Income Worksheet: Fannie Mae Tips for Approval

Embarking on the journey to homeownership is an exciting yet daunting experience, especially when navigating through the complexities of mortgage approval. Fannie Mae, one of the leading players in the secondary mortgage market, has guidelines to ensure that borrowers are not only able to take on a mortgage, but also that the mortgage is sustainable over the long term. One crucial component of the mortgage approval process is the income worksheet. This document is pivotal in illustrating your financial stability and capacity to repay the loan. In this comprehensive guide, we'll explore the intricacies of Fannie Mae's income worksheet, offering tips and strategies to help you secure mortgage approval.

Understanding the Income Worksheet

The income worksheet is not just a formality; it’s a detailed document that provides lenders with a snapshot of your financial health. Here’s what it typically entails:

- Current Employment: Information about your current job, including job title, length of employment, and employer contact details.

- Base Pay: Your salary or wages before any deductions.

- Bonus and Overtime: These are considered if they are regular, verified, and expected to continue.

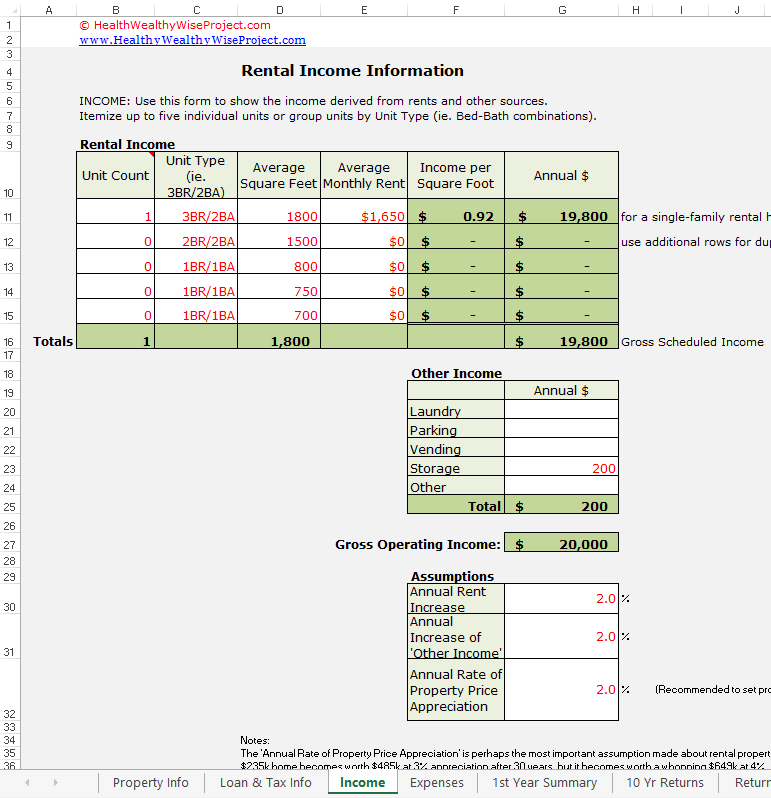

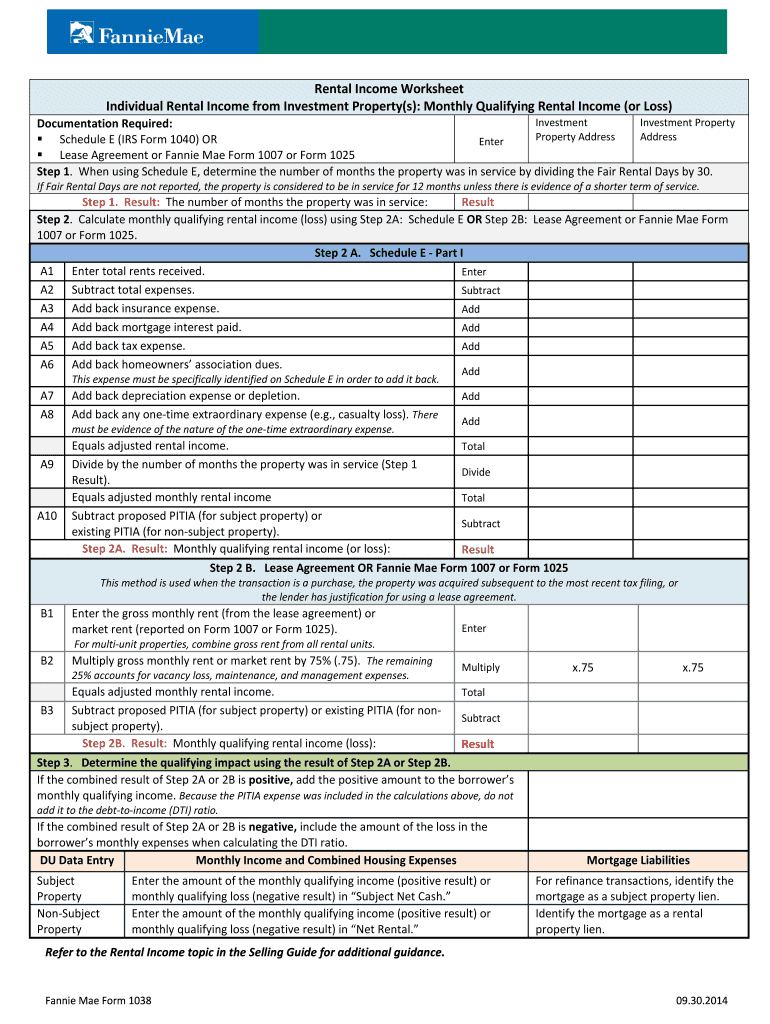

- Other Income: This could include investments, alimony, child support, rental income, or any other steady source of income.

Completing Your Income Worksheet

Here are some tips to ensure your income worksheet reflects your financial position accurately and positively:

- Verify Your Employment: Lenders will typically verify your employment with your current employer. Ensure all information matches your HR records.

- Include All Income: While base salary is crucial, don’t overlook commissions, bonuses, or overtime. If they are a regular part of your income, they should be included.

- Documentation: Gather recent pay stubs (usually for two months), W-2 forms, and tax returns for the last two years. Fannie Mae looks for a track record of steady income.

- Consistency: If there are inconsistencies in your income, be prepared to explain them. A sudden drop or change in income can be concerning to lenders.

- Self-Employed Borrowers: If you’re self-employed, you’ll need to provide additional documentation like profit and loss statements, business bank statements, and K-1s or 1120S forms for partnerships or S corporations.

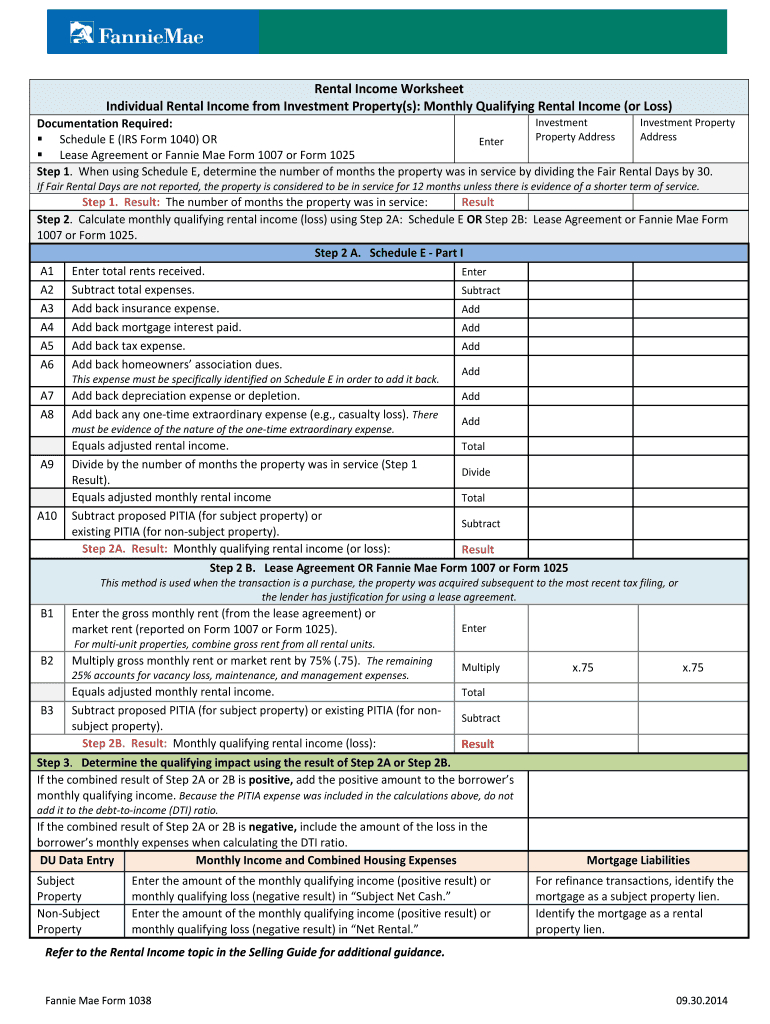

- Rental and Investment Income: If applicable, include rental income from properties or income from investments, ensuring these are stable and likely to continue.

💼 Note: Lenders typically require a two-year history for rental or investment income to be considered for qualification.

Strategies for Income Stability

Here are some strategic steps to strengthen your income profile:

- Extend Employment: If you’ve been in a new job for less than two years, consider extending your contract or securing a letter from your employer stating the permanency of your position.

- Explain Gaps: If you have any gaps in employment, provide explanations. Continuing education, travel, or freelance work can often justify employment gaps.

- Bonus and Commissions: If these are not steady, consider if taking on a role with a more predictable income might increase your chances of mortgage approval.

- Enhance Stability: Lenders prefer borrowers with stable income, so anything you can do to demonstrate stability (like a recent promotion or a contract renewal) can be beneficial.

| Income Type | Documentation Required | Note |

|---|---|---|

| Base Salary | Pay stubs, W-2 forms | Two months of recent payslips are typically required. |

| Bonus/Commission/Overtime | Pay stubs, W-2 forms, employer's letter | Must be regular and verifiable for qualification. |

| Rental Income | Lease agreements, tax returns, Schedule E | Consistency over two years is crucial. |

| Investment Income | Dividend/interest statements, 1099 forms, tax returns | Income from assets can supplement primary income. |

| Self-Employment | Tax returns, business financial statements, K-1 forms | Proving income can be more complex but crucial. |

💡 Note: When in doubt, over-documentation is preferable to under-documentation, especially for complex income scenarios like self-employment.

The Importance of Accurate Income Reporting

Accuracy is not just important for approval; it ensures that the loan is appropriate for your financial situation. Here’s why:

- Qualification: Accurate income reporting determines if you qualify for the loan amount you seek.

- Sustainable Borrowing: An overestimated income can lead to an unaffordable mortgage, increasing the risk of default.

- Interest Rates: Your income and debt-to-income ratio influence the interest rate you receive, affecting your monthly payments.

- Future Financial Stability: Proper loan sizing supports long-term financial health by ensuring your mortgage payments are manageable.

In wrapping up this comprehensive guide, ensuring a well-prepared and accurate income worksheet is critical for securing mortgage approval from Fannie Mae. The process demands attention to detail, clear documentation, and strategic preparation to present your financial profile in the best light possible. By following these guidelines, you're not only increasing your chances of approval but also setting the foundation for a stable and sustainable homeownership experience.

How recent should my income documents be for Fannie Mae approval?

+

Lenders typically require documents like pay stubs to be within 30 days of the loan application, while tax returns and W-2s should be from the most recent two years.

What if my income is not stable or consistent?

+

If your income varies, explain the situation, and provide additional documentation to illustrate income trends. Consistency can be established through an average of your income over time.

Can I include child support or alimony as income?

+

Yes, if these payments are expected to continue for at least three years and are documented through agreements or court orders, they can be included as income.