Maximize Your Earnings with W2 Income Calculation Guide

Maximizing your earnings through careful calculation of your W2 income can be a key step towards optimizing your financial health. Understanding the intricacies of how your income is computed not only aids in better financial planning but also ensures that you are not leaving any money on the table. Whether you're aiming to increase your take-home pay, plan for retirement, or reduce your taxable income, this guide will provide you with detailed steps and strategies to make the most out of your W2 income.

Understanding W2 Forms

The W2 form, or Wage and Tax Statement, is one of the most critical documents for any employee in the United States. This form summarizes your income and taxes withheld for the year:

- Box 1: Wages, tips, and other compensation

- Box 2: Federal income tax withheld

- Box 3: Social Security wages

- Box 4: Social Security tax withheld

- Box 5: Medicare wages and tips

- Box 6: Medicare tax withheld

- And others for state and local taxes, contributions to retirement plans, etc.

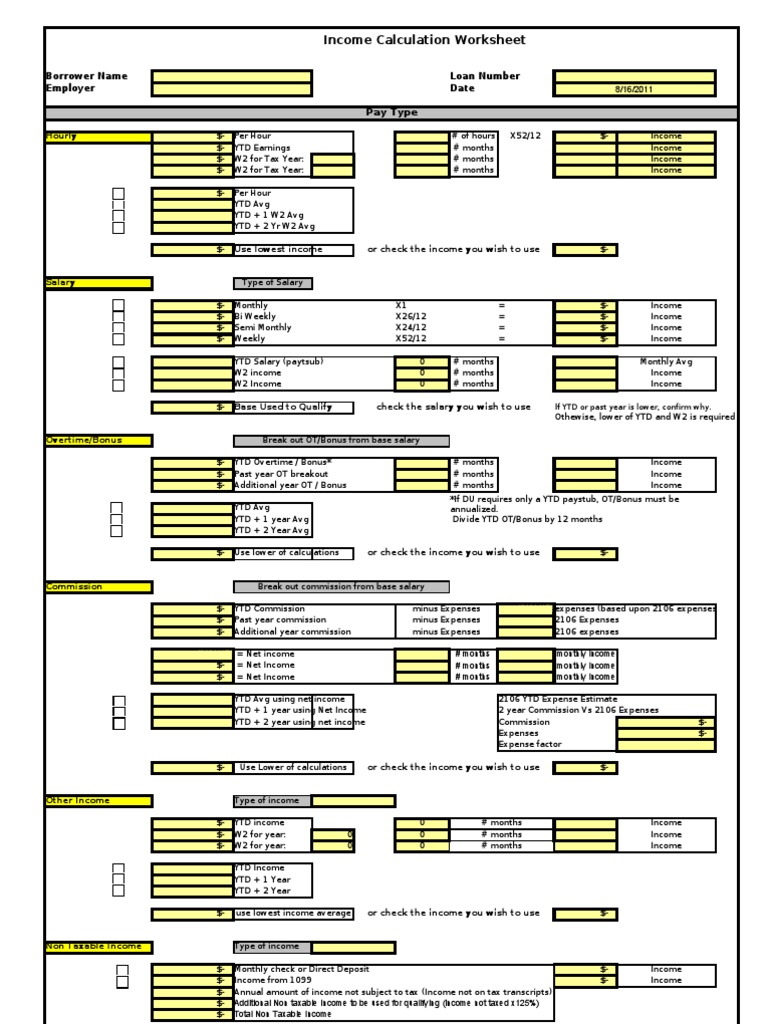

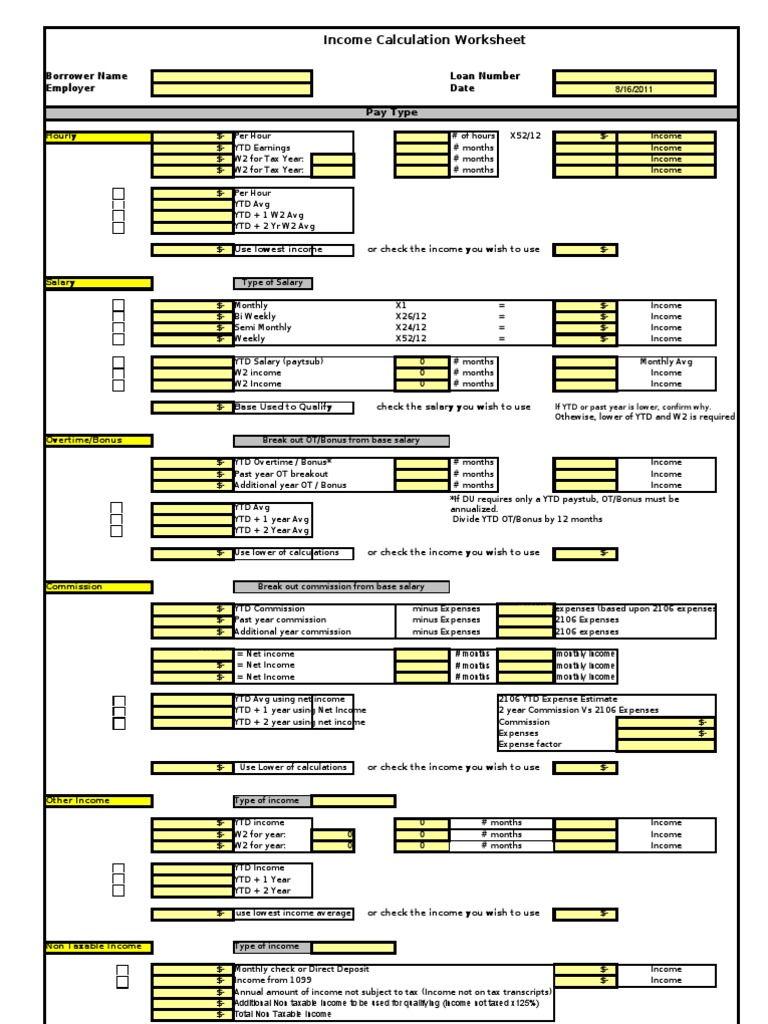

How to Calculate W2 Income

Here’s how you can calculate your W2 income:

- Gather Your W2 Forms: Ensure you have all the W2 forms if you worked multiple jobs in a year.

- Identify Your Gross Income: This is typically found in Box 1 of your W2 form.

- Check for Additional Income: Look for any additional compensations like commissions, bonuses, or tips, which should also be reported on the W2.

- Deduct Pre-Tax Contributions: Some contributions like to 401(k) or health savings accounts can reduce your taxable income. These are often found in Boxes 12a - 12d.

- Calculate Adjusted Gross Income (AGI): Subtract the pre-tax contributions from your total gross income.

- Understand Your Taxable Income: From your AGI, you can then subtract standard or itemized deductions to find your taxable income.

Tax Planning with Your W2

Strategically planning your taxes with your W2 can significantly affect your income:

- Retirement Contributions: Contributing more to your 401(k) reduces your taxable income while building for your future.

- Health Savings Account (HSA): If eligible, contributions here are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses.

- Flexible Spending Accounts (FSA): Similar to HSA but for other expenses like dependent care.

- Charitable Contributions: Deduct these if itemizing deductions.

⚠️ Note: Always ensure you’re contributing the maximum allowable amount to retirement accounts or other tax-advantaged savings to minimize taxable income.

Maximizing Your Take-Home Pay

To ensure you’re getting the most out of your salary:

- Update Withholding: Use the IRS’s W-4 form to adjust how much tax is withheld, possibly increasing your paycheck.

- Claim Allowances: More allowances mean less tax withheld, so review this yearly.

- Track Expenses: Keep good records of expenses that might reduce taxable income like job-related expenses or home office costs.

- Check for Overtime and Bonus Compensation: Ensure these are accurately reported on your W2.

Year-End Review and Planning

Here’s what to focus on as the tax year closes:

- Review Deductions: Determine if itemizing deductions would benefit you more than taking the standard deduction.

- Make Last-Minute Contributions: If you have extra funds, contribute to retirement accounts, HSAs, or FSAs before December 31st.

- Assess Your Tax Situation: Use tax software or consult a tax advisor to estimate your tax liability or potential refunds.

Conclusion

Understanding and effectively managing your W2 income calculation can be a pivotal strategy in enhancing your financial well-being. By knowing how your income is calculated, taking advantage of tax planning, and ensuring you claim all deductions and contributions, you can significantly increase your take-home pay and plan for a more secure financial future. Keep your documents organized, stay updated on tax laws, and don’t hesitate to seek professional advice to ensure you’re making the most of your earnings. Remember, every dollar saved is a dollar earned, and with a bit of planning, you can make your income work harder for you.

What if my employer made an error on my W2?

+

Contact your employer’s payroll department to request a corrected W2 form (W-2C). Ensure all your personal details, income, and deductions are accurately reflected.

Can I reduce my taxable income through W2 adjustments?

+

Yes, contributing more to pre-tax retirement accounts, like a 401(k), or health-related FSAs and HSAs can lower your taxable income by reducing the amount shown in Box 1 of your W2.

How often should I update my W4?

+

It’s advisable to review and potentially adjust your W4 annually, especially after major life events like marriage, having a child, or a significant change in income or employment status.