Maximize Savings with Maryland's Top 5 Deductions

When tax season rolls around, Maryland residents have a variety of state-specific deductions available to them, each designed to help maximize their tax savings. Whether you're a homeowner, a parent, or a commuter, understanding these deductions can significantly reduce your taxable income. This guide walks through Maryland's top 5 deductions, detailing how to claim them and the potential savings they can offer.

Maryland Homeowner’s Property Tax Credit

The Maryland Homeowner’s Property Tax Credit helps ease the burden of high property taxes. This credit is particularly valuable for homeowners on a fixed income or with substantial property taxes. Here’s how to make the most of this deduction:

- Eligibility: Homeowners with a net worth under 200,000 for single filers and 300,000 for joint filers can qualify. Also, the total household income must be below a certain threshold.

- Claiming: You’ll need to apply each year, providing documentation of your income and property taxes paid.

- Savings Potential: Depending on your tax liability and the value of your home, savings can range from a few hundred to several thousand dollars.

Child and Dependent Care Tax Credit

For families in Maryland with young children or dependents requiring care, this tax credit can offer substantial relief. Here’s what you should know:

- Eligibility: The credit is available for expenses related to the care of a dependent under 13, a disabled spouse, or other qualifying dependents. The care must allow you or your spouse to work or look for work.

- Claiming: Use IRS Form 2441 to calculate the federal credit first, then apply the Maryland credit, which is 30% of the federal credit, up to $510 per eligible child or dependent.

- Savings Potential: This can reduce your tax liability significantly, especially for multiple dependents.

⚠️ Note: Ensure you keep all receipts and documentation related to childcare expenses as they might be required for verification.

Earned Income Tax Credit (EITC)

The Maryland Earned Income Tax Credit aligns with the federal EITC, providing additional financial assistance to low-to-moderate-income workers:

- Eligibility: Earned income thresholds apply, and the credit is calculated based on federal guidelines.

- Claiming: You must file for the federal EITC, and then claim the Maryland EITC on your state return.

- Savings Potential: Depending on your income and number of children, this credit can be quite substantial, often exceeding $1,000.

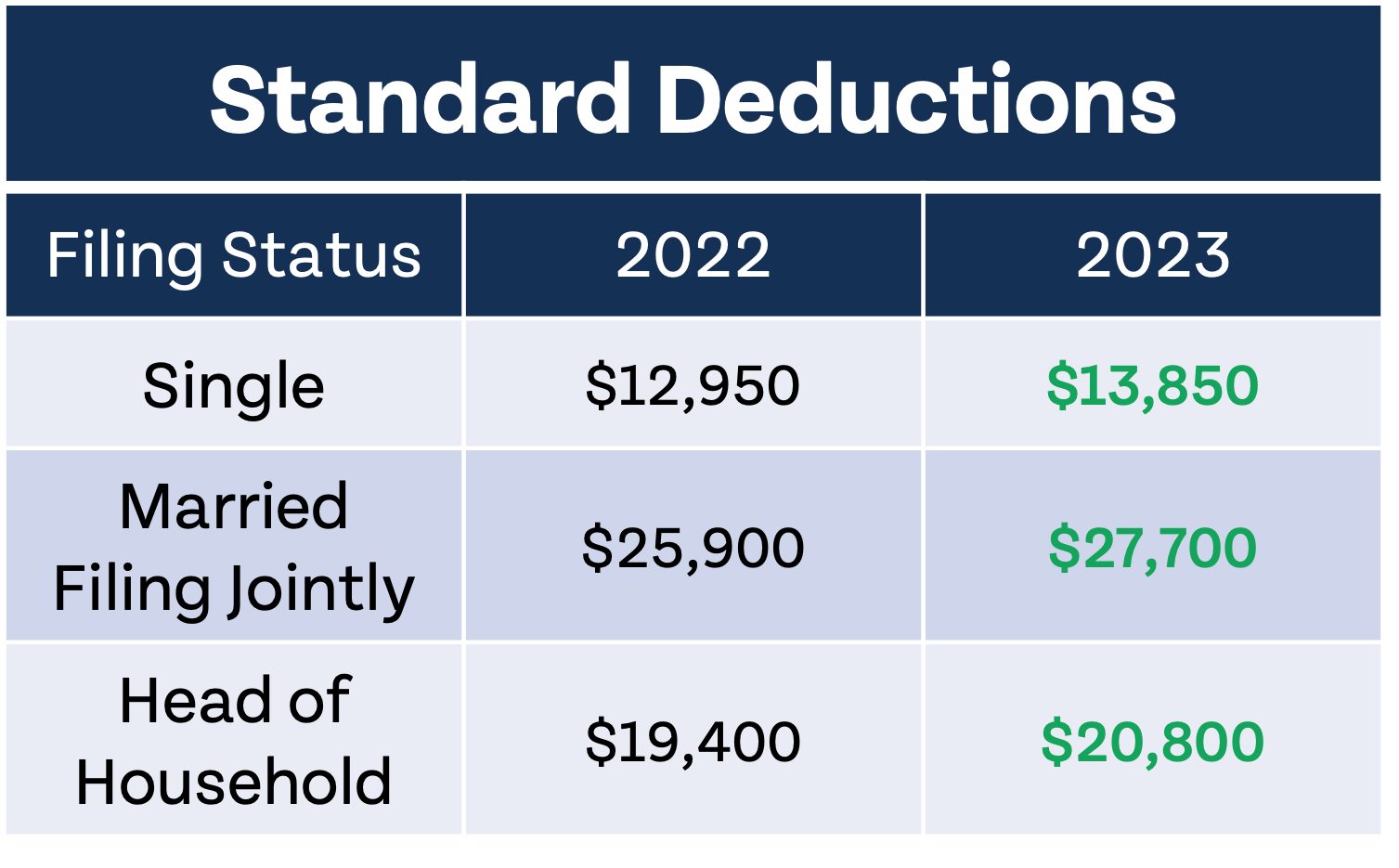

| Income Range | Maximum Federal EITC | Maryland EITC Rate | Maximum Maryland EITC |

|---|---|---|---|

| Less than $10,000 | $6,660 | 28% | $1,865 |

| $10,000 to $20,000 | $5,980 | 28% | $1,674 |

529 College Investment Plan Deduction

The Maryland Prepaid College Trust and College Investment Plan offer tax benefits for educational savings:

- Eligibility: Open to all Maryland residents saving for higher education expenses for themselves, their children, or other dependents.

- Claiming: Contribute to an approved 529 plan, and you can deduct up to $2,500 per beneficiary from your state taxable income annually.

- Savings Potential: This deduction can reduce your taxable income, potentially saving you hundreds or more each year based on your tax bracket.

📝 Note: The beneficiary of the 529 plan does not need to be claimed as a dependent on your tax return.

Commuter Tax Credit

If you commute to work using public transport, here’s a credit designed to ease the financial strain:

- Eligibility: Use public transportation or vanpools for your commute to work.

- Claiming: Save your fare receipts. You can claim up to 100 per month in credits, leading to a maximum annual credit of 1,200.

- Savings Potential: This can be a straightforward way to reduce your taxable income, especially for regular commuters.

In closing, Maryland offers several opportunities for tax savings that can significantly impact your financial health. From homeownership benefits to educational savings plans, these deductions are designed to fit different aspects of life in Maryland. Remember, the key to maximizing savings is understanding eligibility, keeping meticulous records, and staying informed about changes to tax laws. By leveraging these top 5 deductions, Maryland residents can optimize their tax strategy, save more, and potentially improve their quality of life.

Can I claim the Maryland Homeowner’s Property Tax Credit if I have a rental property?

+

No, the Maryland Homeowner’s Property Tax Credit is intended for your primary residence only. If you rent out your property, you are not eligible for this credit.

How do I calculate the Maryland Child and Dependent Care Tax Credit?

+

Start by calculating your federal Child and Dependent Care Tax Credit using IRS Form 2441. Then, Maryland allows you to claim 30% of your federal credit, up to $510 per eligible child or dependent.

What if I don’t qualify for the Earned Income Tax Credit?

+

There are other credits available. You might still qualify for the Maryland Commuter Tax Credit or the 529 College Investment Plan Deduction, or other state-specific benefits. Always consult with a tax professional to identify all possible deductions and credits.