Ramsey Budget Worksheet: Simplify Your Financial Planning

Welcome to the world of streamlined financial planning with the Ramsey Budget Worksheet! Managing finances can often feel like a daunting task, but with the right tools and a clear strategy, you can transform this overwhelming challenge into an empowering journey towards financial freedom. This comprehensive guide will delve into how the Ramsey Budget Worksheet can revolutionize your approach to personal finance, ensuring you stay on top of your budget with ease and confidence.

What is the Ramsey Budget Worksheet?

The Ramsey Budget Worksheet is a free budgeting tool created by Dave Ramsey and his team, designed to help individuals and families take control of their money. It follows the principles of Ramsey’s famous budgeting plan, emphasizing zero-based budgeting where every dollar has a purpose before the month even begins.

- Zero-Based Budget: Every penny is accounted for, ensuring no discretionary spending goes unnoticed.

- Simplicity: The worksheet provides a straightforward format, which makes it accessible for everyone from novices to seasoned budgeters.

- Customization: You can tailor the budget to your specific financial situation, whether you’re paying off debt, saving for a big goal, or simply aiming to live within your means.

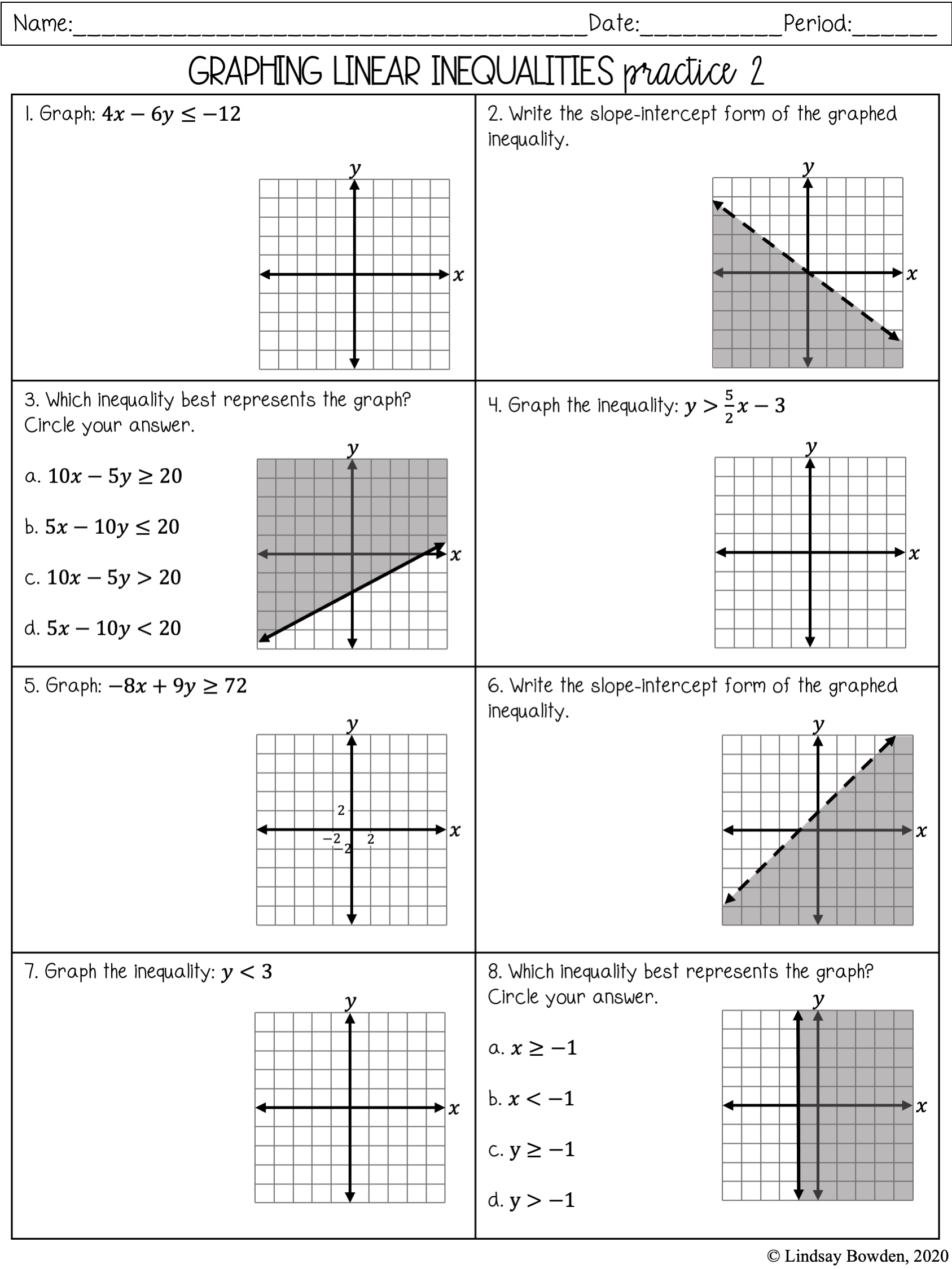

How to Use the Ramsey Budget Worksheet

Step 1: Gather Your Financial Information

Before you start filling out the Ramsey Budget Worksheet, you’ll need to collect key financial data:

- Your monthly income

- Recurring expenses (bills, subscriptions, etc.)

- Variable expenses (like groceries or entertainment)

- Any debts or savings goals

Step 2: Fill Out Your Budget

With your financial information at hand:

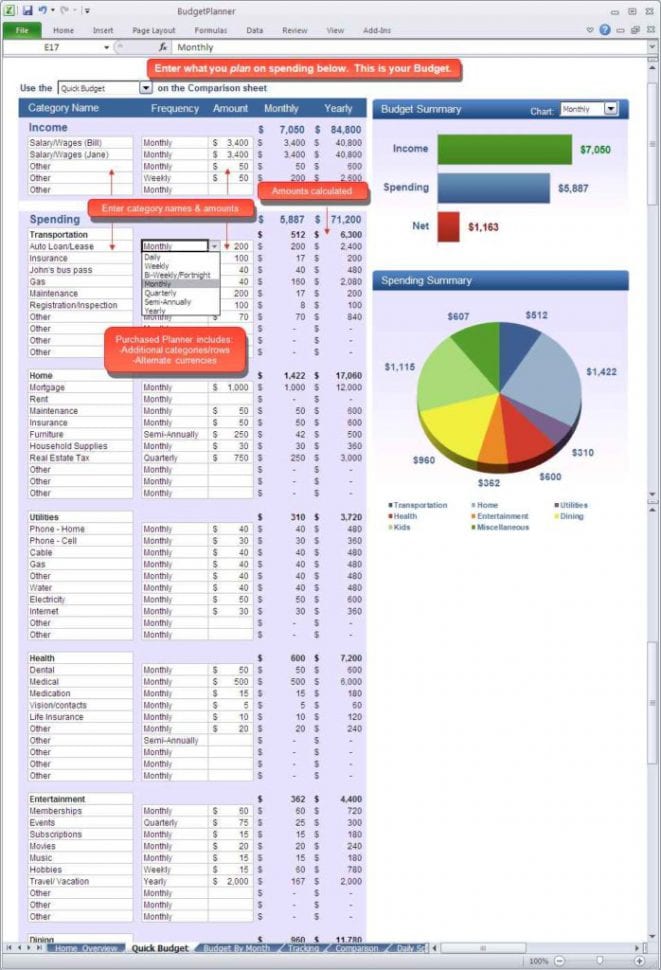

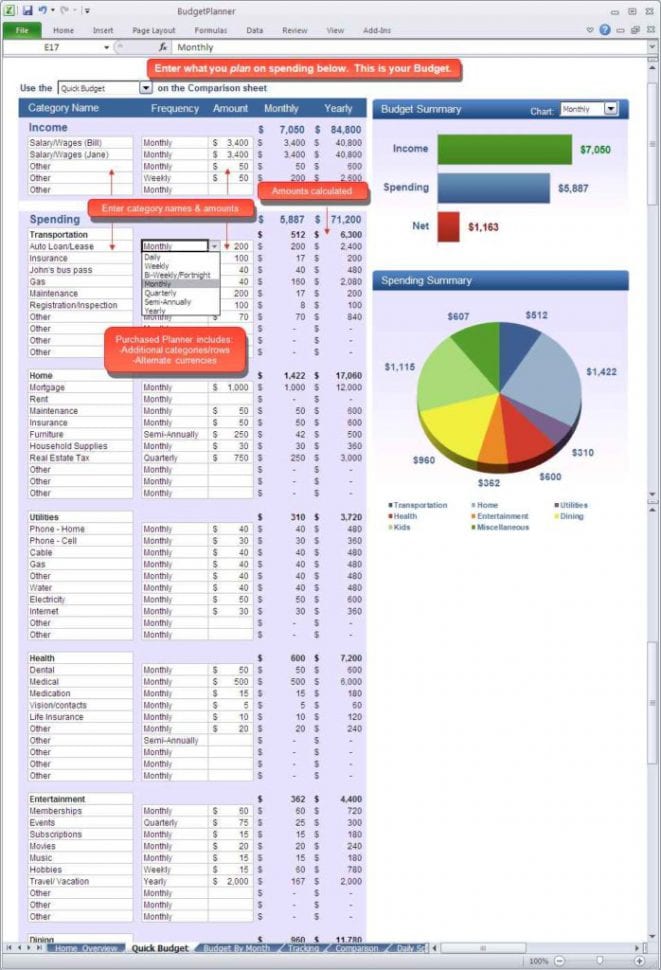

- Income: List all sources of income, even if it’s a rare freelance gig or side hustle.

- Expenses: Break down your expenses into categories like housing, utilities, food, transportation, entertainment, etc.

- Planned Expenses: This includes irregular but anticipated expenses like car maintenance or holiday gifts.

- Zero Out: Adjust the expenses until the total matches your income, giving every dollar a job.

Step 3: Monitor and Adjust

As the month progresses, track your spending against the budget:

- Mark off expenses as you pay them.

- Identify areas where you might be overspending and adjust accordingly.

- If you have extra money, decide where it should go: debt, savings, or next month’s budget.

💡 Note: Keep in mind that your first month might not be perfect, but with time, you'll refine your budgeting skills.

The Benefits of Using Ramsey’s Budget Worksheet

1. Clarity and Control

Having a visual representation of where your money goes can help eliminate financial stress. You’ll know exactly how much you can spend without jeopardizing your financial goals.

2. Debt Reduction

Dave Ramsey’s principles focus heavily on debt reduction. The worksheet allows you to allocate funds to pay off debts faster, providing a clear path out of debt.

3. Goal Achievement

Whether it’s a vacation, a new car, or an emergency fund, the Ramsey Budget Worksheet helps you set and track financial goals, ensuring you save towards them systematically.

4. Financial Education

The process of budgeting with this tool teaches you about your spending habits, financial priorities, and personal discipline, fostering long-term financial literacy.

Integrating the Ramsey Budget Worksheet into Your Life

Sync with Your Calendar

Set reminders for when bills are due, savings goals are reached, or when it’s time to review your budget. This keeps you proactive rather than reactive in your financial management.

Involve Your Family

Make budgeting a family affair. Explain the importance of financial planning to your children or partner, making it a collaborative effort. This fosters unity and financial responsibility within the household.

Digital and Physical Copies

While the worksheet is available digitally, keeping a physical copy can be helpful, especially if you prefer traditional note-taking or want to make it a family activity.

📝 Note: Using both digital and physical copies provides a backup and can make budgeting a tangible and engaging activity for everyone involved.

In wrapping up this journey through the Ramsey Budget Worksheet, remember that the ultimate goal is not just to survive financially but to thrive. By adopting this budgeting tool, you are setting a solid foundation for financial independence and peace of mind. Every dollar now has a purpose, and every expense is intentional. As you continue to use and refine your budget, you’ll find that financial planning becomes less of a chore and more of an empowering tool in your life.

Over time, you’ll witness not just the growth of your savings but also a transformation in your financial mindset. You’ll see yourself making better choices, prioritizing needs over wants, and taking control of your financial destiny. It’s about creating a lifestyle that aligns with your values, goals, and dreams, making financial freedom not just an aspiration but a reality.

Can I use the Ramsey Budget Worksheet if I’m not familiar with Dave Ramsey’s principles?

+Absolutely! The Ramsey Budget Worksheet is designed to be user-friendly and can be adapted to any financial philosophy. Its primary aim is to help you manage your finances efficiently, regardless of your familiarity with Dave Ramsey’s methods.

How often should I update my Ramsey Budget Worksheet?

+It’s recommended to review and update your budget at least once a month. However, significant changes in your financial situation, like an unexpected expense or income, might warrant an immediate update to keep your budget current.

What if my expenses exceed my income on the worksheet?

+This is a critical point in budgeting. If your expenses exceed your income, you’ll need to adjust. Options include increasing your income, reducing unnecessary expenses, or identifying areas where you can cut back. The worksheet will help you see exactly where adjustments need to be made.