-

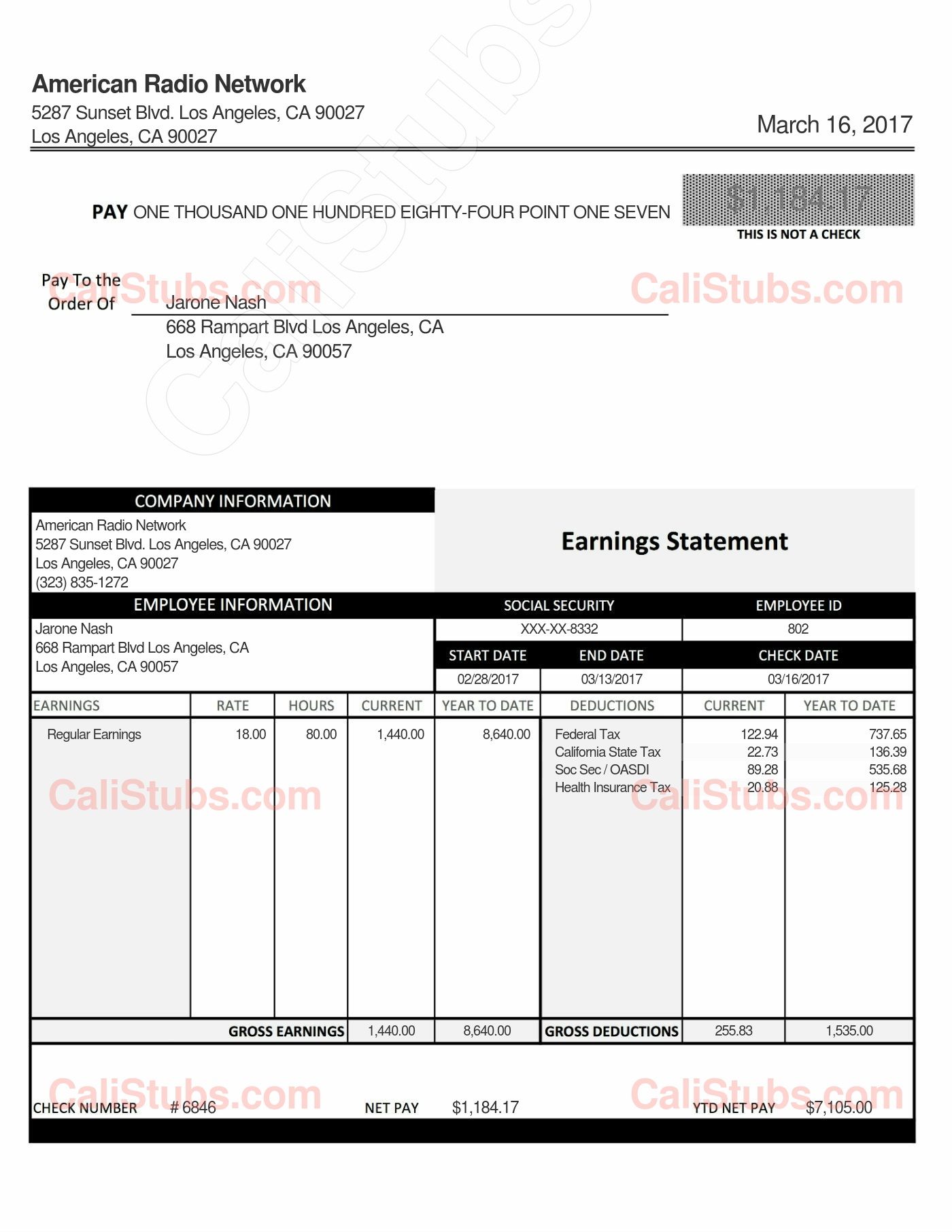

5 Essential Tips for Reading Your Pay Stub

This worksheet provides answers to common questions about interpreting details found on a pay stub, assisting employees in understanding their earnings, deductions, and net pay.

Read More » -

Maximize Your Social Security with Form 1040 Worksheet

The 1040 Social Security Worksheet is a vital tool for calculating the taxable portion of your Social Security benefits for federal income tax purposes.

Read More » -

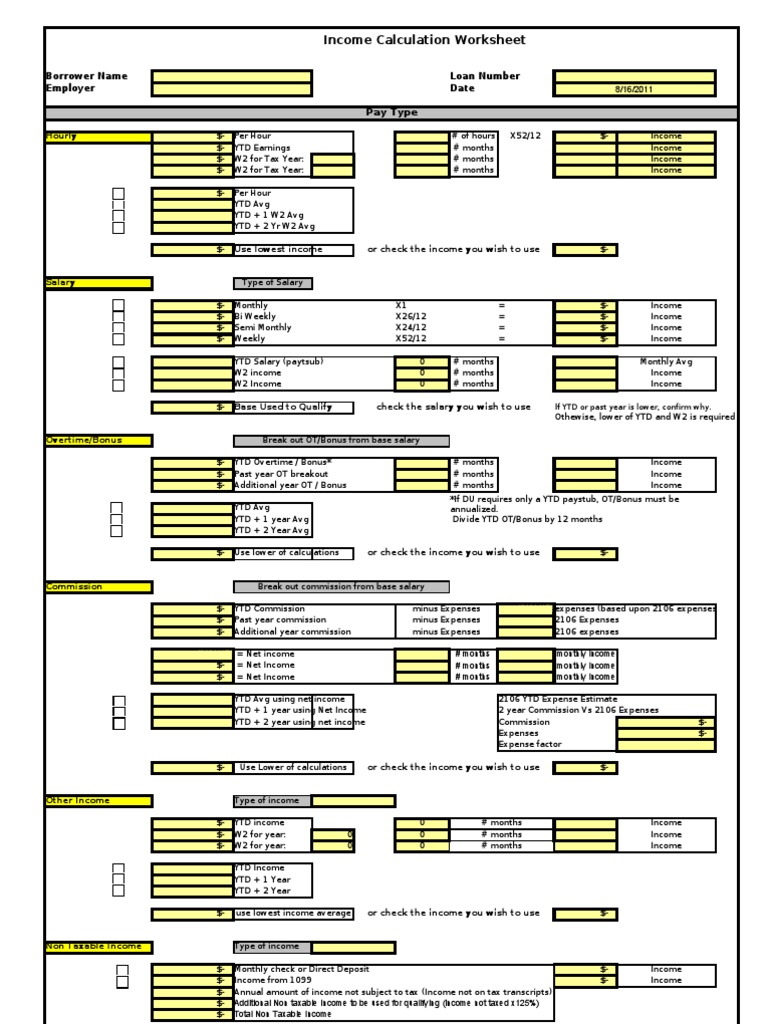

Maximize Your Earnings with W2 Income Calculation Guide

This worksheet simplifies the calculation of W2 income by providing step-by-step instructions for employees to compute their taxable earnings, withholdings, and net pay for tax purposes.

Read More » -

Decoding Your Paycheck: A Simple Guide

Learn how to interpret and manage your earnings with this comprehensive guide on understanding your paycheck worksheet.

Read More » -

7 Tips for Understanding Your Pay Stub Easily

A worksheet designed to educate users on interpreting pay stubs, including understanding gross earnings, taxes, deductions, and net pay.

Read More » -

Maximize Your State Tax Refund with This Worksheet

A guide to calculating your state tax refund efficiently.

Read More » -

State and Local Income Tax Refund Guide

Worksheet to calculate state and local income tax refunds, aiding in tax preparation.

Read More » -

Maximize Your Oregon Tax Savings with Personal Allowances Worksheet

Oregon Personal Allowances Worksheet: A step-by-step guide to help Oregon taxpayers determine their tax withholdings by calculating personal allowances based on state-specific criteria.

Read More » -

5 Tips to Understand Your Pay Stub Easily

A worksheet guide to understanding and interpreting the components of a pay stub.

Read More » -

Unlocking Your W2 Income: The Magic Worksheet Guide

A detailed guide on calculating income for tax purposes using the MGIC W-2 form, designed for homeowners and real estate professionals.

Read More »