5 Tips to Complete Your MW507 Exemption Worksheet Easily

Filing for the MW507 Exemption Worksheet can seem like a daunting task, but with the right approach, you can navigate through the process smoothly and efficiently. This guide aims to simplify your experience, offering practical tips to expedite and ease the completion of your exemption worksheet. Here are five tips to make your journey through the MW507 process as straightforward as possible.

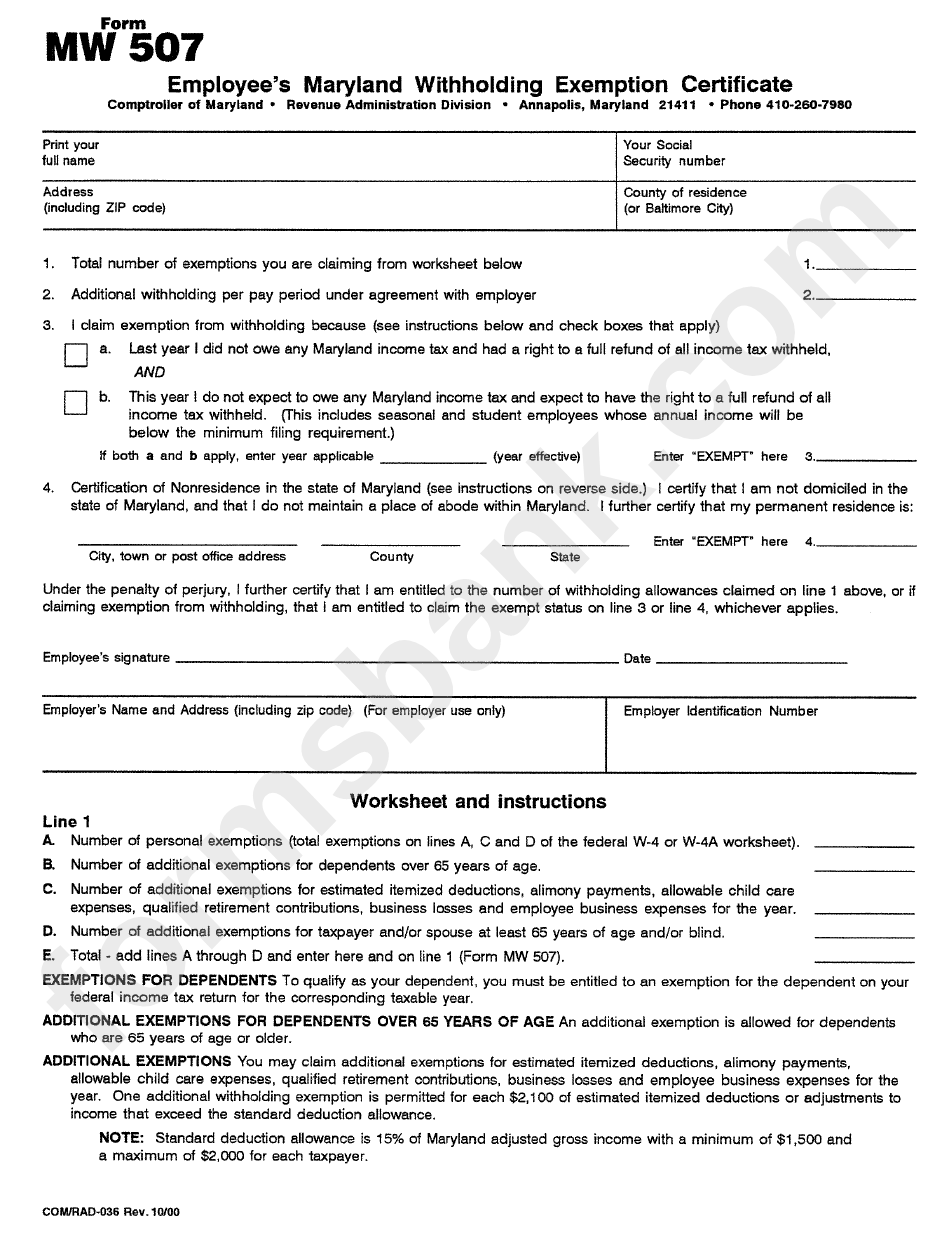

Understand the MW507 Form

Before you dive into filling out the MW507 Exemption Worksheet, it’s crucial to understand its purpose and structure. Here’s what you need to know:

- The MW507 Form is used to determine the amount of Maryland state income tax to withhold from your wages.

- It includes sections for personal exemptions, additional withholdings, and situations like filing status changes.

Spend some time reviewing the form or visit the Maryland Comptroller’s website for comprehensive details. Knowing the form’s layout and what each section asks for can save time and reduce errors.

Get Organized

Organizing your documents and information is vital to completing the MW507 form without hitches. Here’s what you should do:

- Gather your personal information: Social Security Number, previous year’s federal tax return, and any W-2 or 1099 forms.

- List all your income sources: Employment income, self-employment, investments, etc.

- Identify changes in your financial situation: Marriage, divorce, additional dependents, etc.

Having all this information at your fingertips ensures you fill out the form accurately, avoiding the need to make corrections later on.

Fill Out the Worksheet Methodically

When you start filling out the MW507 form:

- Start with your personal information, like name and Social Security Number.

- Proceed to determine your filing status, which will influence the number of exemptions you can claim.

- Calculate your Maryland taxable income from all sources, adjusting for any deductions or credits.

- Enter the number of exemptions. Remember that exemptions differ from withholdings, as they are deductions from your taxable income.

- If applicable, adjust for additional withholdings based on your tax liability.

📌 Note: Ensure you enter your exemptions correctly, as any overclaiming can result in owing taxes when filing your return.

Double-Check Your Entries

Accuracy is key when dealing with tax forms. Here are some double-checking steps:

- Verify your Social Security Number is correct.

- Ensure all income figures match your source documents.

- Double-check that your exemptions reflect your current financial status.

- Look over your math, especially when calculating withholdings or exemptions.

Mistakes can lead to complications when filing your state income tax, so take your time and review everything carefully.

Ask for Help if Needed

Don’t hesitate to seek assistance if you find the form overwhelming or unclear:

- Consult the Maryland Comptroller’s office or their website for clarification.

- Consider using online resources or tax preparation software that can guide you through the process.

- If you’re employed, your employer’s HR department might offer help or have resources available.

- Professional tax advisors or accountants can provide expert guidance for complex situations.

🎓 Note: Seeking professional help can be invaluable, especially if you have a more complex tax situation or if you’re unsure about any aspect of the form.

Wrapping up your MW507 Exemption Worksheet might feel like a big task, but by following these five tips, you can make the process much simpler. Understanding the form, organizing your documents, filling out the worksheet methodically, double-checking your entries, and seeking help when needed are all crucial steps to ensure you complete your MW507 form accurately and efficiently.

What happens if I overclaim exemptions on the MW507?

+

Overclaiming exemptions on the MW507 can result in having less tax withheld from your paychecks than required. Consequently, when you file your annual return, you might owe taxes, and you could be subject to penalties for underpayment.

Can I change my withholdings mid-year?

+

Yes, you can update your MW507 form and adjust your withholdings if there are changes in your personal or financial situation throughout the year. Inform your employer immediately to reflect these changes.

Who should fill out the MW507?

+

Any employee earning wages in Maryland must fill out the MW507 form unless they are exempt from withholding. This includes residents, non-residents working in Maryland, and residents who work outside the state but have income subject to Maryland tax.