5 Ways to Maximize Your Schedule 8812 Worksheet

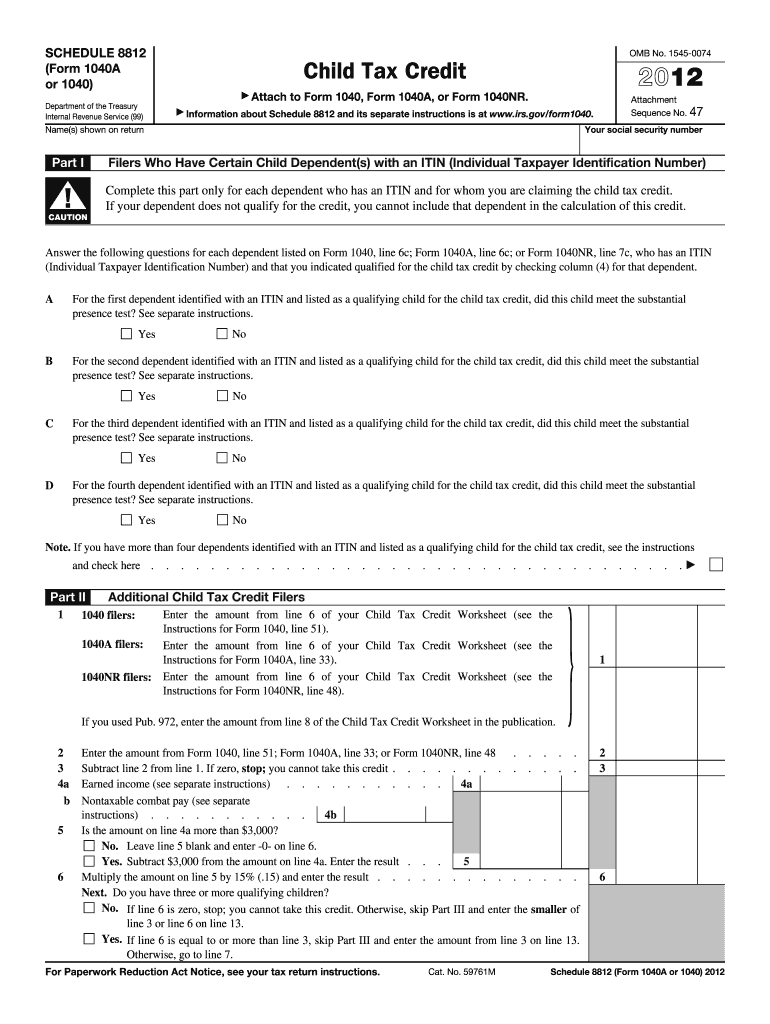

Managing your time efficiently can be the key to balancing personal and professional life, especially when it comes to tax preparation. The IRS Schedule 8812, which pertains to additional child tax credit, might seem straightforward, but with detailed understanding and strategic planning, you can maximize your benefits and streamline the process. Here are five methods to optimize your approach:

1. Understand the Form Thoroughly

The first step to mastering your Schedule 8812 is to understand what it entails. This form is used by taxpayers who have at least one qualifying child, but their tax credit is limited or reduced due to their income or the amount of taxes they owe.

- Know the requirements: Eligibility criteria include having a dependent child, having income below a certain threshold, and potentially owing less in taxes than the credit you are eligible for.

- Check previous tax returns: Familiarize yourself with any previous credits claimed, which can provide insights into potential changes or benefits for the current year.

2. Leverage Technology

Technology can be your ally when dealing with tax forms like Schedule 8812. Here are ways to harness digital tools:

- Online Tax Software: Programs like TurboTax or H&R Block can guide you through the process, ensure accuracy, and even highlight potential savings or credits you might overlook.

- Electronic Filing (e-file): Filing taxes electronically can speed up the process, reduce errors, and allow for quicker refunds if you’re eligible.

3. Organize Documents and Records

Effective organization is vital when preparing for tax season:

- Create a Tax Binder: Keep all your tax-related documents in one place. This should include:

- SSN cards or ITINs for you and your dependents

- Any child support or alimony payments

- Income statements

- File Digitally: Scan and store documents digitally for easy retrieval and to prevent physical loss.

4. Maximize Credits and Deductions

Understanding the interplay between different credits and deductions can significantly increase your tax benefits:

| Action | Benefit |

|---|---|

| Check eligibility for other child-related credits | May qualify for the child tax credit or dependent care credit |

| Explore education credits | Possible additional credit from education expenses |

| Itemize deductions if beneficial | Potentially lower taxable income |

5. Seek Professional Help

Sometimes, the complexity of tax forms or the potential for optimizing your tax return calls for expert assistance:

- Tax Professionals: A tax preparer can provide personalized advice, find overlooked deductions, and manage complex tax situations.

- Check for Free Services: Look for IRS-sponsored or non-profit services if you qualify for free tax preparation.

Summing up, by understanding the IRS Schedule 8812, utilizing technology, organizing your documents, maximizing credits, and seeking professional advice when necessary, you can make your tax preparation process smoother and potentially more beneficial. Remember, preparation is key to minimizing stress and maximizing refunds during tax season.

🚨 Note: Always verify information on the IRS website for the most current tax laws and forms.

What is the Additional Child Tax Credit?

+

The Additional Child Tax Credit (ACTC) is a refundable tax credit for taxpayers with three or more qualifying children who claim the Child Tax Credit but are unable to use the full amount due to income limitations.

How do I know if I qualify for the Additional Child Tax Credit?

+

To qualify for the ACTC, you must have a qualifying child, meet certain income thresholds, and have a tax liability that prevents you from receiving the full Child Tax Credit.

Can I file Schedule 8812 electronically?

+

Yes, you can file Schedule 8812 electronically using approved tax preparation software, which can simplify the process and reduce errors.