-

TurboTax What If Worksheet: Maximize Your Refund Today

Discover how to maximize your tax deductions with Turbotax's What if Worksheet. This tool helps simulate tax scenarios to show potential savings.

Read More » -

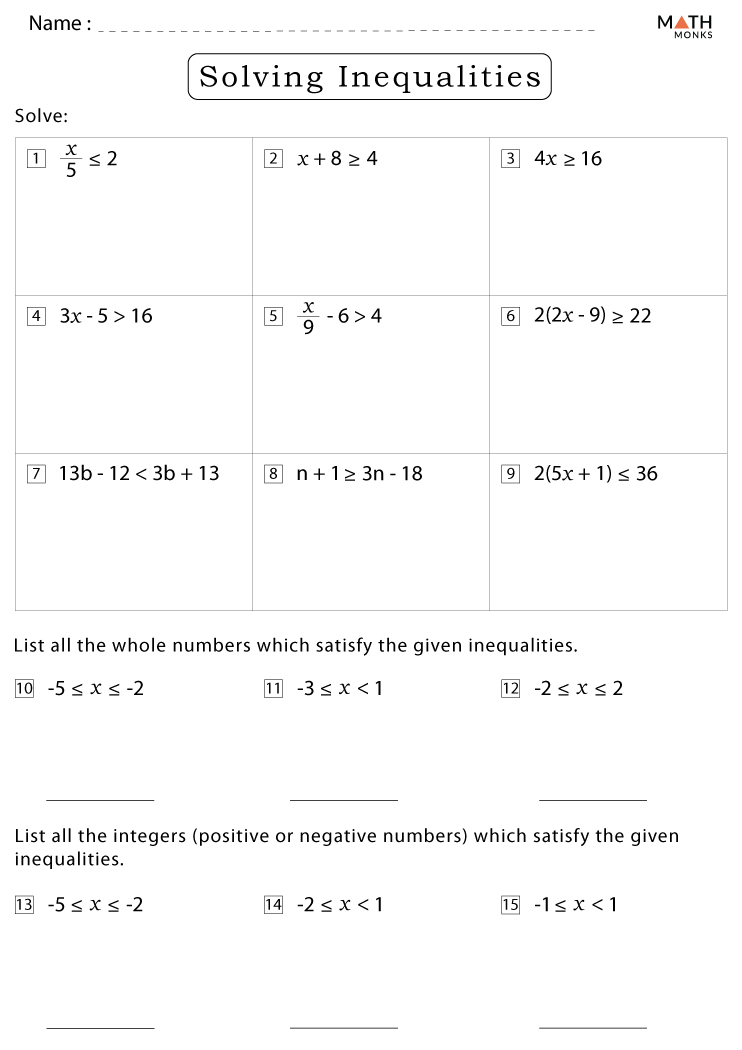

Inequality for All: Answers to Your Worksheet Questions

Explore the comprehensive answers and insights on economic inequality issues with the Inequality for All worksheet.

Read More » -

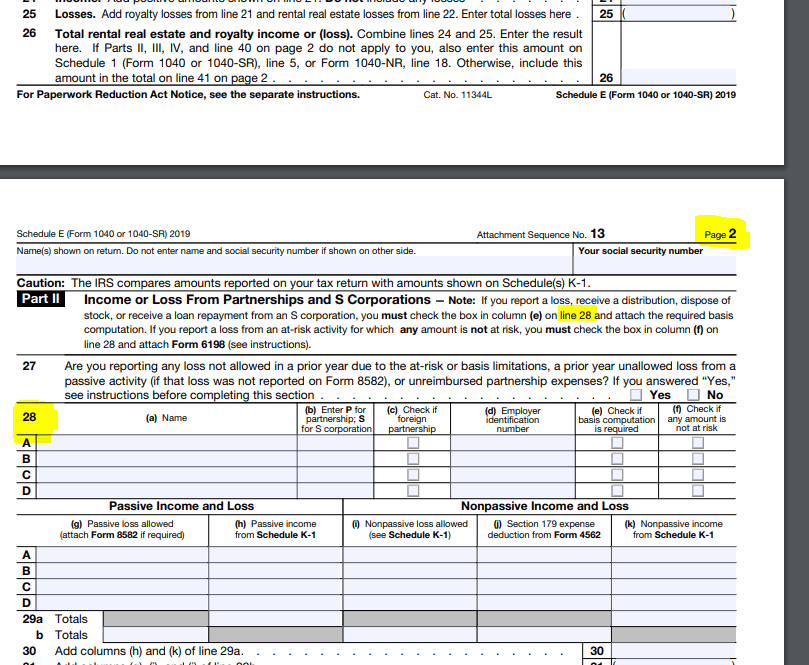

Maximize Savings with Rental Expense Worksheet Tips

A guide to creating and using a worksheet to track and manage rental property expenses effectively.

Read More » -

Maximize Your Savings with IRS Credit Limit Worksheet A

IRS Credit Limit Worksheet helps taxpayers calculate their Earned Income Credit, assisting in determining the maximum allowable credit.

Read More » -

5 Tips for Navigating the Qualified Dividends Worksheet

This article provides a guide on using the Qualified Dividends and Capital Gains Worksheet to accurately report and manage tax liabilities from investments on your tax return.

Read More » -

Unlock Life Insurance Secrets: Chapter 9 Lesson 5 Answers

Delving into the world of life insurance can often seem like navigating through a labyrinth of fine print and complex terms.

Read More » -

Maximize Tax Savings with Qualified Dividends Guide

This article explains how to use the Qualified Dividends and Capital Gain Tax Worksheet to accurately calculate taxes on qualified dividends and long-term capital gains, assisting individuals in determining their tax obligations efficiently.

Read More » -

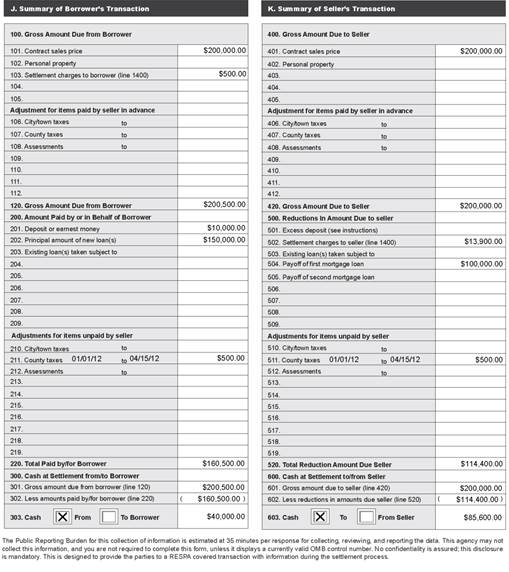

1031 Exchange: Simplified Worksheet for Tax Savings Calculation

Simplify your 1031 exchange process with this detailed calculation worksheet, designed to ensure compliance and optimize your tax benefits.

Read More » -

Maximize Your Tax Benefits with Worksheet 1 in Pub. 596

Explanation of how to use Worksheet 1 from IRS Publication 596 to determine eligibility for the Earned Income Credit.

Read More » -

Master Section 263a Calculations with Our Simple Worksheet

This worksheet aids in understanding the application of Internal Revenue Code Section 263A for allocating direct and indirect costs to inventory for tax reporting.

Read More »