5 Tips for Calculating Sales Tax and Discounts

Calculating sales tax and discounts are everyday tasks for many retailers, accountants, and business owners. Knowing how to manage these calculations efficiently can help in various aspects such as pricing strategies, budgeting, and ensuring legal compliance. Here are five essential tips that will guide you through these often intricate calculations:

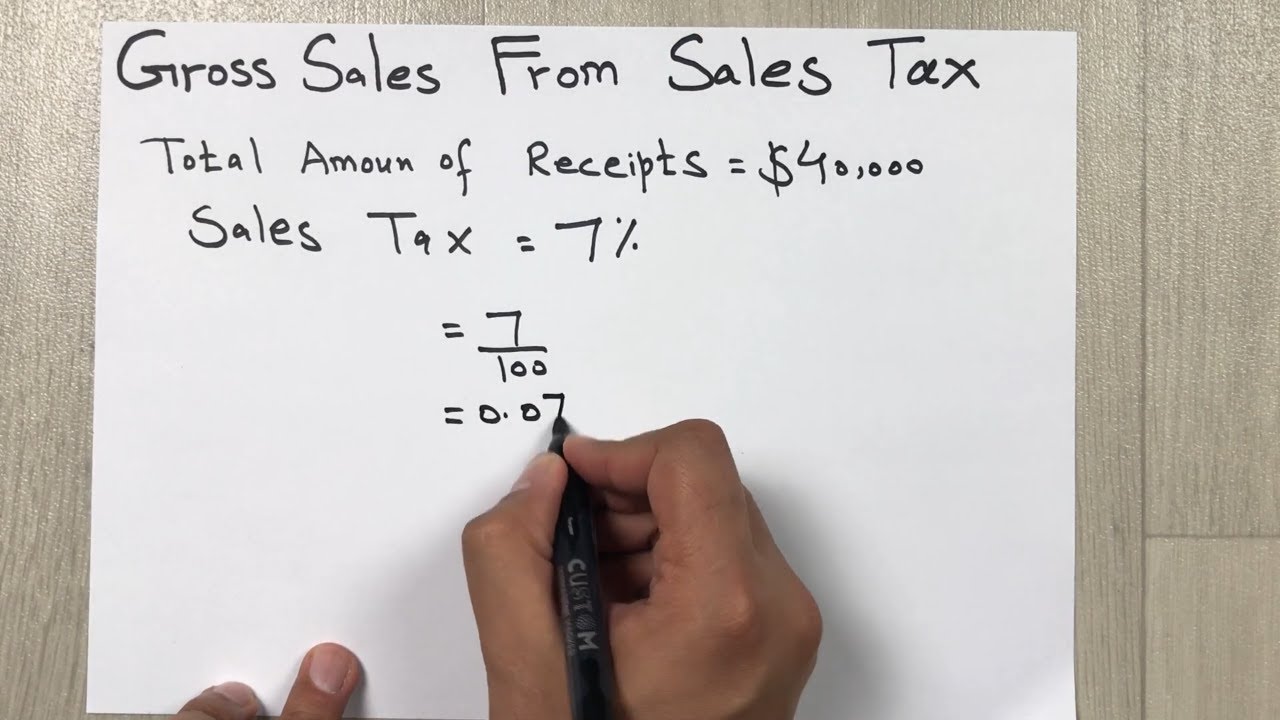

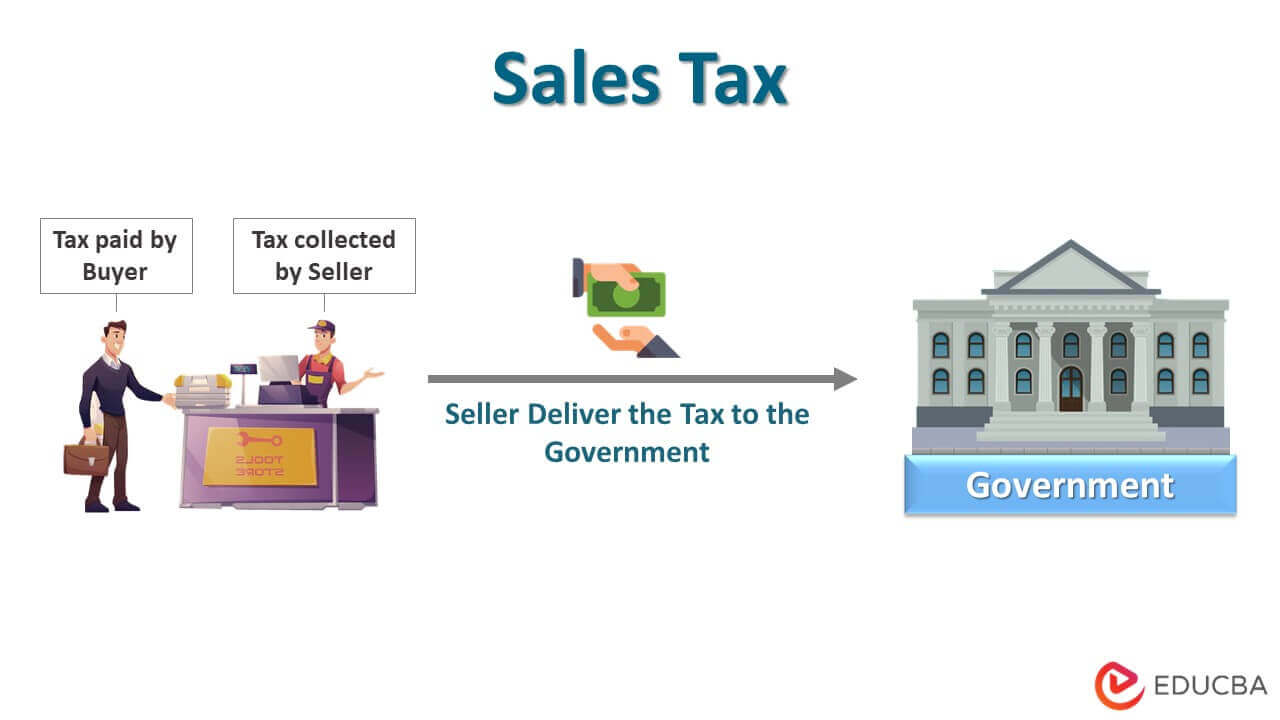

1. Understanding Sales Tax

Sales tax is not only a legal obligation but also a critical element in business operations. Here’s how you can ensure you’re on top of your sales tax calculations:

- Know Your Local Tax Laws: Sales tax rates can vary by state, county, or even city. Make sure you're aware of the latest rates applicable to your location. A simple lookup online or contacting your local tax authority can provide this information.

- Use Software: Manual calculation of sales tax can be error-prone. Leverage modern POS (Point of Sale) systems or accounting software that can handle sales tax automatically.

- Record Keeping: Maintain meticulous records of all taxable sales and ensure you can easily compile this data for tax reporting. This helps not only in compliance but also during audits.

💡 Note: Always check for tax exemptions or special tax rates that might apply to certain products or customers, like non-residents.

2. Applying Discounts

Discounts are an effective way to attract customers, but they need to be applied correctly to avoid confusion and maintain profitability:

- Pre-Tax or Post-Tax Discount: Decide whether your discounts will apply before or after tax. Most retailers opt for pre-tax discounts to keep pricing transparent, but it can vary based on business practices.

- Discounts on Multi-Tiered Products: If you sell products with components (like bundles or gift sets), ensure discounts are calculated on the total before tax or on each item separately if that's your policy.

- Special Promotions: For seasonal sales or specific promotions, clear guidelines on how discounts should be applied can prevent mistakes. For example, 'Buy One, Get One Free' deals require specific calculation methods.

⚠️ Note: Ensure that your system can handle multiple discount scenarios, like combining percentage discounts with fixed amount discounts, without conflicts.

3. Handling Volume Discounts

Volume discounts encourage customers to buy more by offering larger discounts as the quantity purchased increases:

| Quantity | Discount Rate |

|---|---|

| 1-10 units | 5% |

| 11-25 units | 10% |

| 26+ units | 15% |

- Consistent Application: Ensure your sales team understands how to apply volume discounts and ensure consistency in application to avoid customer confusion or over/under-discounting.

- Clearly Communicate: Make your volume discount policy transparent on your website, marketing materials, and in-store to set customer expectations.

4. Combining Sales Tax and Discounts

The integration of sales tax and discounts can become complex, especially when:

- Tax Exempt Purchases: Ensure your system can handle scenarios where discounts are applied but the sale might still be tax-exempt.

- Rounding Issues: When discounts or taxes are applied, ensure proper rounding rules to avoid small discrepancies which can add up over time.

5. Automated Systems for Efficiency

Using automated systems not only reduces human error but also speeds up the entire process:

- Integration: Choose systems that integrate well with your existing POS or e-commerce platform for seamless operations.

- Scalability: As your business grows, your system should be able to handle increased complexity in sales tax and discount calculations without hiccups.

- Updates: Tax laws and rates change, so ensure your software can be updated automatically or has a subscription for these updates.

Managing sales tax and discounts efficiently can significantly impact your bottom line and customer satisfaction. By understanding your local tax laws, setting clear discount policies, applying discounts systematically, and using automated systems, you ensure both compliance and profitability in your business operations.

How often do sales tax rates change?

+

Sales tax rates can change yearly or even quarterly in some states due to budget adjustments or new legislation. Regular updates are crucial for accurate tax calculations.

Can discounts be applied after sales tax?

+

Typically, discounts are applied before sales tax for clarity in pricing. However, some businesses might choose to apply discounts after tax for specific promotions, but this should be clearly stated to avoid customer confusion.

What happens if I miscalculate sales tax?

+

Miscalculating sales tax can lead to fines, penalties, or interest on late or incorrect payments. Regular audits or having an accurate automated system can mitigate these risks.

Are all discounts applied the same way?

+

No, discounts vary; they can be percentage-based, fixed amount, or tiered based on volume. It’s important to have clear policies on how different discounts are applied, especially when combining multiple discount types.

What are the benefits of using automated systems for tax and discount calculations?

+

Automated systems reduce human error, increase efficiency, ensure compliance with real-time tax updates, and can handle complex discount scenarios without confusion.

Related Terms:

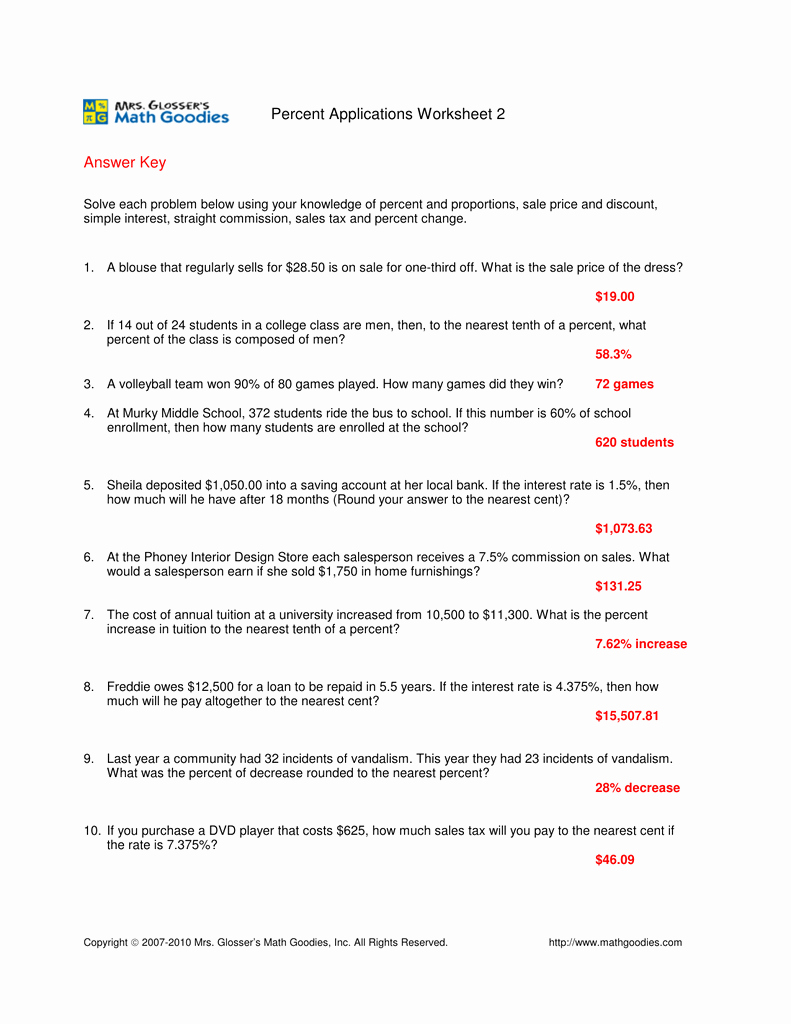

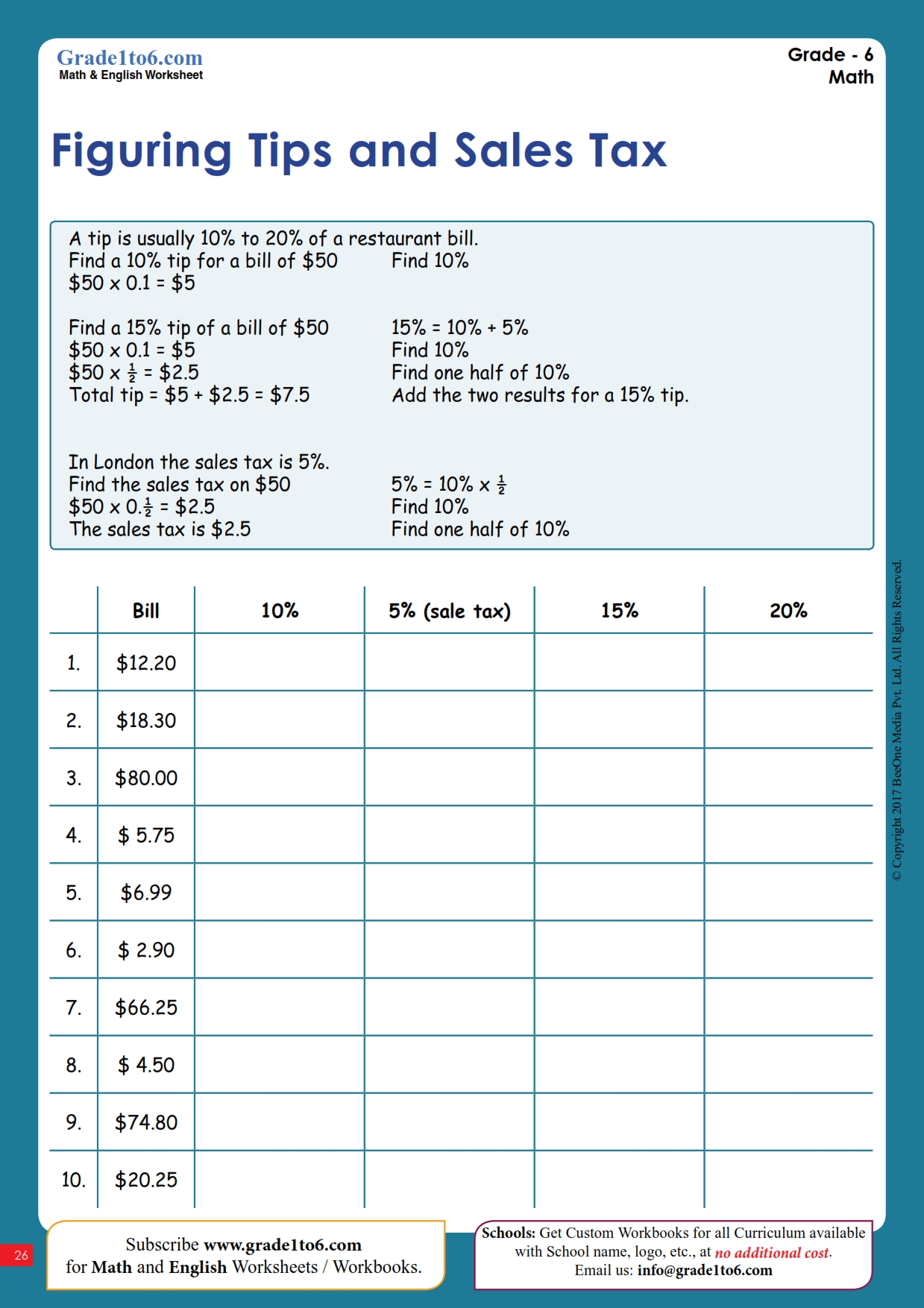

- Sales tax Worksheet Grade 6

- Sales tax worksheet answer key