7 Ways to Maximize Your Credit Limit with Form 8812

Understanding how to leverage Form 8812, also known as the Additional Child Tax Credit, can open doors to better financial management and increased credit opportunities. This guide explores the strategic ways to maximize your credit limit by using this form effectively. Here, we'll delve into the nuances of this tax credit, provide insights into its benefits, and outline actionable steps you can take to ensure you're not leaving money on the table.

What is Form 8812?

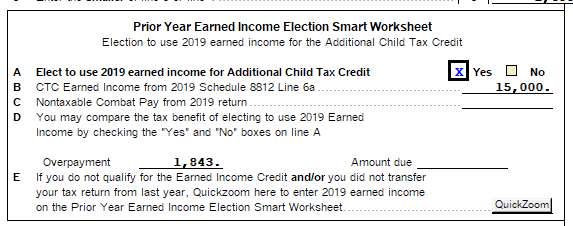

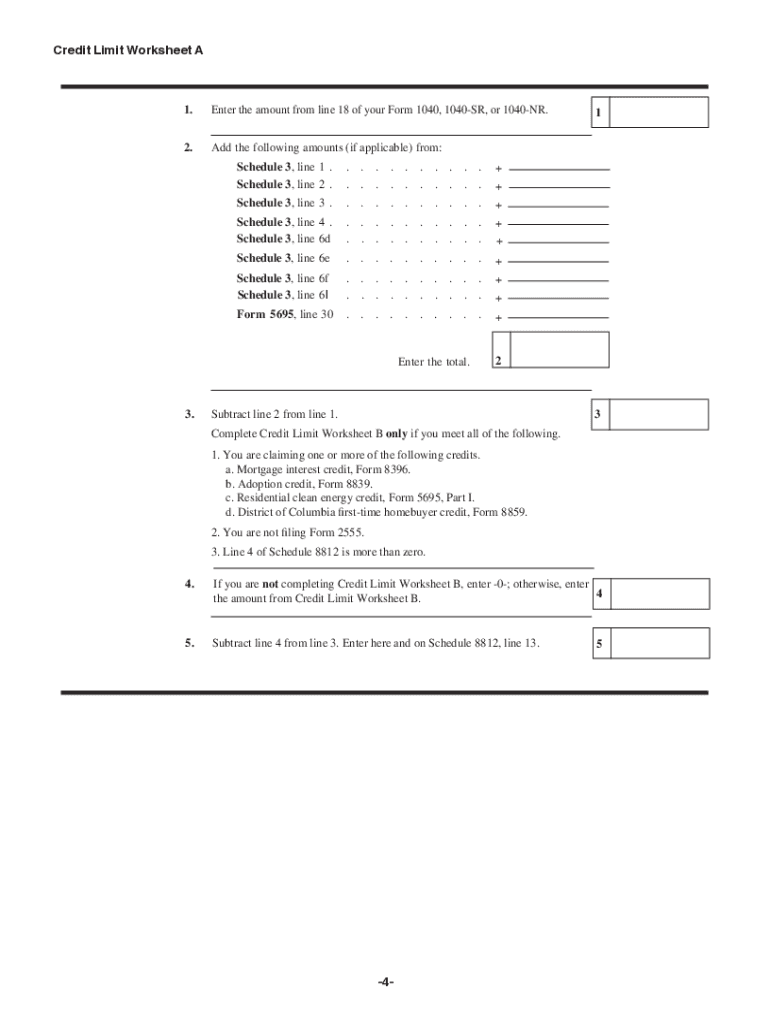

Form 8812 allows taxpayers to claim the Additional Child Tax Credit, a refundable credit designed to help families with children get more money back. It's especially useful if your Child Tax Credit exceeds the amount of tax you owe or if you meet other qualifying conditions.

Eligibility Requirements

- Income Level: There are income thresholds you must meet to qualify for the credit.

- Number of Qualifying Children: You must have a qualifying child for whom you claim the Child Tax Credit.

- Residency: You must have a child who lived with you for more than half the year.

- Work Status: You or your spouse must have earned income.

🚨 Note: Always check the latest IRS regulations as these criteria can change annually.

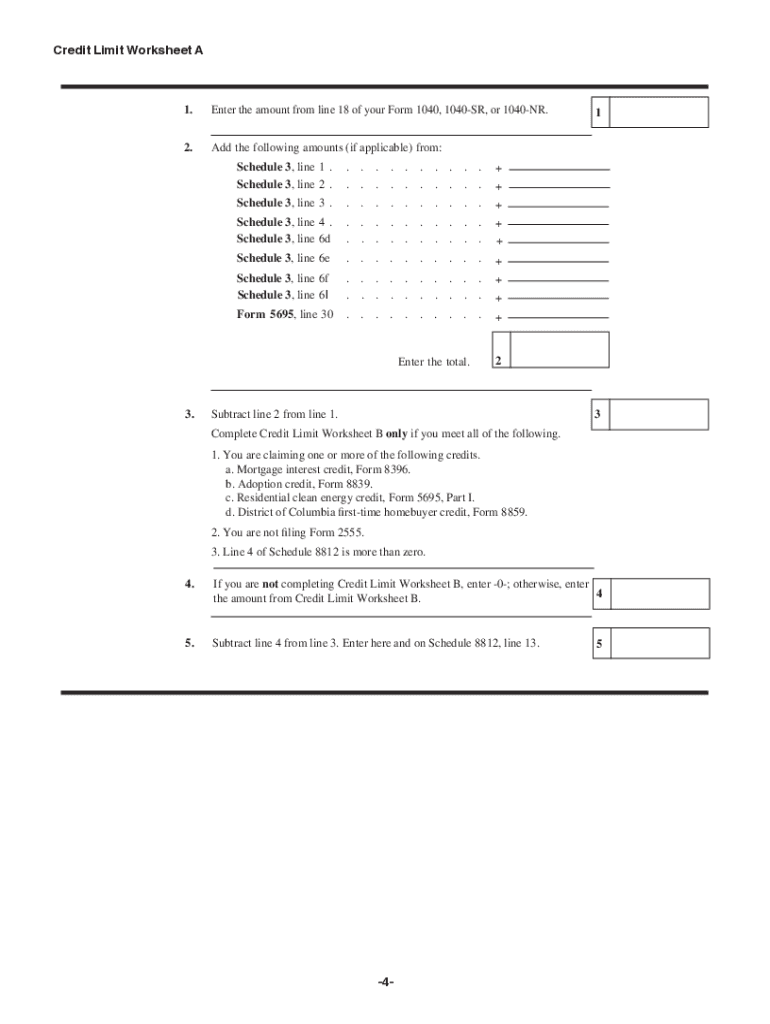

How to File Form 8812

Filing Form 8812 is straightforward:

- Gather Necessary Documents: Collect information on all children, your income, and any documentation related to your tax situation.

- Complete Your Federal Tax Return: You can't file Form 8812 without first completing your main tax return.

- Complete Form 8812: Fill out the form, calculating the Additional Child Tax Credit you're eligible for.

- Submit with Your Tax Return: Attach Form 8812 to your tax return when you file.

Common Mistakes to Avoid

- Not double-checking math calculations.

- Failing to include all qualifying children.

- Misunderstanding the income limits or earned income rules.

7 Ways to Maximize Your Credit Limit

1. Understand Your Income Limits

Knowing the income thresholds can directly influence the amount of credit you can claim. Review the IRS guidelines to ensure you fall within the limits, and if possible, adjust your income:

- Reduce non-qualifying income like capital gains or retirement distributions.

- Increase earned income through employment or freelancing.

2. Optimize Your Child Tax Credit

The Child Tax Credit and the Additional Child Tax Credit work together. Here’s how to maximize it:

- Ensure all qualifying children are included on your tax return.

- Understand the phase-out thresholds and strategize accordingly.

3. Leverage Earned Income

If your earned income is insufficient, consider:

- Part-time work or freelance gigs to boost your income.

- If married filing jointly, both partners’ earned income is considered, so discuss potential income opportunities.

4. Claim All Deductions

Lowering your taxable income can indirectly increase your credit:

- Take advantage of deductions like student loan interest or educator expenses.

- Consider contributing to retirement accounts to reduce adjusted gross income (AGI).

5. Use Tax Planning to Your Advantage

Strategic tax planning can make a significant difference:

- Defer bonus income or capital gains to a subsequent year if it pushes you over the income limit.

- Bunch deductions like charitable contributions into one year to lower AGI for Form 8812.

6. Keep Detailed Records

Proper documentation is key to claiming and defending your credit:

- Keep records of children’s Social Security numbers, birth certificates, and proof of residency.

- Document any earned income or employment details for potential IRS inquiries.

7. Consult a Tax Professional

If in doubt, seek expert advice:

- A tax professional can ensure you’re claiming all possible credits and navigating complex scenarios like self-employment or multiple income sources.

By implementing these strategies, you can effectively maximize your credit limit through Form 8812. Remember, the key is understanding the intricacies of tax credits, planning, and meticulous record-keeping. These efforts can pay off by helping you receive a substantial tax refund, which can be reinvested in ways that support your financial health.

Summary

Throughout this guide, we’ve explored how Form 8812 can be used to significantly enhance your tax credit. By understanding the rules, optimizing your situation, and avoiding common errors, you can turn this form into a powerful tool for financial betterment. Whether it’s through strategic income management, ensuring all deductions are claimed, or seeking professional advice, each step discussed here is aimed at helping you maximize your returns and utilize your tax credit effectively.

Who qualifies for the Additional Child Tax Credit?

+

Individuals with earned income, specific income limits, and one or more qualifying children for whom they can claim the Child Tax Credit are eligible.

What if I’m close to the income threshold for claiming the credit?

+If you’re near the income threshold, consider reducing non-qualifying income or increasing earned income to ensure you qualify for the credit.

Can Form 8812 help if I owe a lot of taxes?

+Yes, if your Child Tax Credit exceeds the amount of tax you owe, the Additional Child Tax Credit can provide a refundable credit, helping reduce the amount you owe or increase your refund.

How should I keep records for Form 8812?

+Keep detailed records of children’s information, residency, income, and tax deductions for at least three years in case of IRS inquiries or audits.

Can I claim the Additional Child Tax Credit if I am self-employed?

+Yes, as long as you meet the income and earned income requirements, you can claim the credit. Be sure to report all relevant income accurately.