Maximize Savings with Rental Expense Worksheet Tips

Are you tired of feeling like your rental income is slipping through your fingers like sand? With property management requiring meticulous attention to detail, you're not alone if you've wondered if there's a way to keep a tighter grip on your expenses. Rental expense worksheets could be your answer, allowing property managers and landlords to maximize savings with a few smart strategies.

Understanding the Basics of Rental Expense Worksheets

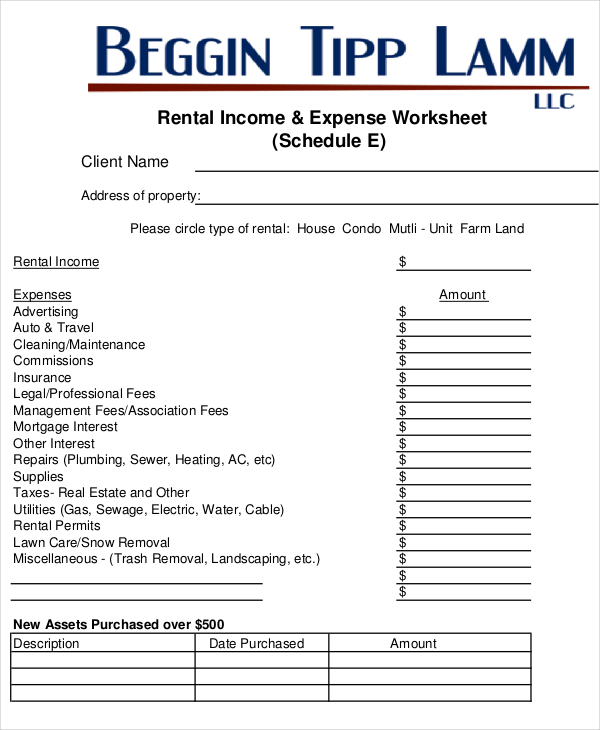

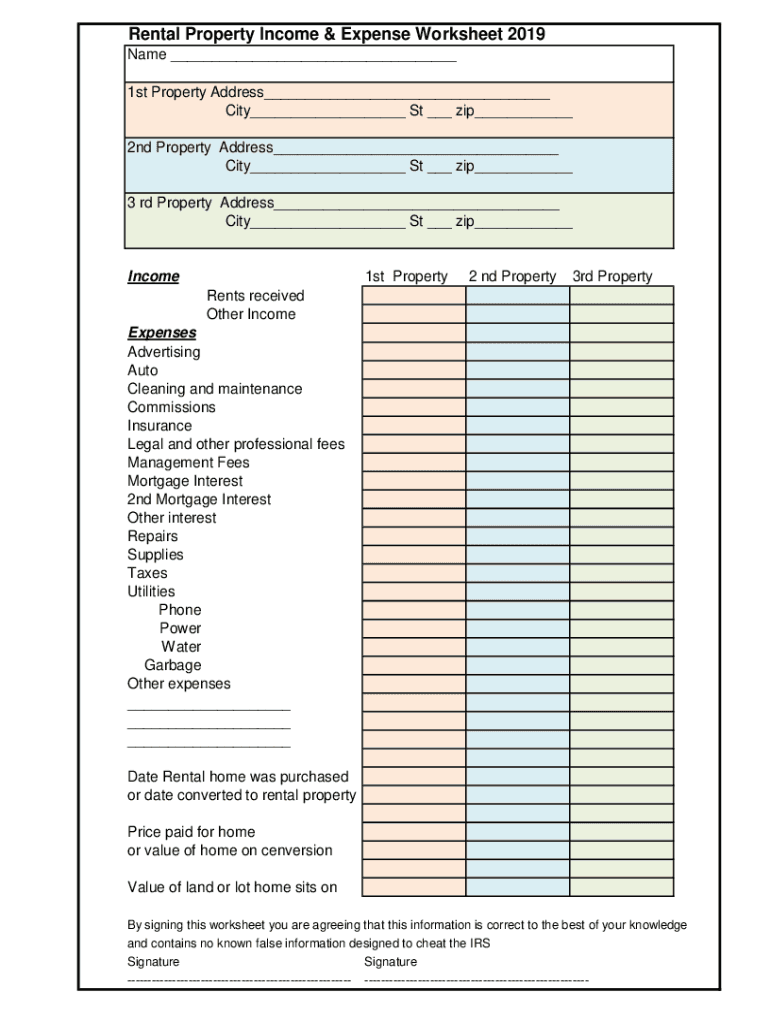

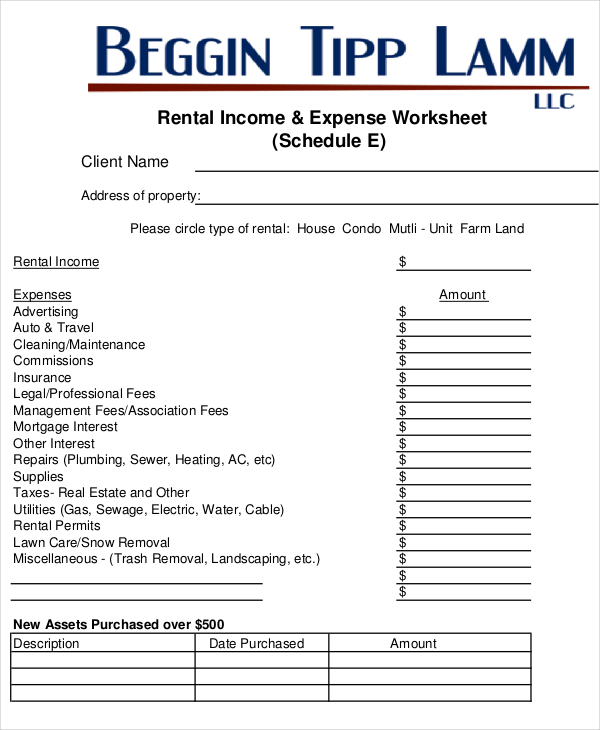

Before diving into strategies, it’s essential to understand what a rental expense worksheet is and why it’s important. Simply put, a rental expense worksheet is a tool to track and categorize all the costs associated with renting out properties. It helps you keep tabs on:

- Mortgage payments

- Utilities

- Maintenance

- Repairs

- Insurance

- Taxes

By keeping a detailed record, landlords can not only ensure their taxes are in order but also pinpoint areas where they can cut costs or optimize their financial strategies.

Key Areas for Savings in Your Rental Expenses

Here’s where your expense worksheet really shines:

1. Utilities

Utilities can be a significant expense, especially if your tenant agreement stipulates that the landlord covers these costs:

- Energy-efficient appliances: Upgrade to energy-saving appliances to reduce electricity bills.

- Smart thermostats: These can automate and optimize HVAC usage, reducing heating and cooling costs.

- Water-saving fixtures: Low-flow faucets and toilets can make a dent in water bills.

2. Maintenance and Repairs

Don’t skimp on maintenance, but be smart about it:

- Regular inspections can prevent small issues from becoming costly repairs.

- Encourage tenants to report minor issues promptly with incentives.

- Hire handymen for smaller jobs instead of expensive specialists.

3. Insurance

Insurance costs can be a sneaky expense if not reviewed regularly:

- Bundle policies to save on premiums, like combining landlord insurance with auto insurance.

- Shop around before renewal time; it’s worth the time to find better rates.

- Increase deductibles if you have a reliable emergency fund.

4. Tax Deductions

Maximizing tax deductions is a prime way to save:

- Keep track of every expense, no matter how small, as many are deductible.

- Understand local and federal tax laws to leverage all possible deductions.

- Consider hiring a tax professional to ensure you’re not missing out.

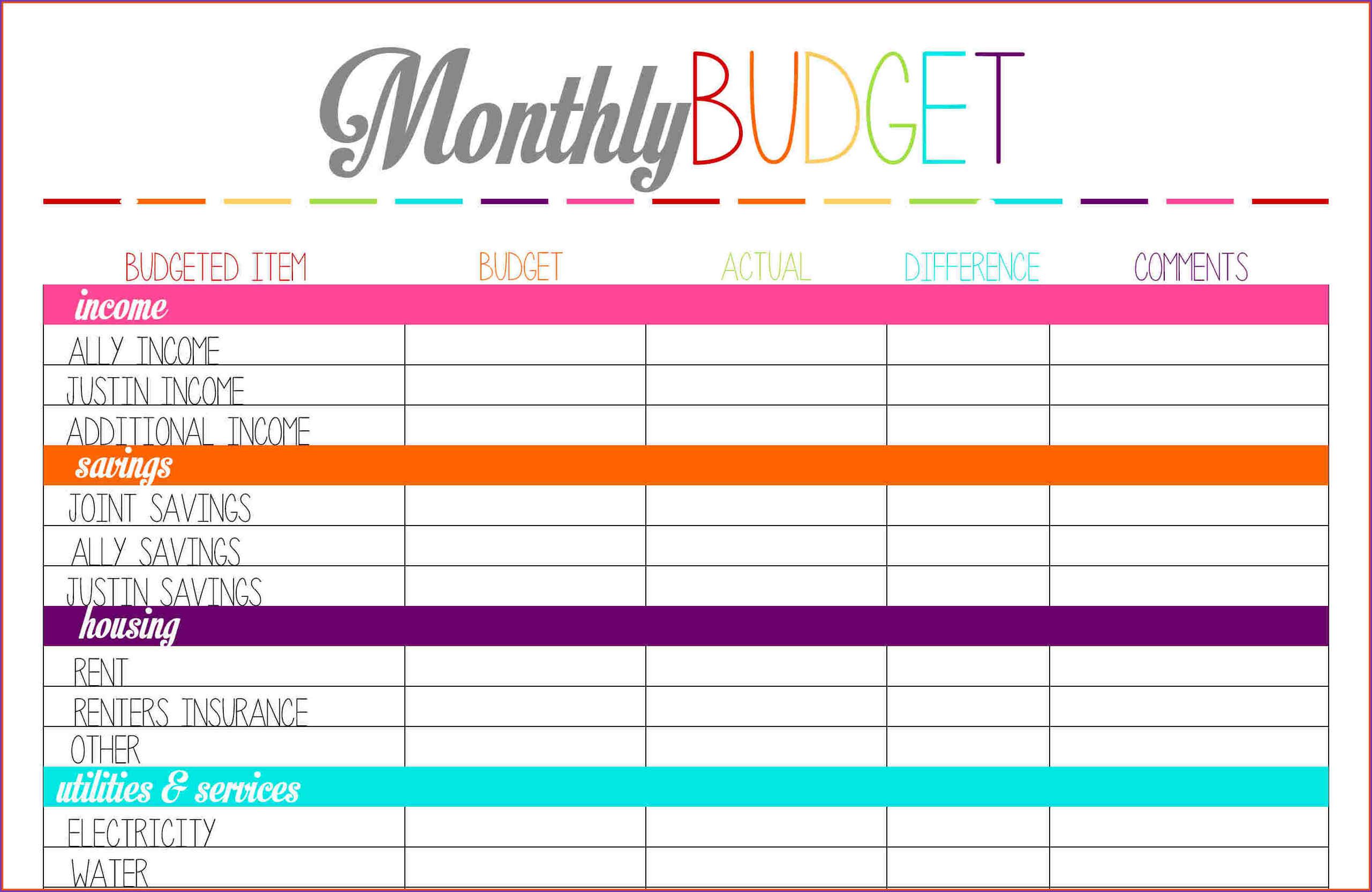

Using Technology to Streamline Rental Expense Management

Technology is a landlord’s ally, offering tools like:

- Software for tracking: Platforms like QuickBooks or specialized property management software can categorize expenses effortlessly.

- Automation: Set up automatic bill payments to avoid late fees and maintain good credit.

- Analytics: Use tools that analyze trends in your expenses, helping you forecast and plan.

💡 Note: Automated expense tracking can save hours of manual work, reducing the chance of human error, but always double-check the data entered into these systems.

Cultivating Cost-Conscious Tenants

Tenants can significantly influence your bottom line:

- Education: Provide tenants with tips on utility conservation.

- Incentives: Offer rewards for reporting leaks or damages early.

- Renter’s Insurance: Require tenants to have renter’s insurance, which can reduce your liability in case of property damage.

By nurturing a partnership with tenants, you're indirectly managing your costs more effectively.

Negotiating Services and Supplies

Landlords often overlook the potential savings from negotiating:

- Regular maintenance services can often be negotiated for better rates.

- Bulk purchase agreements can reduce the cost of supplies.

- Loyalty to local service providers can yield discounts over time.

| Service Type | Negotiation Strategy |

|---|---|

| Emergency Repairs | Prioritize local, quick-response vendors for a reciprocal arrangement. |

| Annual Inspections | Package services with discounts or incentives for quick turnaround times. |

| Utilities | Consider community or bulk rates for multiple properties or work with vendors directly. |

💡 Note: When negotiating, leverage the long-term value of your business relationship. Companies are often willing to offer better terms to ensure they retain your business.

Efficient Investment in Property Improvements

Every dollar you invest in property improvements should yield a return:

- Energy-efficient improvements: These not only save on utility costs but can also qualify for tax credits.

- Curb Appeal: First impressions matter; small investments in landscaping can increase property value.

- Renovation Priorities: Upgrade areas that tenants care about most, like the kitchen and bathroom, for maximum rent increase potential.

Your worksheet should not only track costs but also help you project ROI on these investments.

Optimizing your rental expense worksheet isn't just about saving pennies; it's about creating a system that ensures financial health for both your property and your peace of mind. From detailed tracking and technological aids to cost-conscious tenant relations and smart spending, every facet of your rental operation can contribute to maximizing savings.

In this ever-competitive market, landlords who refine their management techniques with the help of rental expense worksheets stand a better chance of prospering. Whether you're a seasoned property mogul or just starting, understanding and leveraging these tools can shape a more profitable rental business.

What should be included in a rental expense worksheet?

+

A rental expense worksheet should include all costs related to managing your property, such as mortgage interest, property taxes, utilities, maintenance, repairs, insurance, and any other relevant expenses.

How often should I review my rental expense worksheet?

+

It’s beneficial to review your rental expense worksheet monthly to keep track of expenditures and ensure no deductions or cost-saving opportunities are missed. This also helps in preparing accurate financial statements and tax returns.

Can I use software to manage my rental expenses?

+

Absolutely. There are many property management software solutions available that can automate the tracking of rental income and expenses, provide reports, and facilitate financial analysis to help with savings strategies.

Are all rental expenses tax-deductible?

+

While many expenses related to rental properties can be deducted for tax purposes, not all expenses are deductible. Typical deductible expenses include mortgage interest, property tax, operating expenses, repairs, and depreciation. Always consult with a tax professional to ensure you’re claiming all eligible deductions.

How can I encourage my tenants to be more cost-conscious?

+

Educate them on energy-saving practices, provide incentives for reporting issues early, and create a sense of partnership. Consider implementing renter’s insurance or utility billing systems that pass on utility costs to tenants in a fair manner.