EFTPS Payment Worksheet Guide for Easy Tax Payments

Managing your tax payments can often seem daunting, but tools like the Electronic Federal Tax Payment System (EFTPS) simplify the process significantly. This guide will walk you through how to use an EFTPS Payment Worksheet to streamline your federal tax payments, ensuring they are both timely and accurate.

The Basics of EFTPS

Before diving into the details of the payment worksheet, let’s quickly review what EFTPS is:

- EFTPS is an online tax payment system managed by the U.S. Department of the Treasury for making federal tax payments.

- It allows you to schedule payments or pay federal taxes immediately.

- It’s free to use, available 24⁄7, and secure for payments via debit, credit card, or direct from your bank account.

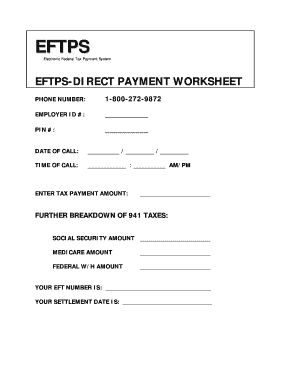

Understanding the EFTPS Payment Worksheet

The EFTPS Payment Worksheet is a tool provided within the EFTPS platform to help you keep track of your tax payments:

- It helps in organizing multiple tax payments.

- It ensures that all payment details are correctly recorded for future reference.

- It can be used as a template for consistency in recording payments.

An example of the EFTPS Payment Worksheet looks like this:

| Date | Tax Form | Tax Period | Payment Amount | Confirmation Number |

|---|---|---|---|---|

| 04/15/2023 | 1040 | 2022 | $2,500 | 123456789 |

| 06/15/2023 | 941 | Q2 2023 | $8,000 | 987654321 |

Steps to Use the EFTPS Payment Worksheet

To maximize the utility of the EFTPS Payment Worksheet, follow these steps:

- Log into EFTPS: Access your account on the EFTPS website or app.

-

Create or Access Your Worksheet:

- If you’re using the EFTPS website, you can download a template from the official site or create one yourself.

- In the mobile app, look for the option to manage payments or create a new worksheet.

-

Enter Payment Details:

- Fill in the date of payment.

- Indicate the tax form related to the payment.

- Specify the tax period the payment is for.

- Enter the exact amount of the payment.

- Record the confirmation number provided by EFTPS after each payment.

-

Verify and Update:

- After each payment, review and update the worksheet to reflect the current status of your tax payments.

-

Maintain for Records:

- Keep a hard copy or electronic version of this worksheet for your records. This is crucial for audits or for reference in case of any discrepancies with the IRS.

👉 Note: It is highly recommended to update your worksheet after each transaction to avoid discrepancies and ensure a complete record of your payments.

Why Use an EFTPS Payment Worksheet?

Here are some compelling reasons to utilize the EFTPS Payment Worksheet:

- Organization: It provides a structured way to document your payments, making it easier to manage finances.

- Accuracy: Helps in double-checking payment amounts and ensuring all payments are accounted for.

- Audit Trail: Provides a clear audit trail, which is invaluable during IRS audits.

- Future Reference: Useful for future tax planning and for ensuring timely and full tax payments.

Advanced Tips for EFTPS Payment Management

- Set Reminders: Use EFTPS’s reminder features to avoid missing tax deadlines.

- Automate Payments: If possible, schedule recurring payments to cover regular tax liabilities.

- Batch Processing: Consider grouping payments for better tracking and efficiency.

By integrating these practices into your tax payment routine, you can ensure a seamless experience when handling your federal tax obligations through EFTPS. The payment worksheet isn't just a tool for record-keeping; it's an integral part of a broader strategy to manage your tax responsibilities effectively.

Understanding and utilizing tools like the EFTPS Payment Worksheet can significantly enhance your tax payment process. This guide has outlined the steps to effectively use the worksheet, highlighted the benefits, and provided some advanced tips to make tax payments both easy and accurate. By keeping your records organized, you not only reduce the stress of tax season but also prepare well for any potential audits or inquiries from the IRS. Remember, managing your taxes isn't just about compliance; it's about peace of mind knowing everything is accounted for.

What is EFTPS?

+

EFTPS stands for Electronic Federal Tax Payment System, which is a free service offered by the U.S. Department of the Treasury to help taxpayers make federal tax payments online, 24 hours a day, 7 days a week.

How do I enroll in EFTPS?

+

You can enroll in EFTPS by filling out an application available from the EFTPS website or contacting the IRS to request an enrollment form. Businesses need their Employer Identification Number (EIN), while individuals should use their Social Security Number (SSN).

Can I schedule future tax payments with EFTPS?

+

Yes, EFTPS allows you to schedule payments in advance, which can be helpful for managing cash flow or ensuring timely tax payments.

What should I do if I encounter issues with my EFTPS payment?

+

If you face issues with a payment, check your transaction history on EFTPS. If needed, contact EFTPS customer service at 1-800-316-6541 for assistance.