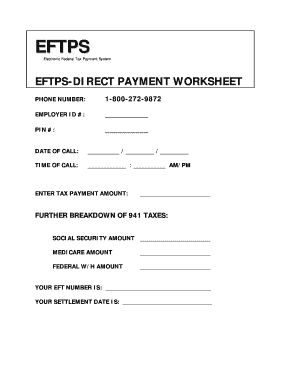

Streamline Your Taxes: Eftps Direct Payment Worksheet Guide

The task of paying taxes can often seem daunting, but using the Electronic Federal Tax Payment System (EFTPS) can make the process much more straightforward. In this guide, we'll walk you through how to use the EFTPS Direct Payment Worksheet to ensure your federal tax payments are on track and timely. Whether you're an individual taxpayer or managing taxes for a business, understanding this system is crucial for seamless tax payment.

What is EFTPS?

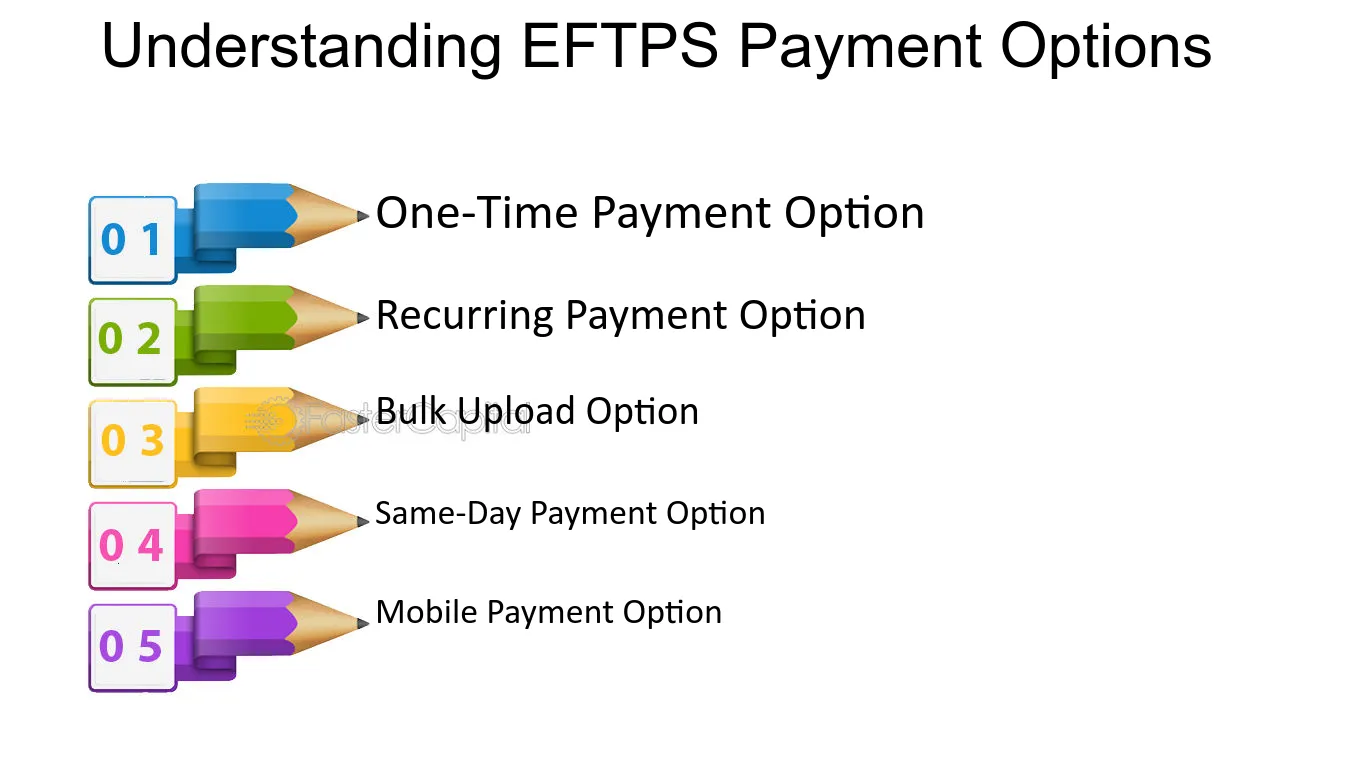

EFTPS is a secure government website run by the U.S. Department of the Treasury that allows you to schedule tax payments online or by phone. Here are some key features of EFTPS:

- Allows payments of federal taxes

- Provides detailed records and confirmation numbers

- Supports same-day or future-dated payments

- Available 24/7 for both enrolled and unenrolled users

Benefits of Using EFTPS

Before diving into how to use the worksheet, let's explore why EFTPS is a preferred method:

- Convenience: Pay anytime from anywhere.

- Accuracy: Errors are minimized with structured data entry.

- Confirmation: Immediate payment confirmation.

- Security: Highly secure government system with multi-factor authentication.

EFTPS Direct Payment Worksheet

The EFTPS worksheet is essentially a pre-payment tool to organize your tax liabilities:

Step-by-Step Guide to Using the Worksheet

- Gather Your Information:

Before starting, ensure you have:

- Your Taxpayer ID Number (TIN, SSN, or EIN)

- Details on the tax type (e.g., Form 941 for Employment Tax)

- Tax period for which you're paying

- Exact amount due

- Payment method (bank account, etc.)

- Download the Worksheet:

Obtain the EFTPS Direct Payment Worksheet from the IRS or EFTPS website.

- Complete the Worksheet:

Fill in the following fields:

Field Description Tax Form Type of tax (e.g., Form 941 for Employment Tax) Tax Period Quarter or tax year Payment Type Regular or Amended Payment Amount The exact amount of tax to be paid Payment Date When you want the payment to be processed Settlement Date Date your bank account will be debited Payment Method How you'll make the payment (check, ACH, etc.)

- Verify Your Entries:

Double-check your worksheet for accuracy. Errors here can lead to incorrect payments.

- Transfer Data to EFTPS:

Use the worksheet to input your payment details on the EFTPS platform.

📝 Note: Always keep a copy of your filled worksheet for your records in case of disputes or future reference.

Frequently Asked Questions

Here are some common questions about EFTPS and the Direct Payment Worksheet:

Can I enroll in EFTPS online?

+

Yes, enrollment can be done online. You'll need your personal details and banking information.

What if I make a mistake on the worksheet?

+

If you realize the mistake before finalizing the payment, you can correct it. If not, contact EFTPS customer service.

How often should I use the worksheet?

+

You should use the worksheet for every federal tax payment you need to schedule.

Is there a fee for using EFTPS?

+

No, there's no fee for using EFTPS to make payments.

Mastering the EFTPS Direct Payment Worksheet can significantly reduce the stress of tax payments. By ensuring accuracy in your tax obligations, you can avoid late fees, penalties, and potential audit issues. Embrace this tool for a more streamlined tax payment process, and enjoy the peace of mind that comes with meticulous tax management.