-

Auto Loans Comparison: Worksheet Answers Revealed

A guide offering insights and answers on various aspects of auto loans, helping you compare and select the best loan option through worksheets.

Read More » -

Maximize Your Refund with California EITC Worksheet

A guide to help California residents determine their eligibility and calculate the potential tax credit they can receive through the state's Earned Income Tax Credit (CalEITC) program.

Read More » -

Maximize Your Savings: California Dependent Tax Worksheet Guide

Explanation of the California Dependent Tax Worksheet used to calculate tax credits for dependents on state tax returns.

Read More » -

5 Steps to Master Dave Ramsey's Budget Worksheet

A guide to managing your finances with a free budgeting tool from Dave Ramsey.

Read More » -

FSA PARP Worksheet Guide for Easy Tax Filing

FSA PARP Worksheet: An in-depth guide on using the PARP (Plant and Relocate Analysis for Projects) worksheet to streamline and enhance project management in the Farm Service Agency (FSA).

Read More » -

Oprah's Debt Diet: Free Worksheet to Financial Freedom

Oprah introduces a practical worksheet designed to help individuals manage and reduce their debt effectively.

Read More » -

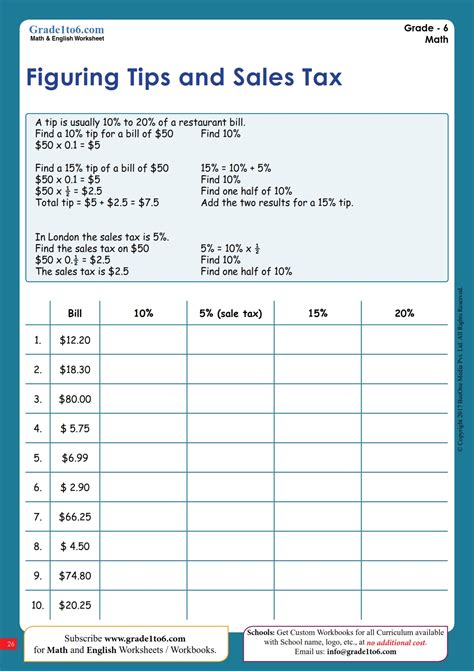

5 Essential Tips for Calculating Tip and Tax

A practical guide on calculating tips and taxes for better financial management.

Read More » -

5 Tips to Optimize Your Usaa Budget Worksheet

A guide to managing finances with the USAA Budget Worksheet, offering a structured approach to tracking income and expenses for effective budgeting.

Read More » -

Maximize Your Tax Credits with Form 8812 Worksheet

Worksheet for Form 8812 is a supplemental document for calculating the Additional Child Tax Credit, ensuring that parents and guardians receive the correct amount of tax relief for their children or dependents.

Read More » -

VA-4 Form: Optimize Your Tax Exemptions with Ease

A guide to completing the Virginia Form VA-4, helping employees determine the correct withholding amount for state income taxes based on personal exemptions.

Read More »