Mastering the 1031 Exchange: Your Essential Worksheet Guide

The 1031 Exchange, also known as a like-kind exchange or a Starker exchange, is an IRS provision allowing investors to defer capital gains taxes on the sale of investment property by reinvesting the proceeds into a similar property. A 1031 Exchange worksheet becomes indispensable when navigating this process. In this guide, we will walk through the crucial elements of a 1031 Exchange worksheet to help you optimize your real estate investments and ensure compliance with IRS regulations.

Understanding the Basics of a 1031 Exchange

A 1031 Exchange is not just about postponing taxes; it's a strategic tool for investors seeking to expand their real estate portfolio. Here's a breakdown:

- Like-Kind Property: Properties must be similar in nature or class for the exchange to qualify.

- 45-Day Rule: Investors must identify replacement property within 45 days of relinquishing their original property.

- 180-Day Rule: The exchange must be completed within 180 days from the sale of the original property or by the due date of the tax return, whichever comes first.

The Components of a 1031 Exchange Worksheet

1. Property Information

This section of the worksheet includes:

- Address of the relinquished property.

- Address of the replacement property or properties.

- Valuation and description of each property.

| Property Type | Address | Valuation | Description |

|---|---|---|---|

| Relinquished | 123 Main St, Anytown, USA | $500,000 | Single-family home with 3 bedrooms, 2 baths, and a large yard. |

| Replacement | 456 Oak Rd, Another Town, USA | $600,000 | Fourplex with separate utility meters for each unit. |

📝 Note: All property values must be documented through an appraisal, a broker's opinion of value, or a contract of sale.

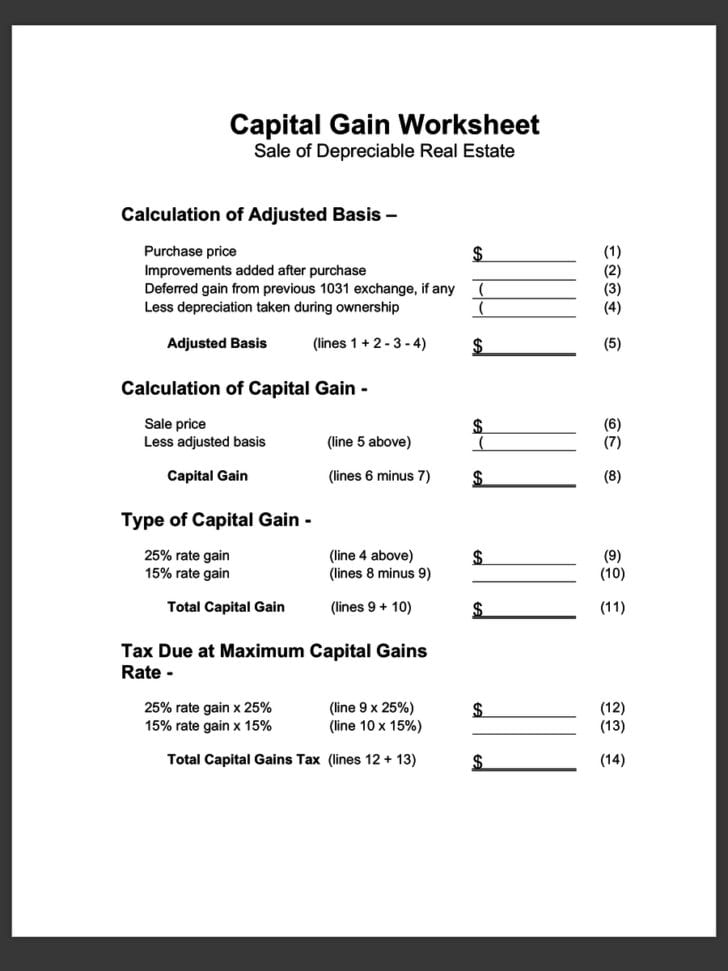

2. Exchange Calculation

Here's how you calculate the gain or loss:

- Determine the Adjusted Basis of the relinquished property.

- Calculate the gain or loss by subtracting this basis from the sales price.

- Adjust for any non-like-kind property received or boot.

⚠️ Note: Boot refers to any cash or non-like-kind property received in the exchange. It triggers recognition of part of the gain for tax purposes.

3. Timeline and Deadlines

Accurate time management is crucial:

- Document the date of relinquishment.

- Track the 45-day identification period.

- Monitor the 180-day completion period.

🗓️ Note: Missing these deadlines can result in disqualification of the exchange, leading to immediate tax liability on gains.

4. Identification Rules

The IRS provides three options for identifying replacement properties:

- Three-Property Rule: Identify up to three replacement properties, regardless of value.

- 200% Rule: Identify any number of properties as long as their total fair market value does not exceed 200% of the relinquished property's value.

- 95% Exception: Identify any number of properties, but you must purchase at least 95% of the aggregate value of all identified properties.

Steps to Complete a 1031 Exchange Worksheet

Here's a step-by-step process for completing your worksheet:

- Record Initial Information: Fill in the relinquished and potential replacement properties' details.

- Perform Exchange Calculation: Work out the gain or loss and document the boot if applicable.

- Set Deadlines: Mark the 45-day identification deadline and the 180-day completion deadline.

- Identify Replacement Properties: Choose from the three identification rules outlined above.

- Document All Transactions: Maintain records of all contracts, sales, and exchanges.

By following these steps, you'll ensure your 1031 Exchange process is well-documented and compliant with IRS regulations.

Common Mistakes to Avoid

- Not sticking to the 45-day identification or 180-day completion deadlines.

- Failure to reinvest all net proceeds from the sale into like-kind properties.

- Purchasing replacement property from a related party to avoid tax.

- Not considering the impact of boot or mixing personal and investment property.

Benefits of Using a 1031 Exchange

Here are some compelling reasons to consider a 1031 Exchange:

- Tax Deferral: Keep more cash on hand by postponing capital gains taxes.

- Portfolio Diversification: Exchange properties into different types or locations.

- Increased Cash Flow: Reinvest into properties with higher rental income potential.

- Consolidation: Trade multiple smaller properties for a single larger one, reducing management time.

The final stage of this guide brings us to a critical juncture - understanding the nuances of a 1031 Exchange through meticulous record-keeping with a comprehensive worksheet. This practice not only ensures regulatory compliance but also provides a clear path towards optimizing real estate investments. The key takeaways from our journey are: - Grasping the intricacies of IRS rules like the like-kind exchange criteria, identification deadlines, and boot considerations. - Completing a detailed 1031 Exchange worksheet to track all aspects of the process from property valuations to transaction timelines. - Avoiding common pitfalls by understanding the rules and maintaining proper documentation. By mastering the 1031 Exchange process, investors can effectively leverage their portfolios, grow their assets, and manage their tax liabilities more efficiently. A well-structured worksheet serves as your roadmap to a successful like-kind exchange, enabling you to make informed decisions and steer clear of costly errors. Always consult with a qualified intermediary or tax advisor to ensure you're following the latest IRS guidelines.

Can I exchange my primary residence with a 1031 Exchange?

+

No, a 1031 Exchange applies only to investment or business property, not to your primary residence. However, if you have lived in the property for 2 out of the last 5 years, you might qualify for the Section 121 exclusion, allowing you to exclude up to 250,000 of gain (500,000 for a married couple filing jointly).

What if I don’t find a replacement property within the 45-day period?

+

If you fail to identify a replacement property within 45 days, the 1031 Exchange is considered failed, and you’ll owe capital gains tax on the sale of your relinquished property. It’s important to use this time efficiently to locate and secure potential properties.

How does boot affect my 1031 Exchange?

+

Boot is any non-like-kind property or cash you receive in the exchange, leading to partial recognition of the gain. To avoid taxes, all net proceeds must be reinvested into the replacement property. Boot results in taxable income in the year of the exchange.