5 Steps to Calculate Income with Fannie Mae Worksheet

The Fannie Mae Income Calculation Worksheet is an essential tool for those involved in the real estate industry, from real estate agents and mortgage brokers to loan officers and homebuyers. This worksheet simplifies the often complex process of determining an individual's eligibility for a mortgage by standardizing income calculations. Here are the detailed steps to effectively use the Fannie Mae Worksheet for income calculation.

Step 1: Gather All Financial Documents

The first step in using the Fannie Mae Income Calculation Worksheet involves collecting all the necessary financial documentation. This includes:

- Pay stubs: Typically, the last two months’ worth.

- W-2 forms: From the most recent two years.

- Tax returns: Including all schedules and K-1s, for the past two years.

- Proof of any additional income sources: Such as rental income, retirement accounts, child support, or alimony.

It’s critical to ensure that all these documents are complete and unaltered, as discrepancies can lead to delays in loan approval.

Step 2: Identify Income Types

Income can come from various sources, and the Fannie Mae worksheet helps in categorizing them:

- Base Employment Income: Salary or wages from employment.

- Bonus and Overtime: These must be averaged over a period to predict future income.

- Self-Employment Income: Profits after expenses and depreciation, as reported on tax returns.

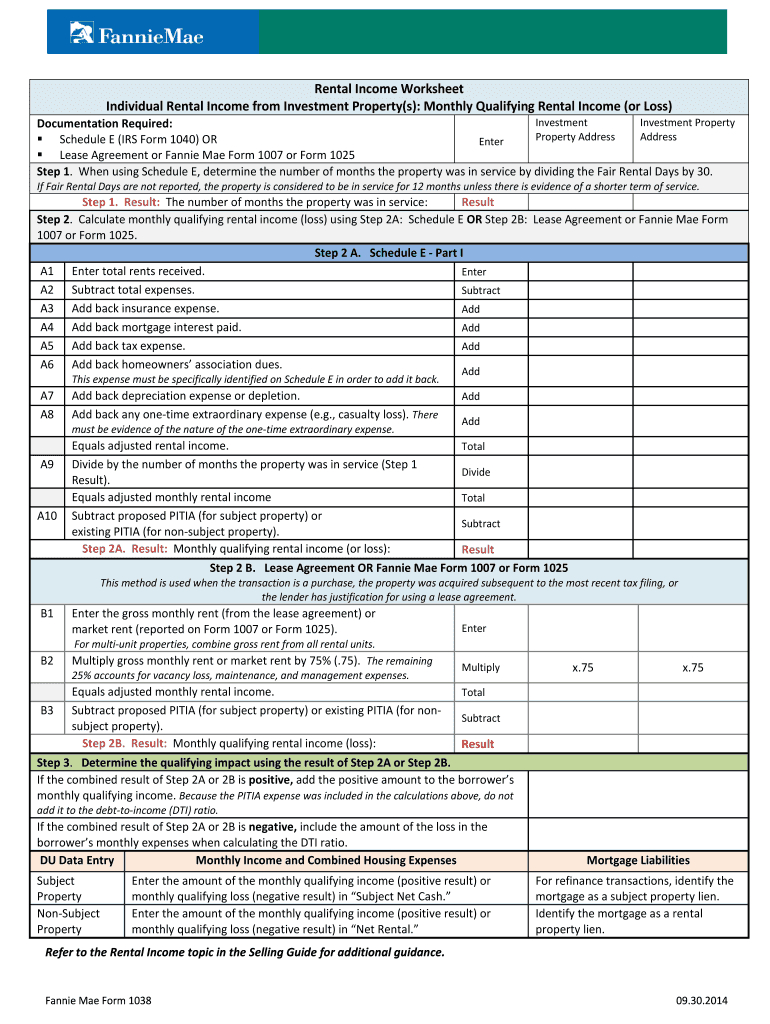

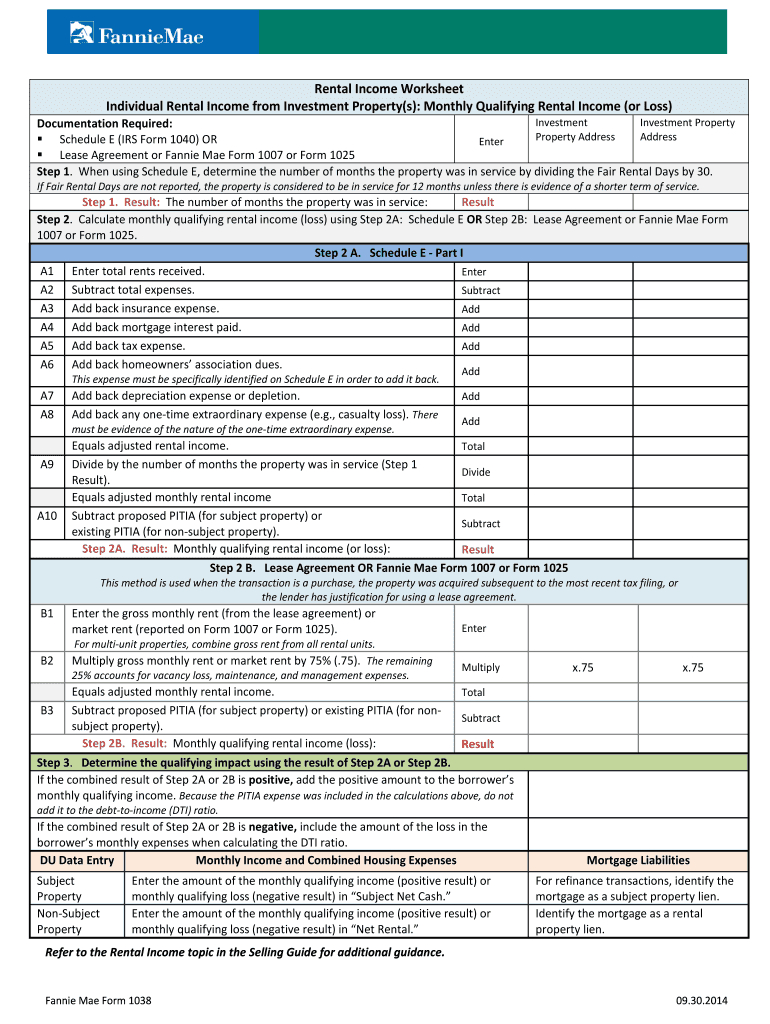

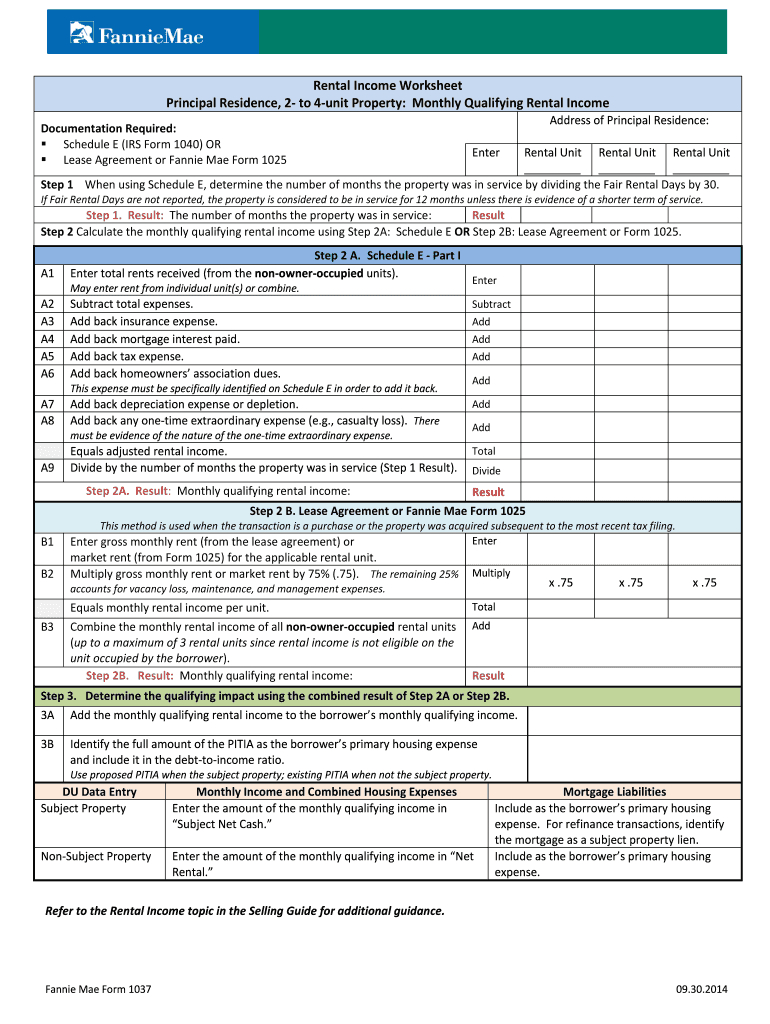

- Rental Income: If properties are rented out, this can be included after subtracting expenses.

- Other Income: Including alimony, child support, disability, social security, etc.

Correctly identifying each income type ensures that you use the appropriate section of the worksheet for calculations.

Step 3: Complete the Worksheet

The Fannie Mae worksheet provides specific fields for each income type:

| Income Type | Section in Worksheet |

|---|---|

| Base Employment | Section I |

| Bonus and Overtime | Section II |

| Self-Employment | Section III |

| Rental Income | Section IV |

| Other Income | Section V |

Each section requires the input of relevant financial figures from the documents gathered in Step 1. Here, you’ll calculate the average income over the stipulated period to ensure an accurate reflection of income stability.

💡 Note: It’s important to use the correct year for each income source to avoid inconsistencies.

Step 4: Adjust for Non-Recurring and Discretionary Income

The worksheet allows for adjustments:

- Exclude non-recurring income: Such as bonuses that are unlikely to continue, or one-time payments.

- Adjust for discretionary expenses: For instance, if someone has been paying into a 401(k) or similar plan, these amounts are often added back to the income.

These adjustments ensure that the income figure is as realistic and sustainable as possible for mortgage purposes.

Step 5: Review and Verify

Before submitting the Fannie Mae worksheet for underwriting:

- Recheck all calculations: Ensure all figures are accurate.

- Verify with client or applicant: Discuss any discrepancies or notable changes in income.

- Check compliance: Ensure all guidelines set by Fannie Mae are met, including income stability, continuity, and adequacy for the loan amount sought.

Accuracy and attention to detail are paramount to avoid delays in loan processing.

By following these steps, the Fannie Mae Income Calculation Worksheet becomes a powerful tool in assessing an applicant's financial standing for a mortgage. It not only helps in determining eligibility but also in providing a clear, standardized method for income verification, which is crucial for underwriters and loan officers. This process also benefits the applicant by providing a detailed breakdown of their income, often revealing overlooked income sources that could improve their loan options.

What should I do if my income is inconsistent?

+

If your income is inconsistent, focus on averaging your income over the last two years to show stability. Document any reasons for fluctuations and provide proof of current employment or new income sources to strengthen your application.

Can I use the worksheet if I’m self-employed?

+

Yes, self-employed individuals can use the worksheet. You will need to provide tax returns, profit and loss statements, and other documents to accurately reflect your business income and expenses.

How often do I need to update my income calculation?

+

It’s recommended to update your income calculation every time there’s a significant change in income or annually for mortgage recertification or if you’re applying for a new loan.

What happens if my income is too low for the loan amount I want?

+

If your income doesn’t support the loan amount you’re seeking, you might need to look for a smaller loan, find additional income sources, or adjust your expectations regarding the property value or loan type.

Are there other factors considered besides income for loan approval?

+

Yes, apart from income, lenders look at credit history, debt-to-income ratio, employment history, assets, and property appraisals to determine loan approval and terms.