-

Mastering the 199a Worksheet by Activity Form for Maximum Deductions

A detailed guide to help users navigate and fill out the 199a Worksheet by Activity Form.

Read More » -

5 Tips to Maximize Your Social Security Tax Benefits

This article explains how to use the Social Security Taxable Benefits Worksheet to determine the taxable portion of your Social Security benefits, assisting readers in understanding their tax obligations and preparing for tax filing.

Read More » -

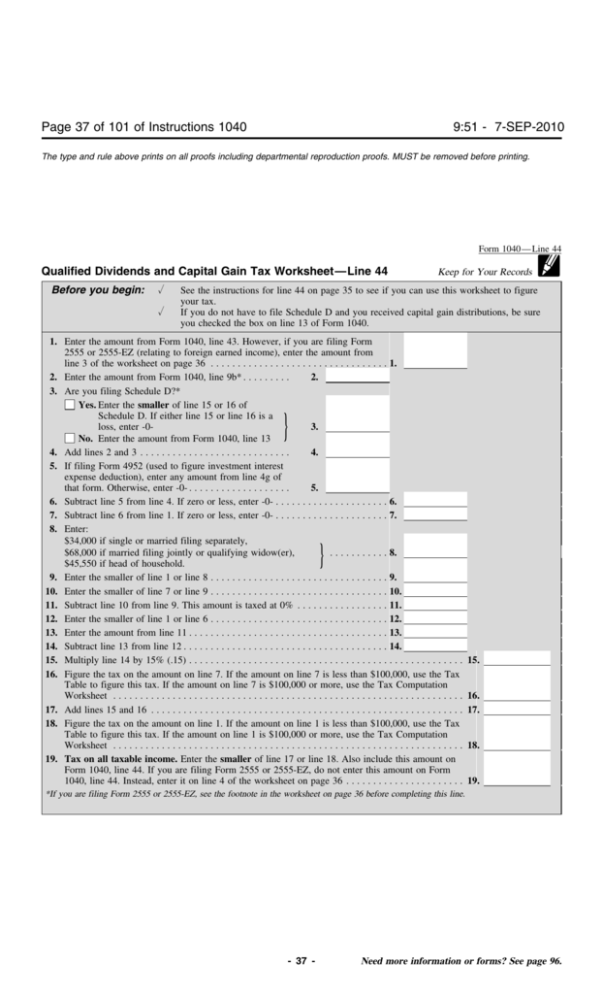

2023 Guide: 5 Tips for Qualified Dividends Tax Worksheet

A downloadable PDF worksheet for calculating 2023 qualified dividends and capital gains, providing tax planning assistance.

Read More » -

5 Tips for Navigating the Qualified Dividends Worksheet

This article provides a guide on using the Qualified Dividends and Capital Gains Worksheet to accurately report and manage tax liabilities from investments on your tax return.

Read More » -

Maximize Tax Savings with Qualified Dividends Guide

This article explains how to use the Qualified Dividends and Capital Gain Tax Worksheet to accurately calculate taxes on qualified dividends and long-term capital gains, assisting individuals in determining their tax obligations efficiently.

Read More » -

Unlock Tax Savings with the Qualified Dividends Worksheet

A guide explaining how to use the Qualified Dividends Worksheet to calculate tax on dividends.

Read More » -

Unlock Tax Savings: Qualified Dividends & Capital Gains Worksheet Guide

This worksheet helps taxpayers calculate the tax on qualified dividends and long-term capital gains, which may be taxed at different rates than ordinary income.

Read More » -

Maximize Your Savings with Qualified Dividends Tax Guide

This worksheet helps determine the tax on qualified dividends and long-term capital gains, providing a method to calculate taxes separately from other income, ensuring accurate tax liability.

Read More » -

5 Iowa Social Security Tax Tips for Retirees

This article explains how to use the Iowa Social Security Worksheet to determine if your social security benefits are taxable on your Iowa state income tax return.

Read More »