Mastering Form 2210: Your Essential Tax Estimation Guide

Have you ever found yourself in a position where you owe more than you anticipated? Form 2210 could be your answer to avoiding underpayment penalties. In this post, we'll guide you through the steps of calculating, filling out, and submitting Form 2210 to meet IRS requirements and keep your tax situation in check. Whether you're a seasoned tax expert or a beginner, our comprehensive guide ensures you understand how to navigate the complexities of tax estimation with ease.

Understanding the Purpose of Form 2210

The IRS requires individuals to pay at least 90% of their tax obligations throughout the year, either through withholding or by making estimated tax payments. Form 2210 comes into play if:

- You owe more than $1,000 when filing your taxes.

- Your tax payments (withholding and estimated taxes) are less than the required percentage of your total tax for the year.

It's used to:

- Determine if you've underpaid your estimated taxes.

- Calculate the amount of penalty you might owe.

⚠️ Note: Form 2210 is not always necessary. You're generally safe from penalties if you meet the IRS's safe harbor rules or qualify for a waiver.

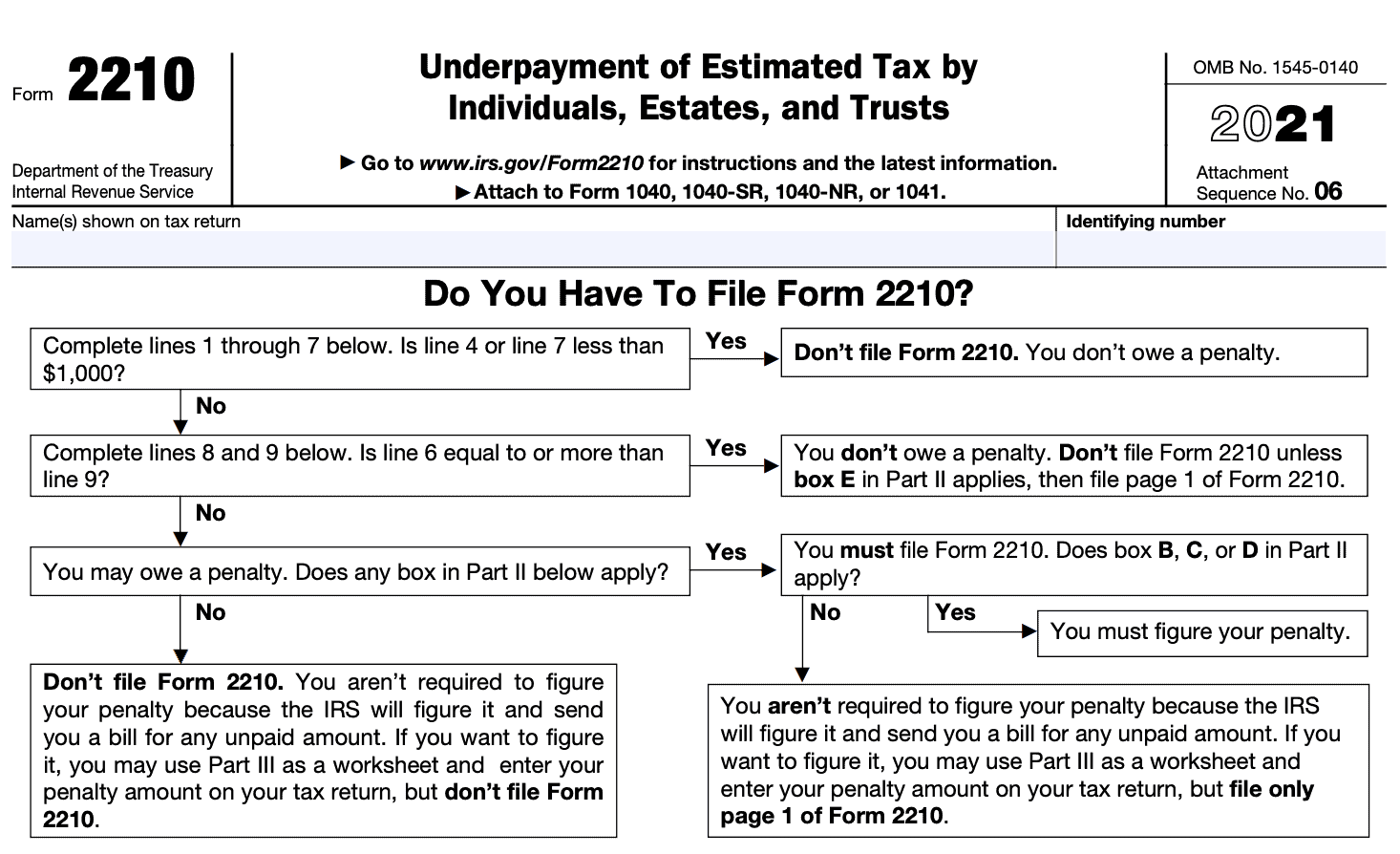

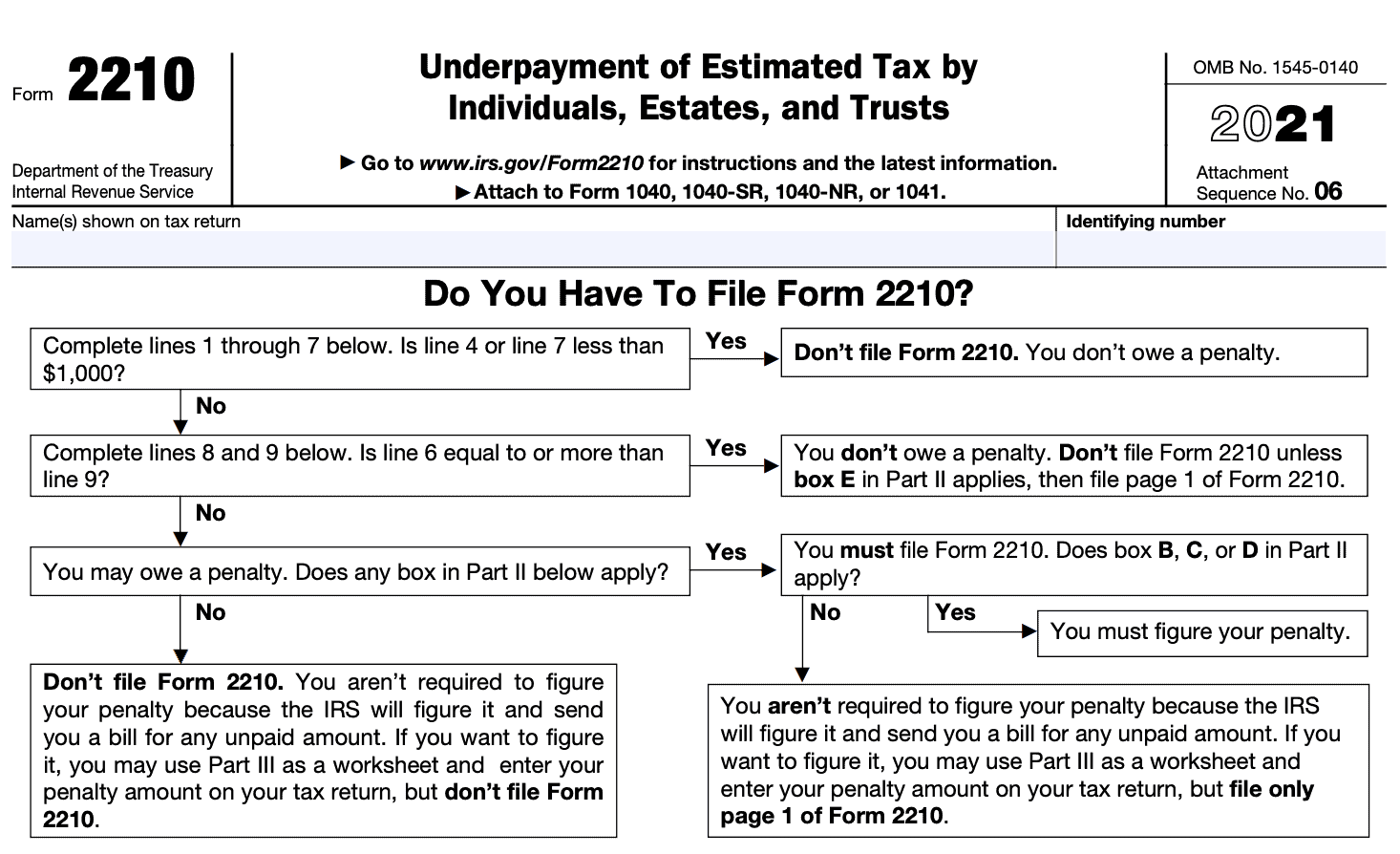

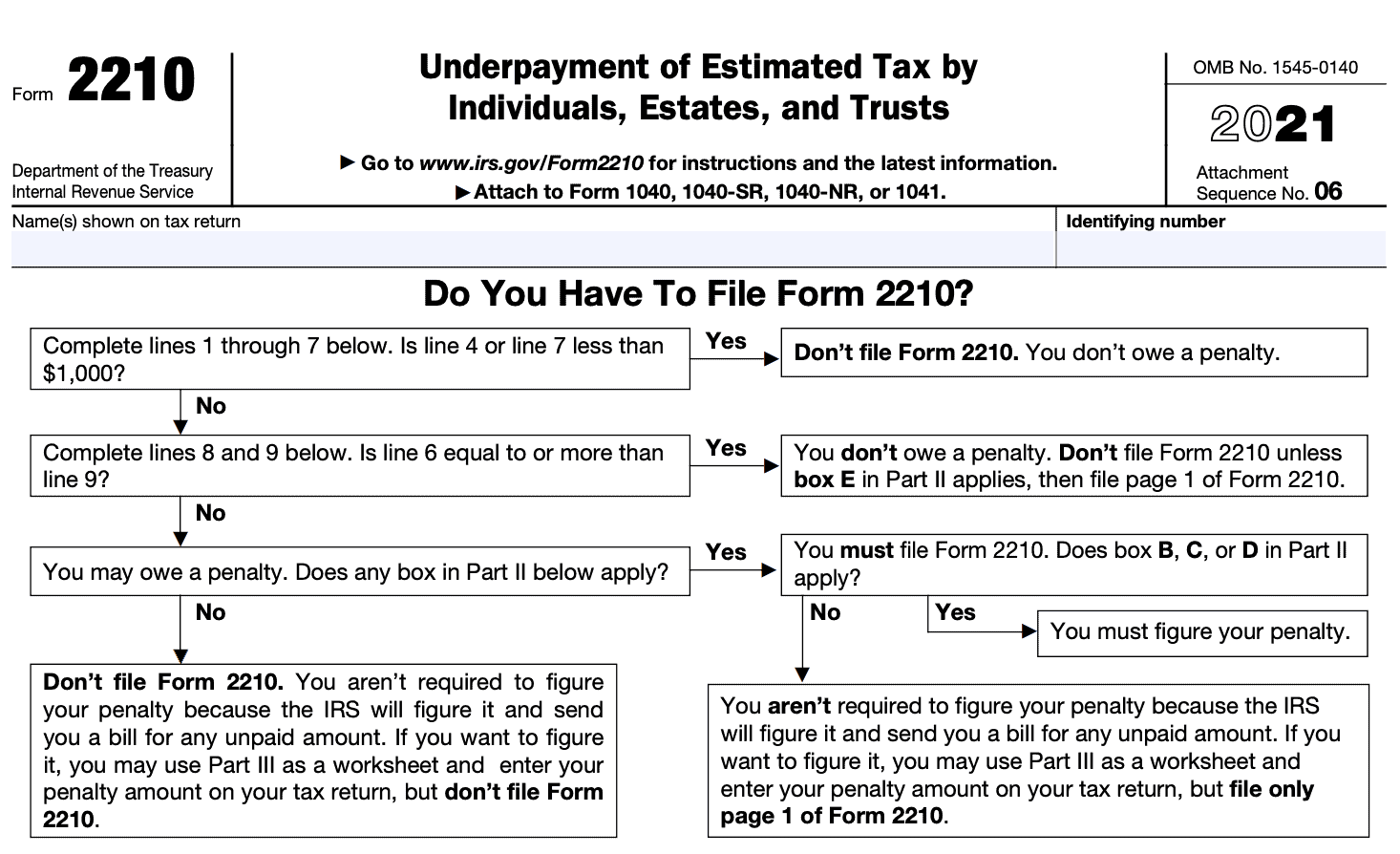

When to File Form 2210?

You should file Form 2210 if you owe a penalty for underpayment of estimated taxes. Here are the scenarios when filing is required:

- If you've paid less than 90% of your current year's tax or 100% of the previous year's tax (110% if your adjusted gross income was over $150,000).

- If you paid more than $1,000 in taxes when filing your return.

- If your tax payments were spread unevenly throughout the year, and you didn't meet the safe harbor rules.

🌟 Note: Filing Form 2210 with your tax return can help mitigate penalties if you're short of the safe harbor thresholds.

How to Calculate Your Estimated Taxes

To complete Form 2210 accurately, you need to estimate your tax liability. Here's how:

- Estimate your total income for the year: Include all sources like salary, freelance work, investments, and more.

- Subtract deductions: Itemized or standard, and adjust for any exemptions.

- Apply tax rates: Determine your tax bracket to calculate your tax.

- Add other taxes: Consider self-employment tax, alternative minimum tax, and other applicable taxes.

- Subtract credits: Tax credits directly reduce your tax liability.

💡 Note: Use the IRS's tax withholding estimator or a tax preparation software to help estimate your taxes accurately.

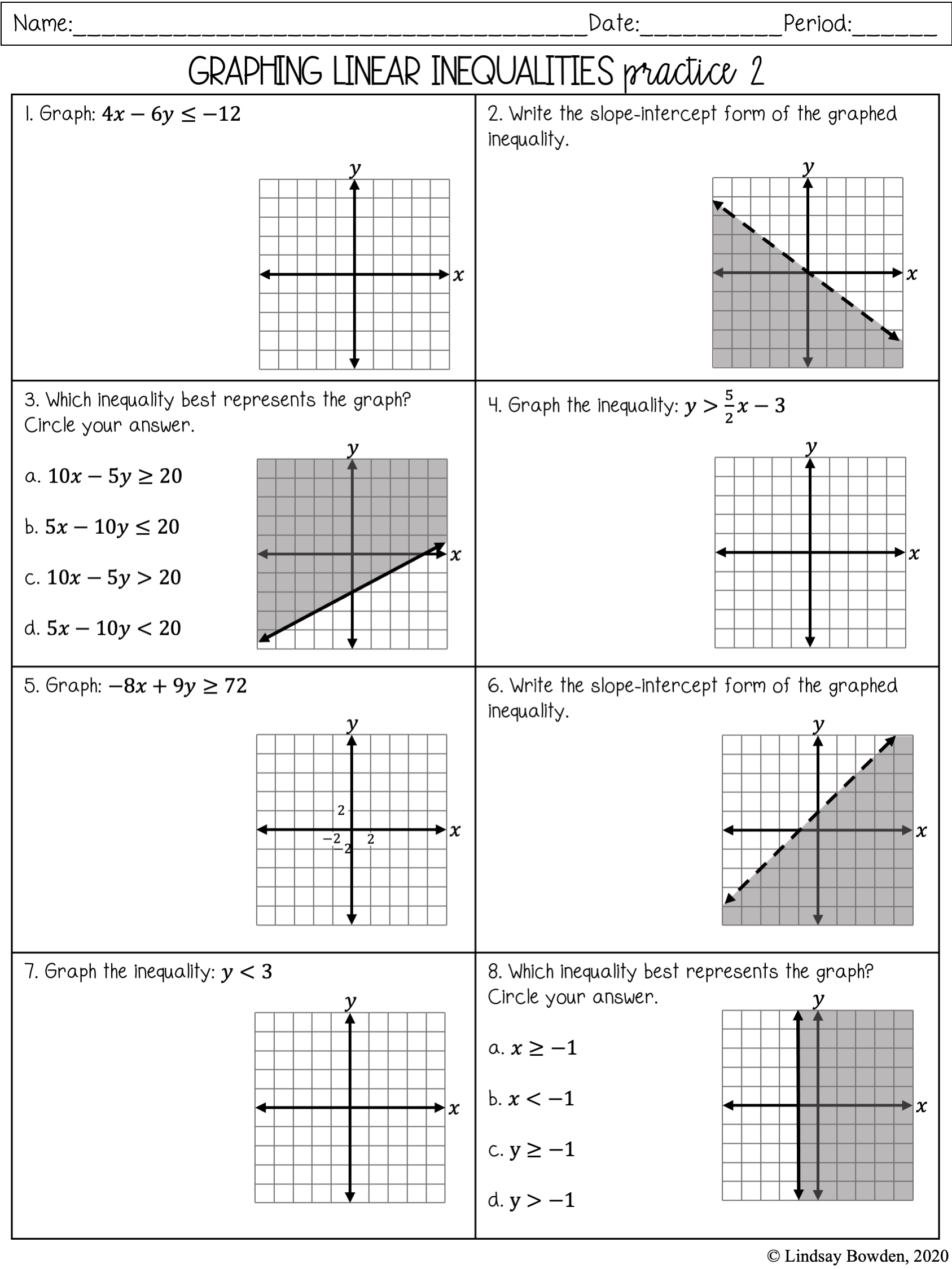

Filling Out Form 2210

The form can be daunting, but breaking it down step-by-step can simplify the process:

Part I: Required Annual Payment

Calculate the minimum amount you should've paid during the year to avoid underpayment penalties.

Part II: Reasons for Filing

Here, you can explain your situation and check any applicable boxes that justify your underpayment:

- If you've retired, become disabled, or your spouse passed away.

- If you made estimated tax payments or paid tax through income withholding.

- If you qualify for the annualized income installment method.

📌 Note: Document your situation with details, especially if you're using the annualized income installment method, to clarify your underpayment.

Part III: Calculation of Underpayment

Use this section to figure out if you've underpaid by calculating the difference between what you paid and what you should have paid throughout the year.

Part IV: Figuring the Penalty

Here, you'll calculate the penalty for underpayment based on the period of underpayment:

- January 1 to March 31

- April 1 to May 31

- June 1 to August 31

- September 1 to December 31

🧮 Note: The IRS provides a penalty rate for each period, which you'll use to compute your penalty. Remember, this rate can change annually.

Submitting Form 2210

Submit Form 2210 along with your tax return, whether you file electronically or by mail. Here's what to do:

- If e-filing: Include Form 2210 with your tax software, or you'll need to print it if your software doesn't support it.

- If mailing: Attach Form 2210 to your Form 1040 or other relevant tax form, and ensure it's signed and dated.

📩 Note: If you're not calculating a penalty, attach Form 2210 to show why you're not liable for the penalty.

By now, you should have a better understanding of Form 2210 and its role in your tax filing process. Remember, planning ahead and paying your estimated taxes on time can save you from unexpected penalties. Ensure you've calculated your taxes correctly, filled out Form 2210 meticulously, and submitted it correctly to keep your financial affairs in order. With this guide, you're now equipped to handle your tax estimation with confidence, avoiding the pitfalls that can catch taxpayers off guard.

Can I avoid Form 2210 by paying 100% of last year’s taxes?

+

If your adjusted gross income was $150,000 or less, paying 100% of last year’s tax or 90% of this year’s tax can avoid the underpayment penalty. However, if your income exceeds this threshold, you’d need to pay 110% of last year’s tax to meet the safe harbor rules.

What if I can’t pay the full amount of my estimated taxes on time?

+

Consider setting up a payment plan with the IRS. Additionally, if you can show reasonable cause for not paying on time, you might qualify for a penalty waiver. Always communicate with the IRS regarding your situation.

Is Form 2210 necessary for every taxpayer?

+

No, Form 2210 is only required if you owe a penalty for underpayment of estimated taxes. If your payments meet the IRS’s safe harbor rules or you qualify for a waiver, you don’t need to file it.