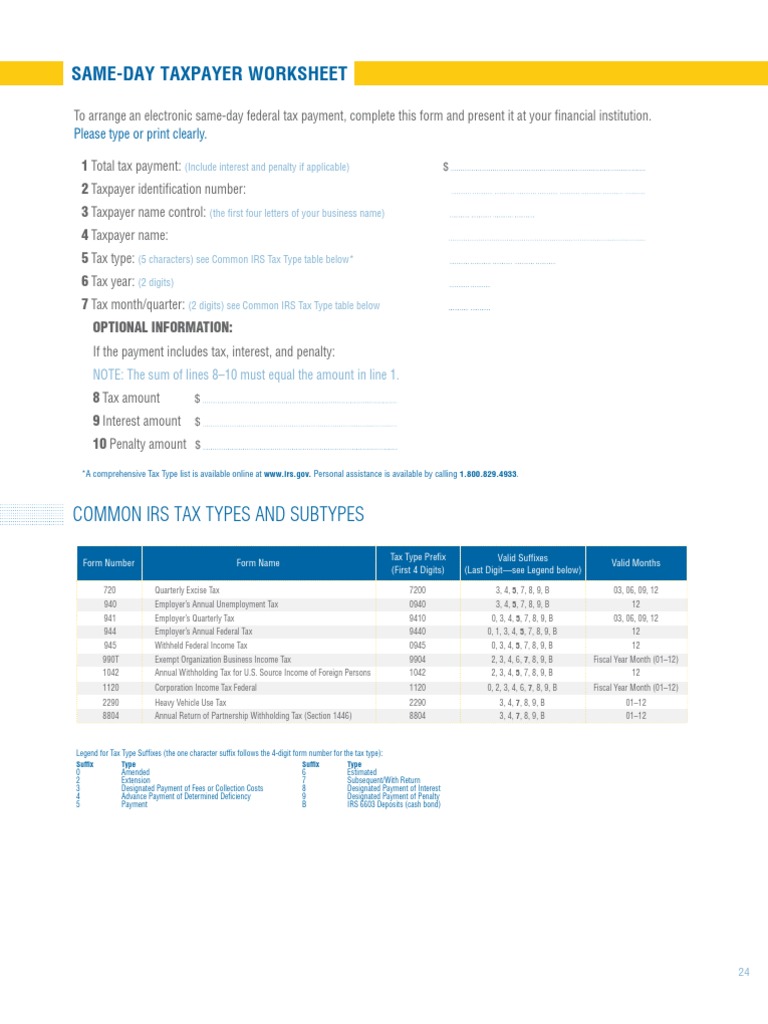

Same Day Taxpayer Worksheet IRS Guide

In today's increasingly digital financial landscape, one might think that all interactions with the IRS, including tax filings, have been streamlined for instant resolution. However, there's still a considerable amount of manual paperwork involved, especially when you require faster processing, like in the case of the Same Day Taxpayer Worksheet. Understanding how to effectively manage this part of your tax obligations can significantly reduce waiting times and streamline the entire tax filing process.

What is the Same Day Taxpayer Worksheet?

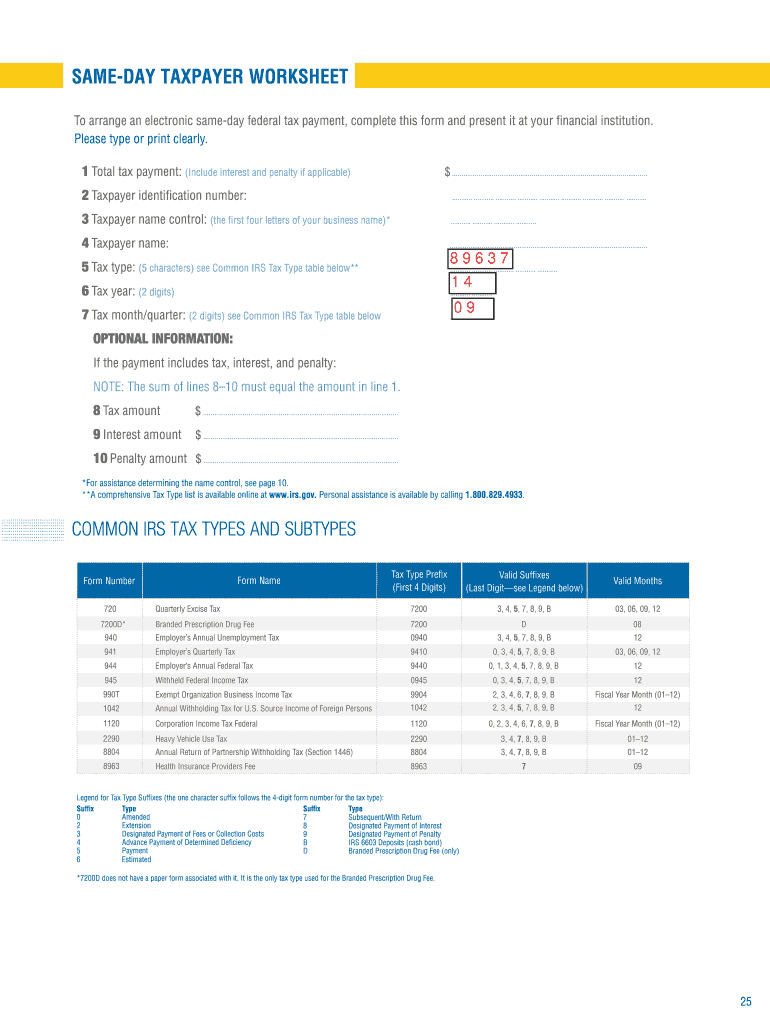

The IRS introduced the Same Day Taxpayer Worksheet as a way to expedite the processing of certain tax forms and refunds. This worksheet is particularly useful when you need immediate attention to your tax matters. Essentially, it's a form where you provide detailed information about your tax situation, including:

- Your name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- A summary of your tax situation.

- Contact information for any tax preparer or representative.

- Details on the type of tax return you're filing.

- Information on payments and credits you're claiming.

When to Use the Same Day Worksheet?

The Same Day Taxpayer Worksheet should be used in specific situations where immediate attention from the IRS is needed. Here are some scenarios:

- Emergency Refunds: If you're facing financial distress and need your refund as soon as possible.

- Complex Returns: For returns that require extensive review or include several special situations like foreign income, tax credits, or if you're filing on behalf of someone else (e.g., estate returns).

- Resolution of Issues: If you've received an IRS notice and need to address it promptly to avoid penalties or delays.

How to Fill Out the Same Day Taxpayer Worksheet?

Filling out the worksheet requires accuracy to ensure smooth processing. Here's how to do it:

1. Personal Information

- Enter your full name and current address. If your address has changed since the last time you filed, be sure to note it.

- Provide your SSN or ITIN.

2. Tax Return Details

- State the type of form you’re filing (e.g., Form 1040, 1040X for amended returns).

- Note the tax year, the amount of the refund or payment, and any credits you’re claiming.

3. Contact Information

- Include the name and phone number of any tax preparer or authorized representative.

- If applicable, provide a power of attorney form number or fax number.

After filling in the details, ensure you sign the worksheet. This confirms that the information is accurate and gives consent for the IRS to take necessary actions based on the provided information.

💡 Note: It's crucial to keep a copy of the completed worksheet for your records.

Steps to Expedite Processing

Here are several steps to expedite the processing of your Same Day Taxpayer Worksheet:

1. Visit an IRS Office

- Take your worksheet to an IRS Taxpayer Assistance Center (TAC).

- If possible, make an appointment for a walk-in visit.

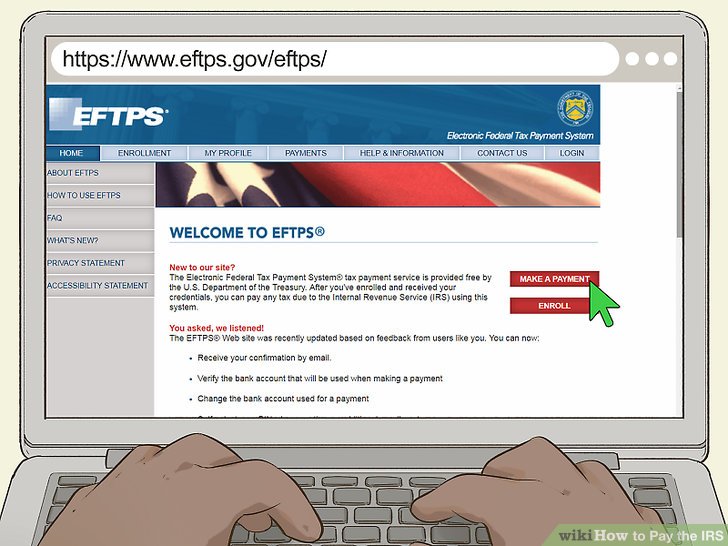

2. Use IRS e-Services

- Register for an IRS online account where you can upload documents or make requests.

3. Contact Your Local IRS Office

- Call the TAC to inquire about local procedures or set an appointment.

Common Mistakes to Avoid

To prevent delays or errors, steer clear of these common mistakes:

- Incomplete Information: Ensure all fields are filled out correctly.

- Wrong Tax Forms: Using outdated or incorrect forms can lead to rejections.

- Lack of Supporting Documentation: Attach all required documents like receipts, proof of credits, or tax preparer information.

- Wrong Contact Information: Verify that all contact details are current to prevent the IRS from reaching out to an outdated address or phone number.

🌐 Note: Always double-check your information before submission.

Final Words

Dealing with tax issues, especially when immediate attention is required, can be overwhelming. However, using the Same Day Taxpayer Worksheet can help expedite the process, making your tax experience less stressful. Remember, the key to a smooth tax filing is accuracy, completeness, and timeliness in providing the IRS with the necessary information. With the right approach, you can manage your tax obligations effectively, ensuring you receive any owed refunds or address issues promptly.

Can the Same Day Taxpayer Worksheet be used for any type of tax return?

+

While the worksheet can expedite processing for many returns, it is particularly useful for returns with specific issues or immediate attention needs. It is not necessary for straightforward returns without any complications.

How long does it take for the IRS to process a return with a Same Day Taxpayer Worksheet?

+

Processing times can vary, but using this worksheet typically expedites the process significantly, often reducing wait times from weeks to days, especially if you visit an IRS TAC.

What should I do if I’ve received an IRS notice that needs immediate attention?

+

Fill out the Same Day Taxpayer Worksheet with all relevant information, including the notice details, and either visit an IRS TAC or use IRS e-services to submit it. This will help expedite your resolution.