Auto Loans Comparison: Worksheet Answers Revealed

The process of securing an auto loan can be as daunting as choosing the car itself. With countless options and varying terms, it's crucial to dive deep into comparison for securing the best deal. This comprehensive worksheet will reveal the answers to help you in making an informed decision when comparing auto loans.

Understanding Auto Loans

An auto loan is a type of secured loan, where the vehicle itself acts as collateral. Lenders evaluate several factors like credit score, debt-to-income ratio, and the down payment amount before offering terms.

- Interest Rates: This is the percentage of the loan charged annually.

- Loan Term: How long you have to repay the loan, typically ranging from 36 to 72 months.

- Monthly Payments: The amount you pay each month towards the loan.

- Total Interest Paid: The sum of interest you pay over the life of the loan.

- Down Payment: The initial payment you make when purchasing the car.

- Additional Costs: Fees like origination fees, prepayment penalties, or gap insurance.

Comparing Auto Loans: A Step-by-Step Guide

1. Assess Your Financial Situation

Before diving into loan offers, know your:

- Credit Score - This can significantly impact your interest rate.

- Monthly Budget - How much can you comfortably pay each month?

- Loan Duration - Decide if you prefer shorter terms with higher monthly payments or longer terms with lower payments.

2. Gathering Loan Offers

Collecting loan offers from various sources:

- Banks

- Credit Unions

- Online Lenders

- Car Dealerships

Always ask for a complete breakdown of costs including interest rates, APR, loan terms, and any additional fees.

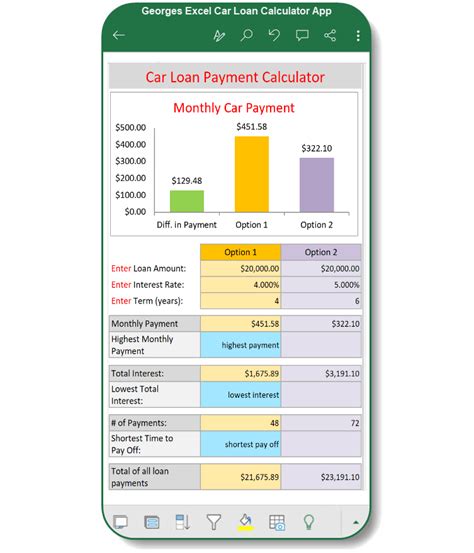

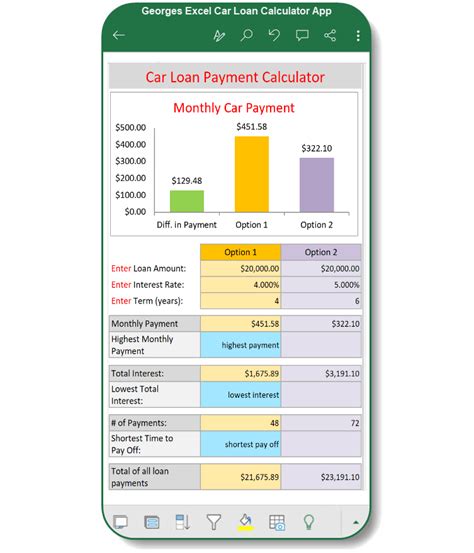

3. Comparing the Numbers

Create a table to compare the details of each loan offer:

| Lender | Loan Amount | Interest Rate | Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Example Bank | $20,000 | 3.5% | 60 months | $370 | $2,216 |

| Example Credit Union | $20,000 | 3.2% | 60 months | $365 | $1,896 |

💡 Note: Always check if the interest rate is fixed or variable.

4. Analyze Loan Terms

- Prepayment Penalties: Some loans might penalize you for paying off your loan early.

- Loan Term: A shorter loan term usually means higher monthly payments but less total interest paid.

- Fees and Charges: Look for any application fees, administrative fees, or other costs.

5. Additional Factors to Consider

Consider the following factors that can influence your decision:

- Pre-approval: Get pre-approved to understand your borrowing capacity.

- Loan Origination: Some lenders might have different origination processes.

- Service Quality: Online reviews can give insights into the customer service of lenders.

6. Make Your Decision

Now that you’ve compared all the offers, select the loan that aligns best with your financial goals and circumstances:

- Lowest Total Cost: Look for the loan that will cost you the least over its term.

- Monthly Affordability: Ensure the monthly payment fits into your budget.

- Reputation: Trustworthy lenders with transparent terms can provide peace of mind.

After meticulously comparing auto loan offers, you will have equipped yourself with the knowledge to select an auto loan that not only matches your financial situation but also provides the best value. Remember that the cheapest loan on paper might not always be the best fit for your specific needs. Consider the long-term implications of each option before making your decision.

What is the difference between a fixed and variable interest rate for auto loans?

+

A fixed interest rate remains constant throughout the loan term, ensuring your payments are predictable. A variable interest rate can fluctuate based on market conditions, potentially leading to lower or higher payments over time.

Should I go for a shorter or longer loan term?

+

Shorter loan terms usually mean higher monthly payments but less total interest paid. Longer terms offer lower monthly payments but at the cost of higher total interest over the life of the loan.

How does my credit score affect auto loan rates?

+

A higher credit score often qualifies you for lower interest rates because lenders see you as less of a risk. Conversely, a lower credit score might lead to higher rates or stricter terms.