Maximize Tax Savings with Form 4562: Depreciation Guide

The journey to maximize tax savings is a strategic endeavor that involves various tax forms and deductions. Among these, Form 4562 stands out as a critical tool for business owners, rental property investors, and self-employed individuals aiming to reduce their taxable income through depreciation. This guide will delve into the intricacies of Form 4562, offering insights on how to effectively use depreciation to your advantage, ensuring you comply with IRS regulations while optimizing your tax strategy.

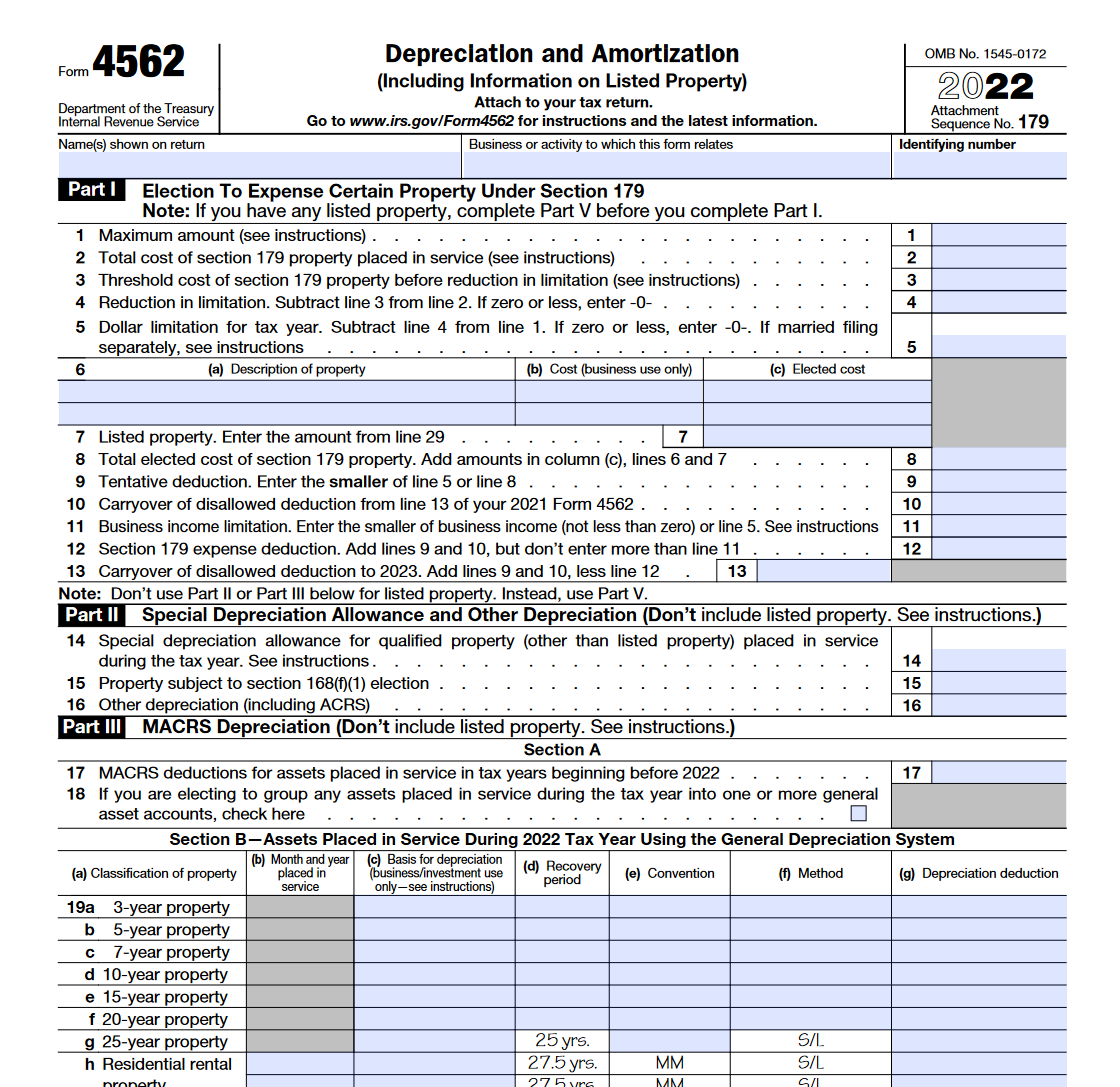

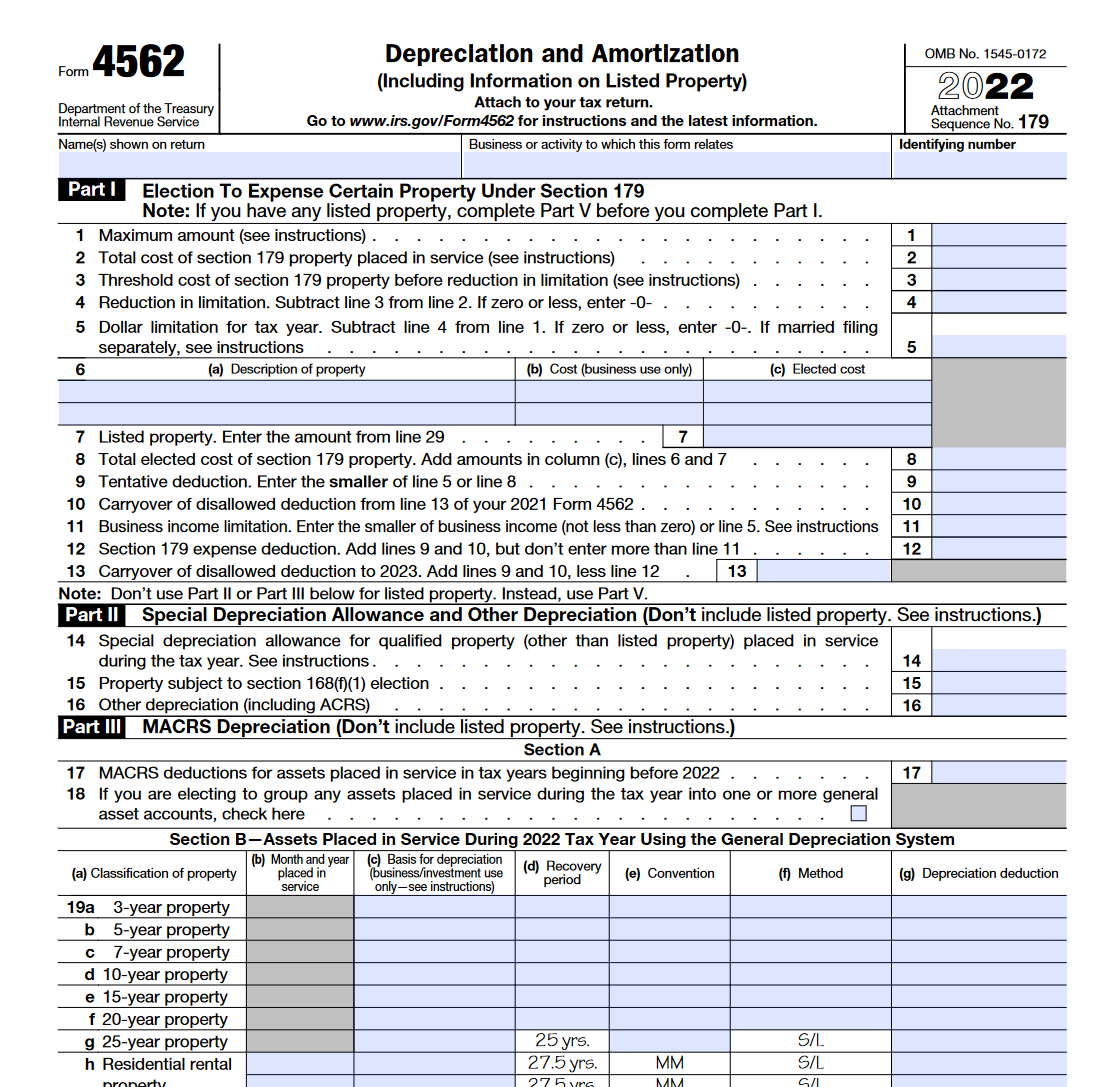

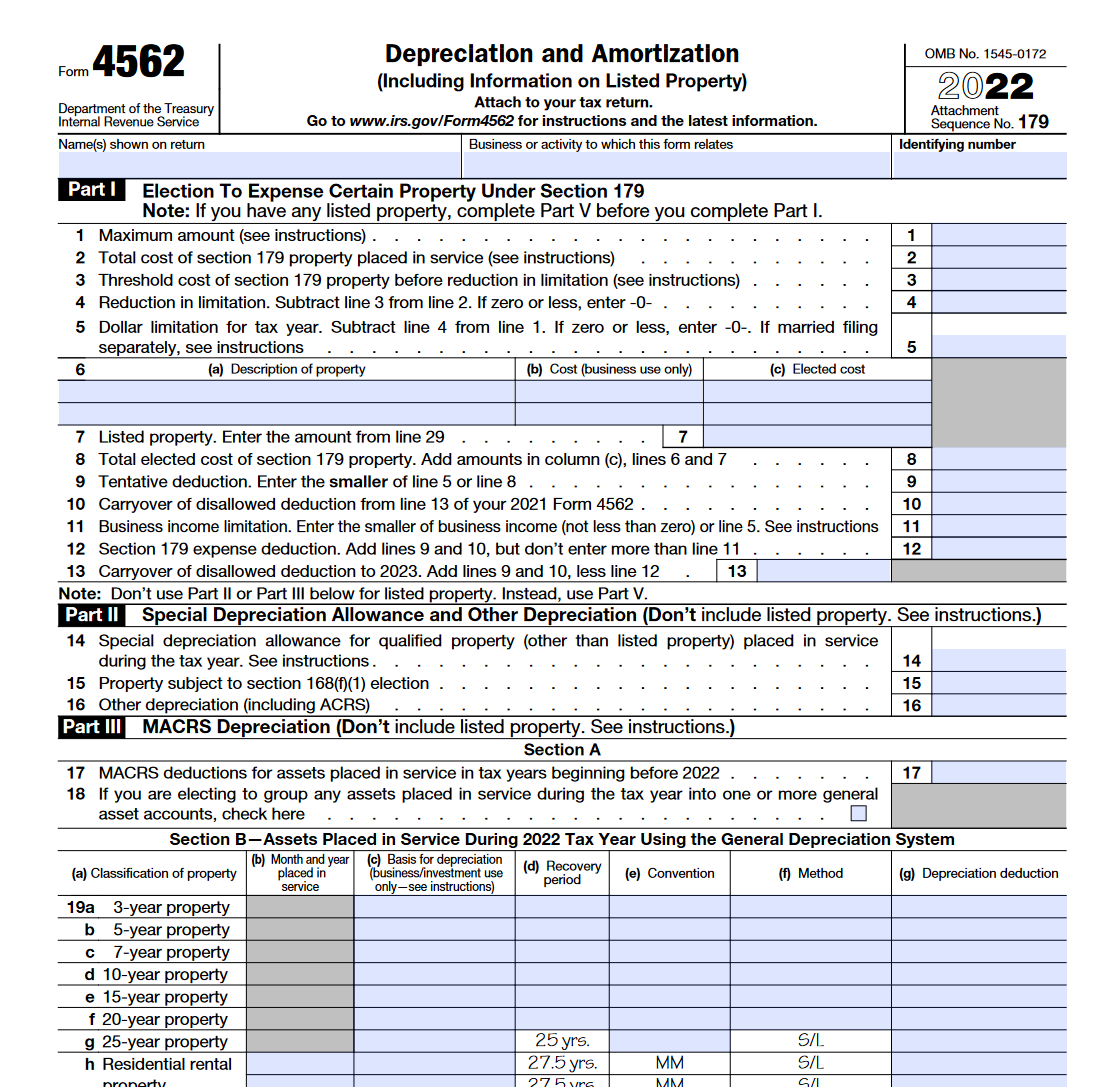

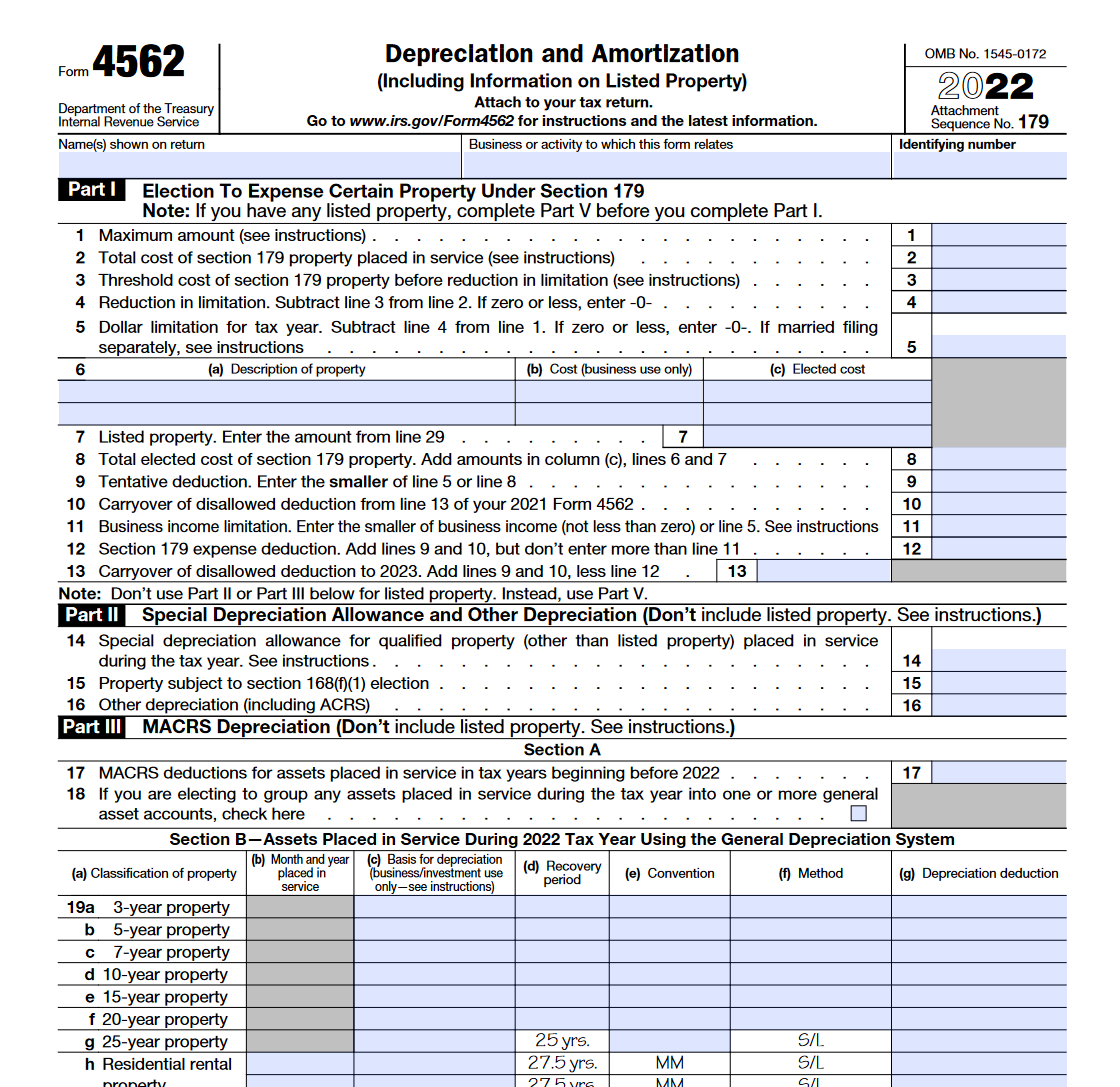

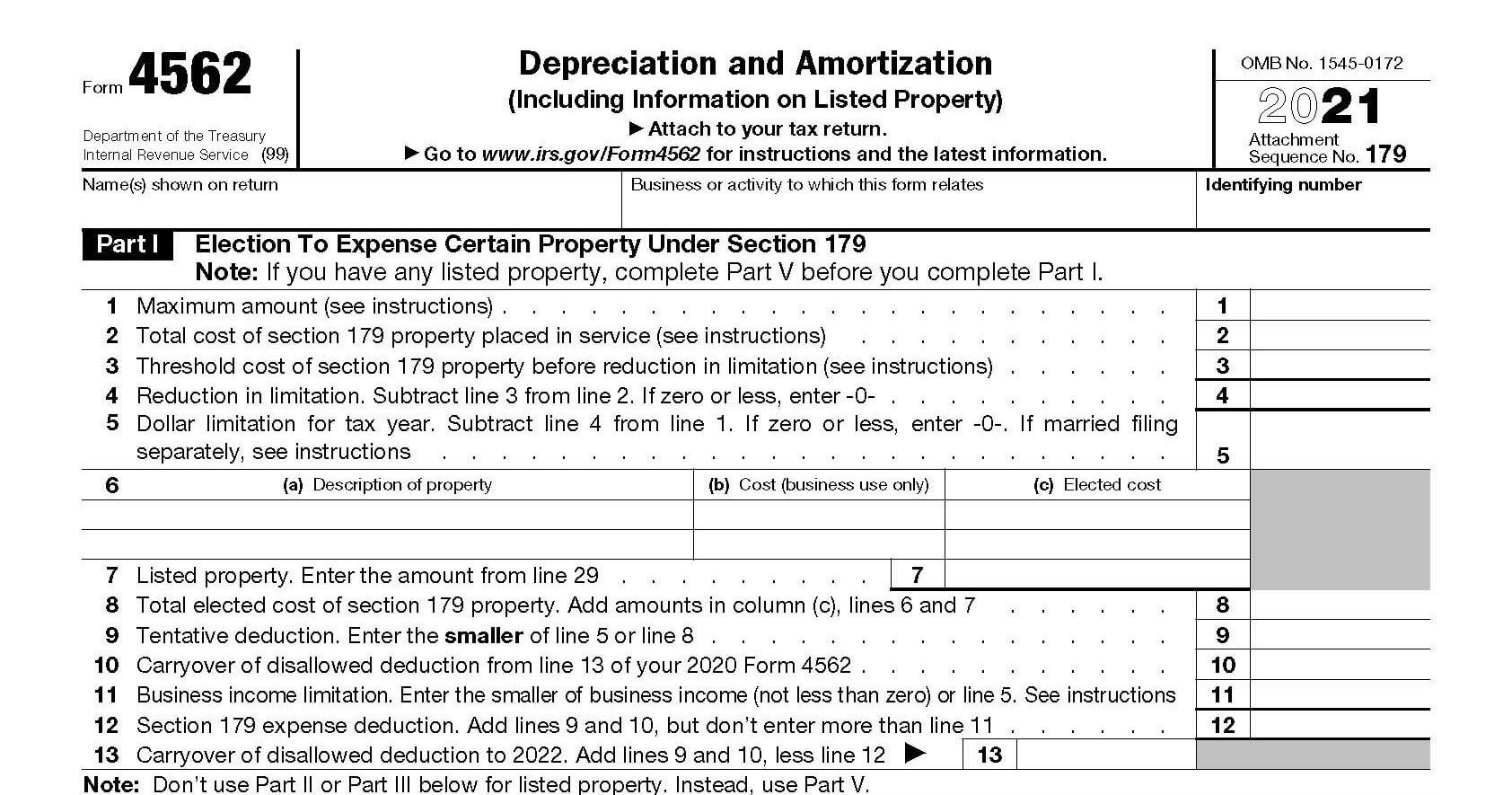

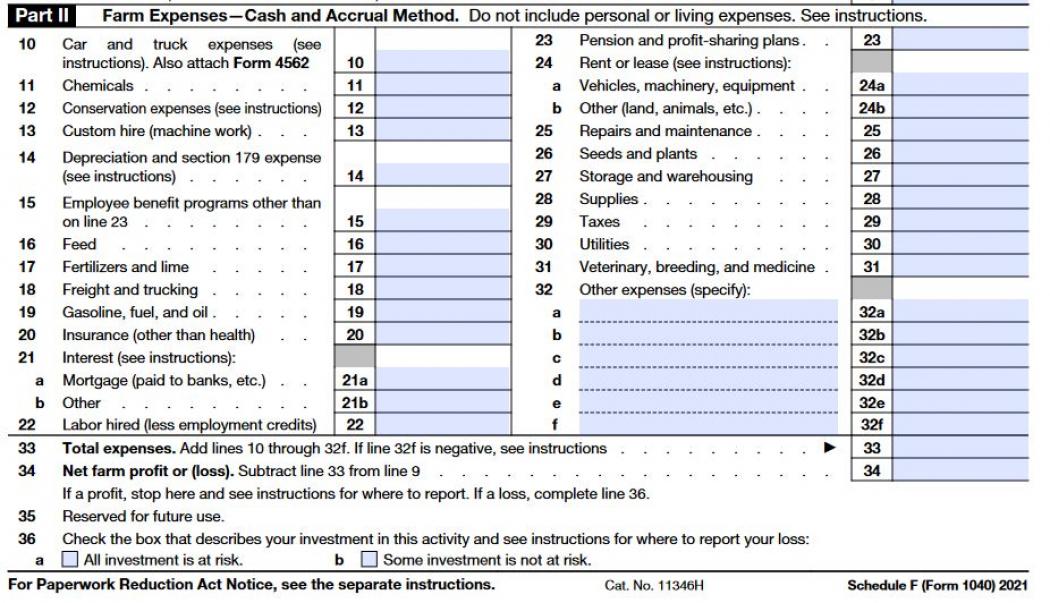

What is Form 4562?

Form 4562, also known as the Depreciation and Amortization form, is utilized by taxpayers to report depreciation, amortization, and any Section 179 expense deductions. The IRS mandates the use of this form to claim these tax benefits for business assets that have a useful life extending over more than one year. Understanding its purpose and utility is the first step in leveraging it for tax savings:

- Claim deductions for tangible property used in your business or income-producing activity.

- Report Section 179 expensing, allowing you to deduct the cost of certain property in the year it’s purchased.

- Calculate depreciation for assets like buildings, furniture, vehicles, or equipment.

Depreciation Methods

The IRS provides several methods to depreciate assets, each suited to different scenarios:

| Depreciation Method | Description |

|---|---|

| Straight-Line Method | Distributes the cost evenly over the asset’s useful life. |

| Declining Balance Method | Allows for larger deductions in earlier years. |

| Modified Accelerated Cost Recovery System (MACRS) | The default method for most tangible business assets, offering flexibility in deductions. |

| Section 179 Deduction | Permits immediate deduction of up to $1,040,000 (2021 limit) in the year of purchase for qualifying property. |

🔍 Note: Always review the IRS guidelines for the current year, as deduction limits can change.

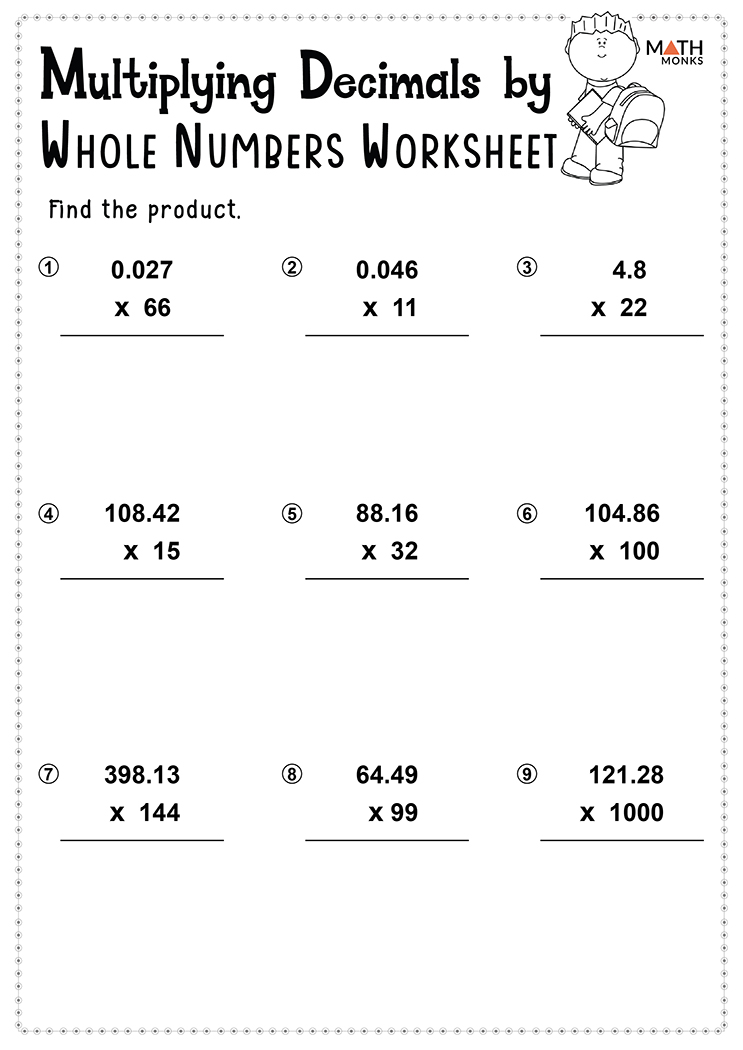

How to Fill Out Form 4562

Properly completing Form 4562 requires attention to detail and a step-by-step approach:

- Identify the Assets: List all business assets that qualify for depreciation or expensing.

- Determine the Cost: Include the total purchase price or fair market value at acquisition.

- Select a Depreciation Method: Choose the appropriate method for each asset.

- Calculate Depreciation: Compute the deduction for each asset based on its method and useful life.

- Fill Out Sections: Enter the calculated data into the relevant sections of Form 4562.

📚 Note: Ensure you have the asset’s cost basis, date placed in service, and its useful life documented for IRS records.

Common Mistakes to Avoid

Here are some errors to watch out for when dealing with Form 4562:

- Overstating Deductions: Claiming more depreciation than allowed by IRS rules.

- Using Incorrect Useful Life: Applying the wrong useful life for assets under MACRS.

- Neglecting to File: Failing to submit Form 4562 even if you’ve claimed depreciation or Section 179 deductions.

- Not Considering Bonus Depreciation: Forgetting to take advantage of bonus depreciation when available.

Tax-Saving Tips

Here are some strategic tips to enhance your tax savings:

- Plan Asset Purchases: Time your asset acquisitions to leverage Section 179 deductions for the maximum benefit.

- Consider Bonus Depreciation: Utilize bonus depreciation when applicable to accelerate deductions.

- Maintain Detailed Records: Keep thorough documentation to substantiate your deductions in case of an audit.

- Consult a Tax Professional: Seek expert advice to navigate complex depreciation scenarios or changes in tax laws.

💡 Note: Proper planning and documentation can significantly reduce your taxable income, but always ensure you're compliant with IRS rules.

In essence, understanding and using Form 4562 to depreciate assets is a smart tax strategy for any business or individual with significant investments in property. By choosing the right depreciation methods, accurately filling out the form, and staying abreast of tax law changes, you can legally minimize your tax liability. Remember that while this guide provides a comprehensive overview, the intricacies of tax law mean personalized advice can be invaluable. A deep dive into Form 4562 can unlock substantial tax savings, providing you with more resources to reinvest in your business or other ventures.

Who Must File Form 4562?

+

Anyone who depreciates assets, claims Section 179 deductions, or has made improvements to their business or rental property must file Form 4562. This includes businesses, rental property owners, and self-employed individuals.

Can I claim Section 179 for vehicles?

+

Yes, you can claim the Section 179 deduction for vehicles, but there are specific limitations and requirements. Ensure the vehicle is used more than 50% for business purposes, and note that there are annual limits on the deduction amount.

What is bonus depreciation?

+

Bonus depreciation is a tax incentive that allows you to deduct a larger percentage of the cost of new or used, previously owned property in the year you place it in service. It’s typically 100% in recent years, but can change, so check current IRS guidelines.

How does the Modified Accelerated Cost Recovery System (MACRS) work?

+

MACRS is the current tax depreciation system in the U.S. It allows for accelerated depreciation, meaning you can recover your investment more quickly. Assets are assigned a recovery period based on their type, and deductions are taken using either the General Depreciation System (GDS) or Alternative Depreciation System (ADS).

Is there a limit to Section 179 expensing?

+

Yes, there is a deduction limit for Section 179. For 2021, this limit was set at 1,040,000, but it's subject to annual adjustments. Also, the deduction starts to phase out if your total business purchases exceed 2,620,000 (2021 figures).