-

5 Easy Steps to Master Rounding Decimals

A practical worksheet designed to help students master the skill of rounding decimal numbers to the nearest whole number or specified place value.

Read More » -

Streamline Your Taxes: Eftps Direct Payment Worksheet Guide

A detailed guide on using the EFTPS Direct Payment Worksheet Long Form, explaining how to accurately record, calculate, and make electronic federal tax payments.

Read More » -

Maximize Your Savings with IRS Credit Limit Worksheet A

IRS Credit Limit Worksheet helps taxpayers calculate their Earned Income Credit, assisting in determining the maximum allowable credit.

Read More » -

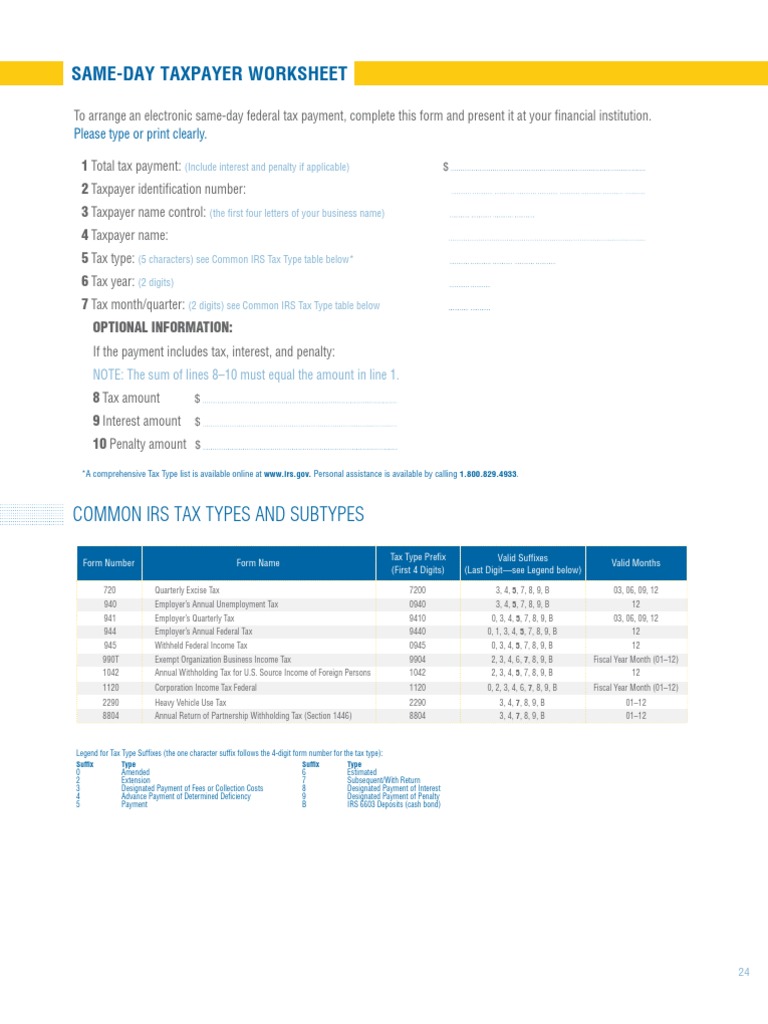

Same Day Taxpayer Worksheet IRS Guide

A guide on how to correctly fill out and use the IRS Same Day Taxpayer Worksheet for tax purposes.

Read More » -

Quick Resolution with FTB 5822 Ens Worksheet

The FTB 5822 Ens Quick Resolution Worksheet provides guidance on resolving discrepancies noted in Form 5822, allowing for a faster turnaround of estate tax issues.

Read More » -

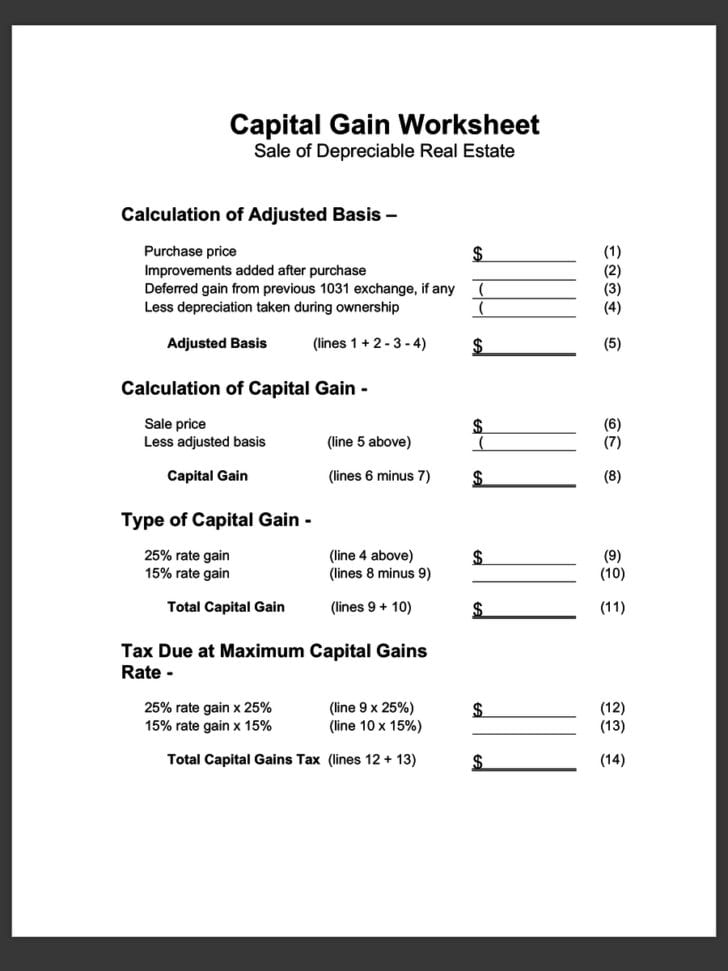

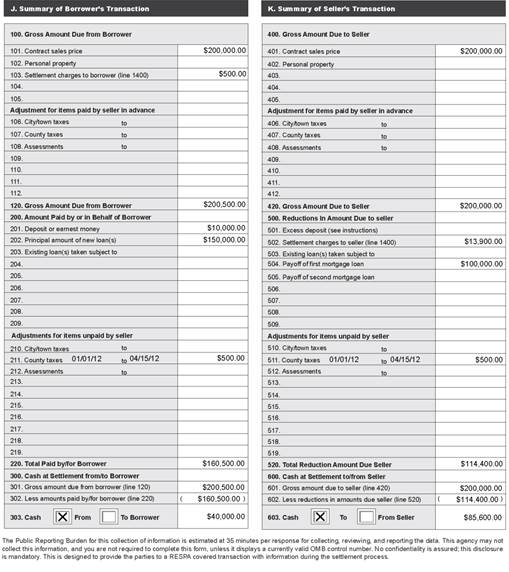

Mastering the 1031 Exchange: Your Essential Worksheet Guide

A guide providing tools and tips for managing Section 1031 tax-deferred exchanges, including a worksheet for calculations.

Read More » -

Master Section 263a Calculations with Our Simple Worksheet

This worksheet aids in understanding the application of Internal Revenue Code Section 263A for allocating direct and indirect costs to inventory for tax reporting.

Read More » -

5 Ways to Handle Miscellaneous Expenses on Schedule C

This article provides guidance on accurately entering miscellaneous expenses on Schedule C, ensuring compliance and optimization of tax deductions for small business owners.

Read More » -

5 Common Logical Fallacies to Avoid in Arguments

A worksheet designed to help students identify and understand common logical fallacies in arguments.

Read More » -

7 Ways to Maximize Your Credit Limit with Form 8812

This article provides an in-depth guide on Form 8812, detailing how to calculate and report the Additional Child Tax Credit using the Credit Limit Worksheet, helping taxpayers understand eligibility and maximize their tax benefits.

Read More »