3 Ways to Simplify Your 941-X Worksheet for ERC Claims

When it comes to managing your business's finances, Employee Retention Credits (ERC) can be a significant boon, especially during times of economic distress. However, navigating the IRS Form 941-X to claim these credits can be a daunting task. Here, we'll delve into three effective strategies to simplify your 941-X worksheet for ERC claims, ensuring you maximize your tax benefits with minimal hassle.

1. Use Comprehensive Checklists and Templates

One of the best ways to streamline your ERC claim process is by using detailed checklists and templates. These tools help ensure you cover all necessary points and do not miss out on any credits due to incomplete or incorrect information.

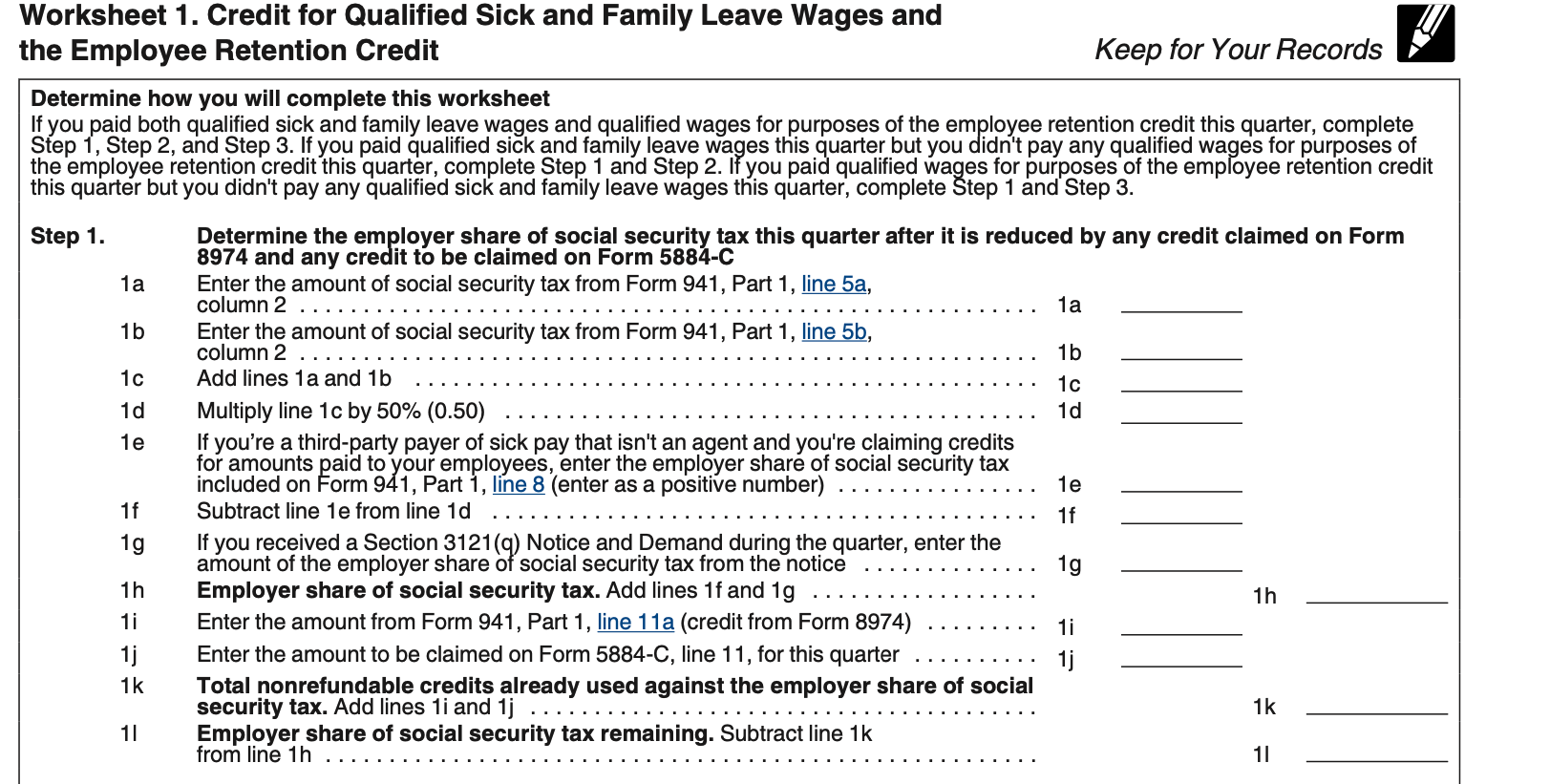

- Create or Use Existing Templates: Develop or download templates specifically designed for ERC claims. These should include sections for each part of the form, helping you to systematically approach filling out Form 941-X.

- Checklists for Compliance: Use checklists to verify that you're adhering to IRS guidelines. Here’s what a typical checklist might look like:

Compliance Check Action Item Qualified Wages Identify and record qualified wages for each quarter Health Plan Expenses Include allocable health plan expenses in the calculation Documentation Maintain records of governmental orders and business operations

- Audit Trail: Keeping an audit trail can expedite the process if your claim is reviewed by the IRS.

📝 Note: Utilizing templates and checklists can significantly reduce errors in your ERC filings.

2. Leverage Professional Assistance

Sometimes, the complexity of ERC claims requires expertise beyond what a business owner might typically manage:

- Accounting Professionals: An accountant or CPA with ERC experience can provide invaluable assistance, not just in filling out the form but also in optimizing your claim strategy.

- Legal Advisors: Legal counsel might be necessary if your business's circumstances are unusual or if there are disputes regarding eligibility or the amount of credit.

- Outsourced Payroll Services: Companies specializing in payroll can simplify the calculation and documentation process.

Engaging professionals not only reduces the burden of learning complex tax laws but also enhances your chances of a successful claim:

⚖️ Note: Professional guidance ensures compliance with IRS regulations and can help in negotiating any potential issues with your ERC claim.

3. Software Solutions

The advent of specialized tax software has transformed how businesses manage complex tax forms like 941-X:

- Automated ERC Calculation: Look for software that can automate the calculation of credits based on your business data. This not only saves time but also reduces errors in the computation process.

- Integration with Payroll Systems: Ensure the software integrates seamlessly with your existing payroll system to pull in the necessary data automatically.

- Real-time Updates: Choose software that provides real-time updates on IRS rules or any changes in ERC guidelines to keep your filings up-to-date.

- User-Friendly Interface: An intuitive interface can make navigating through the complexities of Form 941-X much easier.

💻 Note: Software solutions can provide peace of mind by automating much of the heavy lifting involved in ERC calculations.

In summary, simplifying your 941-X worksheet for ERC claims can be approached from various angles. From using detailed checklists and templates, engaging professionals for complex issues, to employing specialized software, each method offers unique advantages tailored to different business needs. By implementing these strategies, business owners can focus more on running their operations while ensuring they leverage all possible financial relief opportunities offered by ERC. Remember, the key is not just in claiming the credits but in doing so correctly to avoid future complications or penalties.

What makes a business eligible for the ERC?

+

To be eligible for the Employee Retention Credit, a business must have:

- Operations fully or partially suspended due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings due to COVID-19.

- Had a significant decline in gross receipts.

How does software help with ERC claims?

+

Software automates the calculation process, integrates with payroll systems for data accuracy, provides real-time updates on tax law changes, and reduces the manual entry errors that can occur with complex forms.

What if I make a mistake on Form 941-X?

+

If you make an error on Form 941-X, you can amend the form by submitting another Form 941-X with the corrections. It’s advisable to consult with a tax professional to ensure all amendments are correctly applied to avoid complications or audits.