Unlock Tax Savings with the Qualified Dividends Worksheet

The world of investments can be a complex tapestry, and one of the intricate details within this vast canvas is the treatment of dividends. Qualified dividends are particularly notable as they are taxed at a lower rate than ordinary income, making them an attractive option for investors looking to optimize their tax savings. In this comprehensive guide, we will delve deep into understanding and utilizing the Qualified Dividends Worksheet, a tool that can significantly aid in managing your tax obligations.

Understanding Dividends

Before diving into the nitty-gritty of qualified dividends, let’s clarify what dividends are:

- Dividends are payments made by a corporation to its shareholders from its earnings.

- They are commonly distributed in cash or additional shares, known as stock dividends.

The Difference Between Ordinary and Qualified Dividends

When it comes to taxation, not all dividends are created equal:

- Ordinary Dividends: Taxed at the investor’s normal income tax rate.

- Qualified Dividends: Meet certain criteria set by the IRS to receive preferential tax rates similar to long-term capital gains. These criteria include:

- Being paid by a U.S. corporation or a qualified foreign corporation.

- Meeting a minimum holding period.

The Importance of the Qualified Dividends Worksheet

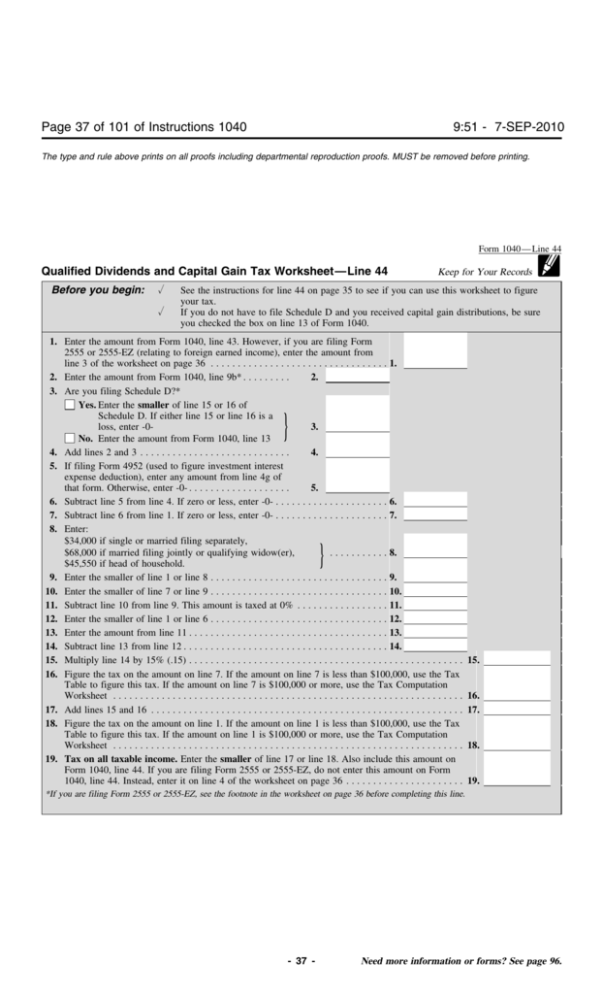

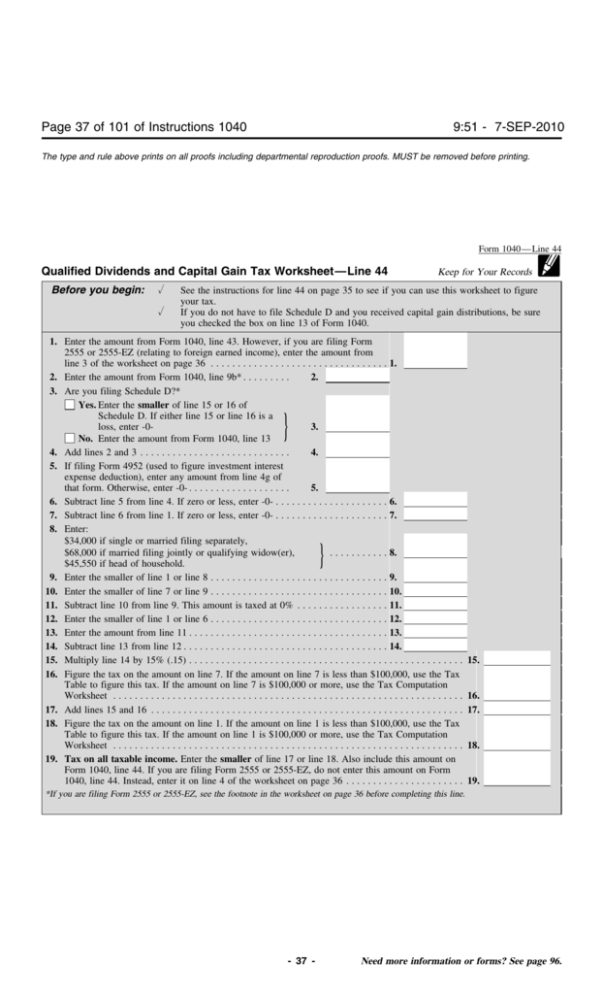

The Qualified Dividends Worksheet is a critical tool provided by the IRS to help taxpayers accurately calculate the tax due on their qualified dividends:

- It ensures that you correctly categorize and tax your dividends.

- Reduces the likelihood of errors in reporting, potentially saving you from penalties or audits.

Steps to Utilize the Qualified Dividends Worksheet

Here’s how you can effectively use the worksheet:

1. Identify Your Income

- List all taxable income, including wages, interest, dividends, etc.

2. Distinguish Between Ordinary and Qualified Dividends

- Your investment statements or 1099-DIV forms will specify this.

3. Complete the Worksheet

- Enter your total dividends on Line 1.

- Identify and list qualified dividends on Line 2.

- Calculate your taxable income without qualified dividends on Line 3.

- Use the qualified dividends and capital gains tax worksheet from IRS instructions to determine your tax on Line 5.

- Account for your qualified dividends by following the IRS guidelines, typically reducing your taxable income by the amount of qualified dividends.

- Compute your total tax, including any alternative minimum tax or additional taxes as required.

Important Notes

💡 Note: Always use the most current version of the Qualified Dividends Worksheet provided by the IRS, as tax laws can change annually.

🔍 Note: Ensure your dividends qualify for the lower tax rate by checking the holding period and the nature of the issuing corporation.

In conclusion, the Qualified Dividends Worksheet plays a pivotal role in tax planning, especially for investors with significant dividend income. By understanding and applying this tool correctly, you not only comply with IRS regulations but also potentially reduce your tax liability. It's worth noting that while dividends offer an excellent opportunity for passive income, leveraging the correct taxation benefits can make your investment strategy even more rewarding.

What makes a dividend “qualified”?

+

A dividend is considered qualified if it is paid by a U.S. corporation or a qualified foreign corporation, and the investor meets the holding period requirement, which typically means owning the stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date.

Can all my dividends be qualified?

+

No, not all dividends are qualified. Dividends from certain entities like REITs or money market accounts are usually not qualified due to their classification or nature of the payment.

Do I need to use the Qualified Dividends Worksheet if my dividends are not qualified?

+

If you have only non-qualified dividends, you would report these as ordinary income on your tax return, and the use of the Qualified Dividends Worksheet would be unnecessary.