5 Ways to Master EFTPS Direct Payment Worksheet

The IRS's Electronic Federal Tax Payment System (EFTPS) offers taxpayers an efficient and secure method to make federal tax payments directly from their bank account. However, mastering EFTPS for tax payments requires understanding its payment worksheet. Here's a guide to help you:

1. Get Familiar with EFTPS

EFTPS is a free service provided by the U.S. Department of the Treasury to pay your federal taxes online or via phone. Here’s what you need to know:

- Enrollment: Register via EFTPS.gov with your taxpayer identification number (TIN), bank account details, and your preferred payment schedule.

- Security: Use your PIN to access your EFTPS account to prevent unauthorized access.

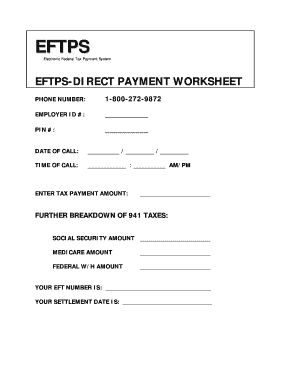

2. Understanding the Payment Worksheet

The EFTPS worksheet is crucial for organizing and confirming your tax payments. Here’s how to use it:

- Payment Amount: Clearly state the amount you wish to pay to avoid any errors.

- Tax Form Number: Indicate the form associated with the payment.

- Tax Period: Provide the tax period for which the payment is intended.

- Payment Date: Choose a payment date in advance, keeping in mind EFTPS schedules and holidays.

| Tax Form | Tax Period | Payment Date | Amount Due |

|---|---|---|---|

| 1040 | 2022 | April 15, 2023 | $3,500 |

🛑 Note: Ensure the payment date does not fall on a federal holiday, when processing might be delayed.

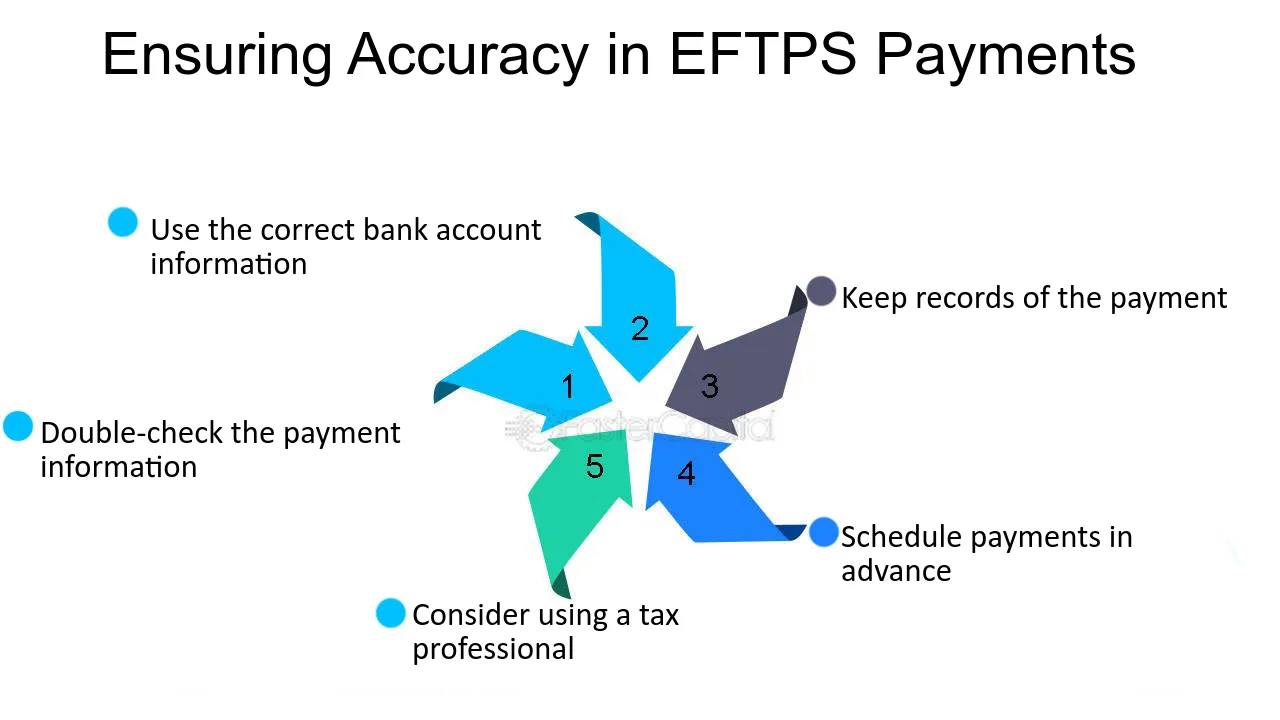

3. Verify Your Payment Details

Before confirming your payment, double-check the following:

- The tax form number matches the payment you are making.

- The tax period corresponds correctly to your tax liability.

- The payment amount is correct and within your bank account balance.

- The payment date is suitable for your financial planning.

4. Schedule and Track Your Payment

Once your payment is scheduled:

- Look out for a confirmation from EFTPS that your payment is scheduled.

- Use EFTPS to track when your payment has been processed.

- Print or save the confirmation for your records.

5. Troubleshooting Common Issues

Even with EFTPS’s straightforward interface, issues might arise:

- Problems with scheduling payment dates; remember federal holidays.

- Incorrect TIN or bank details can result in payment delays or rejections.

- If payment isn’t processed within the expected time, contact EFTPS customer support.

By mastering these five ways to handle the EFTPS Direct Payment Worksheet, you can navigate the system with ease, ensuring timely and accurate tax payments. This not only reduces the stress associated with tax season but also helps avoid penalties and interest due to late payments. With the right understanding and preparation, EFTPS becomes an invaluable tool in managing your tax liabilities effectively.

What if I miss the payment date?

+

If you miss the payment date, you might be subject to penalties and interest. However, you can still schedule your payment through EFTPS and potentially contact IRS customer service to discuss your options.

Can I cancel an EFTPS payment after scheduling?

+

Yes, but only if the payment has not yet been processed. You can cancel or change your payment through your EFTPS account.

Is EFTPS safe to use?

+

EFTPS is backed by the U.S. Department of the Treasury, ensuring high levels of security for your transactions.

How long does it take for my EFTPS payment to process?

+

Payments are generally processed within one business day if they are scheduled properly, but federal holidays might cause delays.