-

Navigating Disaster Distributions: Federal Information Worksheet Guide

Learn about the federal guidelines for managing and distributing information during disaster situations.

Read More » -

Streamline Your Taxes: Eftps Direct Payment Worksheet Guide

A detailed guide on using the EFTPS Direct Payment Worksheet Long Form, explaining how to accurately record, calculate, and make electronic federal tax payments.

Read More » -

EFTPS Payment Worksheet Guide for Easy Tax Payments

EFTPS Payment Worksheet: A guide to understanding and utilizing the Electronic Federal Tax Payment System for timely tax payments and recordkeeping.

Read More » -

Navigating Maine Child Support with Ease

A practical tool for calculating child support obligations in Maine, including step-by-step instructions.

Read More » -

5 Tips for Using California Estimated Tax Worksheet

A guide to understanding and calculating estimated tax payments for California residents.

Read More » -

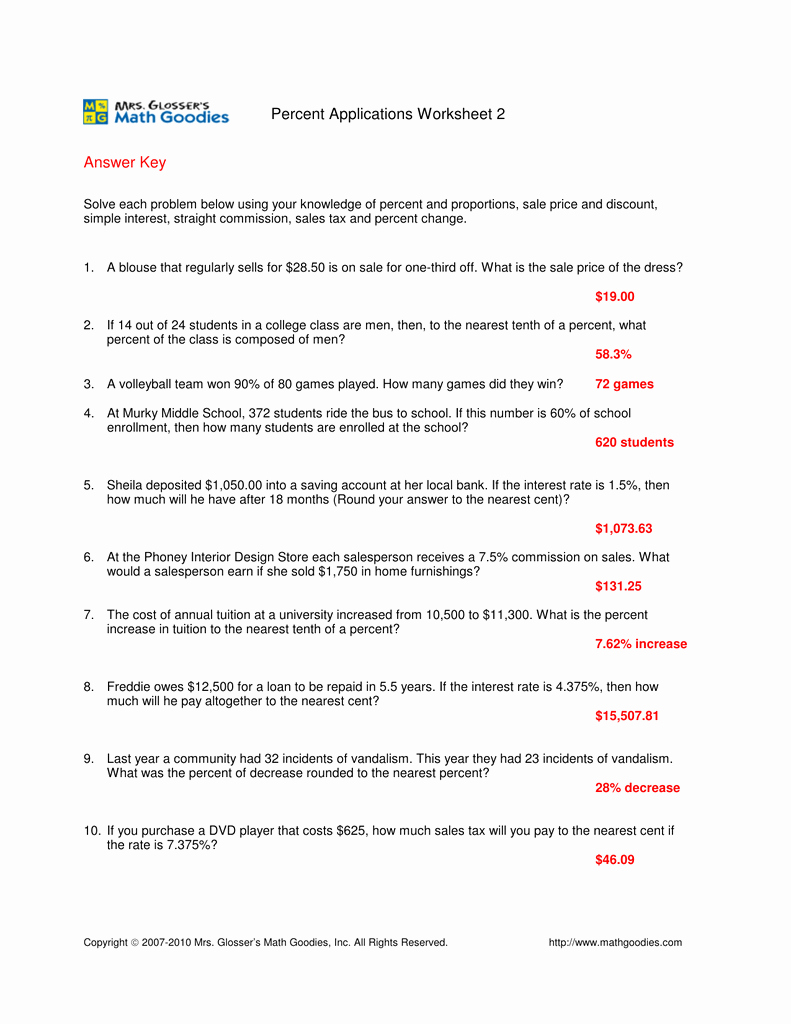

5 Tips for Calculating Sales Tax and Discounts

Worksheet designed to help understand and calculate sales tax and discounts on purchases.

Read More » -

EFTPS Business Phone Worksheet: Simplify Tax Payments

Comprehensive guide to understanding and using the EFTPS phone worksheet for business transactions, detailing payment processing, troubleshooting common issues, and enhancing efficiency.

Read More » -

5 Ways to Master EFTPS Direct Payment Worksheet

Eftps Direct Payment Worksheet is a document designed to assist taxpayers in organizing and calculating their federal tax payments before submitting them through the Electronic Federal Tax Payment System (EFTPS). It streamlines the process of making electronic tax payments directly to the U.S. Department of the Treasury.

Read More » -

Master Your Finances: The Magic Self Employment Worksheet

A practical worksheet designed to assist self-employed individuals in calculating their income for mortgage qualification purposes, simplifying the process with clear guidance on necessary financial documentation.

Read More »