5 Steps to Master Dave Ramsey's Budget Worksheet

Are you struggling to get a handle on your finances? Budgeting can be overwhelming, but with the right tools and approach, you can achieve financial peace. One effective method is to follow Dave Ramsey's Budget Worksheet. Here, we'll guide you through five essential steps to master this budget worksheet, helping you gain control over your finances and move towards a debt-free life.

Step 1: Understand Dave Ramsey’s Zero-Based Budget Concept

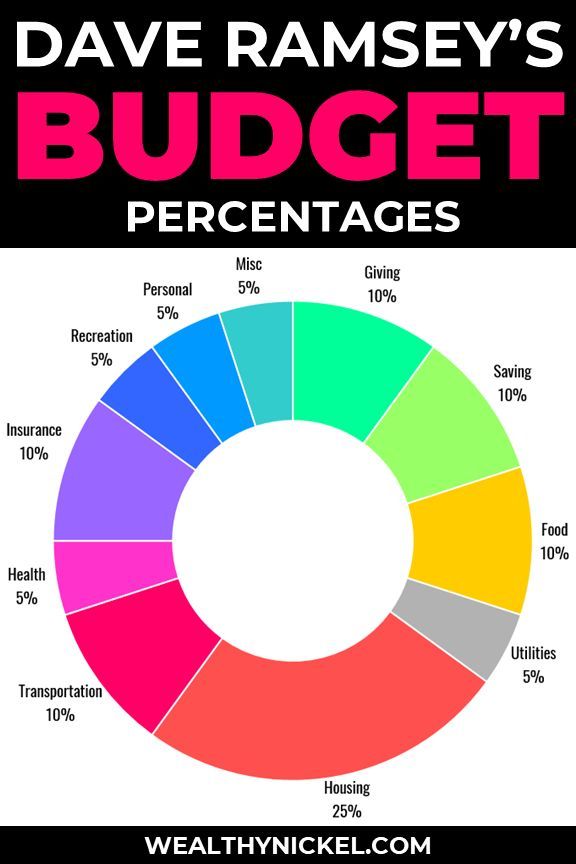

Before you start filling out the worksheet, you need to understand the philosophy behind Dave Ramsey’s budgeting method. This method is known as the zero-based budget, where every dollar has a name or a job. Here’s what you need to do:

- Income - Start by listing all your income sources for the month.

- Expenses - Itemize all your expenses, from fixed costs like rent or mortgage to variable expenses like groceries and entertainment.

- Balance - The goal is to make your income minus expenses equal zero. Any excess money should be allocated to saving or paying off debt.

Step 2: Gathering Financial Documents

To create an accurate budget, you need to gather all necessary financial documents:

- Pay stubs to verify your income

- Bills to track your monthly expenses

- Bank statements to check your transactions

- Credit card statements if you’re working on debt reduction

💡 Note: This step is crucial because missing any documents can lead to incomplete or inaccurate budgeting.

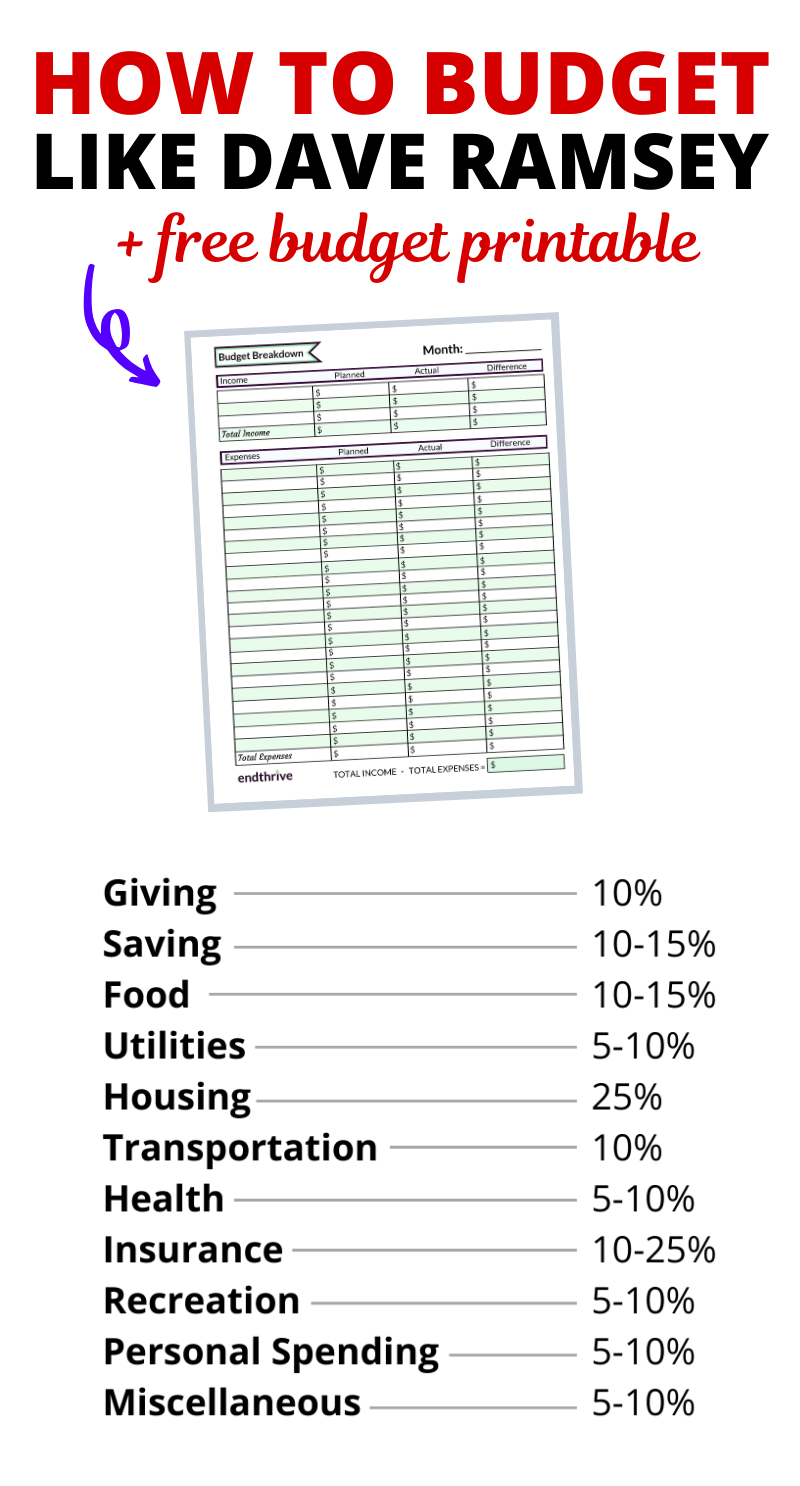

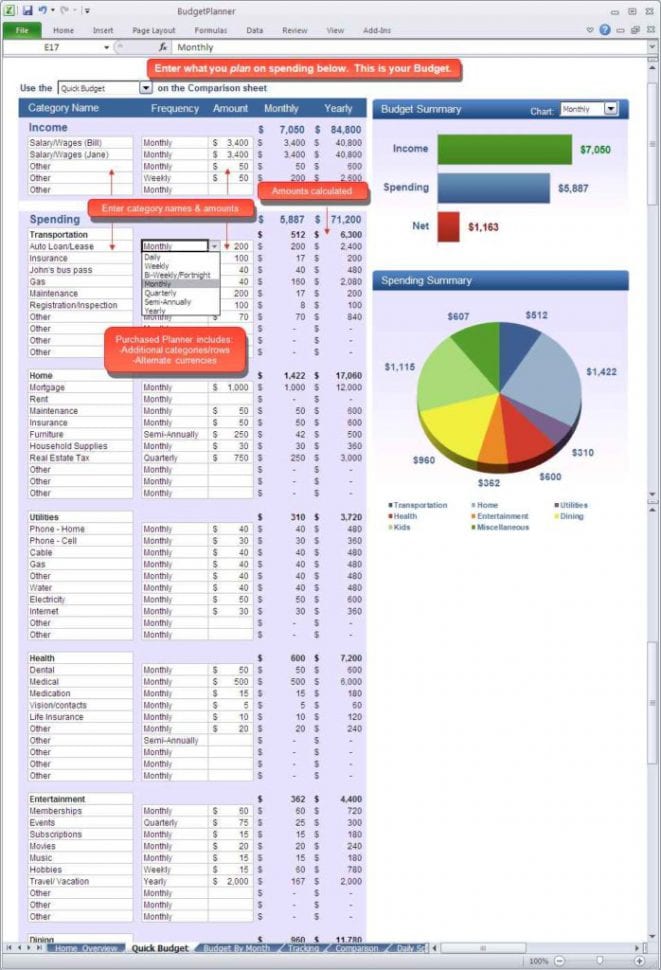

Step 3: Download and Customize the Worksheet

Dave Ramsey’s Budget Worksheet is readily available online. Here’s how you can use it:

- Download the Excel or PDF version from Dave Ramsey’s website or similar budgeting platforms.

- Customize the categories to fit your lifestyle:

- Include specific expenses like pet care, subscriptions, or education costs.

- Set up reminders or color-code for payments that are due.

- Fill in your actual numbers, ensuring you account for all income and expenses.

Step 4: Execution and Tracking

Now that your budget is set up, it’s time to follow through:

- Track your Expenses: Keep a record of every cent you spend. Use the worksheet to log purchases in real-time or by reviewing your transactions.

- Adjust as Needed: If your expenses exceed your income, adjust categories to stay balanced.

- Be Flexible: Life changes; your budget should too. Review it monthly to make adjustments.

Step 5: Review and Reflect

The last step is to review and reflect on your budget’s performance:

- Check if you’ve stayed true to your budget.

- Identify areas where you can cut back or increase savings.

- Celebrate small wins! Achieving budget goals should be rewarding.

| Category | Budgeted Amount | Actual Spent | Difference |

|---|---|---|---|

| Housing | 1,200</td> <td style="border: 1px solid black;">1,150 | +50</td> </tr> <tr> <td style="border: 1px solid black;">Food</td> <td style="border: 1px solid black;">600 | 720</td> <td style="border: 1px solid black;">-120 |

| Transportation | 250</td> <td style="border: 1px solid black;">220 | +30</td> </tr> <tr> <td style="border: 1px solid black;">Savings</td> <td style="border: 1px solid black;">500 | 400</td> <td style="border: 1px solid black;">+100 |

Mastering Dave Ramsey’s Budget Worksheet isn’t just about filling in numbers; it’s about understanding your financial habits, making informed choices, and moving towards a lifestyle of financial freedom. By following these steps, you’re equipping yourself with the tools needed to live below your means, save for emergencies, and work towards becoming debt-free.

How often should I update my budget?

+

Monthly reviews are recommended to keep your budget accurate and relevant. However, significant life changes like job changes, new income sources, or unexpected expenses should prompt an immediate update.

Can Dave Ramsey’s budgeting method work for people with irregular incomes?

+

Absolutely, you just need to be more flexible. When you have an inconsistent income, budgeting becomes even more critical. Use a monthly average of your income to set your baseline budget, and adjust as your actual income varies.

What if my expenses exceed my income?

+

If this happens, you’ll need to either find ways to increase your income or reduce your expenses. Review your budget categories for any potential savings, cut non-essential spending, or consider side gigs to boost your income.