-

Mastering the 199a Worksheet by Activity Form for Maximum Deductions

A detailed guide to help users navigate and fill out the 199a Worksheet by Activity Form.

Read More » -

2023 Guide: 5 Tips for Qualified Dividends Tax Worksheet

A downloadable PDF worksheet for calculating 2023 qualified dividends and capital gains, providing tax planning assistance.

Read More » -

5 Tips for Navigating the Qualified Dividends Worksheet

This article provides a guide on using the Qualified Dividends and Capital Gains Worksheet to accurately report and manage tax liabilities from investments on your tax return.

Read More » -

5 Essential Tips for Completing Your K1 Basis Worksheet

A detailed guide on completing and understanding the Basis Worksheet for K1 tax forms.

Read More » -

Calculating Net Worth: Worksheet Answers & Guide

This chapter provides a worksheet with answers to help individuals calculate their net worth by detailing assets, liabilities, and guiding through financial planning concepts.

Read More » -

Maximize Your Refund with California EITC Worksheet

A guide to help California residents determine their eligibility and calculate the potential tax credit they can receive through the state's Earned Income Tax Credit (CalEITC) program.

Read More » -

Maximize Tax Savings with Qualified Dividends Guide

This article explains how to use the Qualified Dividends and Capital Gain Tax Worksheet to accurately calculate taxes on qualified dividends and long-term capital gains, assisting individuals in determining their tax obligations efficiently.

Read More » -

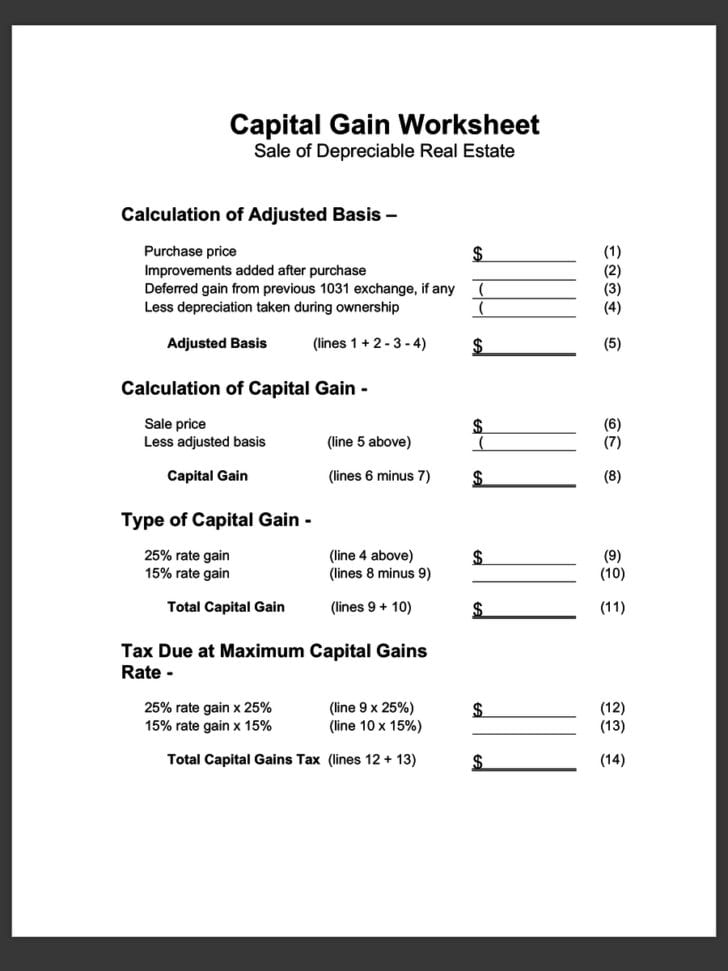

Mastering the 1031 Exchange: Your Essential Worksheet Guide

A guide providing tools and tips for managing Section 1031 tax-deferred exchanges, including a worksheet for calculations.

Read More » -

1031 Exchange: Simplified Worksheet for Tax Savings Calculation

Simplify your 1031 exchange process with this detailed calculation worksheet, designed to ensure compliance and optimize your tax benefits.

Read More » -

Maximize Your Tax Benefits with Worksheet 1 in Pub. 596

Explanation of how to use Worksheet 1 from IRS Publication 596 to determine eligibility for the Earned Income Credit.

Read More »