-

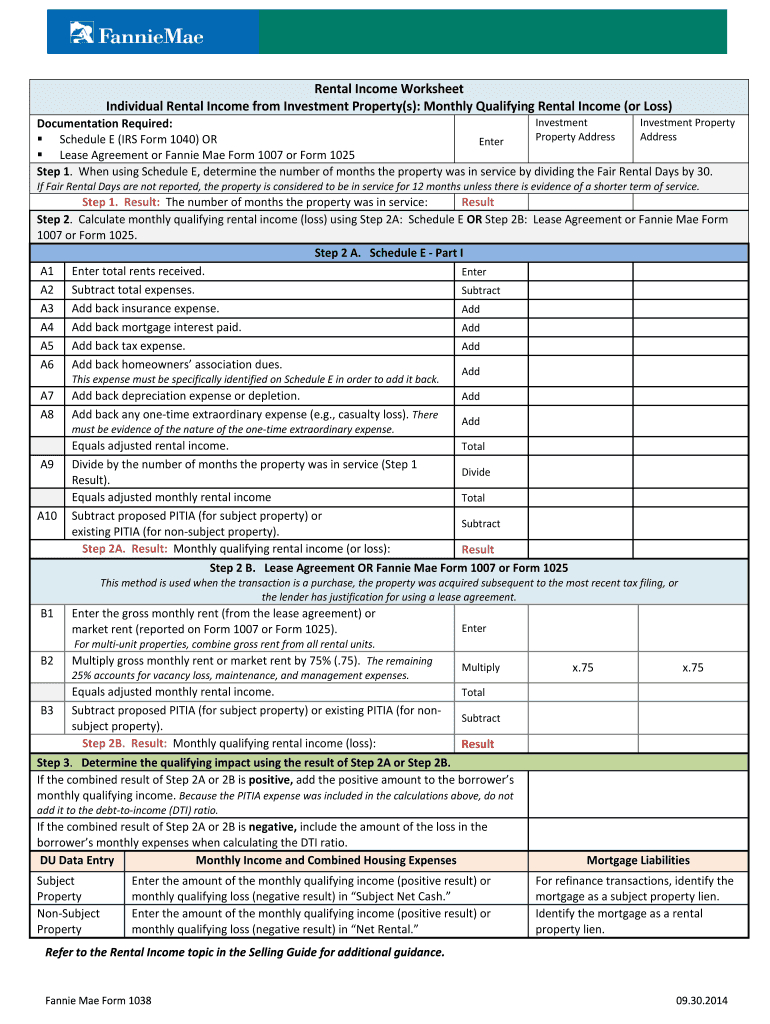

Income Worksheet: Fannie Mae Tips for Approval

Embarking on the journey to homeownership is an exciting yet daunting experience, especially when navigating through the complexities of mortgage approval.

Read More » -

Maximize Tax Savings with Qualified Dividends Guide

This article explains how to use the Qualified Dividends and Capital Gain Tax Worksheet to accurately calculate taxes on qualified dividends and long-term capital gains, assisting individuals in determining their tax obligations efficiently.

Read More » -

5 Tips for Using California Estimated Tax Worksheet

A guide to understanding and calculating estimated tax payments for California residents.

Read More » -

5 Tips for Completing Chipola College's Low Income Worksheet

Worksheet designed to clarify income status for financial aid at Chipola College.

Read More » -

Unlocking Your W2 Income: The Magic Worksheet Guide

A detailed guide on calculating income for tax purposes using the MGIC W-2 form, designed for homeowners and real estate professionals.

Read More » -

Mastering Form 2210: Your Essential Tax Estimation Guide

A guide to understanding and completing Form 2210 for estimating underpayment of taxes, with detailed instructions on calculating penalties.

Read More » -

5 Tips for Completing the Magic Rental Income Worksheet

The Mgic Rental Income Worksheet article provides detailed guidance on how to accurately calculate and document rental income, crucial for loan underwriting processes.

Read More » -

5 Tips to Complete Your MW507 Exemption Worksheet Easily

Guide to correctly completing the MW507 form for personal exemptions.

Read More » -

Mastering Long Division with Decimals Worksheets

Explore these printable Long Division with Decimals Worksheets to help students practice and master dividing numbers with decimal points, improving their arithmetic skills.

Read More » -

Maximize Your Refund: IRS Credit Limit Worksheet Guide

The IRS Credit Limit Worksheet helps taxpayers calculate the maximum amount of certain tax credits they can claim, ensuring they adhere to IRS guidelines and limits.

Read More »