TurboTax What If Worksheet: Maximize Your Refund Today

In the ever-changing landscape of tax preparation, leveraging tools like the TurboTax What If Worksheet can be a game-changer for many taxpayers. Whether you're looking to minimize your tax liability or maximize your refund, understanding and using this worksheet effectively can lead to significant financial benefits. This blog post dives deep into how you can utilize the TurboTax What If Worksheet to get the most out of your tax return for the year.

Understanding the What If Worksheet

The TurboTax What If Worksheet is a powerful feature designed to help you explore different tax scenarios. Before diving into specifics, let’s understand what this tool does:

- Scenario Planning: It allows you to test out various tax situations to see how they might affect your return.

- Data Simulation: You can simulate changes in income, deductions, credits, and even marital status to see potential tax implications.

How to Use the TurboTax What If Worksheet

To begin maximizing your refund with the What If Worksheet, follow these steps:

- Access the Worksheet: Log into your TurboTax account and navigate to the What If section within your tax return.

- Enter Current Data: Input your current financial data for the tax year, including income, deductions, and credits.

- Run Scenarios: Start testing different scenarios:

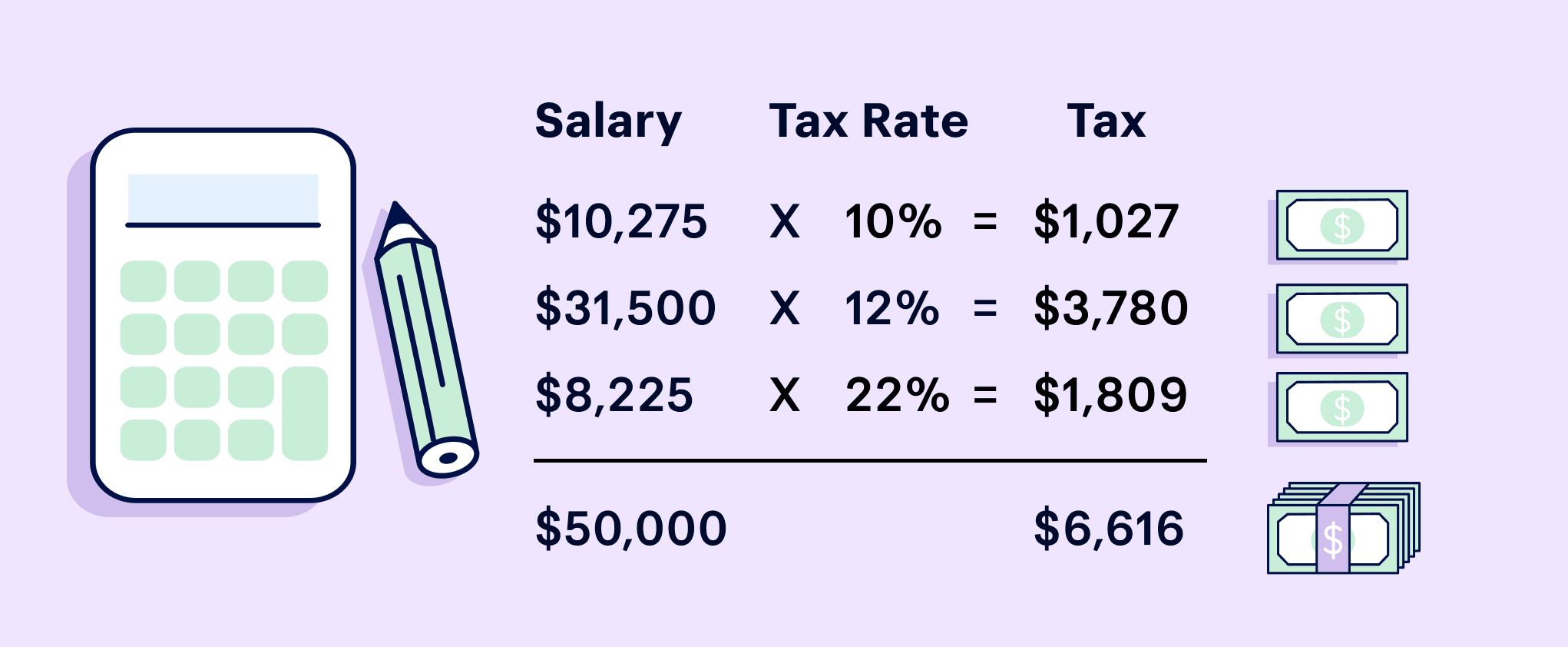

- Change your income by adding or reducing it to see how it affects your tax bracket.

- Modify deductions like charitable contributions or mortgage interest.

- Explore tax credits like the Earned Income Tax Credit or Child Tax Credit.

- Simulate life changes such as marriage, having a child, or buying a home.

✨ Note: Each scenario should be recorded to compare results at the end.

Key Strategies for Maximizing Refunds

Here are some strategies that can help you use the What If Worksheet to maximize your tax refund:

- Optimize Deductions:

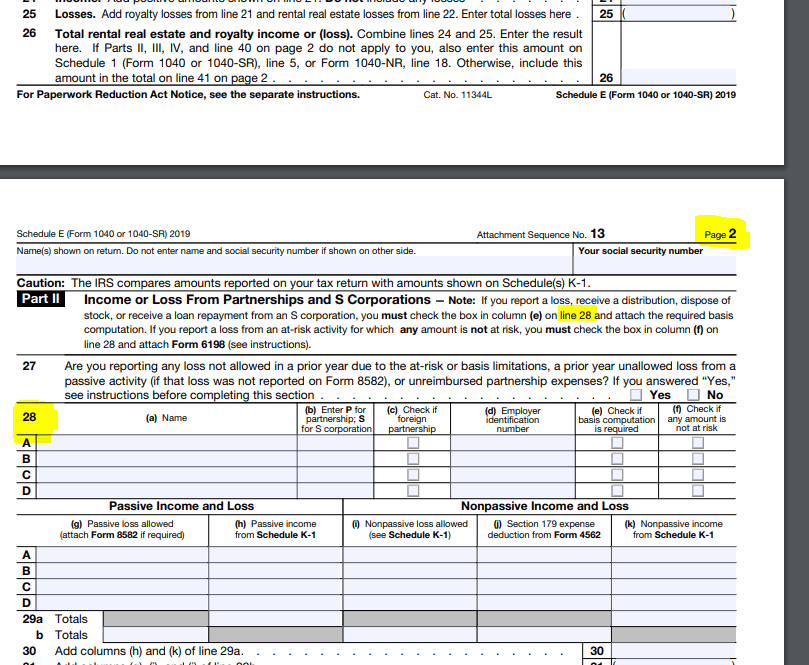

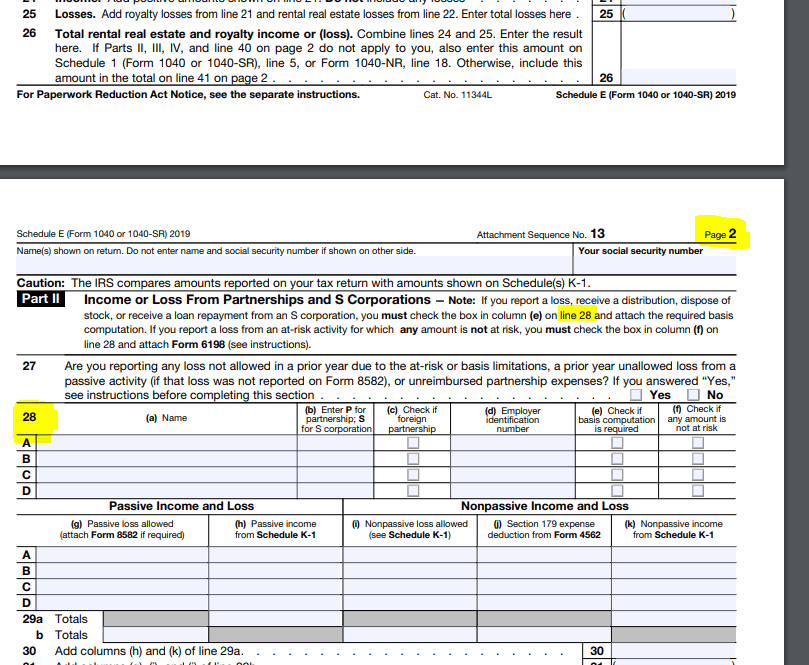

Type of Deduction Description Maximize Refund? Standard Deduction Fixed amount based on filing status Yes Itemized Deductions Listing out specific expenses Yes, if they exceed standard Charitable Contributions Donations to qualified organizations Yes Mortgage Interest Interest paid on home loans Yes

- Tax Credits: Certain credits can be directly applied to reduce tax liability, thus increasing refunds. Key credits to explore:

- Earned Income Tax Credit

- Child Tax Credit

- Education Credits

- Income Management: Simulate changes in income by:

- Reducing income through retirement contributions.

- Exploring income shifts through investment strategies.

Real-Life Examples

To illustrate the power of the What If Worksheet, consider these scenarios:

- Case Study 1: A single taxpayer with a part-time job, who decided to increase their retirement contributions. By testing this scenario in the worksheet, they discovered they could move into a lower tax bracket, saving hundreds in taxes.

- Case Study 2: A married couple expecting a child. They ran simulations to see how their tax situation would change with the addition of the Child Tax Credit, which allowed them to better plan for the future.

📌 Note: These scenarios are for illustrative purposes. Always consult with a tax professional for personalized advice.

By experimenting with different scenarios through the TurboTax What If Worksheet, taxpayers can gain valuable insights into their financial situation. This tool provides a safe space to explore tax decisions without any actual changes to your tax return until you are ready to commit. It empowers you to make informed decisions that can lead to significant tax savings or refunds, ensuring you're not leaving money on the table when you file your taxes.

Can I use the What If Worksheet for past tax years?

+

The What If Worksheet is designed for the current tax year to help with strategic planning for your taxes. For past years, it's advisable to consult with a tax professional or use TurboTax's historical data feature if available.

What if I don't see a change in my refund after running scenarios?

+

Sometimes, the impact of changes might be minimal or offset by other tax implications. Double-check your inputs or consult with a tax advisor to ensure you're not missing out on potential deductions or credits.

Does using the What If Worksheet mean I need to file my taxes online?

+

Not necessarily. While the worksheet is part of the online TurboTax platform, you can use the insights gained to file your taxes using any method you prefer, including paper filing or tax preparation services.

In summary, the TurboTax What If Worksheet is an invaluable tool for anyone looking to optimize their tax returns. By simulating different tax scenarios, you can make informed decisions that could lead to significant financial benefits. Remember to keep track of your tax decisions throughout the year, utilize every possible deduction, and perhaps most importantly, understand your tax bracket and how your actions might shift you into a different one. With this approach, you’re well on your way to not just meeting your tax obligations, but actually turning tax season into an opportunity for financial gain.