-

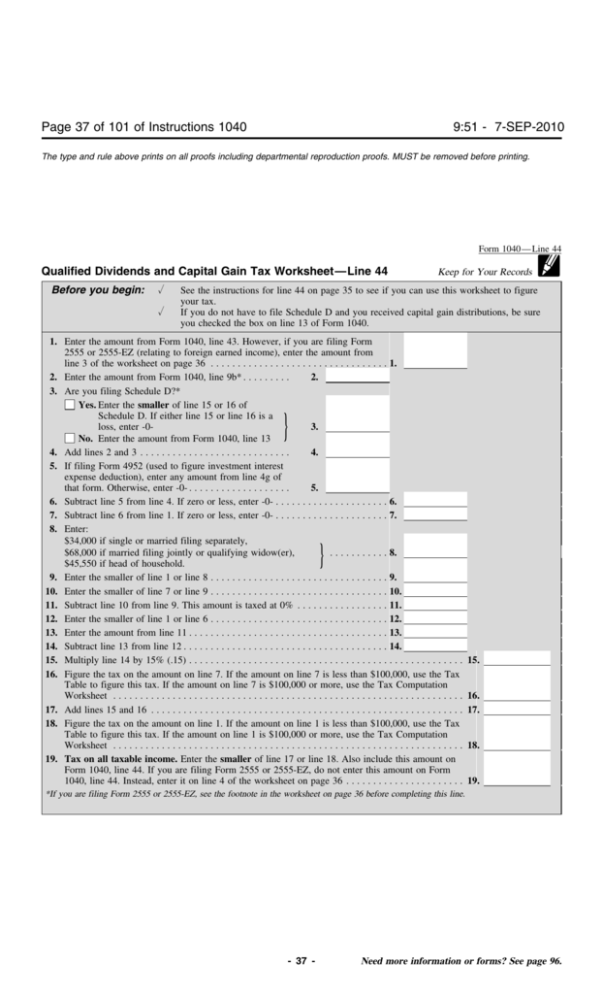

5 Tips for Navigating the Qualified Dividends Worksheet

This article provides a guide on using the Qualified Dividends and Capital Gains Worksheet to accurately report and manage tax liabilities from investments on your tax return.

Read More » -

Calculating Net Worth: Worksheet Answers & Guide

This chapter provides a worksheet with answers to help individuals calculate their net worth by detailing assets, liabilities, and guiding through financial planning concepts.

Read More » -

Maximize Tax Savings with Qualified Dividends Guide

This article explains how to use the Qualified Dividends and Capital Gain Tax Worksheet to accurately calculate taxes on qualified dividends and long-term capital gains, assisting individuals in determining their tax obligations efficiently.

Read More » -

Unlock Tax Savings with the Qualified Dividends Worksheet

A guide explaining how to use the Qualified Dividends Worksheet to calculate tax on dividends.

Read More » -

Unlock Tax Savings: Qualified Dividends & Capital Gains Worksheet Guide

This worksheet helps taxpayers calculate the tax on qualified dividends and long-term capital gains, which may be taxed at different rates than ordinary income.

Read More » -

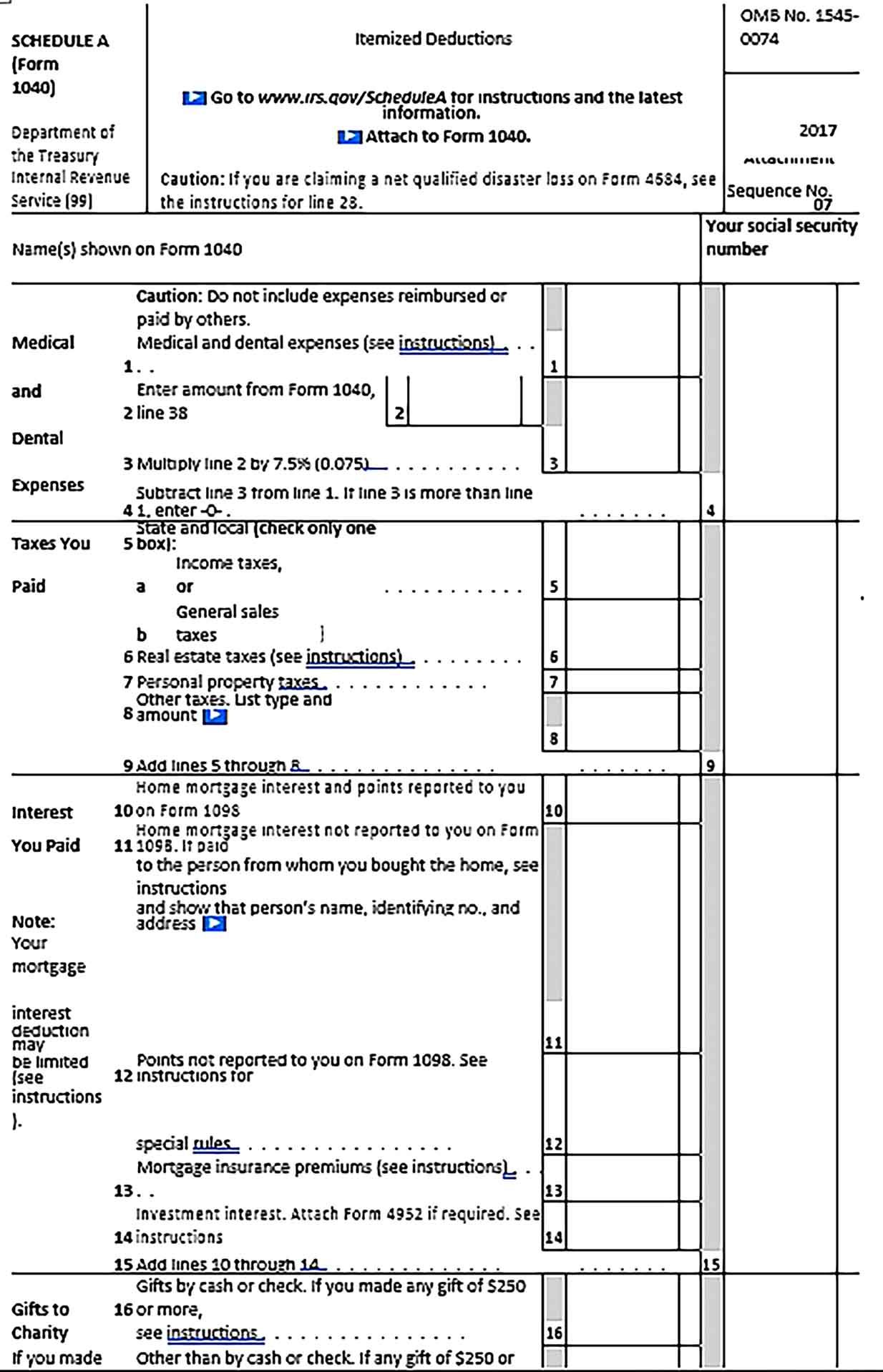

5 Ways to Maximize Your Tax Refund Today

A guide on how to properly calculate and report state and local tax refunds on your federal income tax return.

Read More » -

Maximize Your Savings with Qualified Dividends Tax Guide

This worksheet helps determine the tax on qualified dividends and long-term capital gains, providing a method to calculate taxes separately from other income, ensuring accurate tax liability.

Read More » -

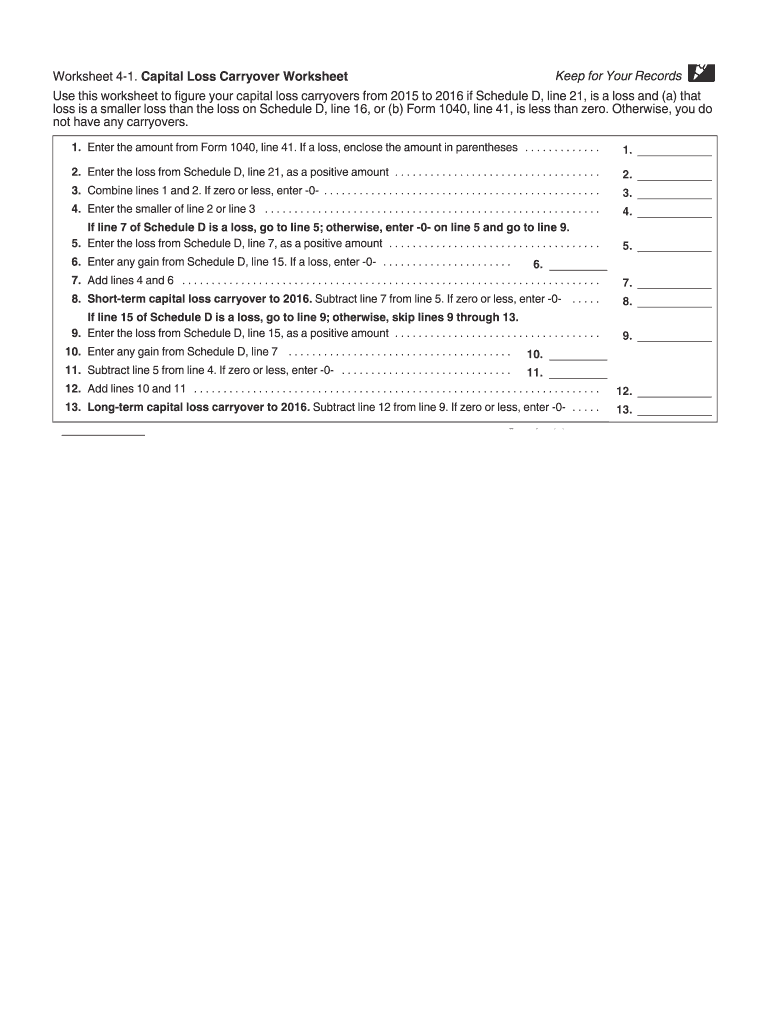

Maximize Tax Savings with California Capital Loss Carryover Worksheet

A guide for determining allowable capital loss deductions in California, detailing carryover provisions from year to year.

Read More » -

Schedule D Tax Worksheet: Simplified Fillable Guide

Fillable worksheet for calculating capital gains and losses tax.

Read More » -

Capital Loss Carryover Worksheet: Master Your Tax Strategy

Learn how to use the Capital Loss Carryover Worksheet to effectively manage your tax deductions from capital losses across multiple tax years, ensuring you maximize your potential tax savings and plan your financial strategy accurately.

Read More »