Maximize Tax Savings with California Capital Loss Carryover Worksheet

If you're a resident of California dealing with investments, understanding how to leverage capital losses for tax purposes can be a game-changer. With the right strategies, you can not only offset your current year's capital gains but also carry forward losses to maximize tax savings over multiple years. This blog post explores the intricacies of the California Capital Loss Carryover Worksheet and how you can use it to your advantage.

What is Capital Loss Carryover?

Capital loss carryover is a tax provision that allows taxpayers to apply their net capital losses from the current tax year to offset capital gains in future years. Here’s how it works:

- Net capital losses in a tax year can be used to offset capital gains of that same year.

- If your losses exceed your gains, you can deduct up to $3,000 ($1,500 if married filing separately) from your ordinary income.

- Any remaining loss can be carried over to future tax years to offset future gains or income.

Understanding California’s Tax Rules

California has some unique tax rules regarding capital losses:

- Unlike federal tax laws, California does not conform with the Netting of Losses between short-term and long-term gains and losses.

- Each loss is tracked individually, which requires meticulous record-keeping for the state.

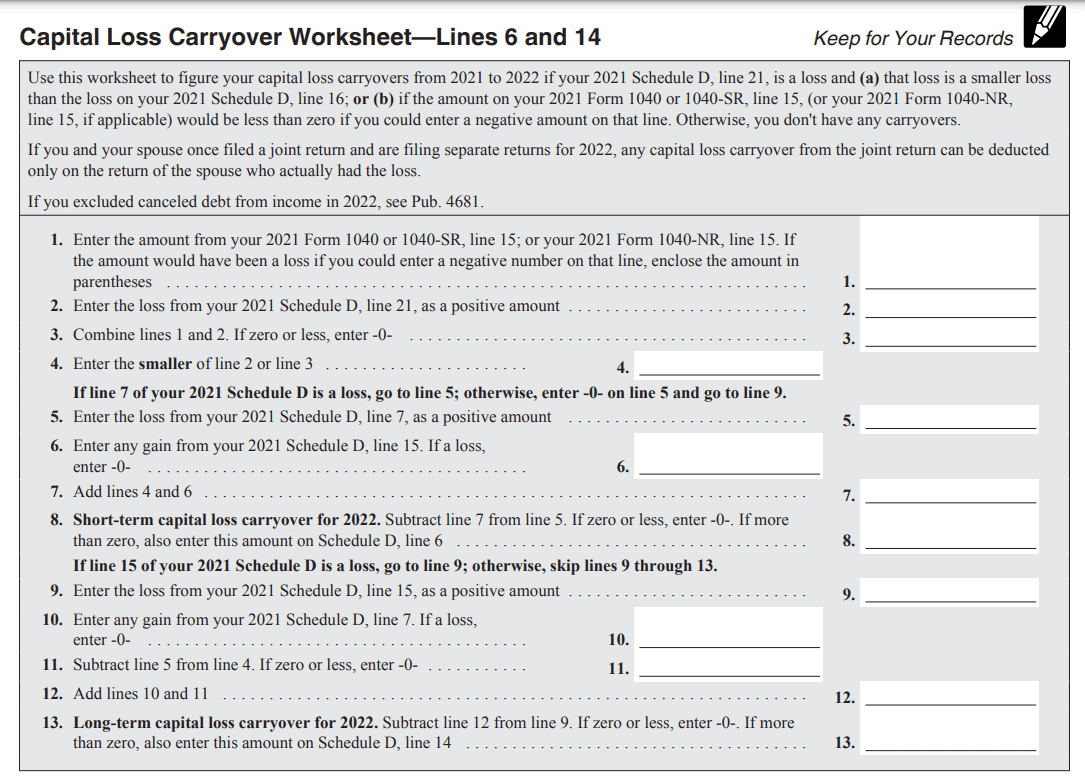

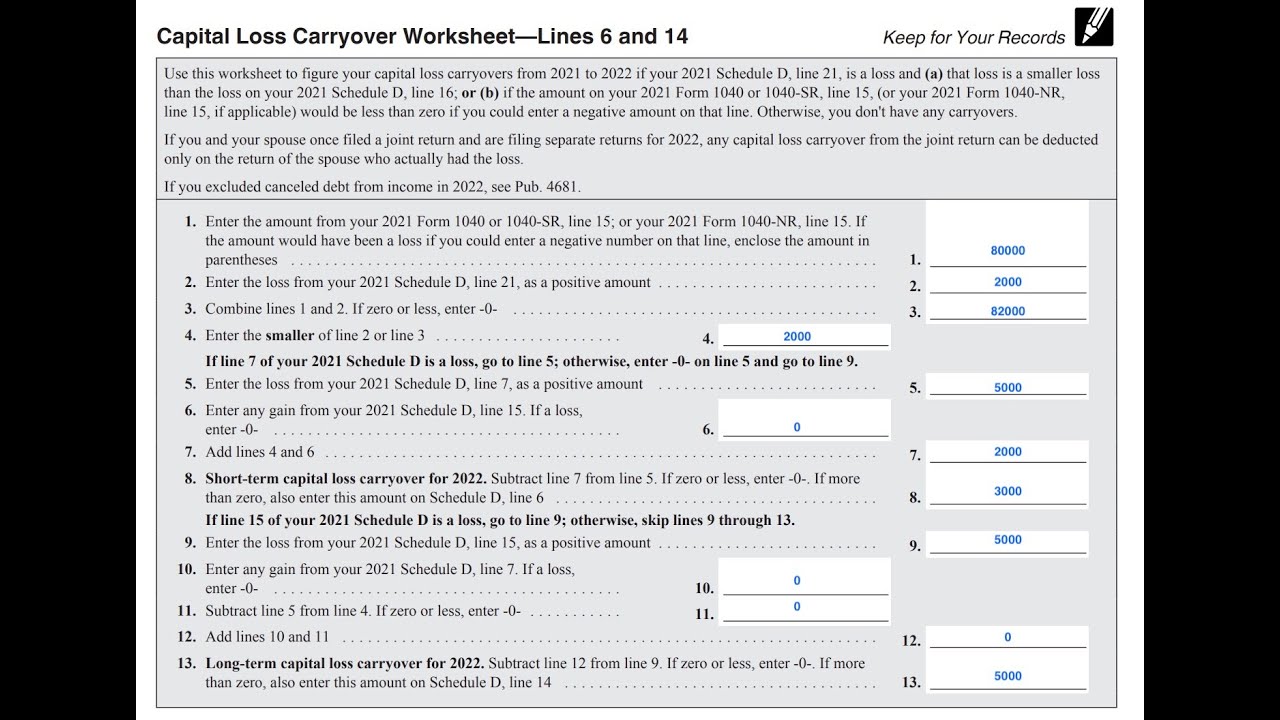

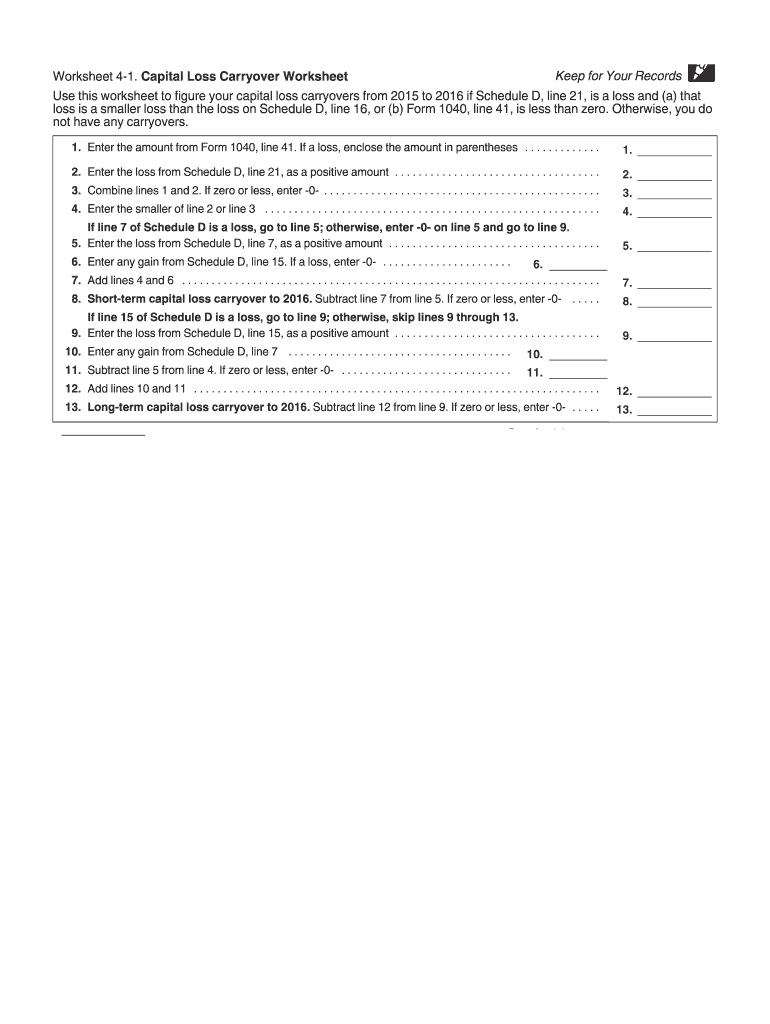

How to Use the California Capital Loss Carryover Worksheet

Here are the steps to effectively utilize the worksheet:

- Calculate Net Capital Gain or Loss: Determine the net capital gain or loss for the current year by adding or subtracting your capital gains and losses.

- Apply the Loss Limit: Use up to $3,000 ($1,500 if MFS) of the excess loss to reduce ordinary income.

- Carryover to Future Years: Record any leftover loss in the Capital Loss Carryover Worksheet, tracking it separately for each asset.

- Complete Schedule D (540): Include your capital loss carryover on Schedule D, line 21 of Form 540.

🔍 Note: It is crucial to keep detailed records of your losses to ensure accurate application to future tax filings.

Maximizing Tax Savings

To maximize your tax savings:

- Offset High-Income Years: If you anticipate higher income in future years, carry over your losses to offset gains and reduce your taxable income.

- Strategic Realization of Gains: Plan the realization of gains to balance against your carryover losses effectively.

- Stay Compliant with AMT: Keep in mind that Alternative Minimum Tax (AMT) rules might apply, potentially affecting your deductions.

Common Mistakes to Avoid

When dealing with capital loss carryover, here are some mistakes to steer clear of:

- Miscalculating or misapplying losses due to lack of record-keeping.

- Not accounting for the wash-sale rule which disallows a loss from a security sale if a similar security is repurchased within 30 days.

- Incorrectly reporting carryover on state returns due to misunderstanding California's specific tax rules.

The strategic use of the California Capital Loss Carryover Worksheet can lead to significant tax savings. By understanding the nuances of capital losses, from recognizing losses to tracking carryover, you can reduce your tax liability, especially in years when your investment gains are substantial. Remember, meticulous record-keeping is your best ally in this process, ensuring you don't miss out on potential tax benefits due to oversights or misunderstandings.

Can I use capital losses to offset income other than capital gains?

+

Yes, up to $3,000 of capital losses can be used to offset your ordinary income each year. Any excess is carried forward to subsequent years.

Do I need to file a different worksheet for each asset with a loss?

+

No, you can combine all losses in one worksheet, but California requires that you track each asset individually for carryover purposes.

How long can I carry over capital losses in California?

+

There is no limit on the number of years you can carry over capital losses in California. They can be applied indefinitely until fully utilized.