Master Section 263a Calculations with Our Simple Worksheet

Understanding and calculating Section 263A costs can be a daunting task for many business owners and financial professionals. Section 263A, also known as the Uniform Capitalization Rules or UNICAP, is an IRS regulation that requires the capitalization of certain direct and indirect costs related to real and tangible personal property produced or acquired for resale. This blog post will serve as a comprehensive guide on how to master Section 263A calculations using our simple worksheet, ensuring that your financial reporting is accurate and compliant with tax laws.

Why is Section 263A Important?

Before diving into the calculations, let’s understand why mastering Section 263A is crucial:

- Compliance: Proper compliance helps avoid penalties and audits from the IRS.

- Accurate Cost Allocation: Ensures costs are correctly capitalized, leading to accurate inventory valuation and cost of goods sold (COGS).

- Tax Savings: Understanding these rules can lead to tax savings by optimizing how costs are capitalized or expensed.

Understanding Section 263A Costs

Section 263A focuses on capitalizing the following costs:

- Direct materials, labor, and other direct production costs.

- Indirect costs such as overhead, quality control, and purchasing.

- Interest costs incurred during the production period.

These costs must be added to the inventory’s cost basis and are not deductible until the inventory is sold.

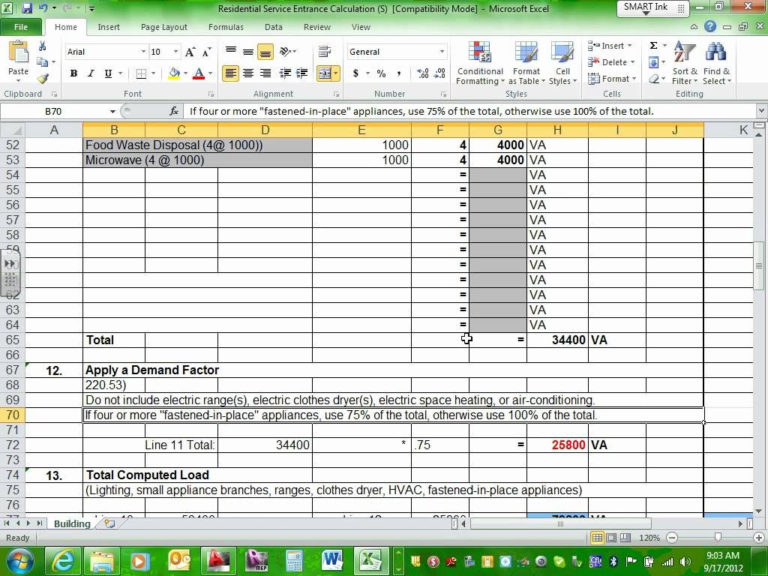

Introduction to the Worksheet

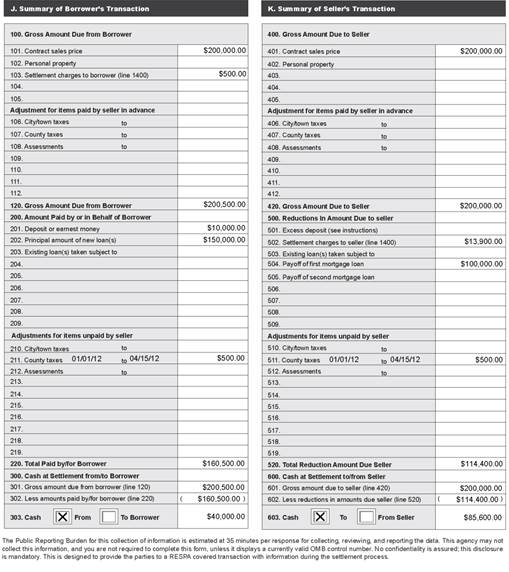

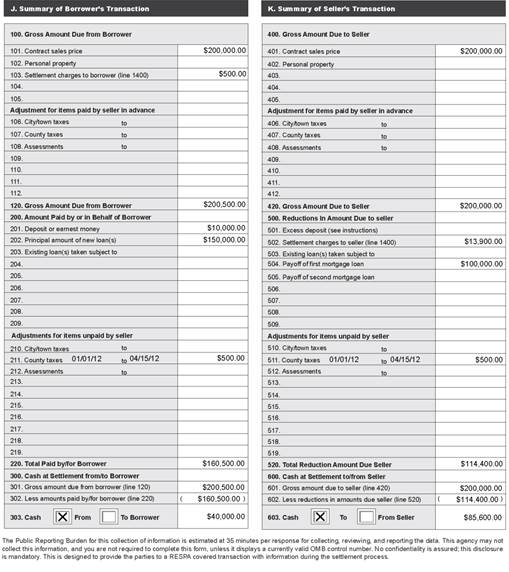

We have developed a simple worksheet to help you through the Section 263A calculation process:

Step-by-Step Guide to Using the Worksheet

Here’s how you can use our worksheet to calculate your Section 263A costs:

1. Identify Capitalizable Costs

- Direct Costs: Enter all direct costs like materials, labor, and direct production expenses in the respective fields.

- Indirect Costs: Include costs such as overhead, factory maintenance, utilities, and other indirect production expenses.

- Interest Costs: Calculate interest related to production and enter it into the worksheet.

💡 Note: Ensure all costs are consistently categorized to avoid errors in capitalization.

2. Apply the De Minimis Safe Harbor Election

You can elect to use a de minimis safe harbor rule if your average annual gross receipts for the preceding three tax years are under 25 million. Under this election:</p> <ul> <li>Units of tangible personal property costing 5,000 or less can be expensed rather than capitalized.

3. Calculate Total Capitalized Costs

Add up all the entered costs to find the total amount to be capitalized under Section 263A.

4. Allocate Costs to Products

Use an allocation method like the ‘specific identification’, ‘dollar-value LIFO’, or ‘FIFO’ method to assign these costs to specific inventory items or batches:

| Method | Description |

|---|---|

| Specific Identification | Assigns costs to specific items based on identification tags or serial numbers. |

| Dollar-Value LIFO | Uses layers of costs based on dollar amounts, adjusting for inflation. |

| FIFO | Costs of the first items produced or purchased are assigned first when inventory is sold. |

💡 Note: The method chosen should reflect the actual flow of inventory through your company.

5. Transfer Costs to Inventory

Once costs are allocated, transfer the total capitalizable costs to your inventory accounts to reflect the true cost of goods produced or purchased.

Common Pitfalls and How to Avoid Them

Here are some common mistakes businesses make with Section 263A calculations:

- Misclassifying Costs: Proper classification of direct vs. indirect costs is essential. Review and double-check categories.

- Ignoring De Minimis Safe Harbor: If your business qualifies, ensure you leverage this election for small assets.

- Incorrect Allocation Methods: Choosing an inappropriate allocation method can skew your inventory valuation and tax liability.

Expert Tips for Streamlining Your Section 263A Calculations

- Use Financial Software: Many accounting software packages have built-in features to handle Section 263A calculations.

- Stay Updated: Keep up with changes in tax law and IRS guidance to ensure compliance.

- Documentation: Maintain thorough documentation of how costs were calculated and allocated for potential audits.

💡 Note: Regular reviews with a tax advisor can help ensure ongoing compliance and optimal cost allocation strategies.

As we've seen, Section 263A calculations, while complex, can be managed effectively with the right tools and knowledge. Using our simple worksheet helps demystify this process, ensuring you can properly account for your production costs. It also facilitates accurate tax reporting and reduces the risk of IRS scrutiny. Keep in mind the importance of proper categorization, taking advantage of safe harbor elections, and choosing the most suitable allocation method for your inventory. With these insights and our worksheet, you're now better equipped to handle Section 263A calculations with confidence and accuracy.

What types of costs are subject to Section 263A?

+

Section 263A primarily focuses on capitalizing costs related to production or resale of inventory, including direct materials, direct labor, indirect production costs, and certain purchasing costs.

How do I know if I need to apply Section 263A?

+

Businesses producing or reselling tangible personal property should consider Section 263A if they have average annual gross receipts over 25 million or engage in significant production activities.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can small businesses use the de minimis safe harbor election?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, if a business's average annual gross receipts for the last three years are under 25 million, they can elect the de minimis safe harbor for expensing certain low-cost inventory or tangible personal property.