Unlocking Your W2 Income: The Magic Worksheet Guide

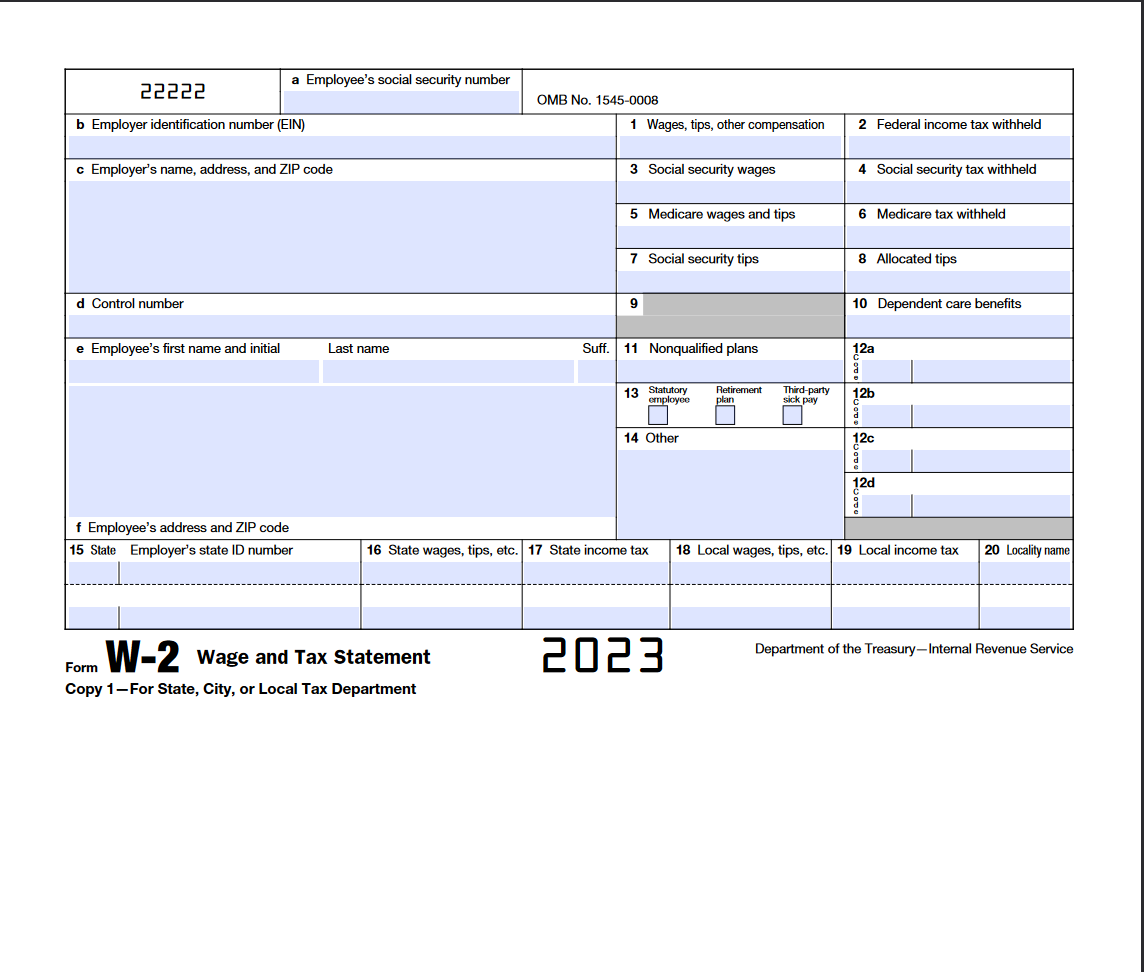

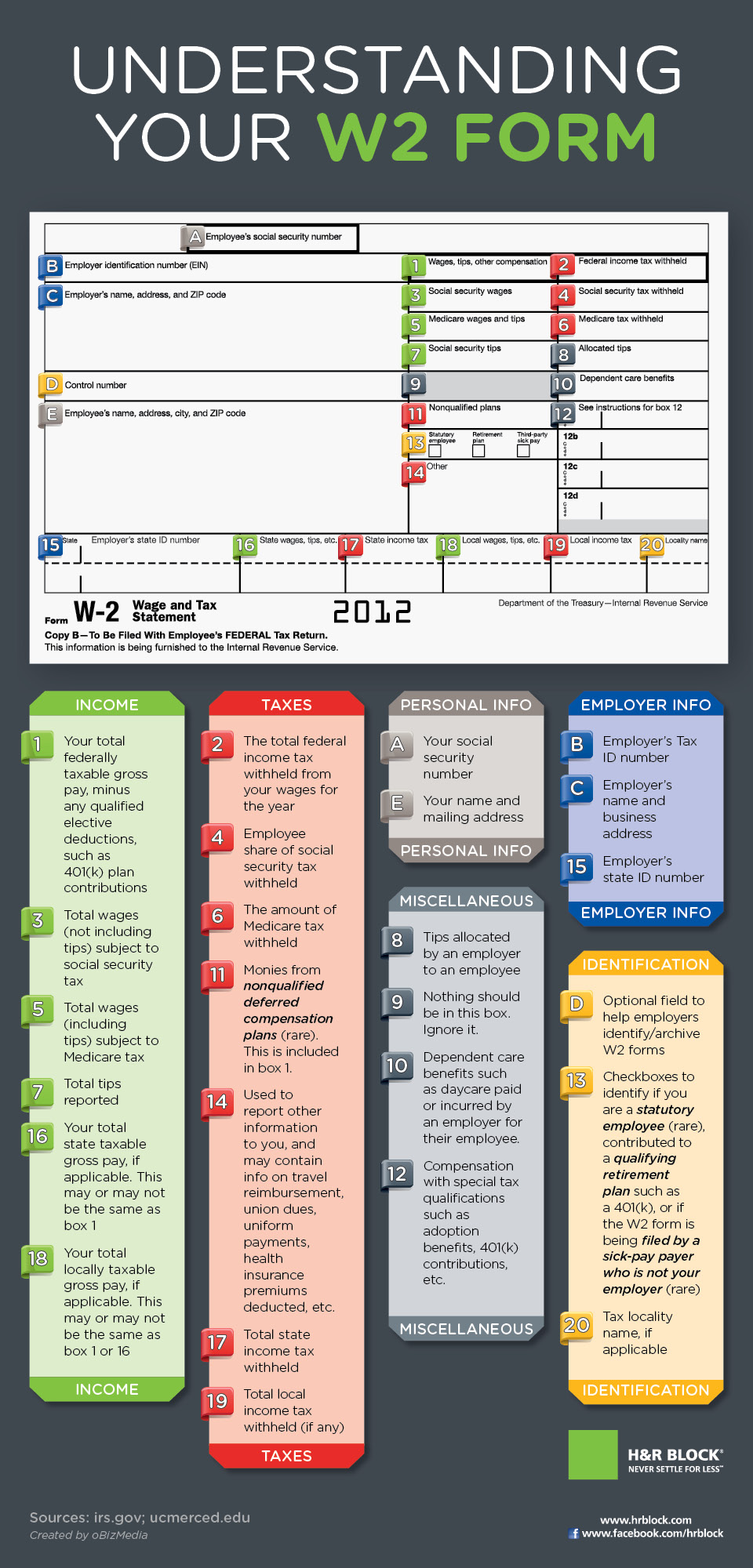

Understanding W2 Forms

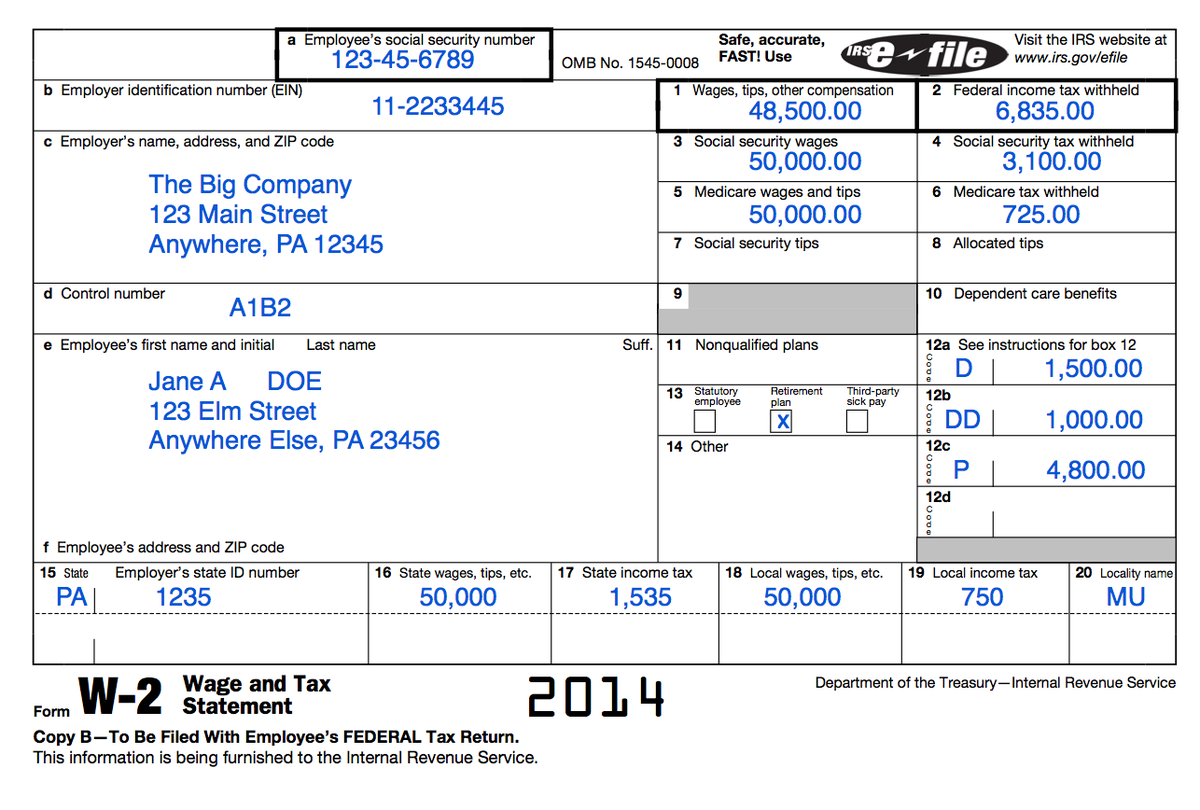

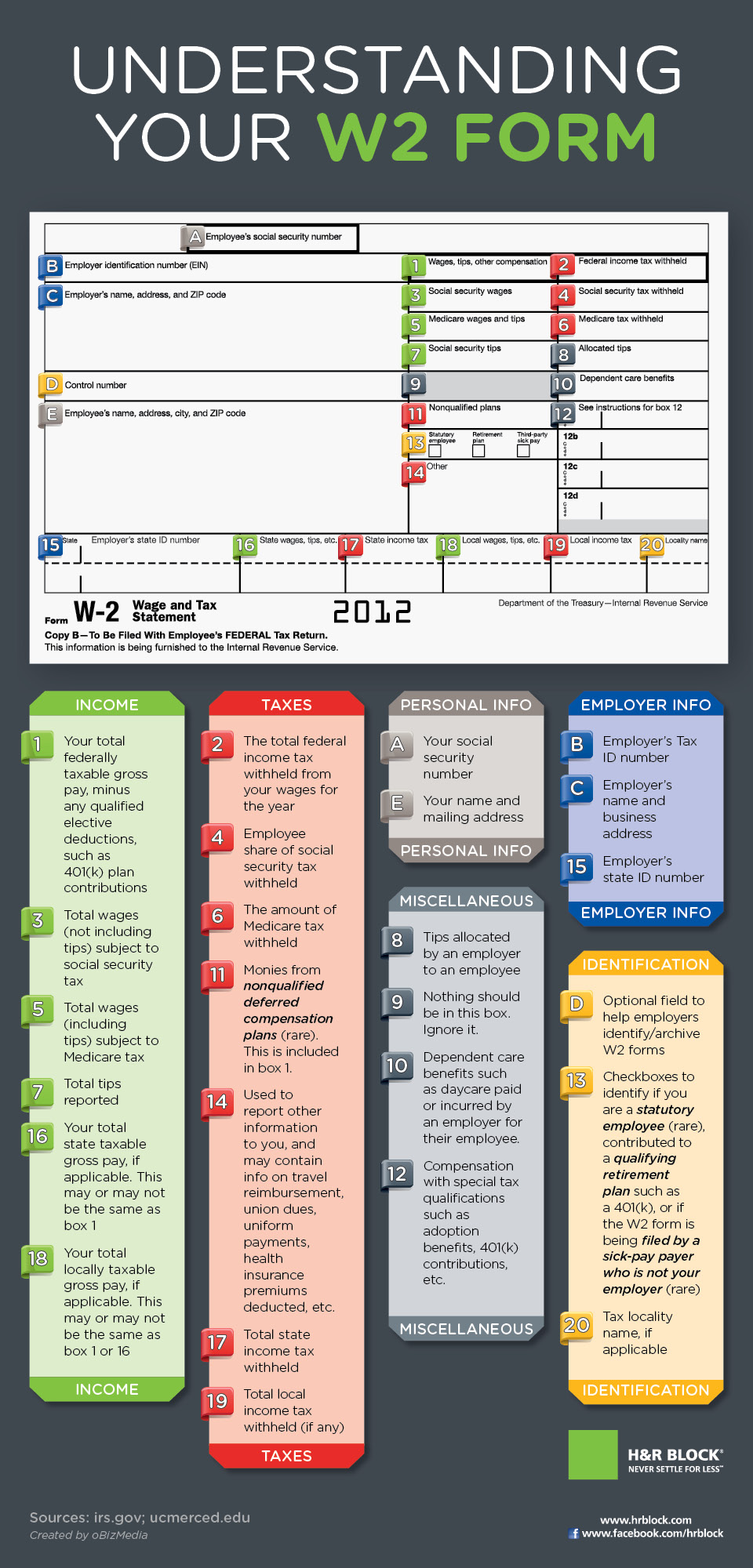

A W-2 form, also known as the Wage and Tax Statement, is an essential document that employers must provide to their employees annually. This form details the total amount of income an employee earned during the previous tax year and the amount of taxes withheld. Understanding your W2 form is critical for preparing accurate tax returns and for effective tax planning.

The W2 form contains several boxes, each with specific information:

- Box 1: Wages, tips, other compensation.

- Box 2: Federal income tax withheld.

- Box 3: Social Security wages.

- Box 4: Social Security tax withheld.

- Box 5: Medicare wages and tips.

- Box 6: Medicare tax withheld.

- And more...

To help you fully understand what each box means, here's a basic table:

| Box Number | Description |

|---|---|

| 1 | Wages, tips, other compensation |

| 2 | Federal income tax withheld |

| 3 | Social Security wages |

| 4 | Social Security tax withheld |

| 5 | Medicare wages and tips |

| 6 | Medicare tax withheld |

| 12 | Deferrals and withholdings |

🔍 Note: Be aware that if your wages exceed certain thresholds, additional boxes on the W2 form might come into play.

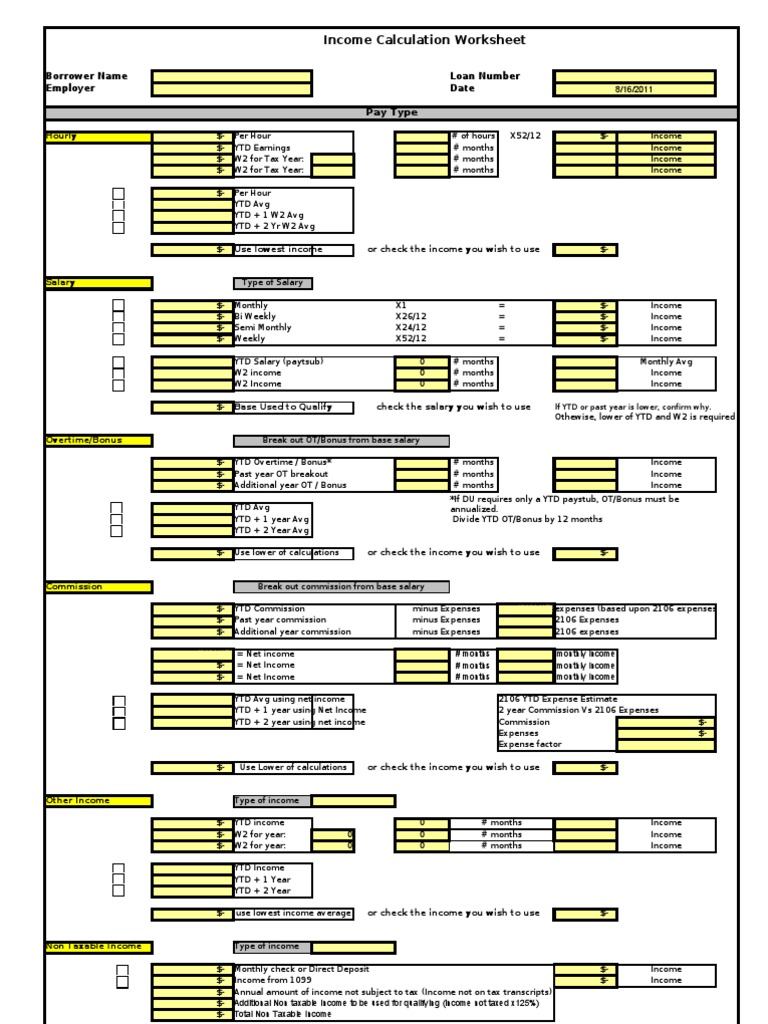

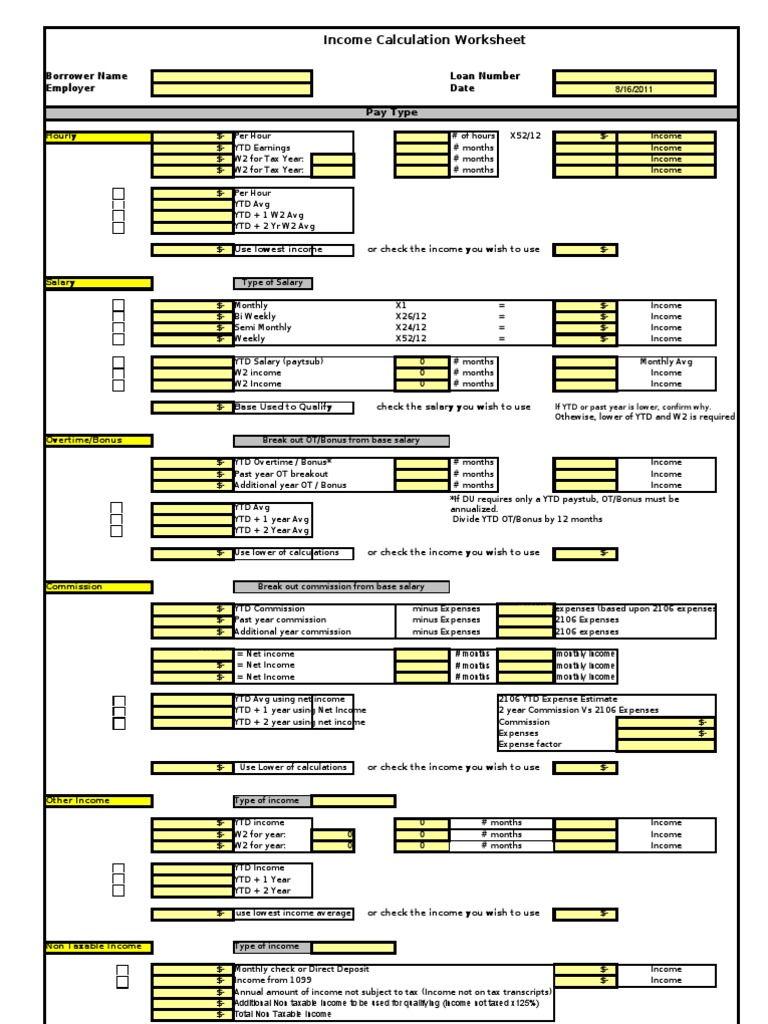

The Magic Worksheet for Calculating Taxable Income

To calculate your taxable income accurately, a magic worksheet can be extremely beneficial. Here’s a step-by-step guide:

Gathering Your W2 Information

- Retrieve all W2 forms for the year.

- List down the figures from the relevant boxes into the worksheet.

Enter the Data

- Box 1 (Wages): This is the starting point of your taxable income.

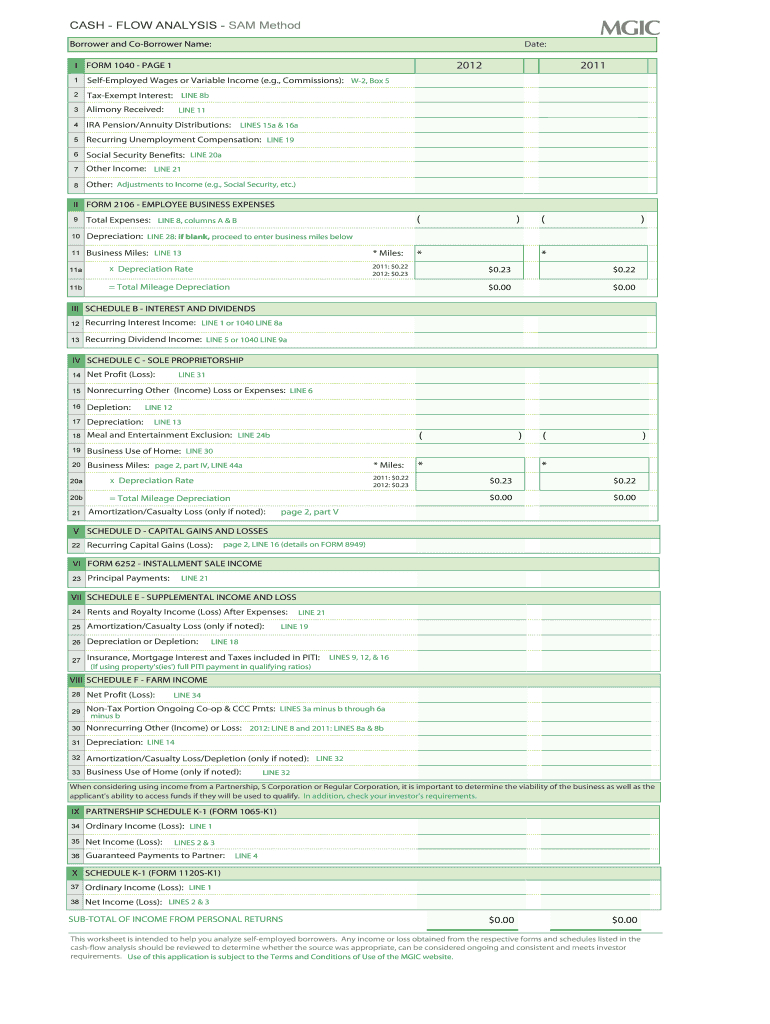

- Other Income: Add any other forms of income not reported in Box 1, such as freelance earnings, investment income, etc.

- Pre-Tax Deductions: Deduct pre-tax contributions, like health insurance premiums or 401(k) contributions, from your total income to get your Adjusted Gross Income (AGI).

Adjustments to Income

- Subtract any adjustments like student loan interest, health savings account (HSA) contributions, etc.

Itemized or Standard Deductions

- Decide whether to take the standard deduction or itemize your deductions. Itemizing requires detailed record-keeping but can sometimes lead to bigger tax savings.

Calculate Taxable Income

- After all adjustments and deductions, you’ll have your taxable income, which you’ll use to compute the tax you owe.

💡 Note: Using software or tax preparation services can make this process easier, especially if you're unsure about certain steps.

Using the Worksheet for Effective Tax Planning

The magic worksheet is not just for calculating taxes; it’s also a powerful tool for tax planning:

Understand Your Tax Bracket

- Knowing your tax bracket helps in planning income and deductions strategically to minimize tax liability.

Estimate Future Taxes

- Predict how changes in income or deductions might impact your future tax situation.

Identify Tax-Saving Opportunities

- Find areas where you can legally reduce your taxable income, such as through retirement contributions, charitable donations, or taking advantage of tax credits.

Common Mistakes to Avoid

- Not Accounting for All Income: Every income source must be reported to avoid penalties.

- Overlooking Deductions: Missing out on potential deductions can cost you significantly in tax payments.

- Errors in Calculations: Double-check your math or use software to avoid simple mistakes.

- Misinterpreting Instructions: Ensure you’re clear on what each line item represents on your W2 and the worksheet.

Incorporating the W2 Worksheet into Your Financial Life

Beyond tax season, integrating the insights from your W2 worksheet into your broader financial strategy can yield numerous benefits:

Budgeting

- Use the figures to better plan your monthly budget, accounting for taxes withheld throughout the year.

Retirement Planning

- Plan for retirement by understanding your current income and how much you can contribute to retirement accounts.

Investment Decisions

- Consider the tax implications when choosing investments, balancing growth with tax efficiency.

The magic worksheet for W2 income is not merely a tool for tax preparation but a comprehensive guide to managing your finances with clarity and foresight. By understanding each element of your income, taxes, and deductions, you're not only ensuring compliance with IRS regulations but also optimizing your financial well-being. This methodical approach allows for better tax planning, helps in setting realistic financial goals, and empowers you to make informed decisions throughout the year, not just during tax season. Remember, tax preparation is a part of broader financial planning. By harnessing the power of your W2 form and the magic worksheet, you can unlock a wealth of financial wisdom to navigate your future with confidence and precision.

What is the purpose of the W2 form?

+The W2 form reports an employee’s annual wages and the amount of taxes withheld from their paycheck. It’s essential for filing your income tax returns and for the employer to report income to the IRS.

Can I use the worksheet if I have income from multiple W2 forms?

+Yes, you can certainly use the worksheet for multiple W2 forms. Simply aggregate the figures from each W2 form into the corresponding lines on the worksheet.

What are common deductions I should look for on my W2?

+Look for deductions in Box 12 such as 401(k) contributions, health insurance premiums, and certain business expenses. Also, consider itemizing if your total deductions exceed the standard deduction.