5 Tips to Optimize Your Usaa Budget Worksheet

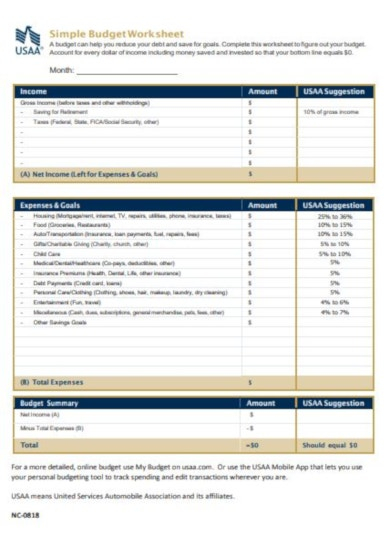

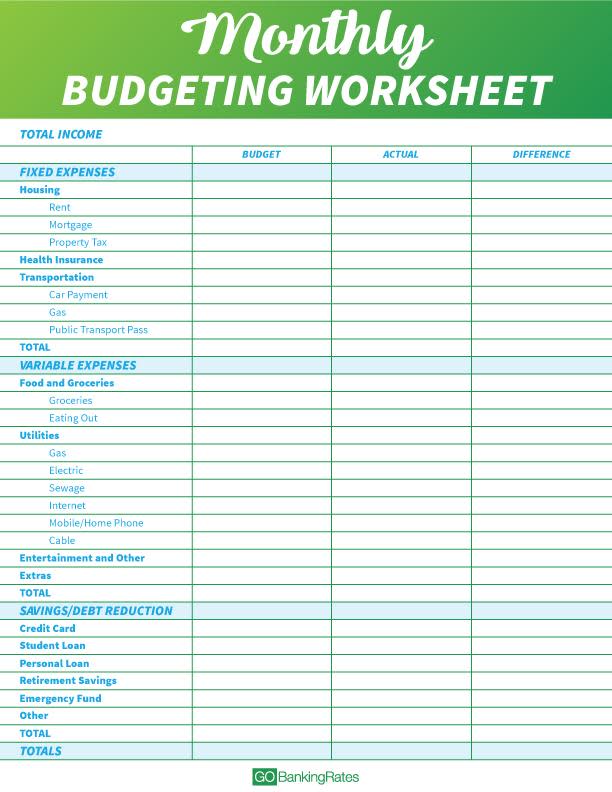

Whether you're a USAA member looking to get a handle on your finances, or you're simply seeking practical advice on budgeting, the USAA Budget Worksheet is a valuable tool. Here are 5 tips to help you optimize your financial planning and get the most out of your USAA Budget Worksheet.

1. Start with Clear Financial Goals

Before diving into any budget worksheet, define what you’re aiming for. Financial goals give your budget purpose and direction:

- Short-Term Goals: Paying off credit card debt, saving for a vacation, or purchasing furniture.

- Medium-Term Goals: Saving for a car down payment or emergency fund.

- Long-Term Goals: Retirement savings, buying a home, or funding education for your children.

With your goals in mind, you can categorize your expenses and savings in a manner that supports your financial roadmap.

📝 Note: Make your goals SMART (Specific, Measurable, Achievable, Relevant, Time-bound) to give your budget clear checkpoints.

2. Use the 50/30/20 Budgeting Rule

The 50/30/20 rule is a simple yet effective budgeting guideline:

- 50% for Needs: Housing, utilities, groceries, healthcare, minimum loan payments.

- 30% for Wants: Dining out, entertainment, shopping, hobbies.

- 20% for Savings and Debt Repayment: Emergency fund, retirement, additional loan payments.

Incorporate this rule into your USAA Budget Worksheet to quickly see if you’re aligning with this well-balanced approach:

| Category | Percentage |

|---|---|

| Needs | 50% |

| Wants | 30% |

| Savings/Debt | 20% |

🧭 Note: This rule is adaptable; adjust percentages based on your personal circumstances.

3. Utilize Automated Savings

One of the best ways to optimize your budget is by setting up automatic savings transfers:

- Direct deposit a portion of your paycheck into a savings account.

- Set up recurring transfers from your checking to savings or investment accounts.

- Use tools like USAA’s “Save Your Change” program to round up purchases and save the difference.

Automation takes the guesswork out of saving, ensuring consistency and helping you meet your financial goals effortlessly.

4. Regularly Review and Adjust Your Budget

Your life is not static, so your budget shouldn’t be either. Here’s how you can keep it current:

- Review your budget monthly to track progress and make necessary adjustments.

- Use the USAA Budget Worksheet to compare budgeted vs. actual expenses and savings.

- Adjust for seasonal expenses, like holiday spending or summer vacations.

Be flexible with your categories but maintain your commitment to saving. Regular reviews will keep your budget on track and your goals within reach.

🔁 Note: Life changes like a new job, a move, or a family member’s needs can require significant budget adjustments.

5. Track Irregular Expenses

Many people forget to account for expenses that aren’t monthly. Here’s how to manage these:

- Add a section in your USAA Budget Worksheet for quarterly, semi-annual, and annual expenses.

- Divide these costs by the number of months until the payment is due and set aside that amount monthly.

- Examples include car registration, insurance premiums, property taxes, or gift spending.

This foresight prevents you from being caught off guard, ensuring your budget remains balanced.

By applying these tips to your USAA Budget Worksheet, you're not just filling out a form; you're creating a roadmap to financial health. Remember, the goal is not to restrict your spending but to empower you to make informed choices about your money. With time and commitment, you'll see how these practices can lead to a more secure financial future.

What if my income varies significantly each month?

+

A fluctuating income can make budgeting challenging, but it’s not impossible. Use a conservative estimate for your monthly income based on the lowest likely amount, and adjust your savings and spending accordingly. Also, keep an eye on your average income over several months to get a better understanding of your financial baseline.

How do I handle unexpected expenses in my budget?

+

Establish an emergency fund as part of your savings category. This fund acts as a buffer for unexpected expenses. Aim for three to six months’ worth of expenses, or start small and build up over time. Additionally, allocate a small percentage of your budget for miscellaneous or unplanned expenses each month.

Can I use digital tools alongside the USAA Budget Worksheet?

+

Absolutely, digital tools can enhance your budgeting experience. Many budgeting apps can import your transactions directly, categorize them, and even alert you when you’re nearing spending limits. Use the worksheet as a guiding tool and the digital tools for real-time tracking and analysis.