5 Tips for Navigating the Qualified Dividends Worksheet

The qualified dividends worksheet can be a powerful tool for investors looking to optimize their tax situation, but it can also be intimidating due to its complexity. Whether you're a seasoned investor or just starting out, understanding how to navigate this worksheet can make a significant difference in your tax strategy. In this comprehensive guide, we'll walk you through 5 essential tips to effectively navigate the qualified dividends worksheet, ensuring you maximize your tax benefits while maintaining compliance with IRS guidelines.

Understanding Qualified Dividends

Before diving into the worksheet, it’s vital to understand what qualified dividends are. Here’s a quick rundown:

- Qualified dividends are dividends that meet specific criteria set by the IRS to qualify for a lower tax rate, typically at the long-term capital gains tax rate.

- To qualify, the stock must have been held for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date.

- The company paying the dividend must be a U.S. corporation or, if it’s a foreign corporation, it must be eligible under specific tax treaties or meet other IRS criteria.

💡 Note: Not all dividends are qualified. Ordinary dividends from REITs, master limited partnerships (MLPs), and certain foreign corporations might not qualify, so it's crucial to check their status.

Tip 1: Identify Your Taxable Income

To navigate the qualified dividends worksheet effectively, you first need to know your taxable income:

- Calculate your adjusted gross income (AGI).

- Subtract any adjustments allowed on your tax return, like IRA contributions, student loan interest, etc.

- Identify which tax bracket your income falls into after considering your standard deduction or itemized deductions.

Understanding your tax bracket helps in determining how qualified dividends will impact your tax liability, as the tax rate on qualified dividends is tied to your ordinary income tax brackets.

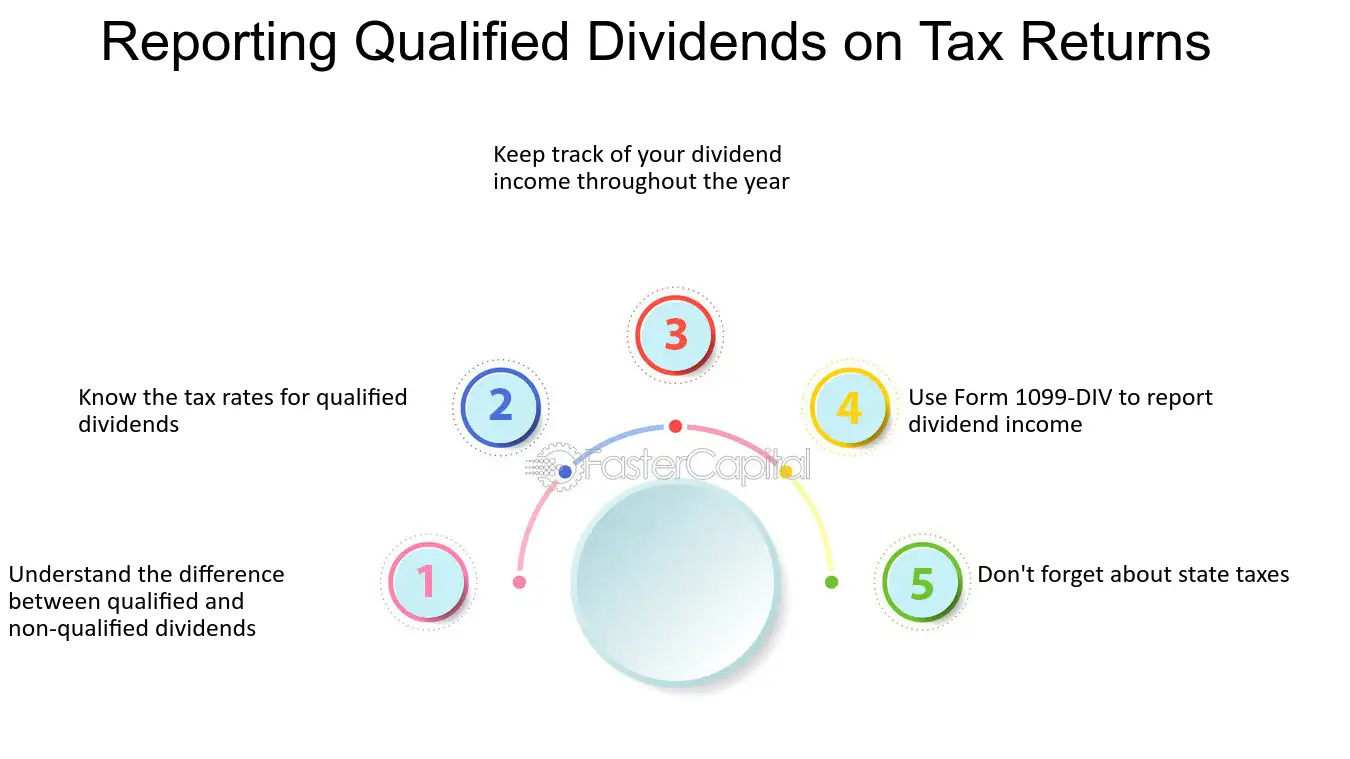

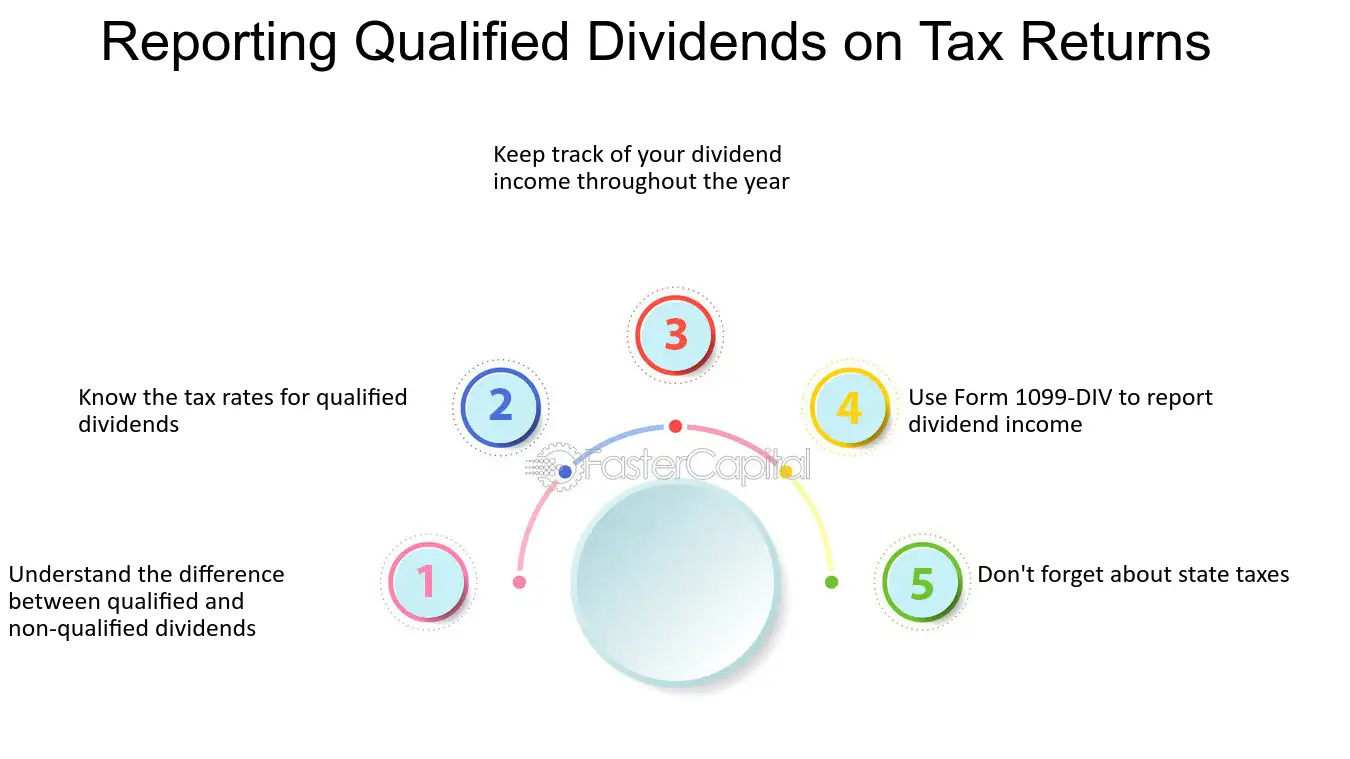

Tip 2: Collect Necessary Documentation

Having all necessary documentation in hand before you begin is crucial for a smooth filing process:

- Your 1099-DIV forms, which detail dividend income received from various investments.

- Brokerage statements, which often provide summaries of qualified vs. ordinary dividends.

- Previous years’ tax returns for comparison and understanding any carryover from previous years.

Ensuring you have all documents organized will save you time and potential headaches during tax season.

Tip 3: Use the Worksheet Correctly

The IRS provides a worksheet specifically designed to calculate the tax impact of qualified dividends. Here’s how to use it:

- Enter your total ordinary dividends: This number comes from your 1099-DIV forms.

- Subtract any amounts that are not qualified dividends: This includes dividends from sources that do not meet the IRS qualifications.

- Calculate your qualified dividends: The remainder after subtracting non-qualified dividends from the total.

- Determine the applicable tax rate: Depending on your income level, you’ll find your capital gains tax rate from the IRS tables.

- Work through the worksheet: Follow the steps provided to compute your tax on qualified dividends.

📝 Note: Be meticulous with your entries. Even minor errors can lead to significant discrepancies in your tax calculation.

Tip 4: Understand the Tax Implications

Here’s a brief explanation of how qualified dividends are taxed:

| Tax Rate | Income Range (Single Filers) | Income Range (Married Filing Jointly) |

|---|---|---|

| 0% | 0 - 41,675 | 0 - 83,350 |

| 15% | 41,676 - 459,750 | 83,351 - 517,200 |

| 20% | 459,751+</td> <td>517,201+ |

Knowing these rates helps in planning how much you'll owe or if you'll receive a refund.

Tip 5: Consider Professional Help

Navigating tax laws, especially concerning investments, can be complex:

- If you have significant investments, or if your financial situation is complicated, consider hiring a tax professional.

- A CPA or enrolled agent can provide personalized advice, ensure accuracy in tax filings, and possibly find tax-saving opportunities you might overlook.

By now, you should have a better grasp of how to navigate the qualified dividends worksheet. Remember, knowledge is your best tool in tax planning. With these tips, you can approach your tax preparation with confidence, making sure every qualified dividend is accounted for and taxed appropriately. Investing time in understanding these processes can lead to substantial savings and a clearer financial picture as you move forward into the future.

What makes a dividend qualified or not?

+

A dividend is considered qualified if it’s paid by a U.S. corporation or certain foreign corporations and if you’ve held the stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date. Additionally, the dividends must not be listed as non-qualified on your Form 1099-DIV.

How do I know my tax bracket for qualified dividends?

+

Your tax bracket for qualified dividends is determined by your ordinary income tax bracket, which depends on your filing status and total taxable income after deductions. The IRS provides tables listing these brackets.

Can I claim a loss on my qualified dividends if I sold the stock at a loss?

+

Yes, if you sold your stock at a loss, you can claim that loss to offset capital gains or, if there are no gains, up to $3,000 of ordinary income each year. Any excess loss can be carried forward to future years.