-

5 Ways to Compute Gross Pay with Ease

This article provides answers to a worksheet on calculating gross pay, including step-by-step instructions for determining regular and overtime wages.

Read More » -

Maximize Your Social Security with Form 1040 Worksheet

The 1040 Social Security Worksheet is a vital tool for calculating the taxable portion of your Social Security benefits for federal income tax purposes.

Read More » -

Maximize Your Tax Benefits with Worksheet 1 in Pub. 596

Explanation of how to use Worksheet 1 from IRS Publication 596 to determine eligibility for the Earned Income Credit.

Read More » -

Gross Pay Calculator: Simplify Your Earnings Calculation

This worksheet provides a step-by-step guide to calculate an employee's gross pay, considering various components like hours worked, overtime, and additional earnings.

Read More » -

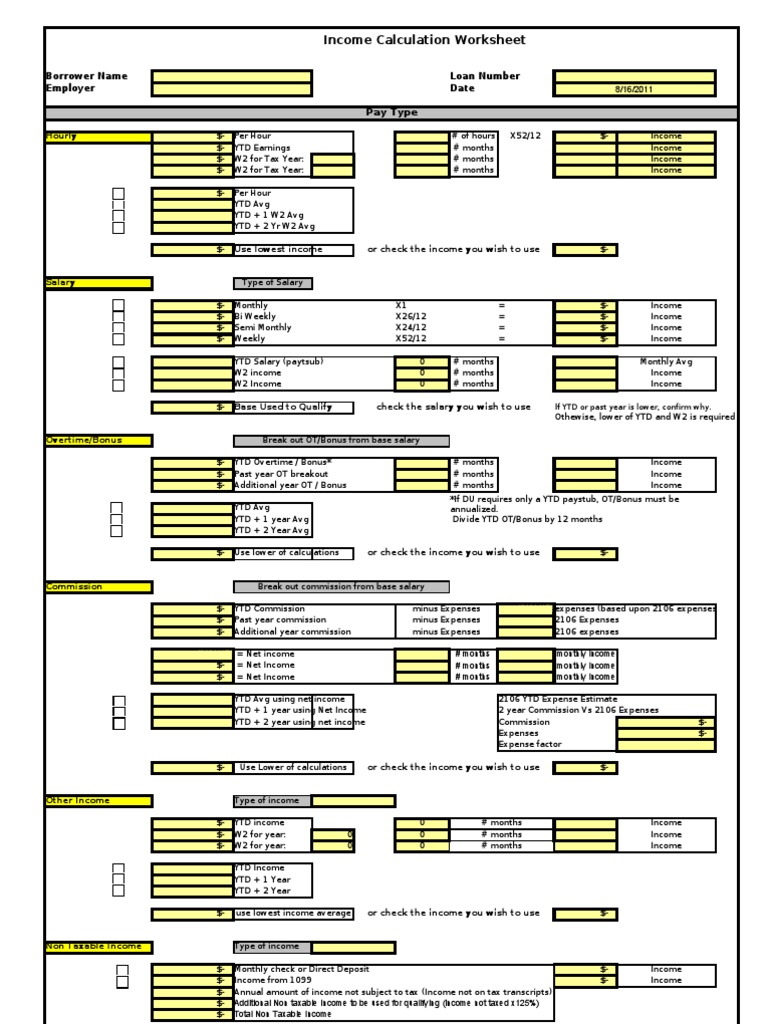

Maximize Your Earnings with W2 Income Calculation Guide

This worksheet simplifies the calculation of W2 income by providing step-by-step instructions for employees to compute their taxable earnings, withholdings, and net pay for tax purposes.

Read More » -

3 Ways to Simplify Your 941-X Worksheet for ERC Claims

A guide detailing the steps and requirements for completing Form 941-X to claim the Employee Retention Credit (ERC).

Read More » -

Mastering Form 2210: Your Essential Tax Estimation Guide

A guide to understanding and completing Form 2210 for estimating underpayment of taxes, with detailed instructions on calculating penalties.

Read More » -

Master Your Finances: The Magic Self Employment Worksheet

A practical worksheet designed to assist self-employed individuals in calculating their income for mortgage qualification purposes, simplifying the process with clear guidance on necessary financial documentation.

Read More » -

TurboTax Carryover Worksheet: Simplify Your Tax Prep

Explanation of using the Turbotax Carryover Worksheet to manage tax loss carryovers effectively.

Read More » -

Maximize Your Tax Deductions with Section 199a Worksheet

The Section 199a Information Worksheet helps taxpayers compute and qualify for the deduction of 20% of qualified business income for tax purposes.

Read More »