-

Maximize Tax Savings with Form 4562: Depreciation Guide

A guide to using Form 4562 for calculating depreciation and amortization expenses for tax purposes, including instructions on completing the form and examples.

Read More » -

Maximize Your Social Security with Form 1040 Worksheet

The 1040 Social Security Worksheet is a vital tool for calculating the taxable portion of your Social Security benefits for federal income tax purposes.

Read More » -

5 Tips for Navigating the Qualified Dividends Worksheet

This article provides a guide on using the Qualified Dividends and Capital Gains Worksheet to accurately report and manage tax liabilities from investments on your tax return.

Read More » -

Calculating Net Worth: Worksheet Answers & Guide

This chapter provides a worksheet with answers to help individuals calculate their net worth by detailing assets, liabilities, and guiding through financial planning concepts.

Read More » -

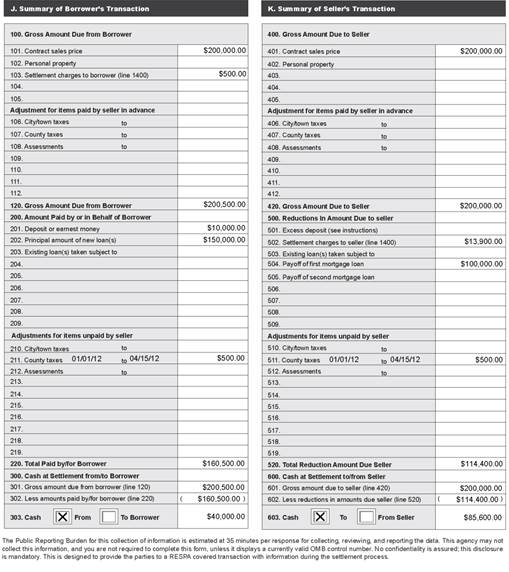

Mastering the 1031 Exchange: Your Essential Worksheet Guide

A guide providing tools and tips for managing Section 1031 tax-deferred exchanges, including a worksheet for calculations.

Read More » -

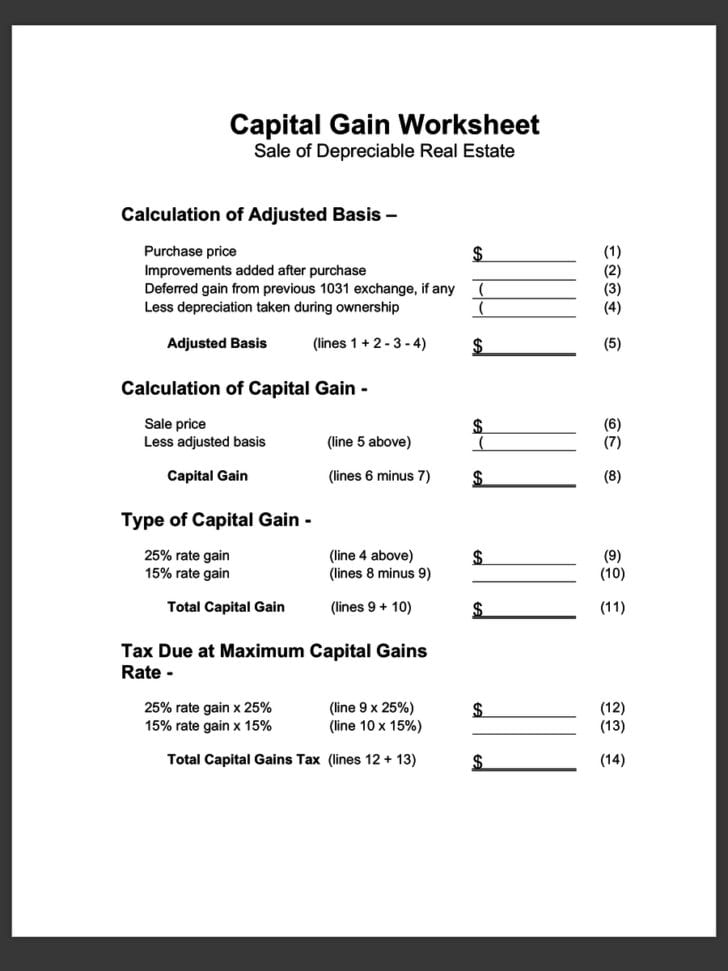

1031 Exchange: Simplified Worksheet for Tax Savings Calculation

Simplify your 1031 exchange process with this detailed calculation worksheet, designed to ensure compliance and optimize your tax benefits.

Read More » -

Earned Income Credit Worksheet CP 27 Guide

Worksheet for calculating and verifying eligibility for the Earned Income Tax Credit on CP 27 forms.

Read More » -

Maximize Your Tax Benefits with Worksheet 1 in Pub. 596

Explanation of how to use Worksheet 1 from IRS Publication 596 to determine eligibility for the Earned Income Credit.

Read More » -

Master Section 263a Calculations with Our Simple Worksheet

This worksheet aids in understanding the application of Internal Revenue Code Section 263A for allocating direct and indirect costs to inventory for tax reporting.

Read More » -

Master Your Tax Savings with a NOL Calculation Worksheet

A guide to calculating Net Operating Loss (NOL) using a step-by-step worksheet for tax purposes.

Read More »