Maximize Your Savings with Qualified Dividends Tax Guide

Are you looking to boost your investment income while reducing your tax burden? Understanding how to leverage qualified dividends can make a significant difference in your overall financial strategy. This comprehensive guide will explore what qualified dividends are, the benefits they offer, the tax implications, and strategies to ensure you're maximizing your savings. Let's dive in!

What Are Qualified Dividends?

Qualified dividends are dividends paid by domestic or qualified foreign corporations that are subject to the same tax rates as long-term capital gains. These dividends must meet certain criteria to qualify for this preferential tax treatment:

- The dividends must be paid by a U.S. corporation or a qualified foreign corporation.

- The stock must have been held for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date.

- For preferred stocks, the holding period requirement increases to more than 90 days during a 181-day period surrounding the ex-dividend date.

- Dividends must not be listed as those not qualifying for this tax advantage, such as dividends from mutual funds or certain types of REITs (Real Estate Investment Trusts).

💡 Note: Not all dividends qualify; for example, dividends from tax-exempt organizations, dividends from certain foreign corporations, or those related to Employee Stock Option Plans (ESOPs) do not qualify for this tax benefit.

Benefits of Qualified Dividends

Investing in stocks that provide qualified dividends can offer several advantages:

- Lower Tax Rates: The tax rate on qualified dividends can be significantly lower than that on ordinary income. Depending on your income level, you might pay 0%, 15%, or 20% on these dividends, compared to up to 37% on other income.

- Potential for Compounding: Because of the reduced tax burden, reinvesting these dividends can lead to greater compound growth over time.

- Income Stability: Dividends from established companies are often more predictable, providing a steady income stream.

Tax Implications

Qualified dividends are taxed at the capital gains tax rates, which are generally more favorable than the rates for ordinary income:

| Income Level | Capital Gains Rate for Qualified Dividends |

|---|---|

| $0 - $40,400 | 0% |

| $40,401 - $445,850 | 15% |

| Above $445,850 | 20% |

These rates can change, so it's essential to stay updated with the current tax laws or consult with a tax advisor. Also, remember that the Net Investment Income Tax (NIIT) could apply an additional 3.8% tax on investment income for high earners.

Strategies to Maximize Qualified Dividend Benefits

1. Hold Stocks for the Required Period

To benefit from the lower tax rates, ensure you meet the holding period requirements for the stocks to classify the dividends as qualified.

2. Diversify Your Portfolio

Spread your investments across multiple sectors and companies to minimize risk while potentially increasing the yield from dividends.

3. Reinvest Dividends

Many investors opt to reinvest their dividends to purchase additional shares, thus leveraging compound interest over time.

4. Tax Planning with Qualified Dividends

Strategically plan your income and investments to remain within lower tax brackets where qualified dividends could be tax-free or at least at a reduced rate.

Income and Investment Considerations

The benefits of qualified dividends can also depend on your personal financial situation:

- Retirement Accounts: Dividends in tax-deferred retirement accounts like IRAs or 401(k)s do not benefit from the qualified dividends tax rate until you withdraw funds. However, when in these accounts, dividends are not taxed until distribution.

- Income Threshold: Keep your overall income in mind as it influences which tax bracket your qualified dividends fall into.

🎓 Note: If you're close to the threshold for a higher tax bracket, consider strategies like charitable contributions or other deductions to keep your dividends in a lower tax bracket.

By now, you should have a clearer picture of how qualified dividends can be part of a savvy tax strategy to maximize savings. Remember, investing in stocks that offer qualified dividends not only helps in income generation but also plays a critical role in tax-efficient wealth accumulation. Assess your personal financial situation, consider tax implications, and craft an investment strategy that includes dividends as a key component.

How do I know if my dividends qualify?

+

Check if the corporation is a U.S. or qualified foreign entity, and ensure you meet the required holding period for the stock before the dividend payment date.

What are the benefits of reinvesting qualified dividends?

+

Reinvesting qualified dividends allows you to purchase more shares with the dividend income, potentially leading to exponential growth through compounding, especially due to the lower tax rates.

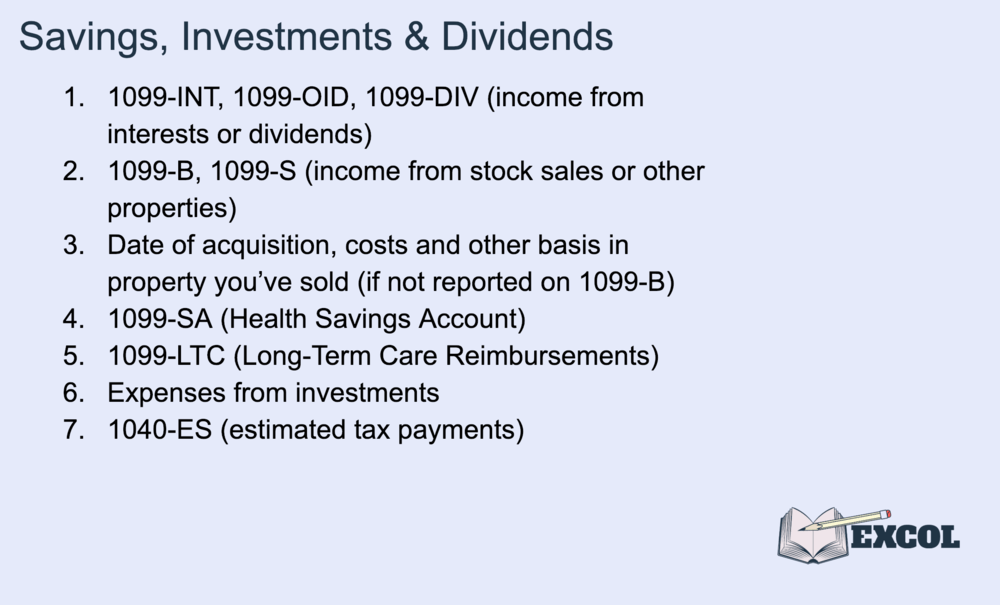

Do I need to report qualified dividends on my tax return?

+

Yes, you must report all dividends on your tax return. Qualified dividends are reported on Schedule D (Capital Gains and Losses) of Form 1040.