filing status.

- Check if your investment income does not exceed the limits set for the EIC.

- Ensure you meet the age requirement; you must be over 25 but under 65 to qualify without a qualifying child, or any age with a qualifying child.

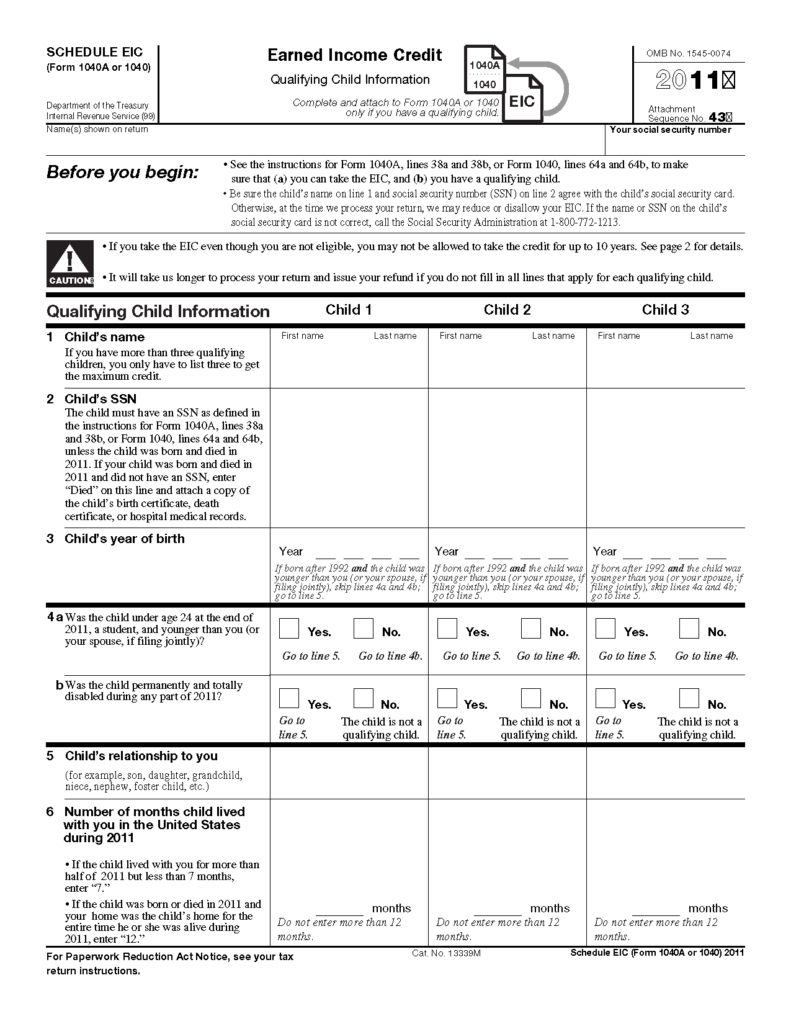

Step 2: Identify Qualifying Children

If applicable, list the details of any qualifying children:

| Child's Name | Birthdate | SSN | Relationship |

|---|---|---|---|

| [Child's Name] | [Birthdate] | [SSN] | [Relationship] |

Step 3: Calculate Adjusted Gross Income (AGI)

Your Adjusted Gross Income (AGI) plays a crucial role in determining your EIC:

- Sum your total earnings before taxes.

- Subtract any adjustments like student loan interest or alimony payments.

Step 4: Use the EIC Table

Refer to the IRS EIC table to find the credit amount based on:

- Your AGI

- The number of qualifying children

- Your filing status

Step 5: Complete the Worksheet

The CP 27 form requires detailed entries:

- Fill in your earned income, investment income, and AGI.

- Include details of each qualifying child if applicable.

- Follow the instructions to determine your EIC based on your situation.

What if I Made an Error on My EIC Calculation?

If you realize you've made an error:

- File an amended return using Form 1040X.

- Pay any additional taxes owed to avoid penalties.

- Inform the IRS immediately to mitigate potential issues.

📞 Note: Early action can prevent issues like audits or repayment of overclaimed EIC.

In summary, the EIC Worksheet CP 27 is not just a piece of paperwork; it's a key component in maximizing your tax benefits. Understanding how to accurately complete this form can lead to significant refunds or reduce your tax liability. Remember that while the EIC is a valuable tax credit, it comes with strict eligibility rules and requires meticulous documentation. By ensuring your information is correct and up-to-date, you not only claim the credit you're entitled to but also avoid potential future tax troubles. This guide should serve as your roadmap to navigate the complexities of EIC and help you keep more of your hard-earned income.

Who is eligible for the Earned Income Credit?

+

To be eligible for the EIC, you must have earned income below a certain threshold, file a tax return with a qualifying income status (single, head of household, married filing jointly), have investment income below a specified limit, have a valid Social Security number, be a U.S. citizen or resident alien all year, and not file Form 2555 or Form 2555-EZ.

How does my child qualify for EIC?

+

A child qualifies for EIC if they meet the relationship test (son, daughter, grandchild, stepchild), age test (under 19 or under 24 if a full-time student), residency test (must live with you in the U.S. for more than half the year), and support test (must not provide more than half of their own support).

What should I do if I received a notice about my EIC claim?

+

If you receive an IRS notice regarding your EIC claim, review the notice carefully. If you agree with the notice, take the necessary actions like filing an amended return or repaying any overclaimed credit. If you disagree, you have the right to appeal. Follow the instructions provided in the notice to explain your case or provide additional documentation.