Maximize Your Oregon Tax Savings with Personal Allowances Worksheet

Understanding how to manage your tax withholdings effectively is key to maximizing your savings and reducing the stress of tax season, especially in a state like Oregon with its unique tax considerations. Utilizing the Personal Allowances Worksheet (PAW) provided by the IRS can significantly aid you in this process. This guide will walk you through the intricacies of the PAW, how to adjust your allowances correctly, and provide insights into Oregon-specific tax benefits.

What is the Personal Allowances Worksheet?

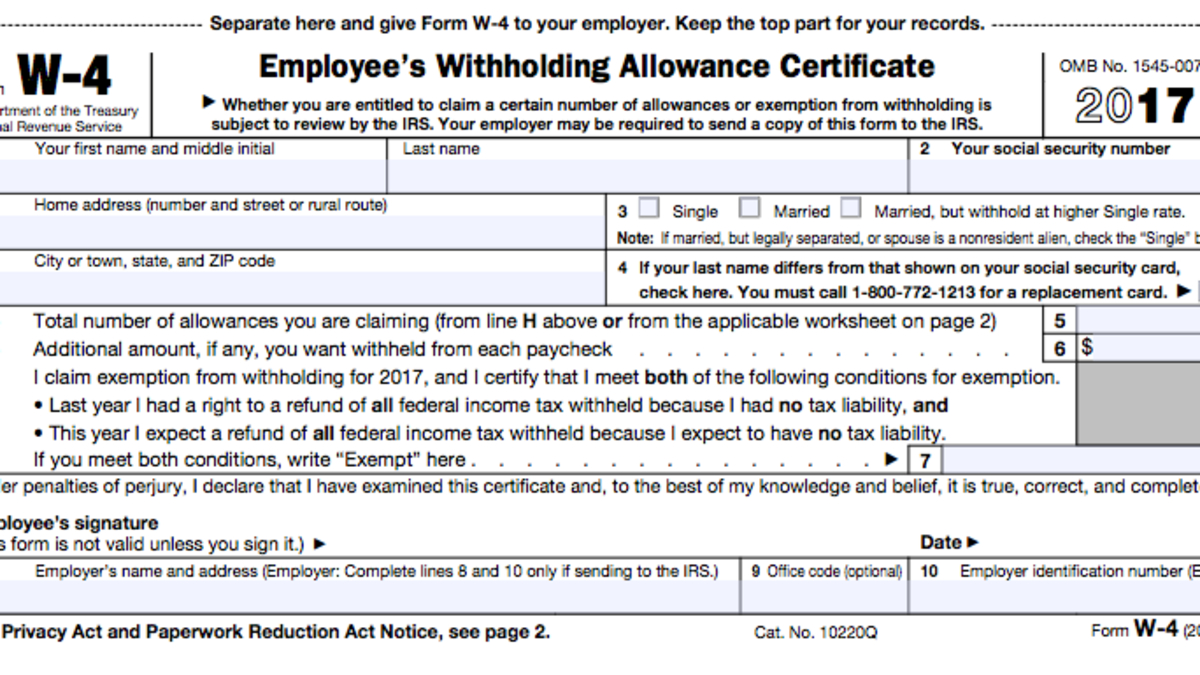

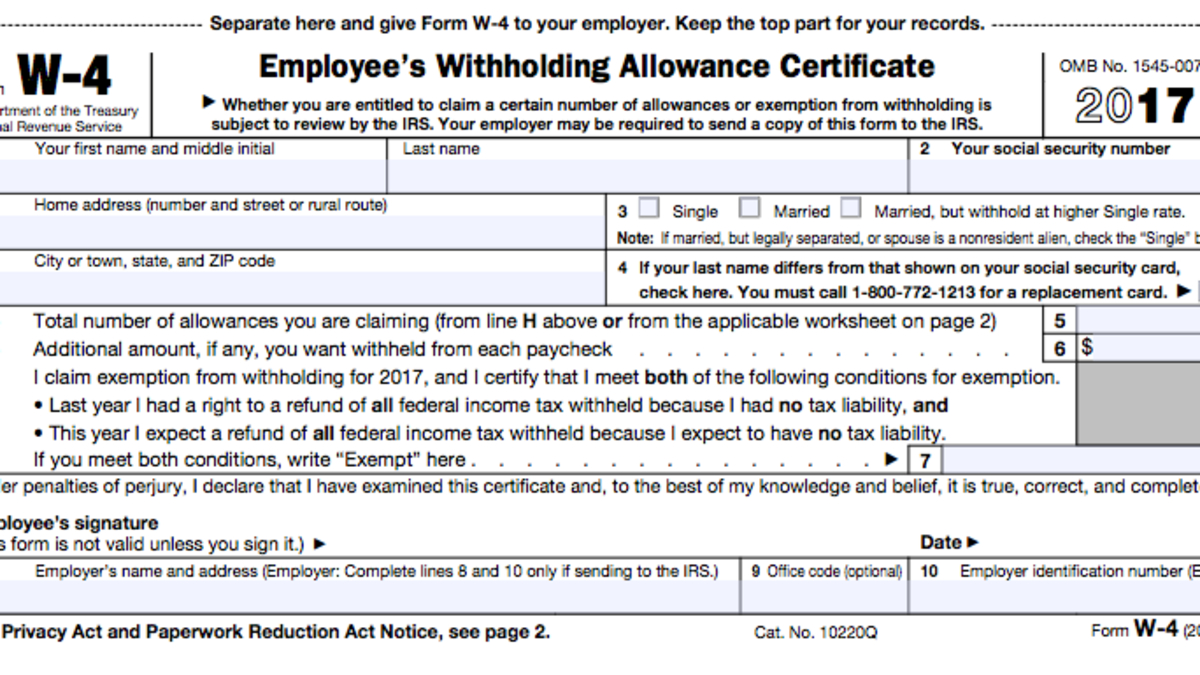

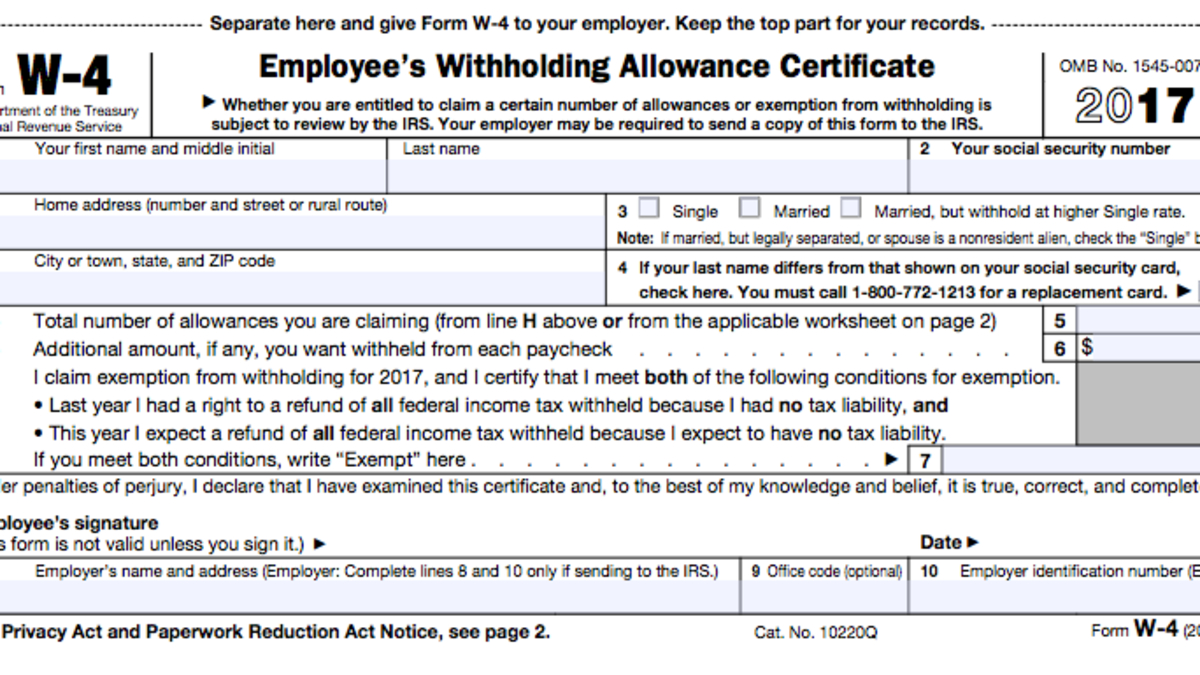

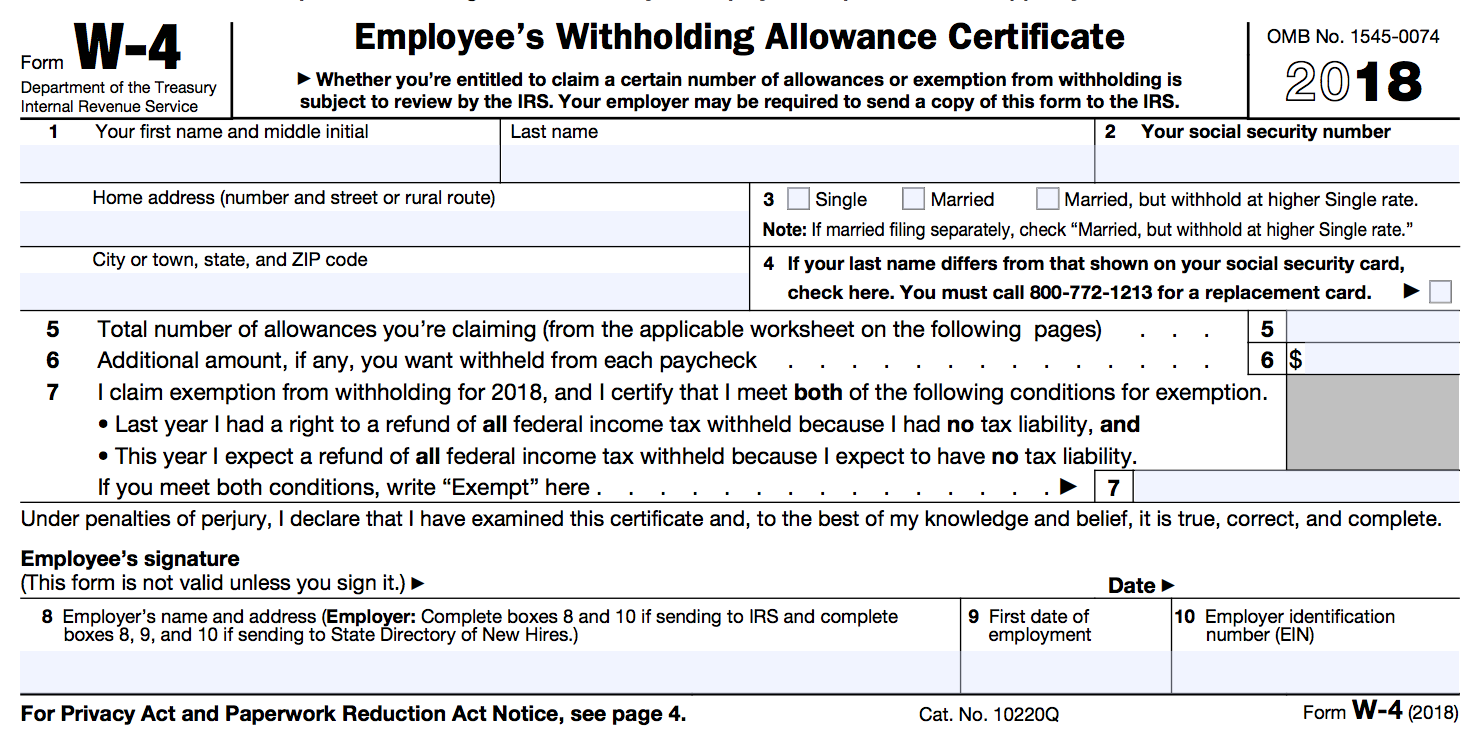

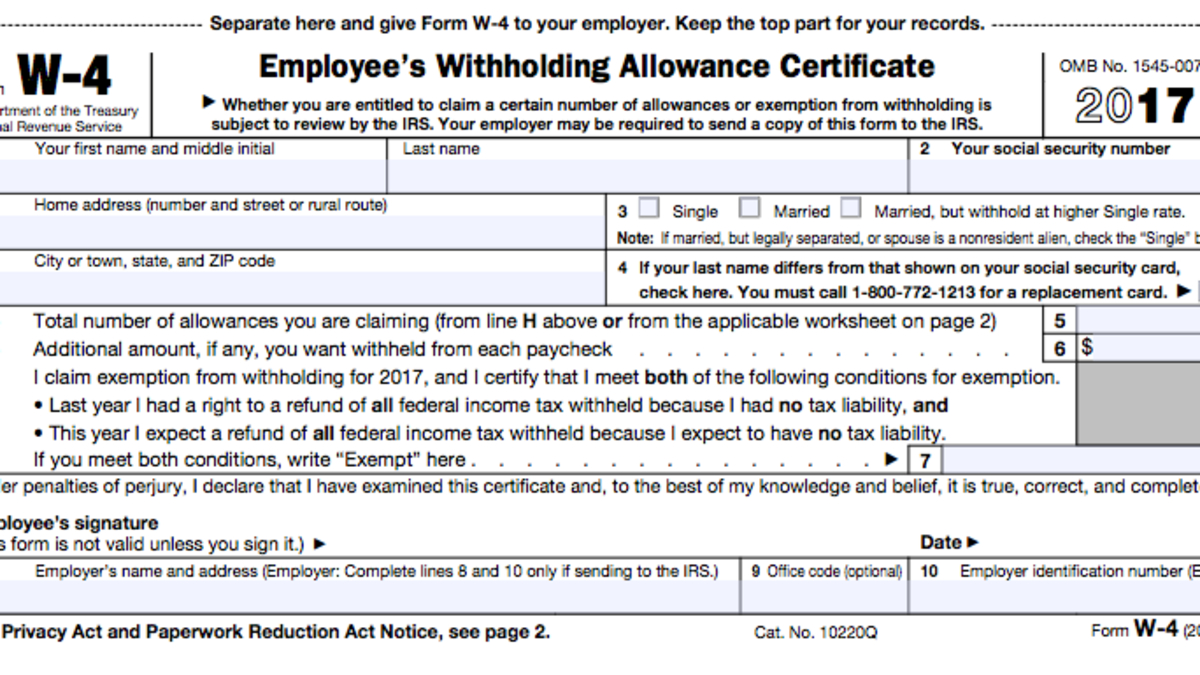

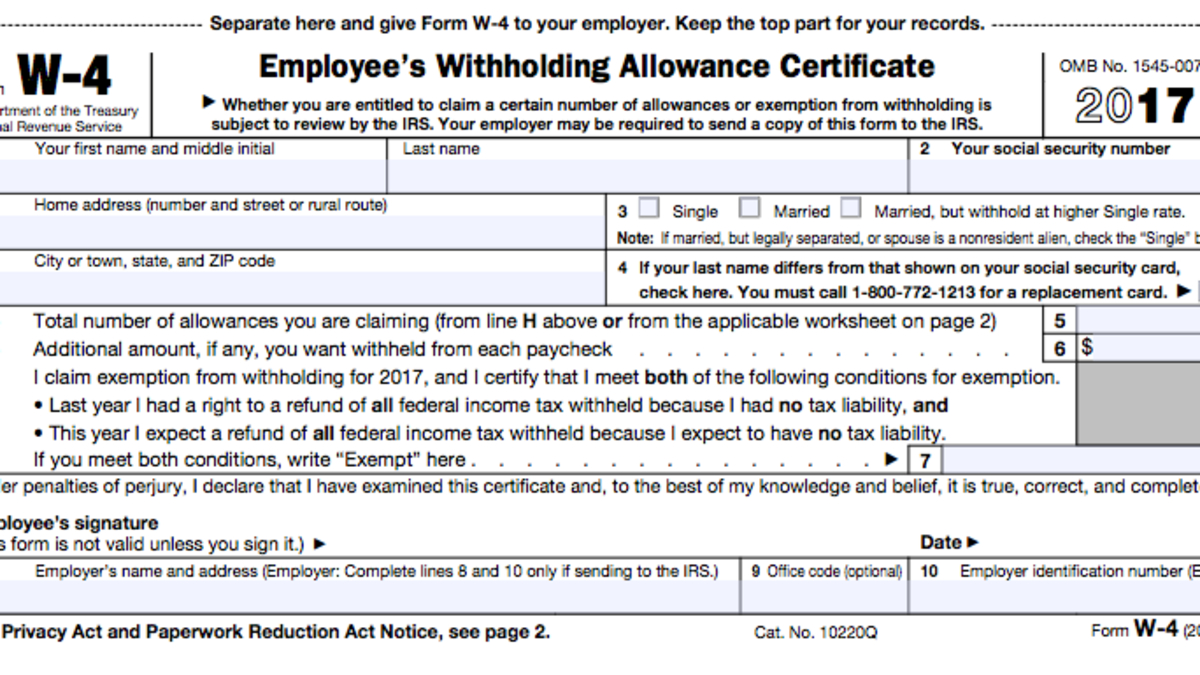

The Personal Allowances Worksheet is a tool designed to help you determine the number of allowances you should claim on your W-4 form. This affects how much tax is withheld from each paycheck, ensuring you don’t overpay taxes throughout the year or owe a large sum when you file your return. Here’s how to use it:

- Basic Allowances: You get one allowance for yourself, another for your spouse if married, and one for each dependent you support.

- Additional Allowances: You can claim extra allowances if you qualify for certain credits, deductions, or if you have income from non-wage sources like interest or dividends.

How to Fill Out Your PAW for Oregon

Filling out the PAW for Oregon residents involves a few additional steps due to the state’s tax policies:

Step 1: Calculate Your Standard Deductions

Oregon offers a standard deduction that you can claim to reduce your taxable income. Here is how it compares with the federal standard deduction:

| Filing Status | Federal Standard Deduction (2023) | Oregon Standard Deduction (2023) |

|---|---|---|

| Single | 12,950</td> <td>2,315 | |

| Married Filing Jointly | 25,900</td> <td>4,630 | |

| Head of Household | 19,400</td> <td>3,490 |

💡 Note: Oregon has a different standard deduction for each filing status. Remember to consider this when filling out your PAW.

Step 2: Account for Oregon’s Tax Credits

- Working Family Child Care Credit: If you have children and pay for child care, Oregon provides this credit to help ease that burden.

- Credit for Tax Paid to Another State: If you pay income taxes in another state, Oregon might give you a credit.

Step 3: Adjust for Oregon-Specific Income Adjustments

Oregon allows for some income adjustments that can affect your withholdings:

- Retirement Income Exclusion: Oregon residents over 62 can exclude a portion of their retirement income, reducing taxable income.

- Oregon Investment Tax Credit: If you have made investments in Oregon, you might qualify for this credit.

Tips for Effective Tax Planning in Oregon

- Consult with a Tax Professional: Oregon tax law can be complex, especially with credits and deductions specific to the state.

- Stay Updated: Tax laws change, so reviewing Oregon’s tax bulletins periodically can be beneficial.

- Maximize Retirement Contributions: Oregon’s exclusions for retirement income can be leveraged for tax savings.

- Use Estimated Taxes: If your income fluctuates or you have significant non-wage income, consider paying estimated taxes to avoid penalties.

Conclusion

In summary, by understanding and utilizing the Personal Allowances Worksheet, Oregon residents can tailor their tax withholdings to optimize their financial situation. This approach not only helps in reducing the amount you owe during tax season but also ensures you’re not withholding too much from your paycheck, leaving more money in your pocket throughout the year. Remember, the key to effective tax planning is staying informed about both federal and state-specific tax laws, adjusting your withholdings when necessary, and taking advantage of available credits and deductions.

How often should I update my W-4 form?

+

It’s recommended to review and possibly update your W-4 form at least annually or when there are significant changes in your personal or financial life like marriage, divorce, having a child, or a change in income.

Can I claim more allowances than I have?

+

You can claim more allowances than you have, but this might result in under-withholding taxes, leading to a tax debt when you file your return. It’s crucial to claim allowances accurately to avoid penalties.

What are the penalties for underpaying taxes in Oregon?

+

In Oregon, underpayment of estimated taxes can lead to penalties, which include interest on the amount underpaid and additional fees. The state offers some safe harbor provisions to avoid these penalties if you meet certain criteria.

How can I maximize my Oregon retirement income exclusion?

+

To maximize your Oregon retirement income exclusion, ensure your income from pension, IRA distributions, or similar retirement plans does not exceed the cap set by Oregon tax laws. Additionally, coordinate your retirement income withdrawals to spread out over multiple tax years if possible.

Are there other state-specific tax benefits in Oregon I should know about?

+

Yes, Oregon provides several other tax benefits like the Working Family Household and Dependent Care Credit, the Credit for Tax Paid to Another State, and specific credits for donations to the Oregon Cultural Trust or contributions to the Oregon 529 College Savings Plan.